SPDR Energy (XLE)

United States Natural Gas (UNG)

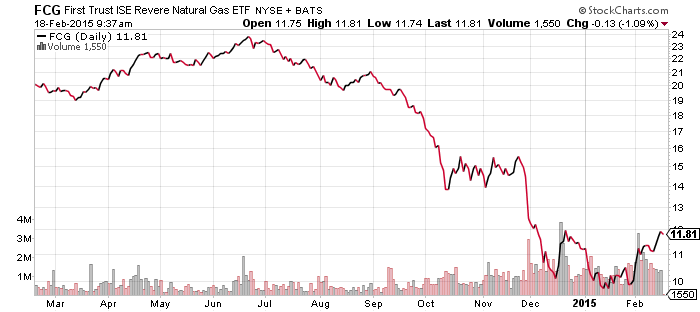

First Trust ISE Revere Natural Gas (FCG)

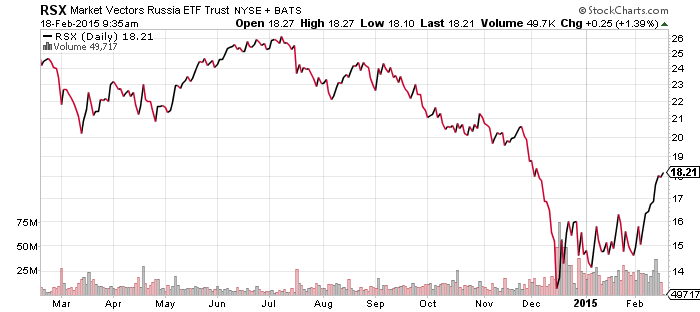

Market Vectors Russia (RSX)

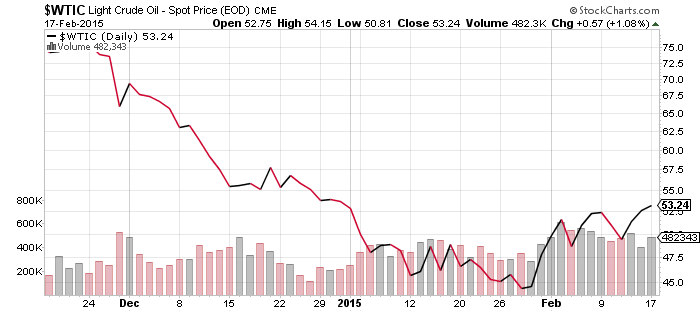

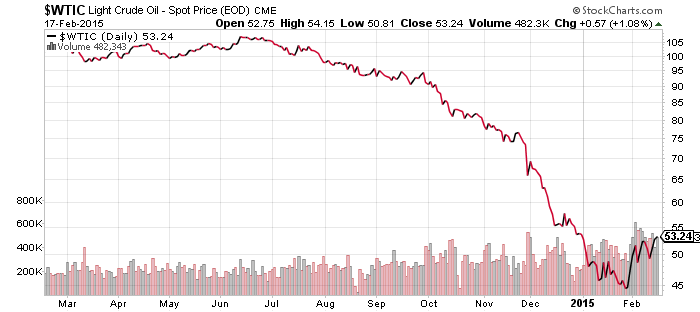

Oil prices continued to form a bottoming pattern over the past week, and in the short-term the trend has turned slightly bullish. However, when we look back at historical performance, it is still too early to say that the current bounce is not a correction within a larger bear market move.

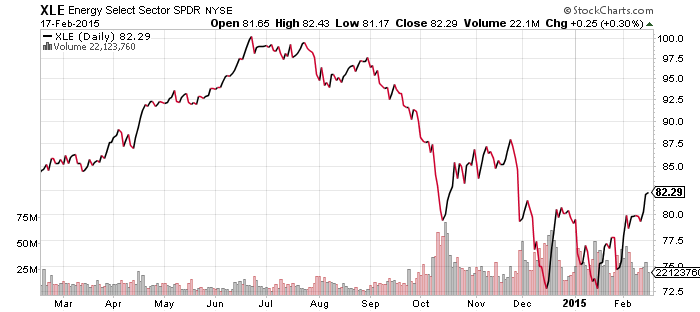

The outlook for energy related stocks is positive. XLE, for example, has erased its losses going back to October. Near term resistance is in the upper $80 range on that ETF, with room to run once it breaks through. This recovery signals that investors are bullish on the energy sector over the long-term and since the stock market is a forward looking market, it is forecasting higher prices over the months ahead.

