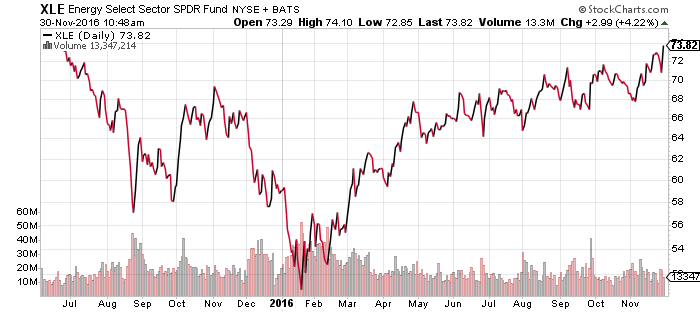

SPDR Energy (XLE)

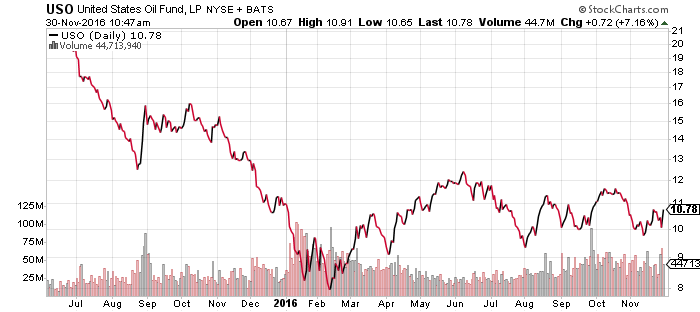

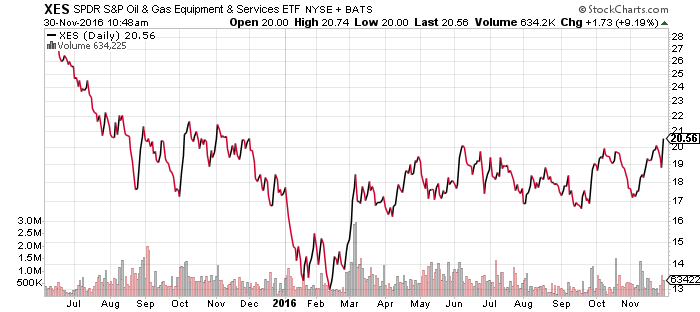

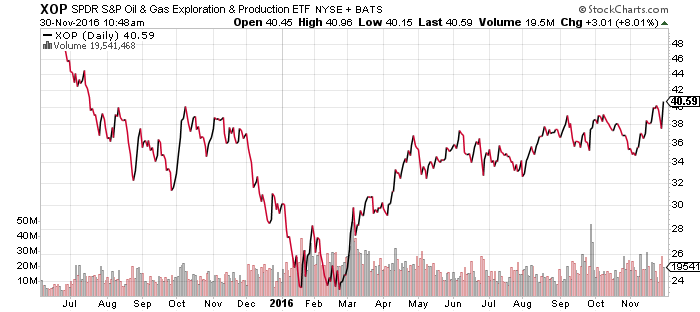

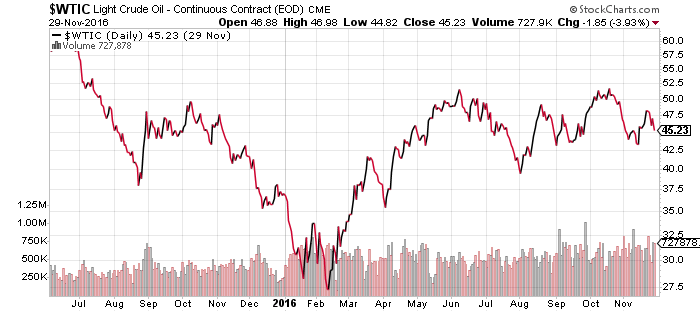

OPEC’s production cut of 1.2 million barrels per day lifted oil prices 9 percent to their highest November level. Iran can increase production thanks to a higher quota, while Libya, Nigeria and Angola are exempt from the deal. American shale producers are not party to any OPEC deal. Assuming prices rise, American output will rise, blunting the impact of the cuts.

