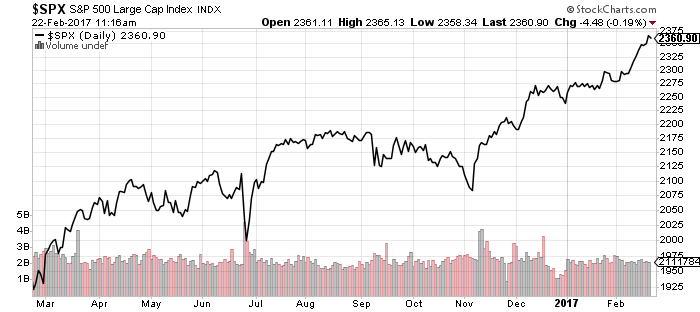

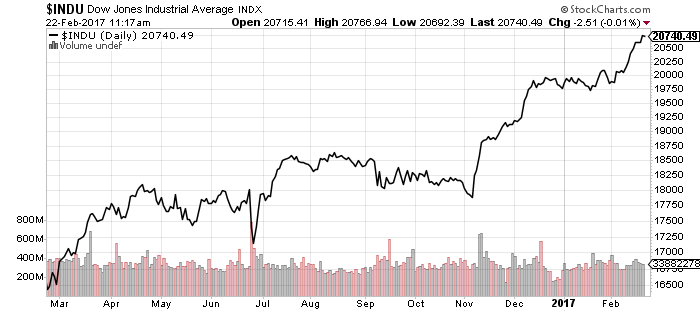

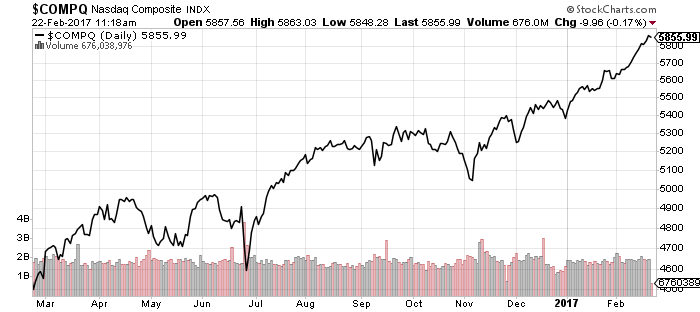

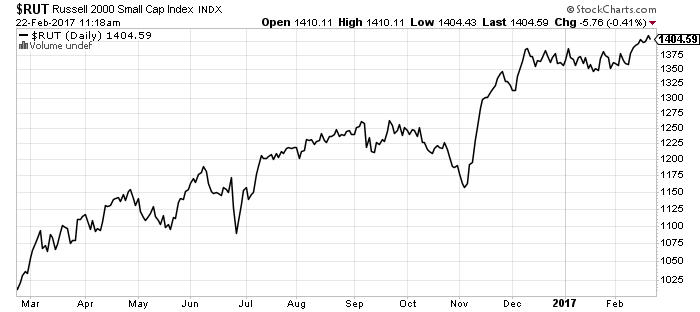

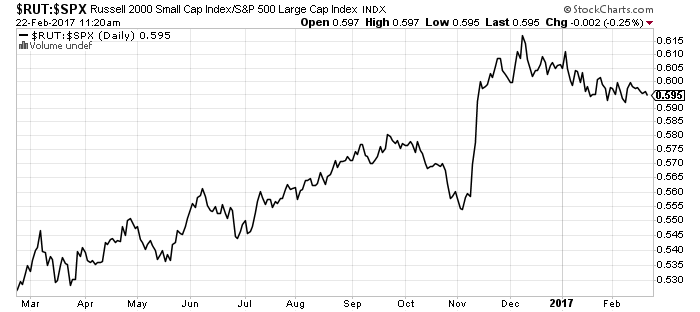

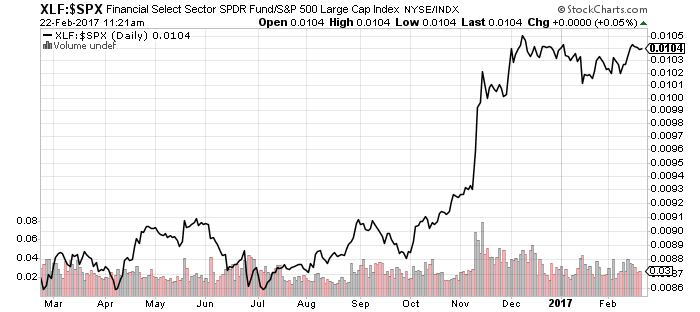

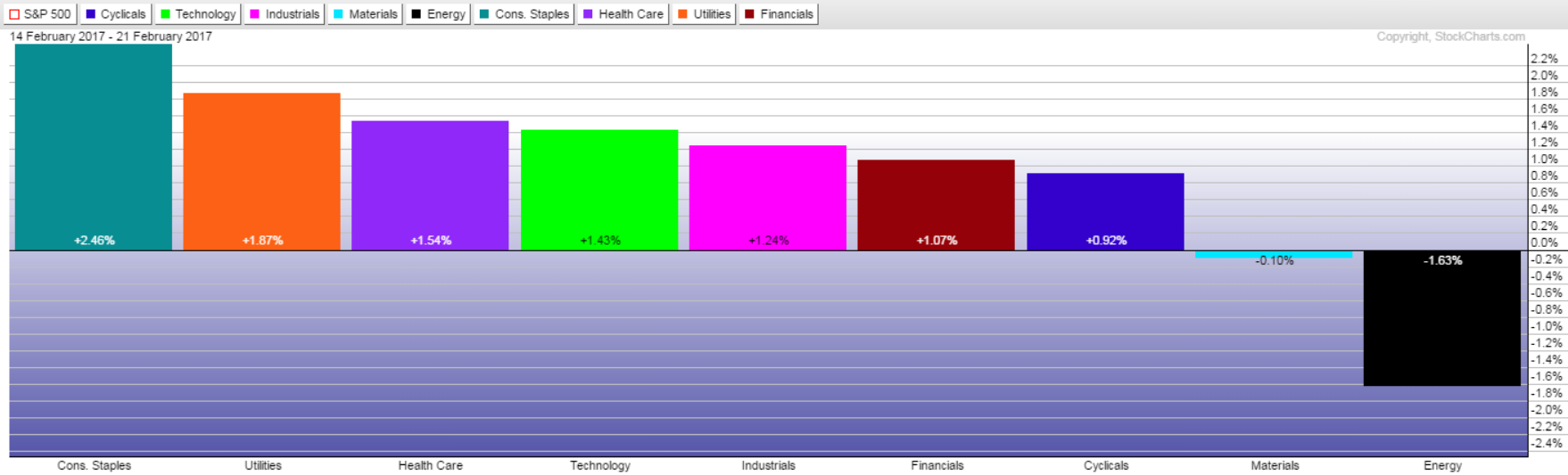

Equities climbed to new all-time highs again last week. The Russell 2000 broke out of its trading range to a new high, though it continues to underperform the S&P 500 Index. Acceleration in the financial sector, however, could eventually boost the index back into leadership.