The commodity spot market is a different story. Commodity prices are much more a function of supply and demand, and oil is not a product that is easily stored. Inventories continue to build while oil production is still rising. In January, China stopped importing extra oil to fill their strategic reserve. Citigroup has forecast oil could drop to $20 a barrel and that is not unreasonable, given rising production and rising inventories.

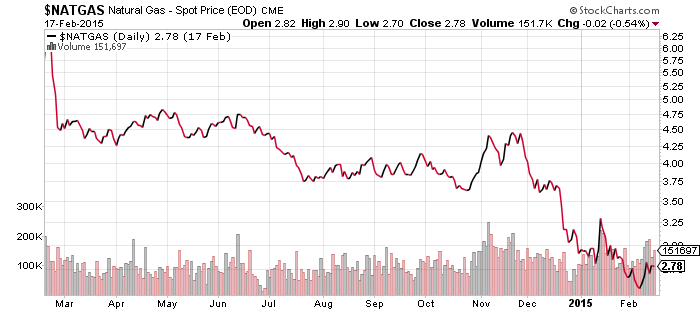

Natural gas is a good example of how rising production can crush prices. Even though much of the country is being frozen by wave after wave of Arctic air, natural gas prices refuse to budge. Luckily for FCG investors, the fund continues to move with energy equities, rather than the underlying commodity.

Finally, last week we noted Russia broke out from its trading range. Over the past week it continued on an upward trajectory. That trading range now serves as support, while the $20 to $21 level provides some resistance.

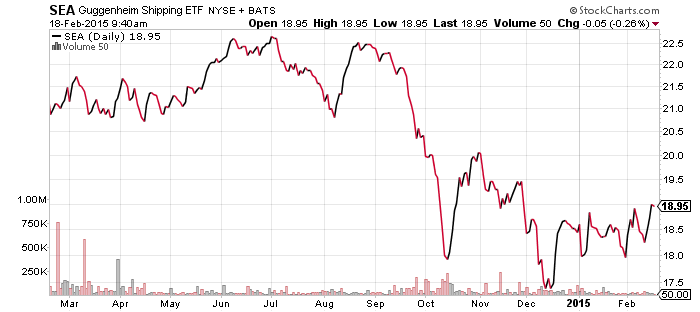

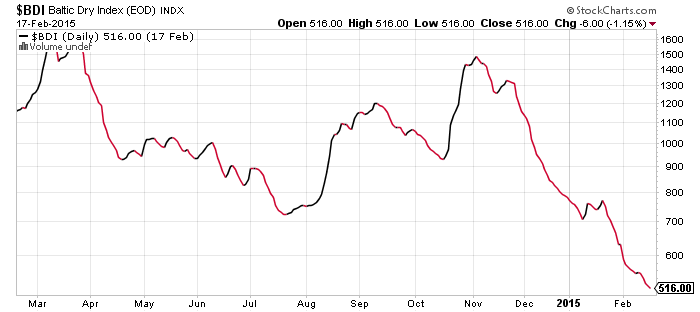

Guggenheim Shipping (SEA)

Although the Baltic Dry Index set a new all-time low last week, SEA moved higher as shipping companies started reducing supply. China COSCO, for instance, mothballed 8 ships in January due to the collapse in prices. As with energy, investors in the shipping companies are pricing in a recovery before the spot market, measured by the Baltic Dry Index, has hit bottom.

