Important Note: The Federal Reserve released its policy statement at 2 PM this afternoon and removed the word “patient” from the statement. Based on Chairman Yellen’s prior statements, could allow for a rate hike, though it will not likely occur before June. The vote on the language change was 10-0. Stocks have rebounded sharply in the few minutes after the release.

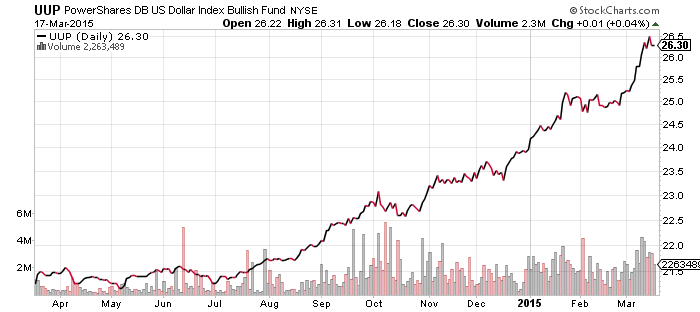

PowerShares U.S. Dollar Index Bullish Fund (UUP)

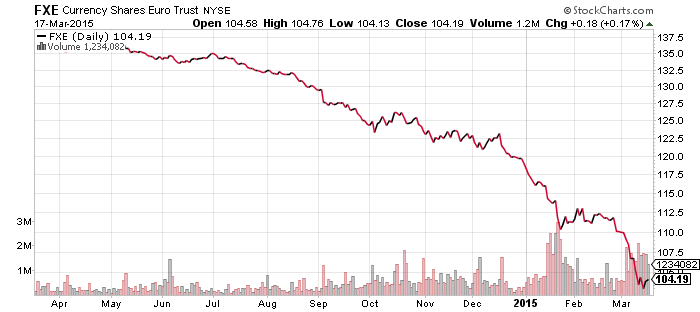

CurrencyShares Euro Trust (FXE)

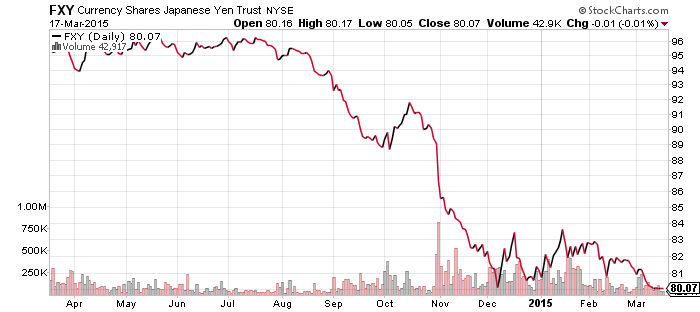

CurrencyShares Japanese Yen (FXY)

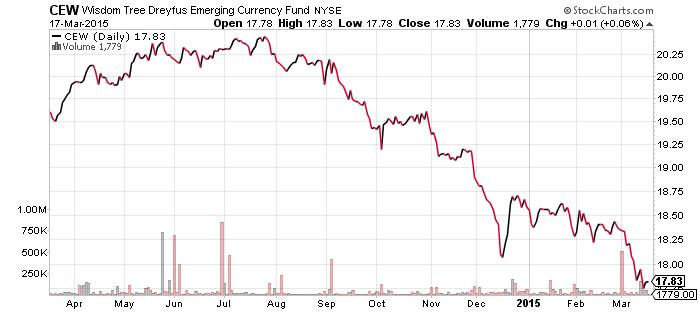

WisdomTree Dreyfus Emerging Currency (CEW)

Last week the euro briefly dipped below the crucial $1.05 level, but it has moved back above this support line and is holding steady. Back in January the euro stabilized, but there was barely any rebound. Speculators are heavily long the U.S. dollar to an extreme degree, which should be fuel for a big rally. That a rally hasn’t broken out yet is a testament to the weakness in the euro and should the euro slip again, it would probably hit parity very quickly before finding support again due to the psychological value of the $1.00 level. However, regarding the long-term picture, if $1.05 is lost, the next target is in the $0.80 to $0.90 range.