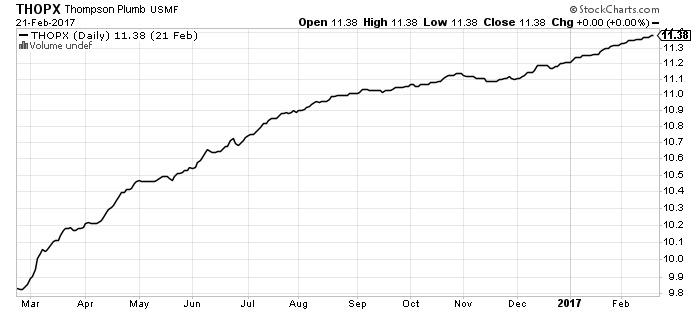

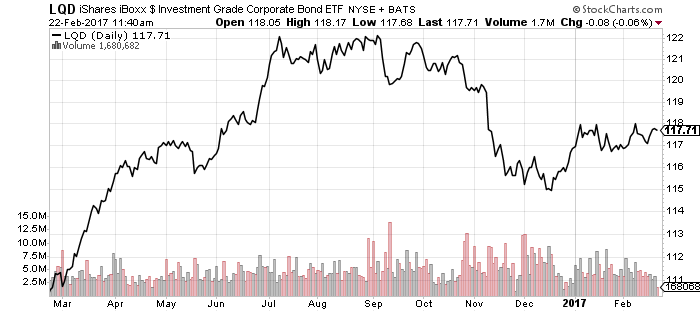

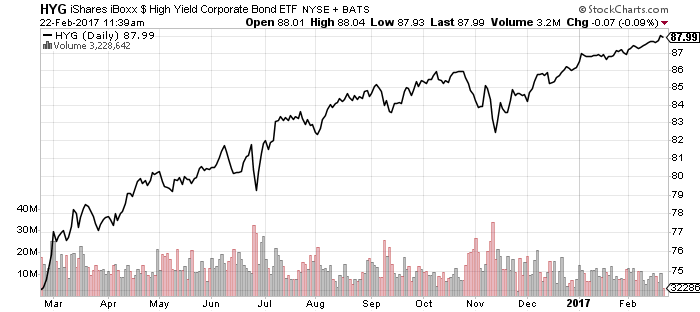

Thompson Bond (THOPX) has marched upwards since December, in contrast to the choppier patterns in high-yield funds, such as iShares iBoxx High Yield Corporate Bond (HYG). Investment-grade bond funds like iShares iBoxx Investment Grade Corporate Bond (LQD) have seen even greater volatility due to much longer duration. THOPX’s very low duration of 1.15 years reduces interest rate risk.

