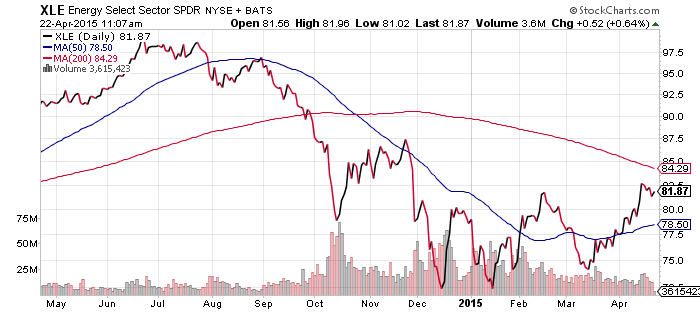

SPDR Energy (XLE)

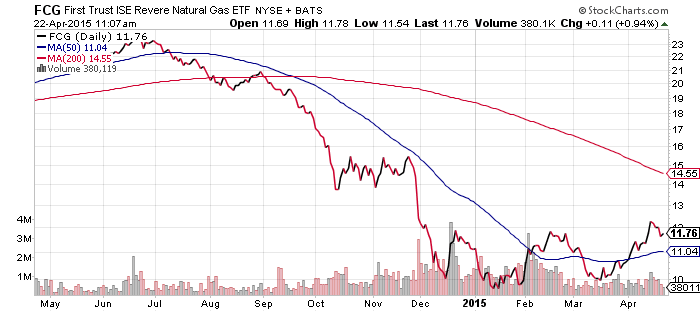

FirstTrust ISE Revere Natural Gas (FCG)

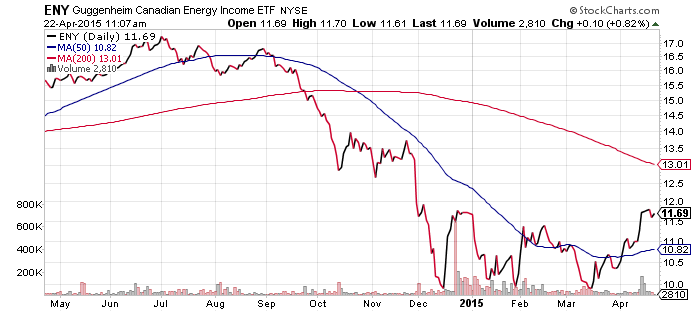

Guggenheim Canadian Energy Income (ENY)

Market Vectors Russia (RSX)

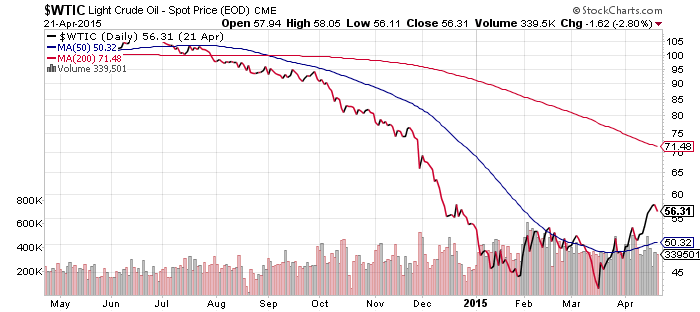

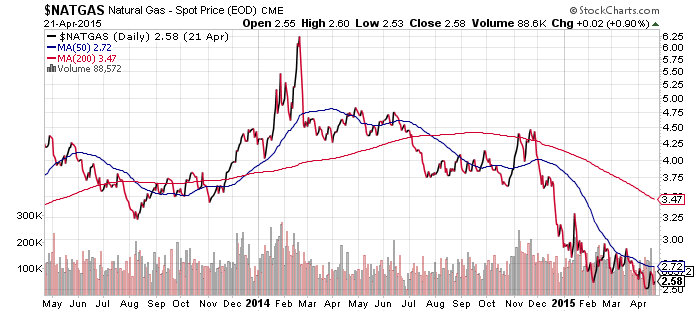

Oil prices ticked up again in the past week, settling into the mid-$50 range. There isn’t much upside resistance should crude oil push higher. Inventory came in on the high side again last week and although this implies the inventory build is still ongoing, prices haven’t reacted negatively.