Aside from the euro, the Japanese yen is also resting at its 52-week lows. Emerging market currencies have broken lower.

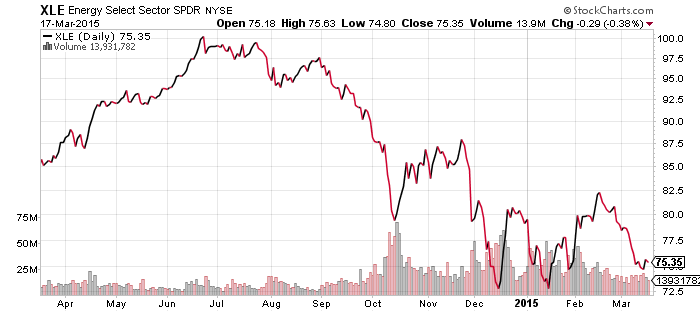

SPDR Energy (XLE)

FirstTrust ISE Revere Natural Gas (FCG)

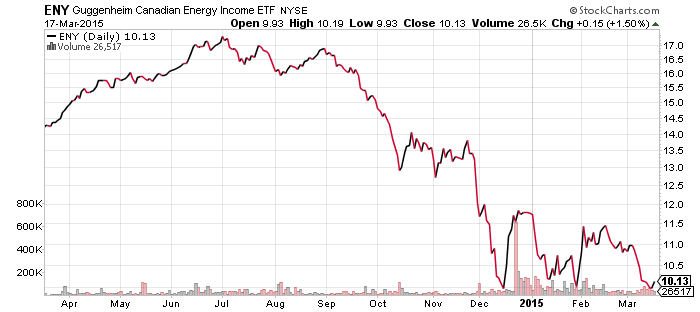

Guggenheim Canadian Energy Income (ENY)

