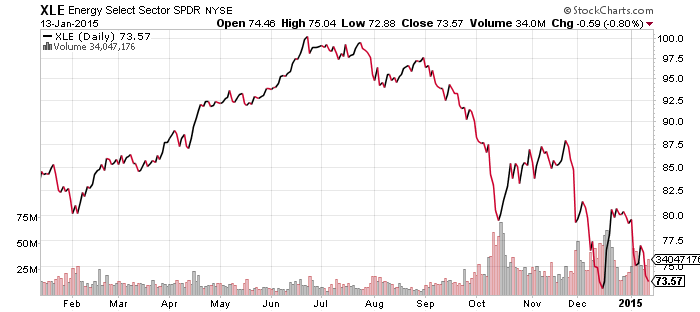

SPDR Energy (XLE)

United States Natural Gas (UNG)

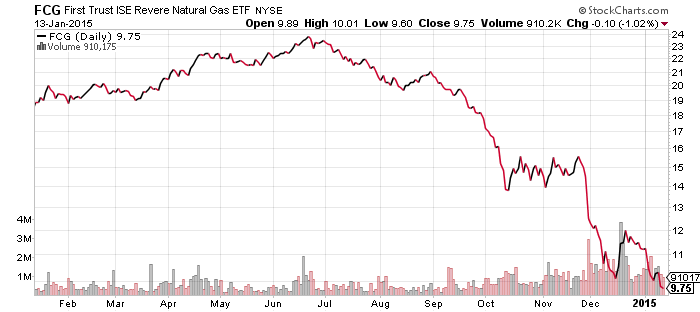

First Trust ISE Revere Natural Gas (FCG)

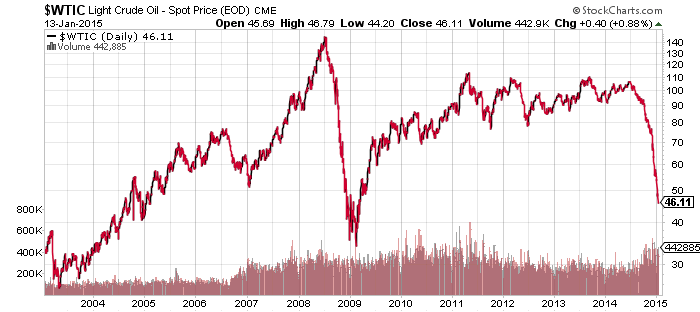

We received two small, but important, pieces of information last week. The first was an interview with Saudi Prince Alwaleed bin Talal, in which he says $100 oil is gone forever and explains that Saudi Arabia will continue pumping to win market share. The second piece of information was China’s oil imports in December surged about 15 percent above their 2014 rate, or roughly 1 million barrels per day. The Chinese are taking advantage of low prices to build up their strategic petroleum reserve and propping up oil prices in the process. On the bright side, the Chinese will not fill their reserves for many months, but on the negative side, they are propping up prices that are already down to $46 a barrel. Where would oil be without this Chinese demand?

The one change in the charts we looked at last week is that FCG broke to a new low. With oil, natural gas, and natural gas stocks at new lows, odds are energy stocks will continue to fall. Bargain hunters have kept the sector afloat, but if oil prices weaken further, energy stocks will not be able to resist the selling pressure.

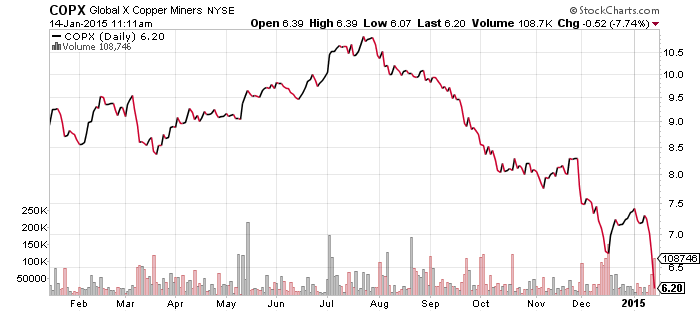

Global X Copper Miners (COPX)