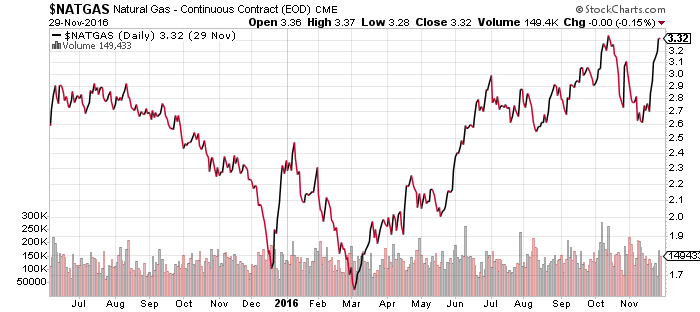

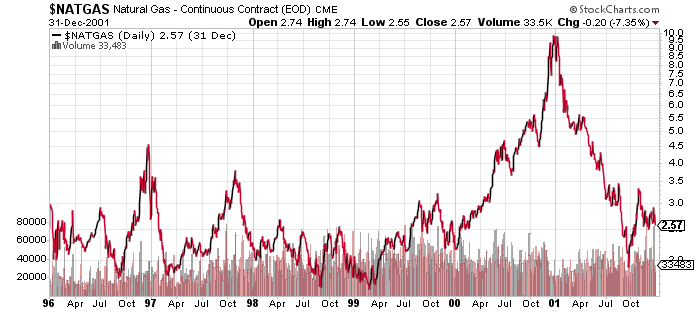

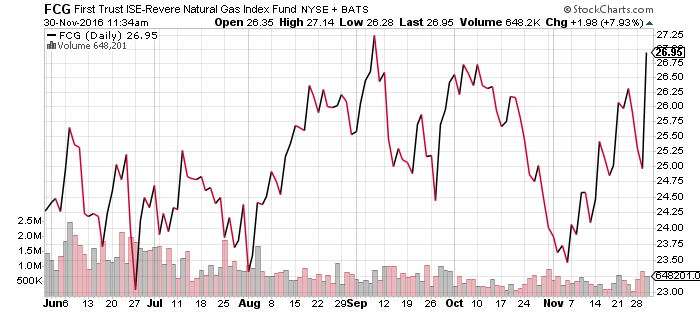

Natural gas, on the other hand, is on the cusp of a bullish breakout. The move could be related to weather patterns, a result of the change from El Nino to La Nina. In brief, El Nino raises temperatures in the Pacific above average and La Nina pulls them below average. The El Nino in 1997-1998 was strong and earned the title of “warmest on record” until this year. The subsequent La Nina was equally strong and reversed all of the warming as global average temperatures collapsed for 2 years before bottoming. As cold winters hit North America, natural gas supplies declined and eventually led to a spike in prices.

The El Nino in 2015-2016 exceeded the 1998 peak, with 2016 likely to be named the warmest on record. Global average temperatures over land have already plunged by 1 degree Celsius since summer, which is consistent with a powerful La Nina. If the newly arrived La Nina goes on to meet or exceed the late 1990s La Nina, natural gas demand will rise as winter temperatures drop over the next one to two years.

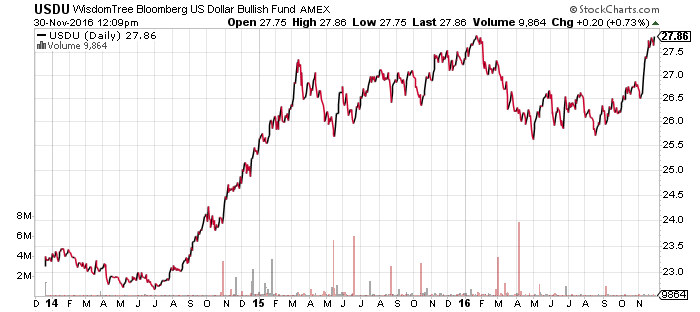

WisdomTree US Dollar Bullish (USDU)