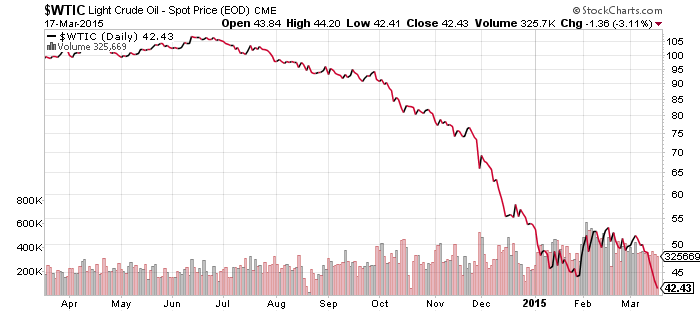

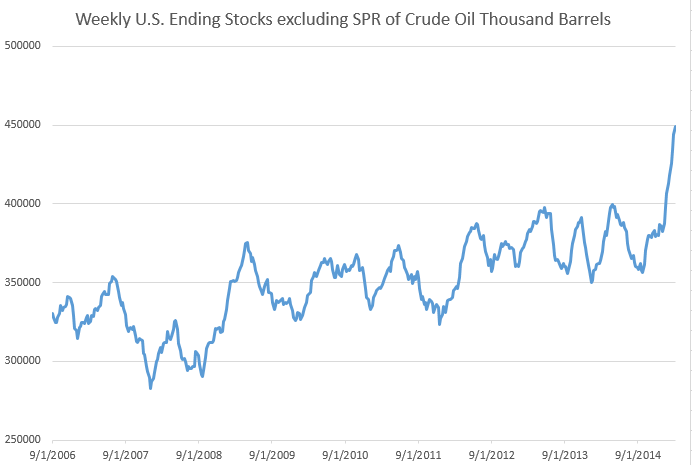

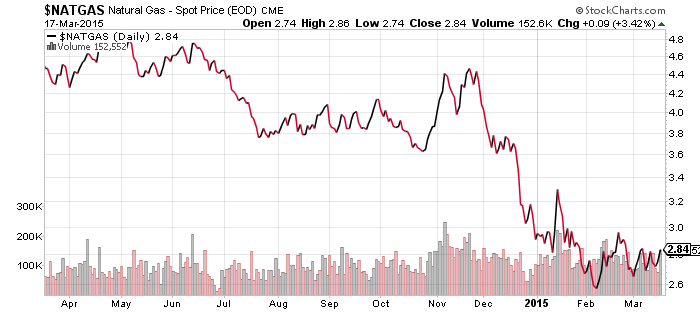

Similar to the euro and yen, oil prices are again sitting at lows for the year. West Texas Intermediate Crude is at new lows, hitting $42 and change, due to a large inventory build reported yesterday. The American Petroleum Institute said inventories increased 10.5 million barrels last week, far above the 3.8 million estimated increase. Below is a chart of the Energy Information Administration’s commercial inventory figures through March 11. It shows how inventories have been surging in 2015 as demand has dropped. EIA has data back to the early 1980s and there is no comparable surge in inventory.

That said, equity investors remain optimistic about energy prices. XLE is above its lows for the year, while ENY hasn’t broken below its lows.

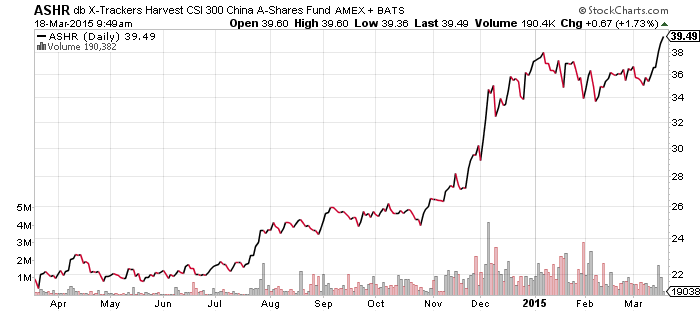

Deutsche X-trackers Harvest CSI300 A Shares (ASHR)

One explanation for sliding oil prices, along with other commodities, is the slowing Chinese economy. Although the government reports growth near 7 percent which is on target for this year, economic data points toward an economy growing much more slowly, perhaps in the range of 4 percent or less.

Last week, China reported industrial production slid in February and producer prices fell as well. Yesterday, we learned home prices are still falling across the country. Government revenues are also starting to tumble. Last year, land sales collapsed, but revenues are only starting to be hit. Land revenue plunged 36 percent in the first two months of this year. Chinese cities rely on that revenue to fund infrastructure projects and in some places, land sale revenue makes up one-third or more of total revenue.

Even though the Chinese economy is slowing rapidly, investors are dumping money into the stock market as they exit investments tied to real estate. Trust companies, insurers and banks are pouring money into the stock market as they search for profits, sending the A share market up nearly 80 percent in less than 8 months.

Also fueling gains are investors who want to dump their yuan. While the central bank says it will not devalue the currency, investors increasingly expect the central bank will make major interest rate and reserve requirement cuts that will have the effect of devaluing the currency. With home prices falling and investors’ options limited, stocks are one way to protect against a drop in the yuan.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

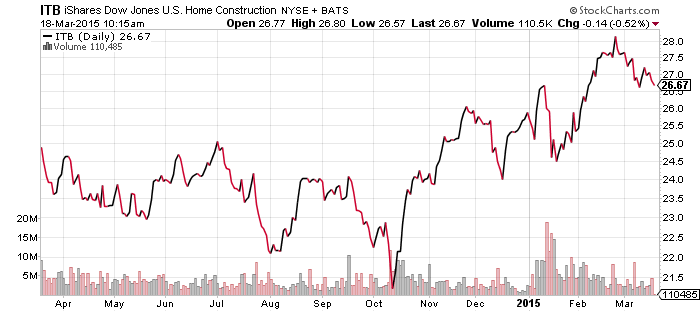

iShares US Home Construction (ITB)