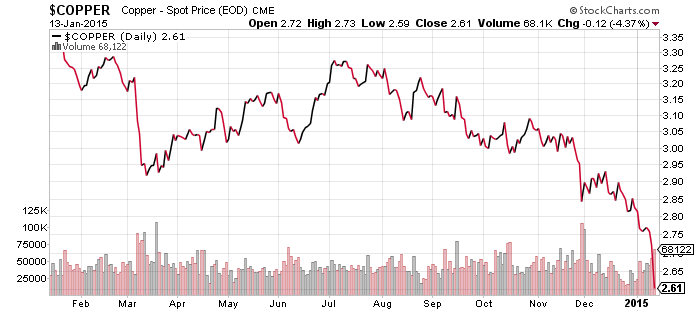

Copper prices have followed in the footsteps of the oil market. At the open of Chinese trading on Wednesday (Tuesday night in the U.S.), copper prices collapsed to $2.50 a pound before bouncing. As with many other commodities, copper has been in a downtrend since 2011, but it had held the $3 long-term support level. As soon as oil started collapsing in November, however, copper fell through $3 and has been declining ever since.

The drop in copper weighed heavily on stock markets today because the metal has a good track record of forecasting global growth, which is why it is sometimes dubbed Dr. Copper. In this case, the metal is pointing to the slowdown in China, which we have been watching since early last year. Copper held up surprisingly well given the slowdown in the Chinese economy, but it appears the market is finally catching up to the reality on the ground. In addition to reduced industrial demand, Chinese borrowers also use copper as collateral for loans in China, and they then funnel the money into speculative real estate and other high risk investments. Fraud was detected last year as borrowers had used the same copper to borrow from multiple banks. If Chinese and foreign banks make fewer of these types of loans, a lot of copper held for financial purposes could end up back on the world market, further depressing prices.

PowerShares U.S. Dollar Index Bullish Fund (UUP)

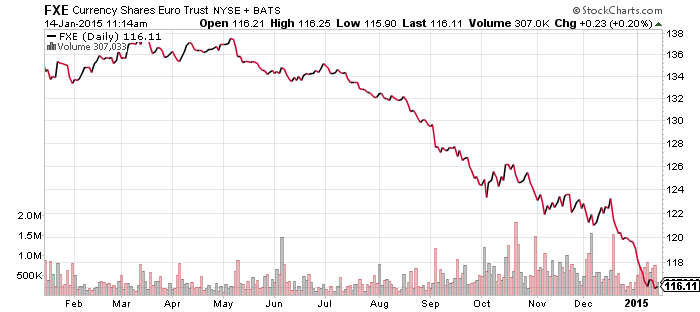

CurrencyShares Euro Trust (FXE)

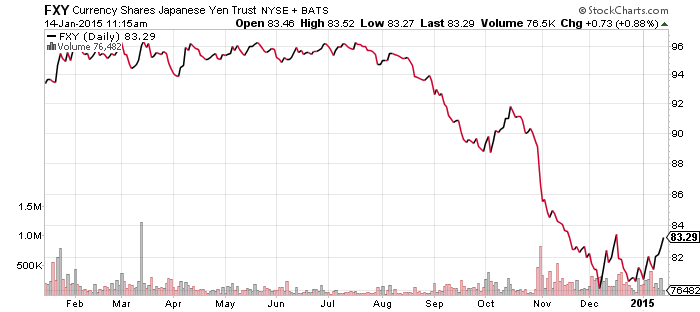

CurrencyShares Japanese Yen (FXY)

The euro fell to a new 52-week low and its lowest point since 2006 over the past week. However, the U.S. Dollar Index did not rally to new highs due to a strong rebound in the Japanese yen. Underperformance in global equity markets may be tied to the yen rebound, since a weak yen has been used to finance carry trades. When markets dip and speculators lose on their carry trades, they close their positions by selling their long positions, such as the Australian dollar, and close their short position by buying the yen.

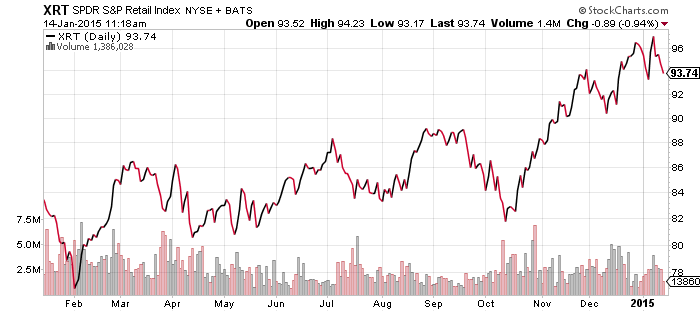

SPDR Retail (XRT)