Some of the equity funds tied to energy prices, including RSX, are near or at resistance levels. There could be a pullback this week, but if oil prices remain on their bullish trajectory, another breakout to the upside is likely for energy-related equities.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

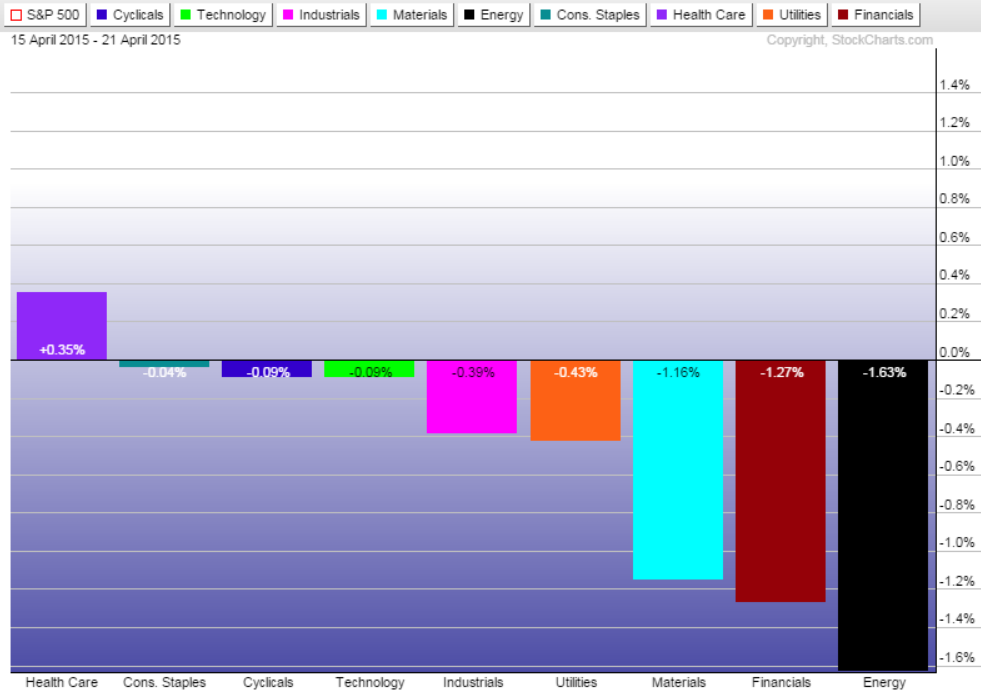

Energy was the worst performing sector over the past week as investors took some profits. Earnings reports from Schlumberger (SLB) and Halliburton (HAL) were both better than expected.

Financials saw many blue chip companies report over the past several days, while many regional banks will announce earnings this week. Thus far, the sector is tied with the healthcare sector for fastest earnings growth. However, nearly two-thirds of that growth is due to a strong earnings report from Bank of America (BAC).

Healthcare remains strong. In addition to the excellent earnings growth, it is also the sector with the fastest revenue growth.

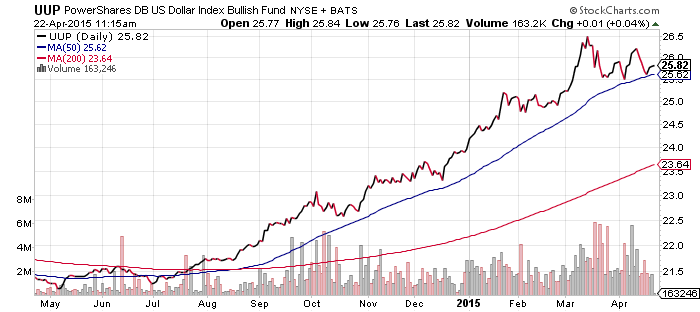

PowerShares U.S. Dollar Index Bullish Fund (UUP)

