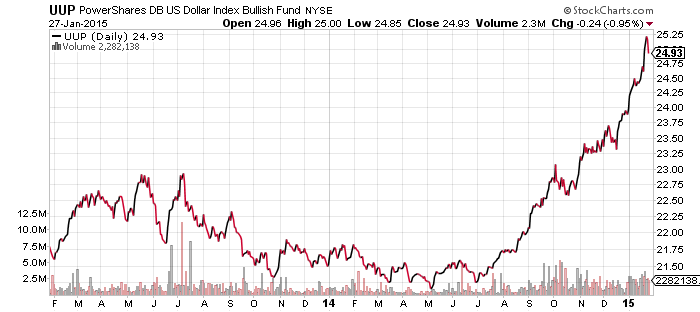

PowerShares U.S. Dollar Index Bullish Fund (UUP)

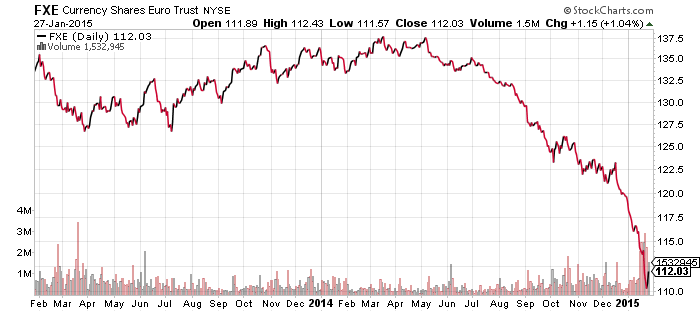

CurrencyShares Euro Trust (FXE)

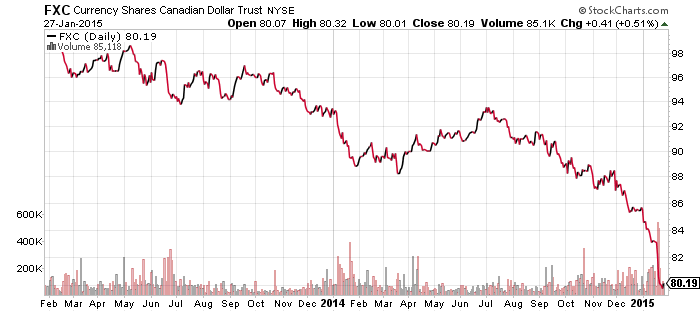

CurrencyShares Canadian Dollar (FXC)

The U.S. dollar pulled back slightly last week thanks to a rebound in the euro. The common currency recovered following the European Central Bank’s announcement of quantitative easing last week. Although the U.S. dollar weakened, ironically the big story of the week for financial media was the strong dollar, due to its impact on the earnings of multinationals. If the greenback goes on to suffer an extended correction, this will be another example of the media acting as a contrarian indicator.

The Canadian dollar may bounce as well after it tumbled when the Bank of Canada announced a surprise interest rate cut. Further cuts will come as the Canadian economy slows due to falling oil prices, with housing bubbles in some areas also at risk of popping. In the short-term, however, a rebound is likely in the wake of the past week’s sharp drop.

Working in favor of the U.S. dollar was the Singapore dollar. Overnight, the currency saw its largest one-day devaluation in nearly 3 years. The Singapore dollar doesn’t play a large role in the overall currency market, but it has a lot of influence in the Asia region, especially because the Singapore government is known for its successful economic management.

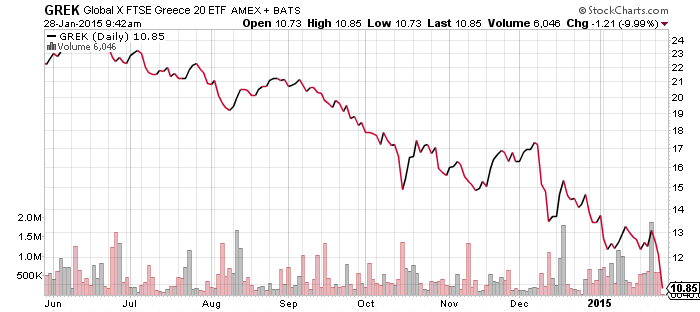

Global X FTSE Greece 20 (GREK)

Greek stocks held up for a day following the election of the anti-austerity Syriza party because investors weren’t sure what to expect from the new government. Now they know: Syriza is serious about ending austerity, and the “coalition of radical leftists” (the name of the party in Greek) which includes more than a dozen parties, including those based on Maoism and Trotskyism, will not be good for business. Greek bank stocks have fallen about 40 percent over the past two days.