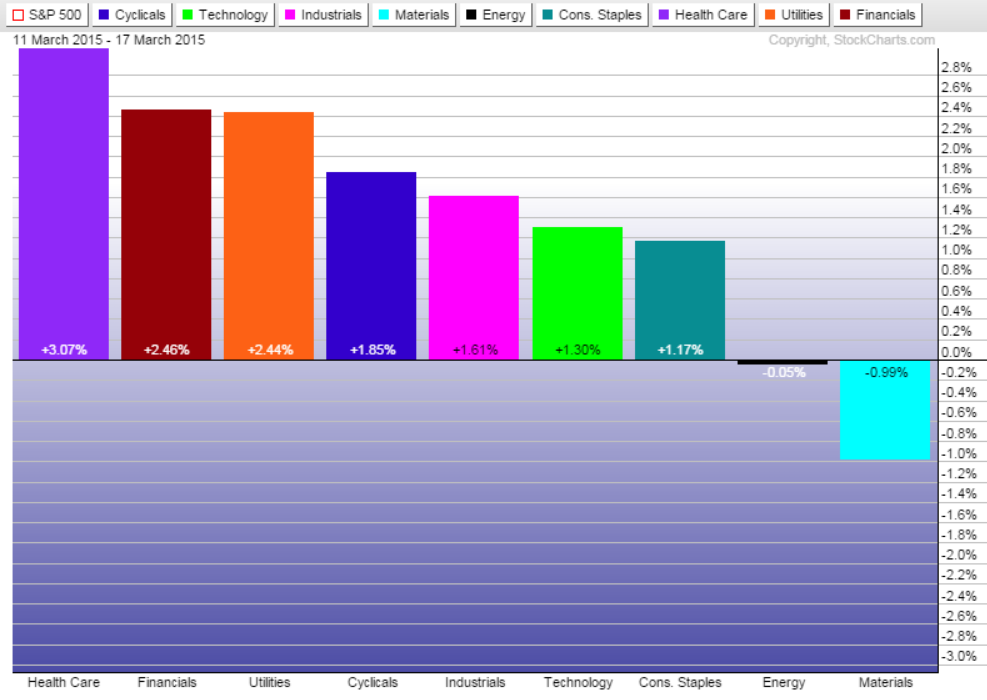

Healthcare was a big winner over the past week, climbing more than 3 percent. The next two winners are an odd couple: financials and utilities. Financials benefit from higher interest rates and investors appear to be bidding the sector up ahead of the Fed’s policy statement, but utilities are hurt by higher interest rates. The increase in utility shares is most likely a rebound from oversold conditions, following a sharp six-week drop in the sector.

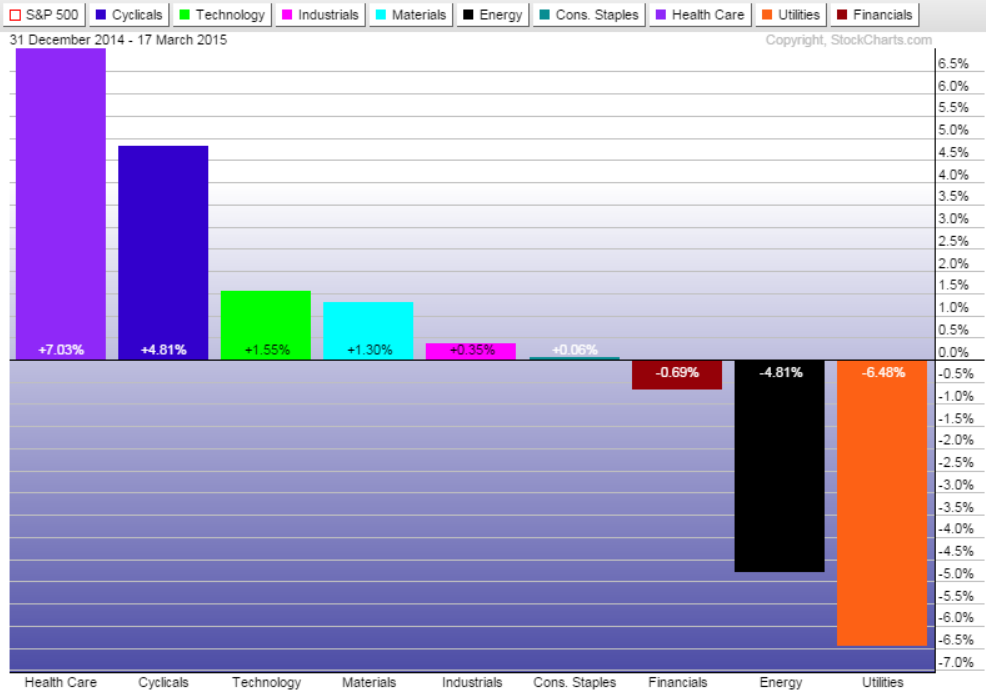

Year to date, healthcare and consumer discretionary are leading the way, responsible for nearly all of the S&P 500 Index’s gains.