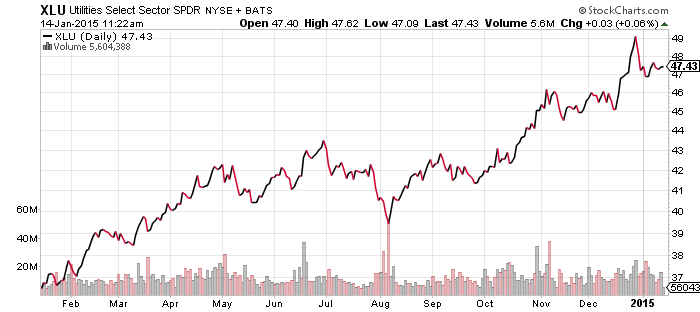

SPDR Utilities (XLU)

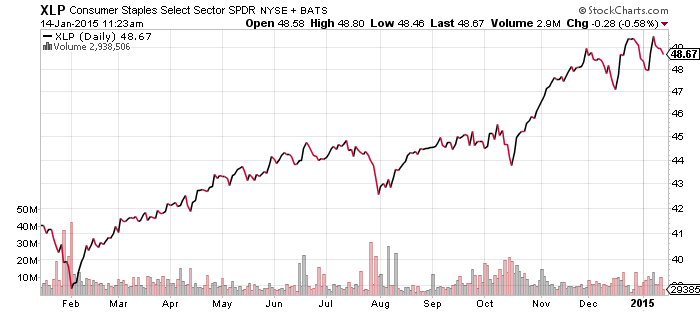

SPDR Consumer Staples (XLP)

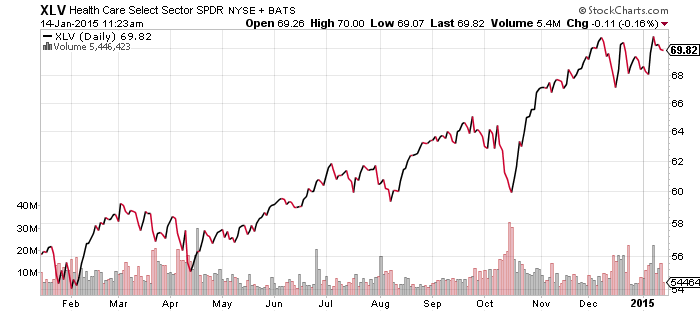

SPDR Healthcare (XLV)

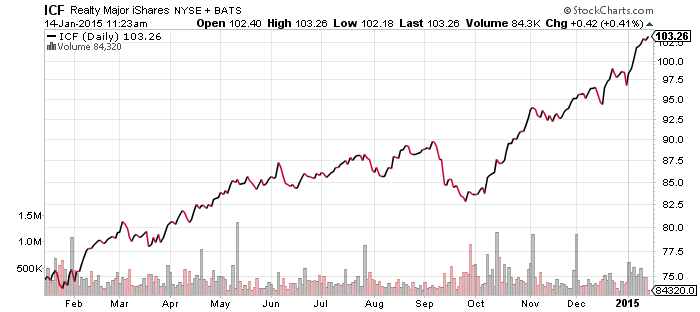

iShares Cohen & Steers Realty Majors (ICF)

Retail stocks dipped on Wednesday following the release of December sales data, which showed a 0.9 percent drop. Most of this drop was due to falling gas prices, but retail sales alone were down 0.3 percent versus expectations for growth of 0.5 percent.

Year-to-date, healthcare, consumer staples and utilities are the best performing sectors (measured by SPDR ETF performance), and they’re the only three beating the S&P 500 Index. Investors are leaning towards the “defensive” sectors, but falling interest rates are helping the rate sensitive sectors, with real estate rallying so far in 2015.