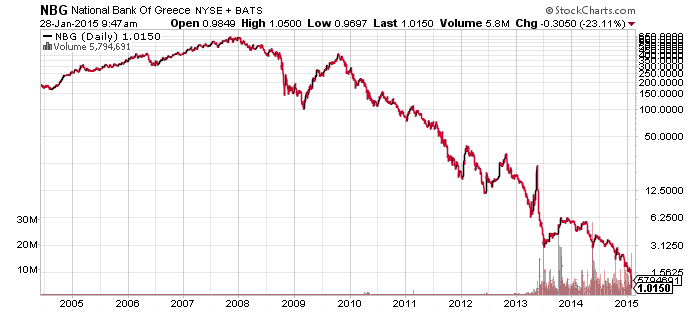

The stock of National Bank of Greece shows how far the Greek banking sector has fallen. Shares were worth hundreds of dollars in the recent past, but today fell to $1.

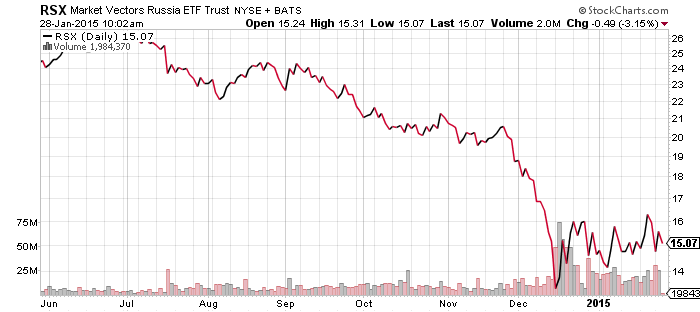

The situation in Greece is unlikely to deescalate. Russia has reached out to Greece and the Syriza government opposed an EU statement calling for new sanctions on Russia. Since the EU requires unanimous consent on many issues, opposition from Greece could have a major impact on European policy, vis-à-vis Russia.

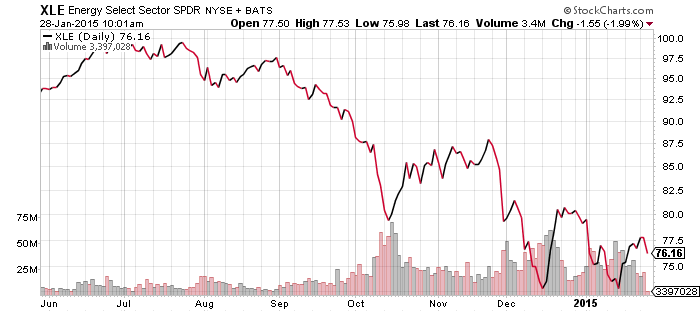

SPDR Energy (XLE)

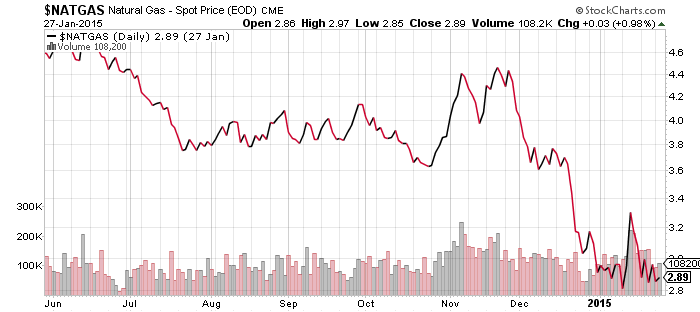

United States Natural Gas (UNG)