Housing stocks dipped this week after housing starts plunged in February. Although the weather was a factor in the Northeast, areas unaffected by bad weather also saw housing starts decline. We’ll have to wait until next month to know if this data point is a blip or points to a weaker economy.

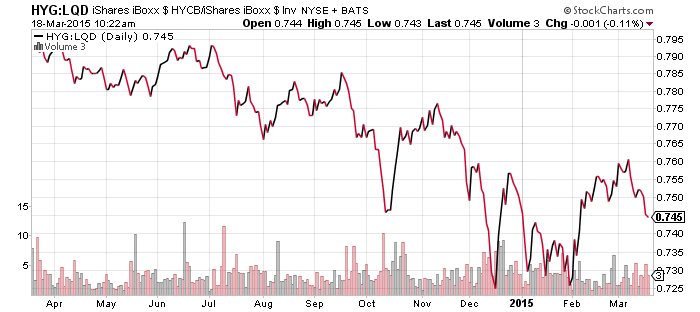

iShares iBoxx Investment Grade Corporate Bond (LQD)

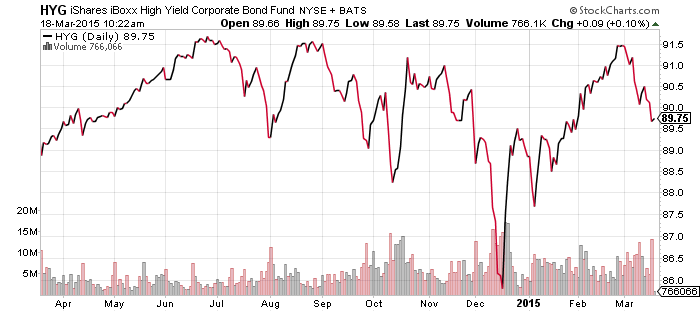

iShares iBoxx High Yield Corporate Bond (HYG)

High yield bonds were down slightly in the past week, with the drop in oil prices weighting on the asset class. Relative to investment grade bonds, high-yield continues to be stuck in a trend of underperformance.

SPDR S&P 500 (SPY)

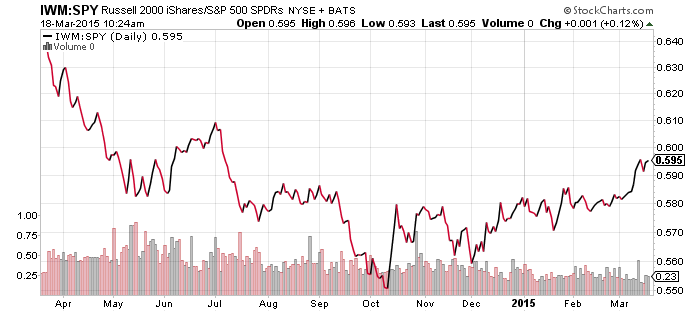

iShares Russell 2000 (IWM)

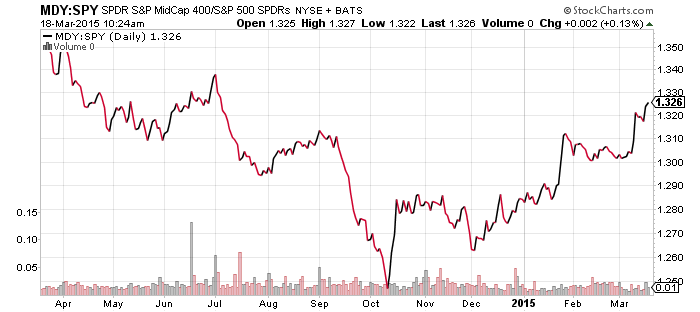

S&P Midcap 400 (MDY)