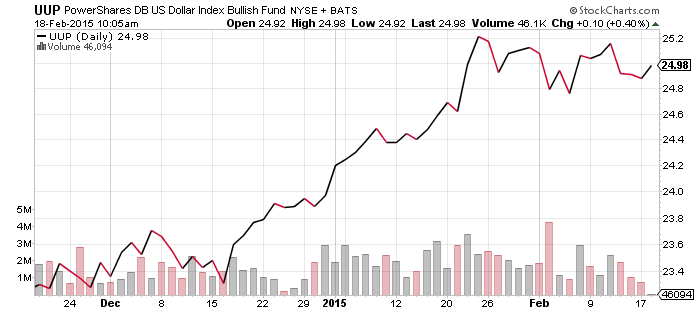

PowerShares U.S. Dollar Index Bullish Fund (UUP)

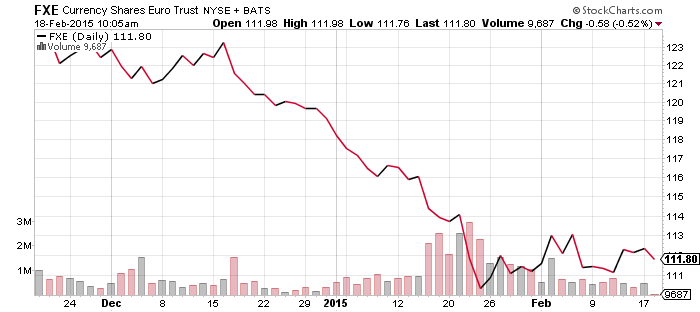

CurrencyShares Euro Trust (FXE)

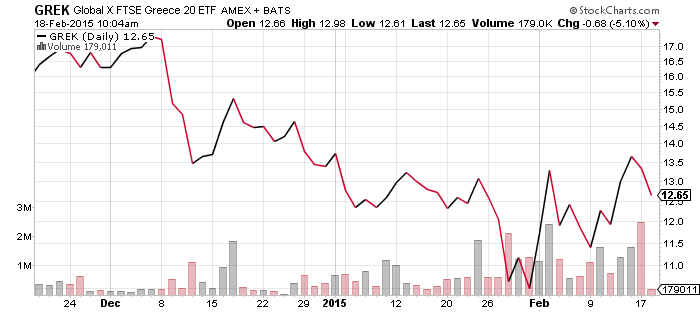

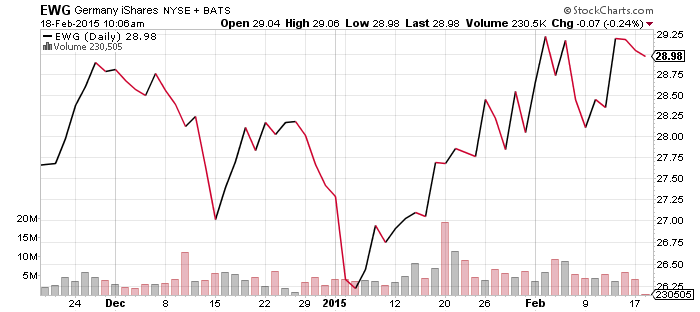

Global X FTSE Greece 20 (GREK)

Attempts at making a deal continue in Europe. Eurozone finance ministers failed to reach an agreement on Monday, but investors are optimistic that a deal will come on Friday. Rhetoric has been turned up in Greece and Germany though, as the two sides remain far apart publicly. The Greeks want a loan extension now and they want to negotiate the terms later, since the current funding runs out in a little over a week. The Germans want the terms settled first. The latest news is that Greece will ask for a bridge loan to keep it from going broke. The Greeks do not want this loan to fall under the bailout terms, while the Germans do.

Stock prices in Greece have bounced off their lows and German stocks have climbed to a new all-time high measured in euros. However, EWG is still trading below its high set in 2014 as losses from the euro have weighed on the ETF. Both of these stock markets can rally domestically even if there’s bad news for the euro. GREK will likely rally once a deal is completed. German stocks priced in euros are likely to rally as well, but depending on how the euro behaves, foreign investors may or may not benefit. For this reason, WisdomTree Europe Hedged Equity (HEDJ) remains attractive.