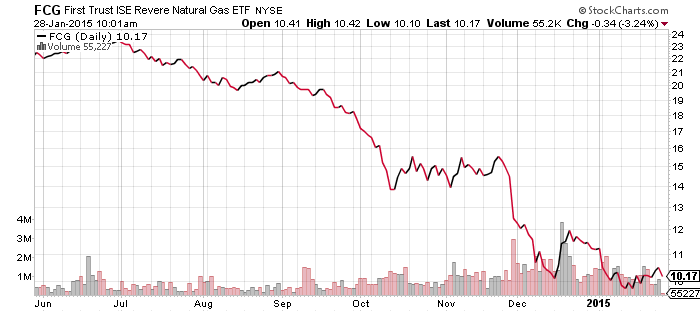

First Trust ISE Revere Natural Gas (FCG)

Market Vectors Russia (RSX)

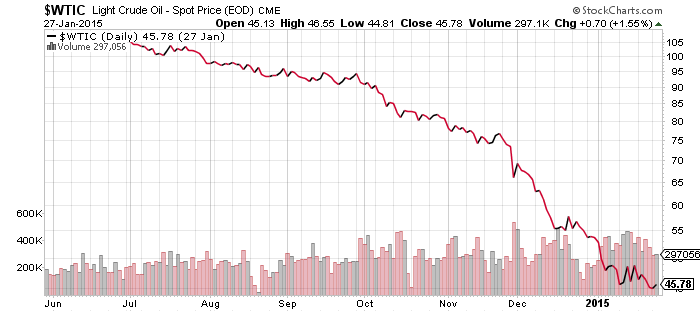

Oil prices are still in a short-term bottoming process, but equity investors are becoming slightly more optimistic. News that crude inventories climbed to a new three-decade high weighed on prices Wednesday morning, pushing West Texas Intermediate Crude prices back to their lows before bouncing. Prices seem to want to stay close to the $45 level.

Over the past week, oil prices rebounded with news of the Saudi king’s passing, but the gains evaporated when it was clear the new ruler will not change energy policy. Yesterday, oil prices rallied on comments made by OPEC’s chief. He said oil could reach $200 a barrel if there are no investments in extraction, but he gave no timetable. The gains evaporated once people realized it will be years before the effect of low investment kicks in.

SPDR Utilities (XLU)

SPDR Consumer Staples (XLP)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

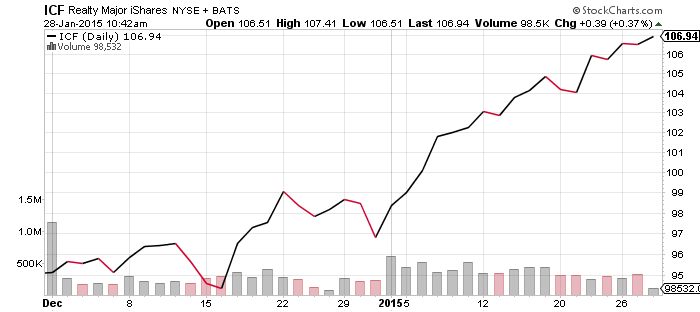

iShares Cohen & Steers Realty Majors (ICF)

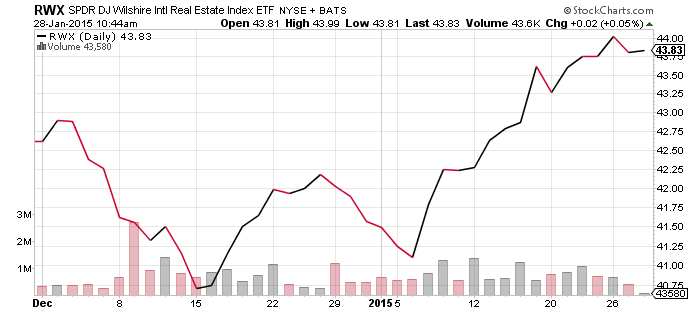

SPDR Dow Jones International Real Estate (RWX)

SPDR S&P Dividend (SDY)