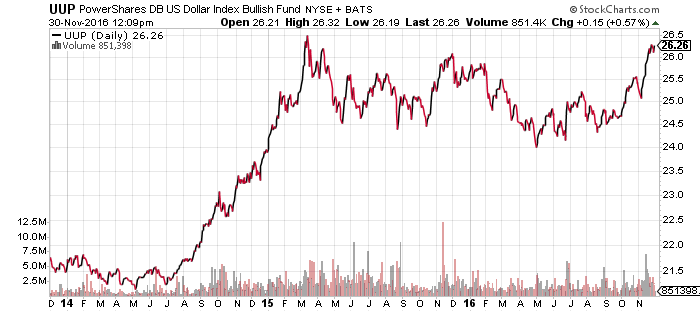

PowerShares DB US Dollar Bullish (UUP)

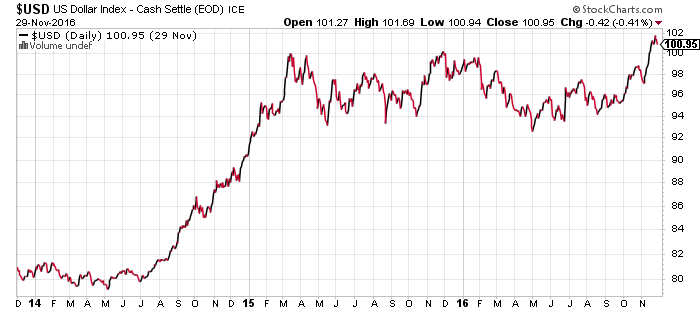

Higher oil prices often accompany a weaker U.S. dollar as inflation is behind the move in both cases. Supply cuts drove the oil rally this week and the U.S. dollar remains strong due to higher interest rates on U.S. Treasuries, which is attracting foreign investment.