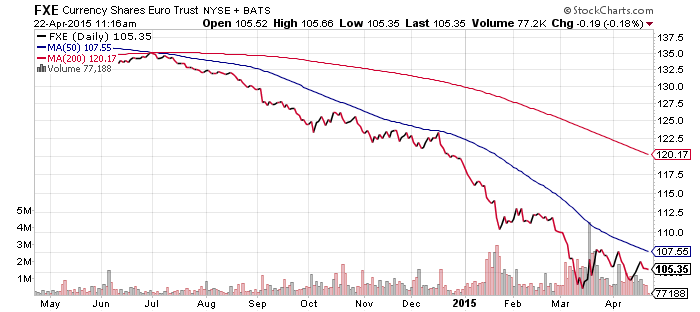

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

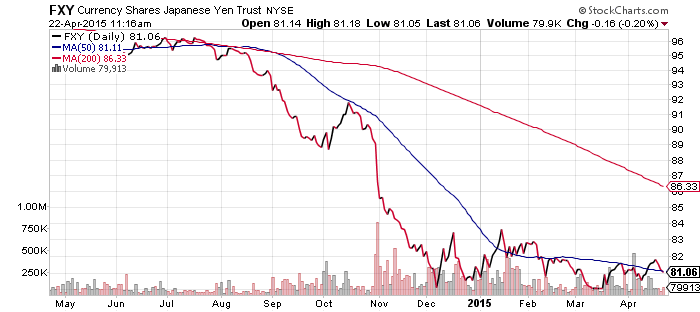

CurrencyShares Japanese Yen (FXY)

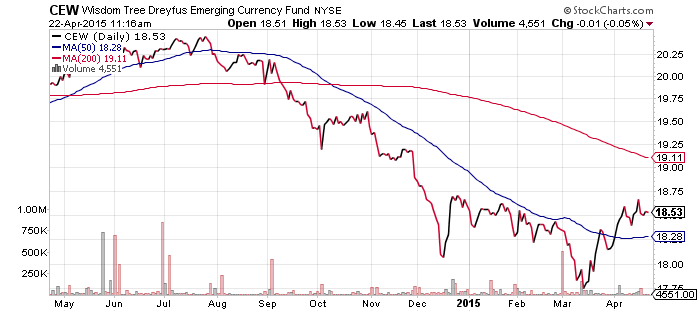

WisdomTree Dreyfus Emerging Currency (CEW)

Greece again weighed on the euro as the country faces another potential default in May. It doesn’t pay to watch the headlines though, the euro will tell the story. It bottomed in March and hasn’t moved lower despite renewed concerns about Greece. On the other hand, the currency is still below its 50-day moving average. Look for a break above the 50-day moving average to signal an end to the current crisis, while a break below the lows of March would likely send the euro to parity with the U.S. dollar.

As for GREK, it broke to new lows last week. This could be a double bottom if shares hold.

The yen remains in a trading range, with no up or down trend. The larger trend still remains bearish.

Emerging market currencies have rebounded, helped by the rise in oil prices. The big rally in Chinese equities has also lifted the yuan near its highs for the year.

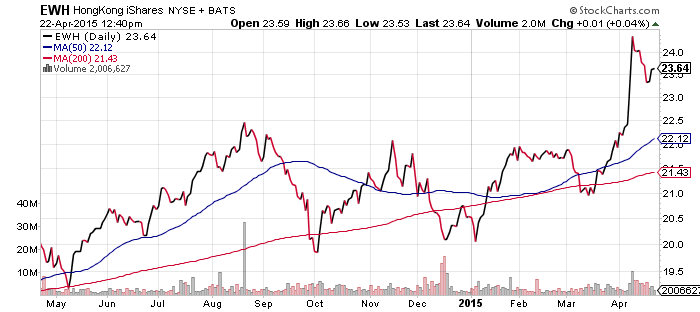

iShares MSCI Hong Kong (EWH)

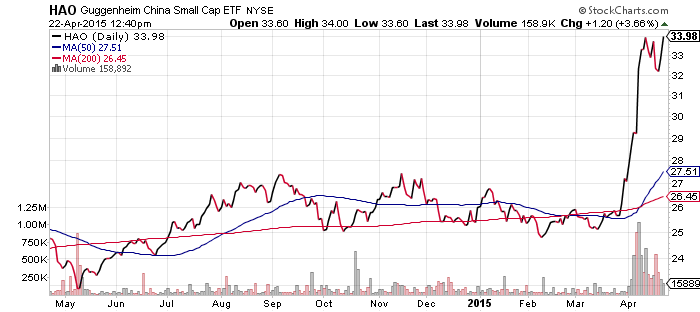

Guggenheim Small Cap China (HAO)

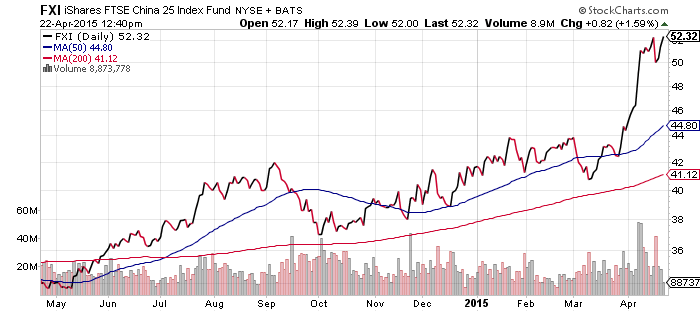

iShares China Large Cap (FXI)