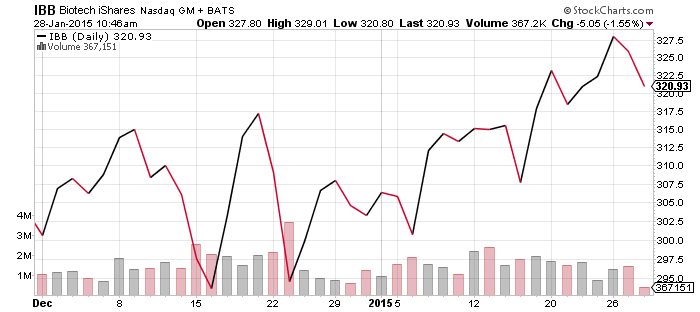

iShares Nasdaq Biotechnology (IBB)

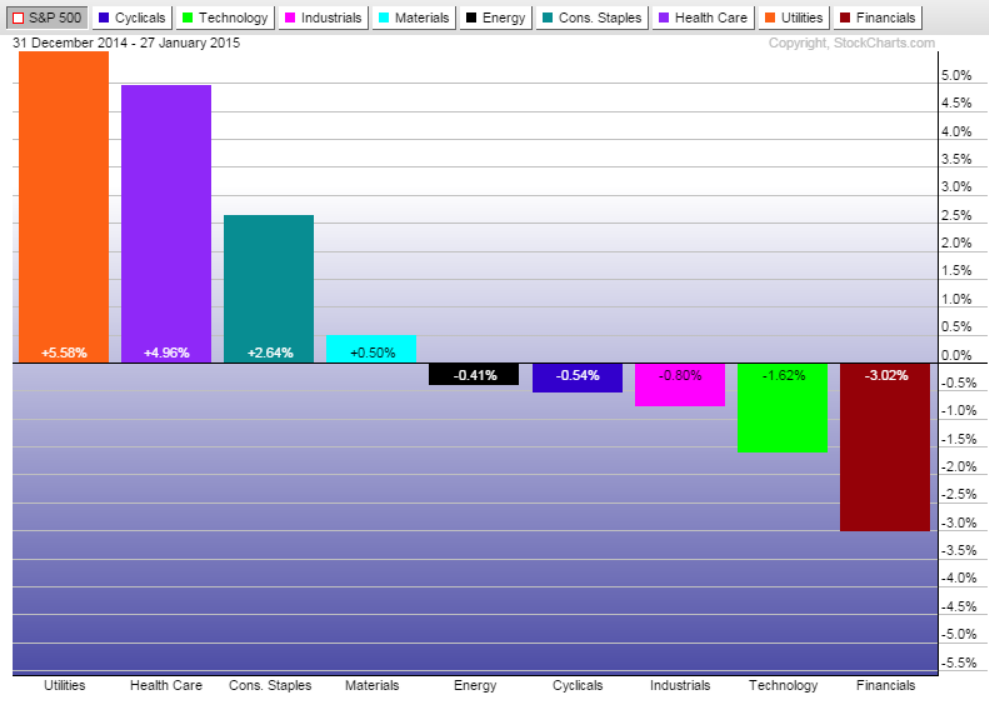

Defensive sectors continue to dominate in 2015. The sector ETF chart below shows the relative gains for each sector versus the S&P 500 Index, which is down 1.4 percent to date. Utilities, healthcare and consumer staples are all up for the year, while the materials sector is down for the year, but still outperforming the market. Although the technology sector has lagged, it is closing the gap sharply today following the rise in Apple (AAPL) shares. Apple is the largest holding in the S&P 500 Index at 3.6 percent of assets, but it is 16.5 percent of XLK’s assets. The firm reported the largest quarterly profit in history, a whopping $18 billion, and shares climbed 7 percent in early trading on Wednesday.

Dividend shares continue to lead the market higher, thanks in part to lower interest rates. The sector benefiting the most from lower interest rates around the globe is real estate. Shares of ICF and other REIT ETFs have been on an almost non-stop rise in 2015. RWX, an ETF which holds foreign REIT shares, has moved almost in lockstep with ICF.