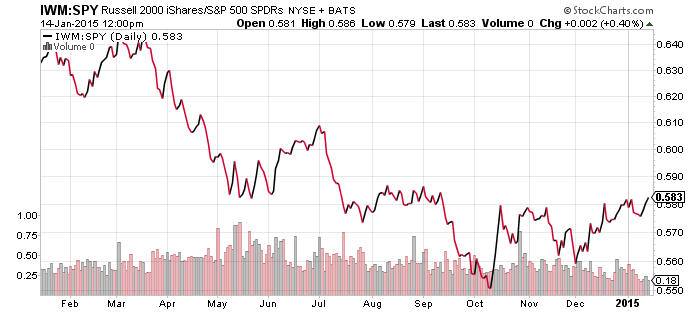

iShares Russell 2000 (IWM)

SPDR S&P 500 (SPY)

Small caps are outperforming large cap, even though stocks are down for the year. This is a bullish sign for the market because small caps typically lead on the way down when selling is intense and lead on the way up when the bull market is very strong. Small caps beat large caps in the big bull rally of 2013, but lagged in the slower growing 2014 market. Investors are clearly positioning for a strong rebound in 2015 by holding small caps despite the market dip in January.

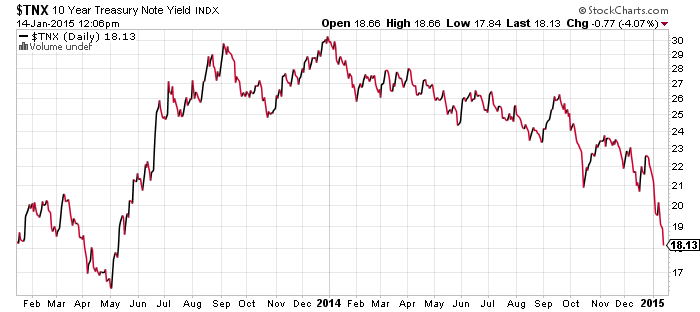

iShares Barclays 20+ Year Treasury (TLT)

Bond prices have rallied strongly in 2015 and the 10-year treasury yield has now fallen below that of the S&P 500 Index. At 1.81 percent, the 10-year delivers less income than SPY’s 1.87 percent yield. Unless stocks are headed for a more serious decline, income investors are likely to push up the prices of income producing shares, which is why we’re seeing a rally in the real estate sector.

Long-term bond yields are down as well, which leads to much larger percentage gains for the more volatile long-duration funds. TLT has pushed to another 52-week high.

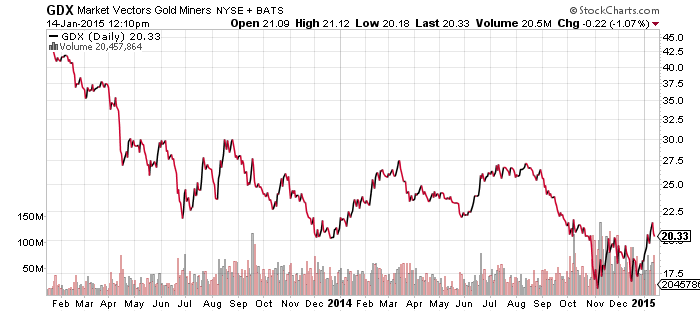

Market Vectors Gold Miners (GDX)

SPDR Gold Shares (GLD)

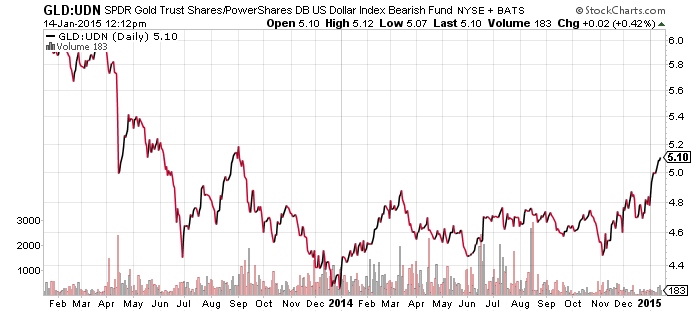

Gold and mining shares could not catch a break over the past two years as prices fell almost continuously, but now it looks as if gold was providing a warning about deflation in the commodity space. It is too early to say if miners have bottomed, since they’ve failed in similar breakouts several times before, but gold is showing an interesting recovery. Measured against the PowerShares U.S. Dollar Index Bearish Fund (UDN), which is a fund that is long foreign currencies (it takes the opposite side of the UUP trade), gold prices actually bottomed in early 2014. For foreign investors, gold was a profitable investment in 2014, as it benefited from currency weakness in most of the world and the collapse of the ruble in Russia.

Since the U.S. dollar remains strong, gold itself may not do well in 2015 for U.S. investors, but many miners are located in foreign countries. Falling energy prices works in their favor, as do weaker currencies which reduce their domestic costs such as labor.