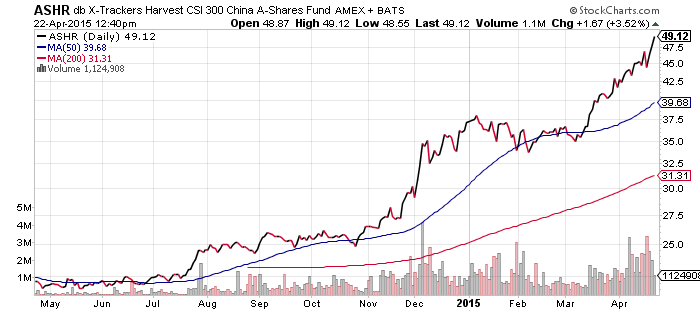

db X-Trackers China A Shares (ASHR)

Chinese A-shares broke out to a new high this week and H-shares are poised to follow. On Monday, the Shanghai and Shenzhen markets set a world record in daily trading volume, topping $250 billion. The exchange’s volume indicator showed all 9s because it wasn’t able to display such a large figure in yuan.

Last Friday, it appeared as if there would be a correction in Chinese shares following some new rules on short-selling and margin, which sent futures down about 7 percent. On Saturday securities regulators reassured investors that the new rules were not designed to trigger a sell-off. On Sunday, the central bank shocked the market and cut reserve requirements by 1 percent, potentially allowing banks to increase lending by as much as $160 billion.

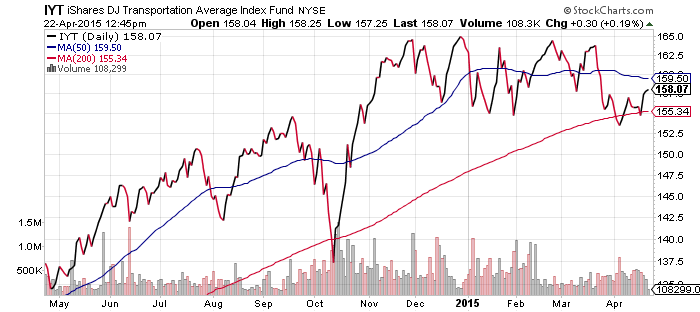

iShares DJ Transportation (IYT)

The transportation average remains at the low end of its recent trading range. A move above $165 on IYT is needed for a bullish breakout, while a breaking of the low in early April could unleash a larger downside move.

SPDR S&P 500 (SPY)

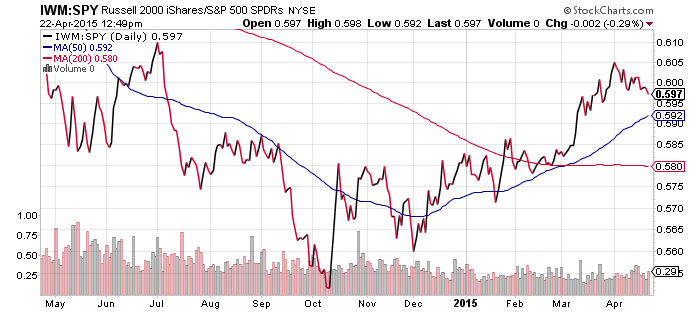

iShares Russell 2000 (IWM)

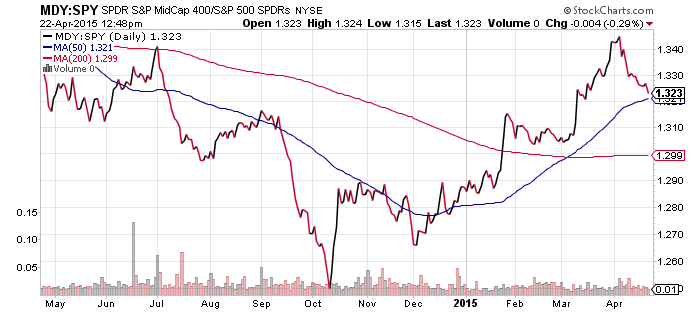

S&P Midcap 400 (MDY)

Mid- and small-caps have led the market higher this year but underperformed the S&P 500 Index over the past few weeks. The price ratio of MDY to SPY is set to test the 50-day moving average that has served as support in 2015. Nevertheless, with no sign of broad large cap leadership yet, weakness here is a bit bearish for stocks over the coming days.