Biotechnology, still the leading sector in this market, has been stable in the past week. The sector is still in an uptrend this year, helped by the strength in the healthcare sector.

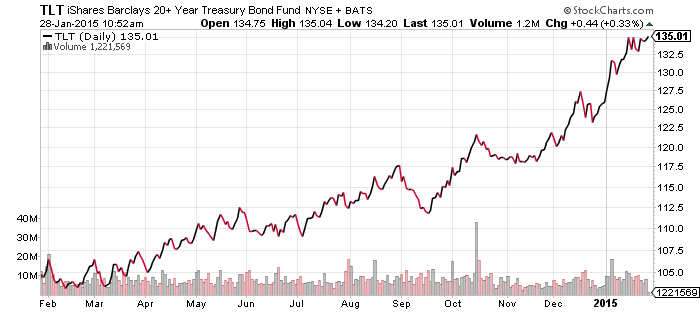

iShares Barclays 20+ Year Treasury (TLT)

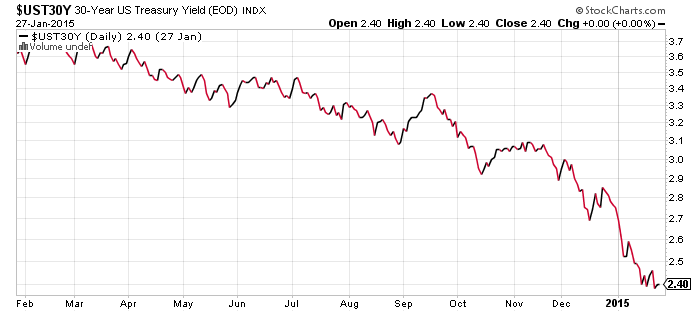

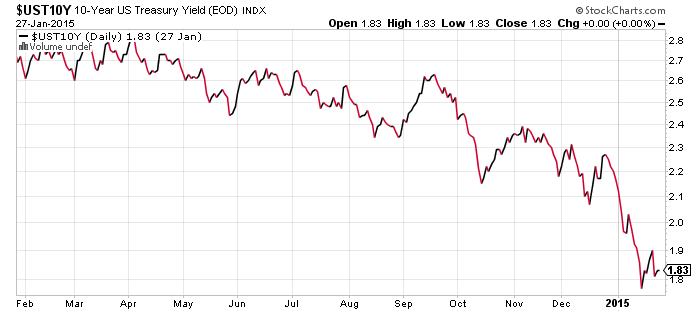

Last week we said bonds are overdue for a pullback, and that’s still the case this week even as bonds climbed back near their 52-week highs. The 10-year treasury yield is at 1.83 percent, lower than the yield on the S&P 500 Index. The 30-year treasury is only 2.4 percent, lower than most dividend ETF yields. These yields became even more attractive in the past week as Swiss bond yields collapsed, with negative interest rates out past a decade.

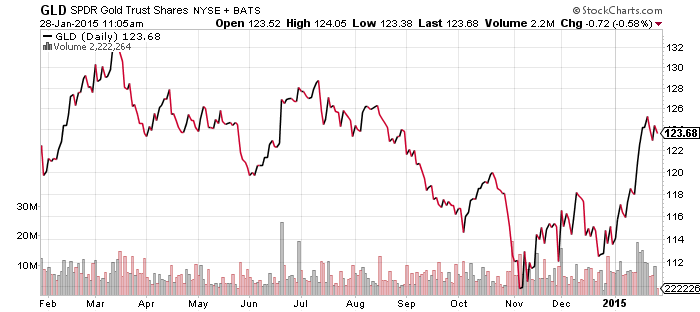

SPDR Gold Shares (GLD)

Gold prices consolidated after crossing $1300 last week. There’s a lot of space for the metal to move in either direction as a slide to $1200 would still leave the metal in an uptrend and there’s no further bullish breakout until it crosses $1400. Over the near term, watch how gold performs relative to the U.S. dollar. Since November, it has rallied along with the U.S. dollar as foreign currency holders search for safe haven assets.