As can be seen in the chart of the FXE and UUP, since the European Central Bank launched quantitative easing in January and the focus shifted to Greece, the market for euros has gone into a holding pattern.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

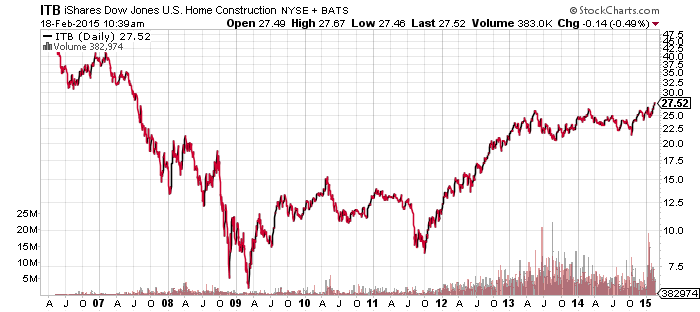

iShares US Home Construction (ITB)

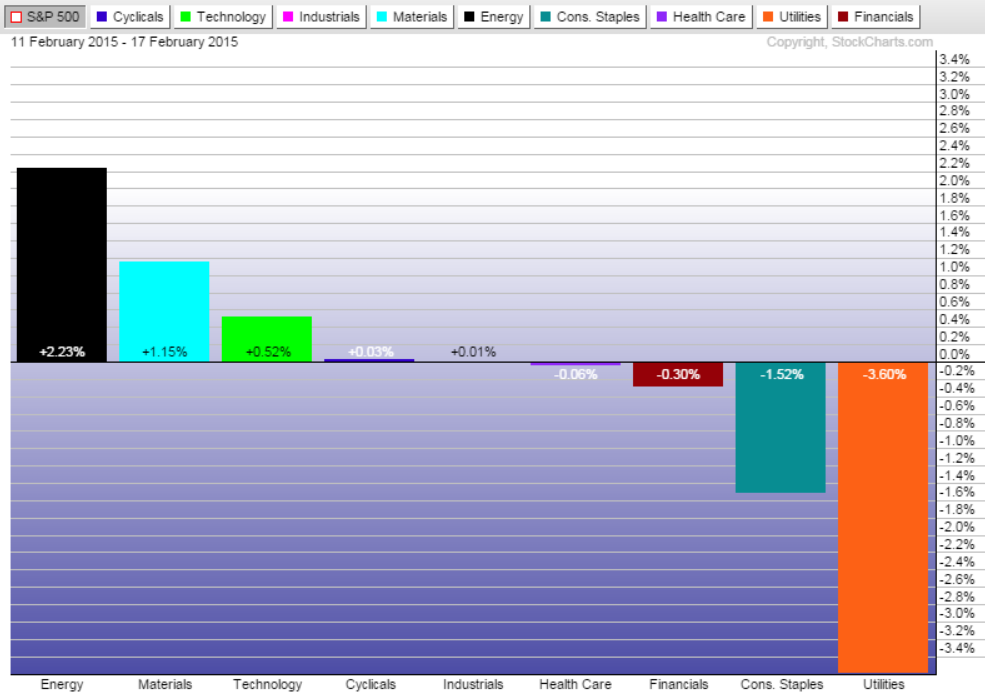

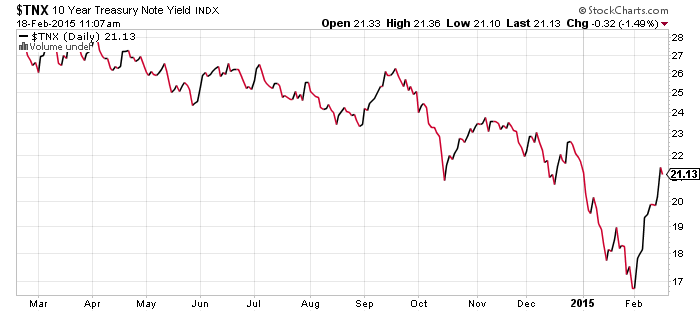

The relative performance chart of the major sector ETFs shows that energy and technology has pushed the market higher in the past week, while the utilities sector lagged again. Interest rates continued to march higher, which weighed on the rate sensitive sectors.