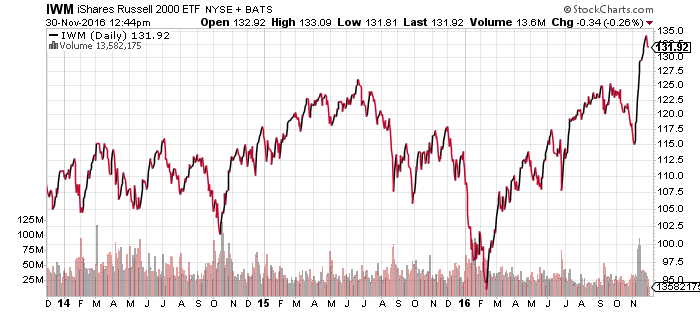

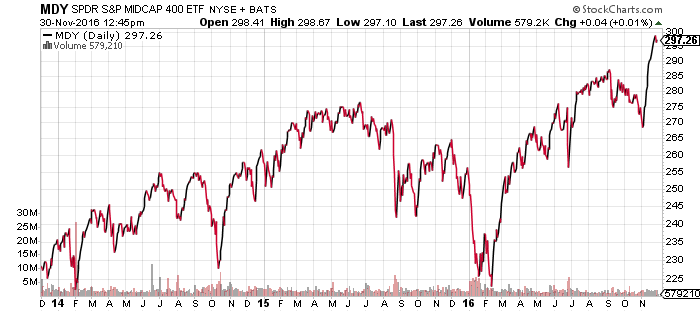

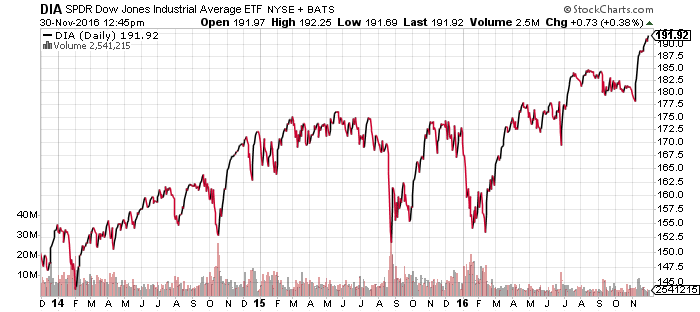

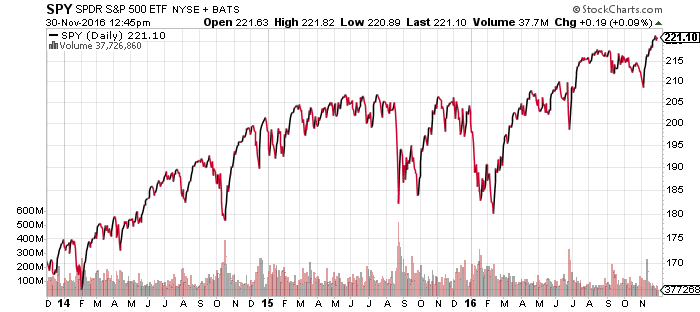

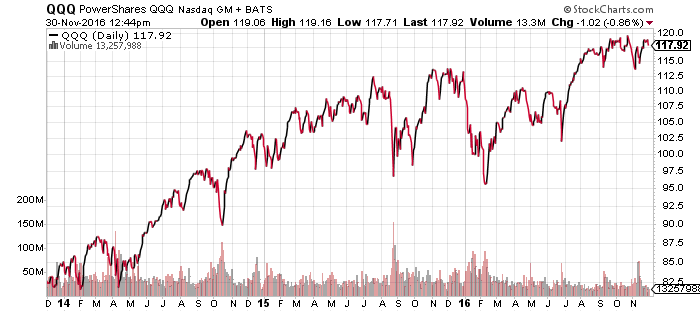

Indexes

Small-cap and mid-cap stocks extended leads last week as more details of Republican tax plans emerged. Many proposed changes will strip away laws that benefit large corporations.

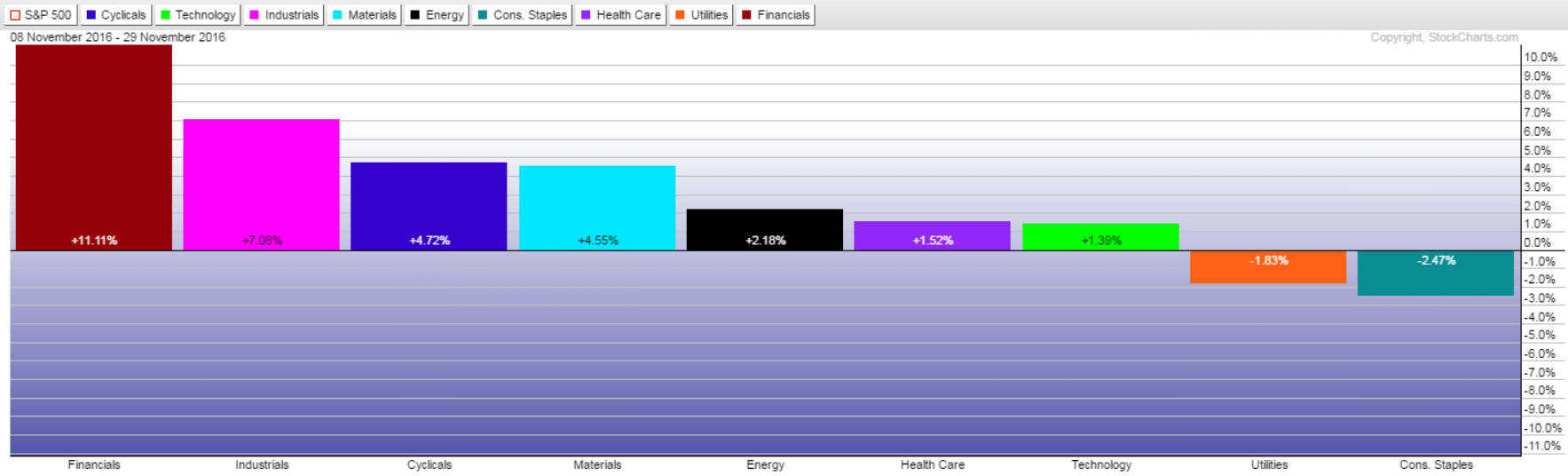

While small- and mid-cap shares trounced large-caps in recent weeks, the Dow Jones Industrial Average also performed well with exposure to industrials and financials, outperforming both the S&P 500 Index and the Nasdaq. The Dow is overweight industrial and financial stocks relative to the S&P 500 and have been the best-performing sectors since the November 8 election.