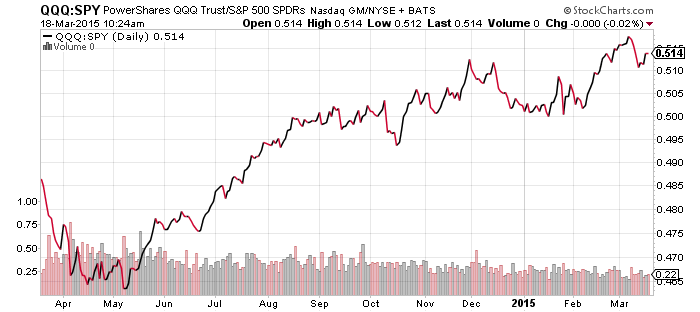

PowerShares QQQ (QQQ)

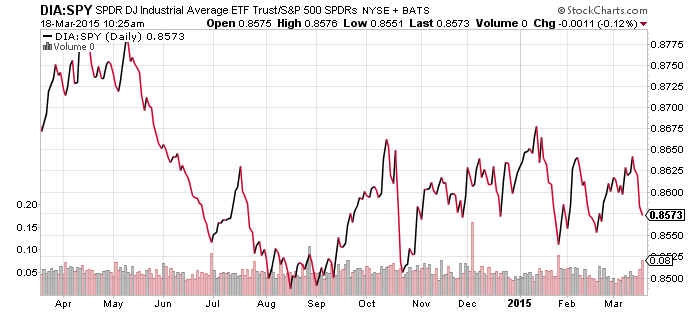

SPDR DJIA (DIA)

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Small-caps were flat versus large caps last week, while mid-caps pushed higher, moving them into the lead among the three in terms of year-to-date performance.

The Nasdaq recovered from its relative underperformance a week earlier. It will look to extend those gains this week after Oracle (ORCL) delivered a good earnings report yesterday.

The Dow dipped again versus the S&P 500 Index. Industrials are not having a strong year and it is the largest sector exposure in the DJIA.

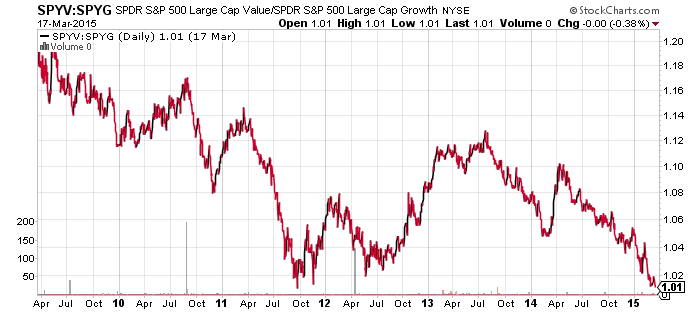

Finally, value broke to a new low versus growth last week and is nearing the October 2011 low. A potential catalyst for a reversal of this trend would be strong performance from the financial sector. SPYV is about 25 percent financials, while SPYG is about 32 percent technology.

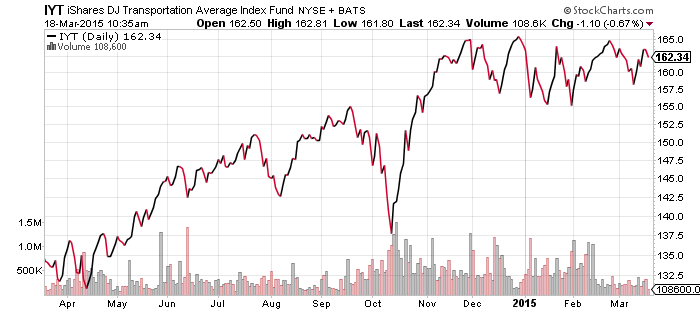

iShares Transportation Average (IYT)

FedEx (FDX) met earnings expectations today and provided a positive outlook on the economy, which is good news for the transportation sector. FDX is 12 percent of IYT. The immediate response from traders was to sell FDX though, and it slipped more than 2 percent in early trading on Wednesday.

IYT has been in a trading range since November.