One sector that hasn’t been hurt by higher rates is home construction. It climbed to a new 52-week high and appears to be breaking out of a trading range it has been caught in for two years. Since the Fed announced the taper in May 2013, ITB had been trading sideways, consolidating gains from its first real rally since the housing crisis. Putting fundamentals aside, which remains a mixed bag, the market is turning bullish.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

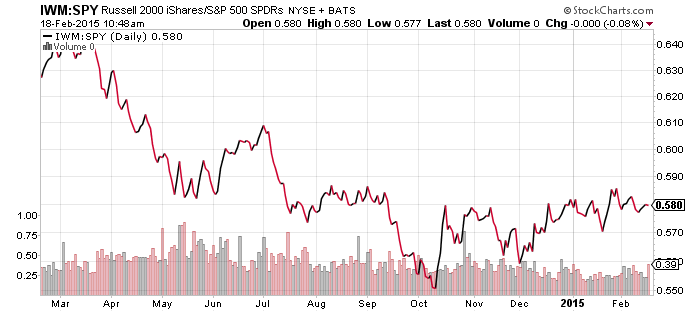

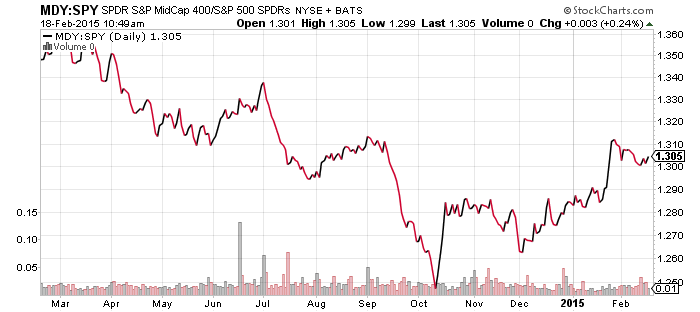

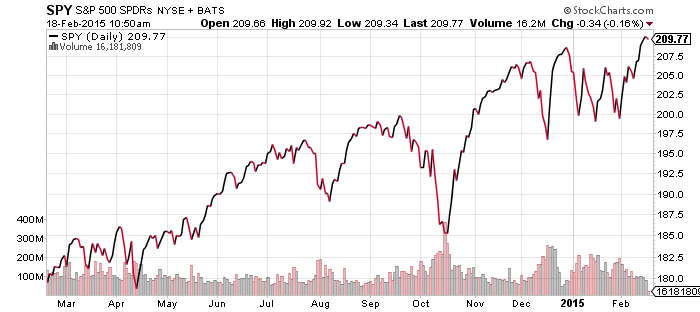

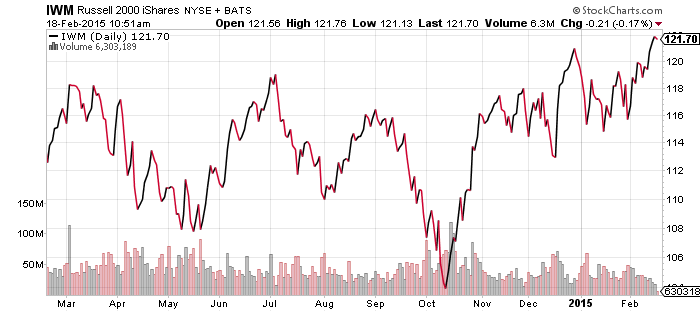

Small caps continue to hold up well versus large caps, as the S&P 500 Index and Russell 2000 closed at new all-time highs last week. Mid caps remain the stronger performing sector in early 2015 though, as they improve their performance after a lackluster 2014.

Our special reports for 2015 have been released and several mid cap funds are in the mix. If you’re not yet a subscriber, call (888) 252-5372 to begin your membership and receive immediate access.