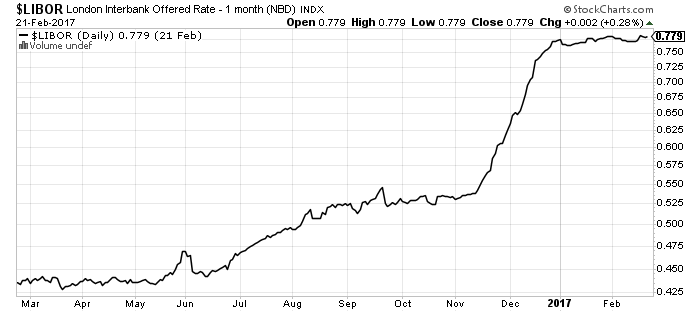

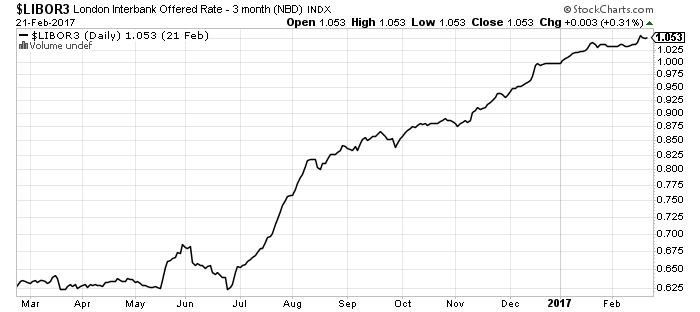

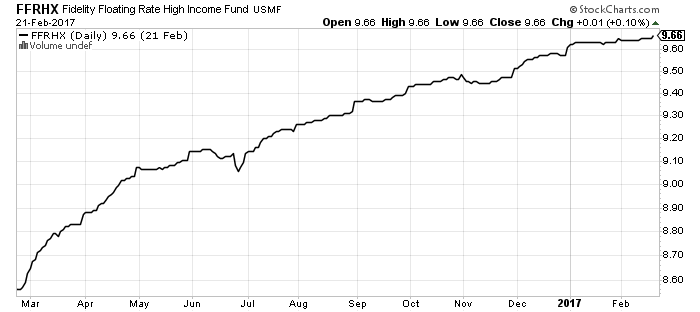

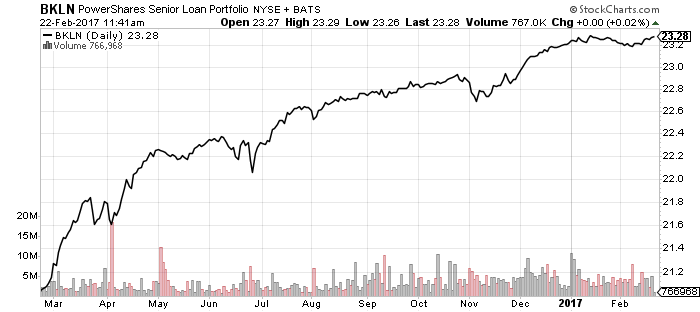

Floating-rate funds, which have durations close to zero, remain in an uptrend as well. An uptick in LIBOR following Federal Reserve Chair Janet Yellen’s Congressional testimony lifted shares.

In contrast to LIBOR, Treasury yields pulled back following the Yellen spike. Both remain in consolidating trading ranges following late-2016 breakouts.

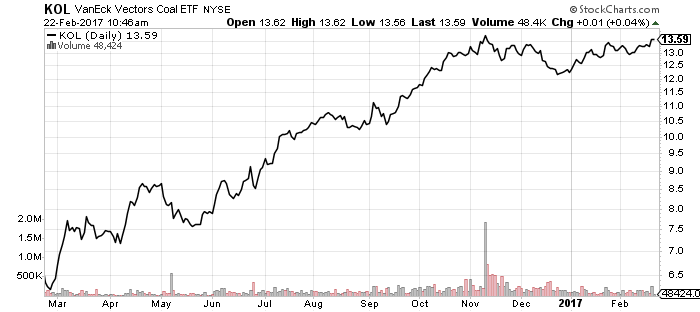

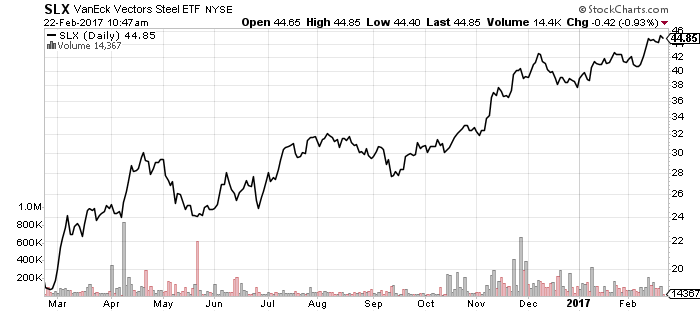

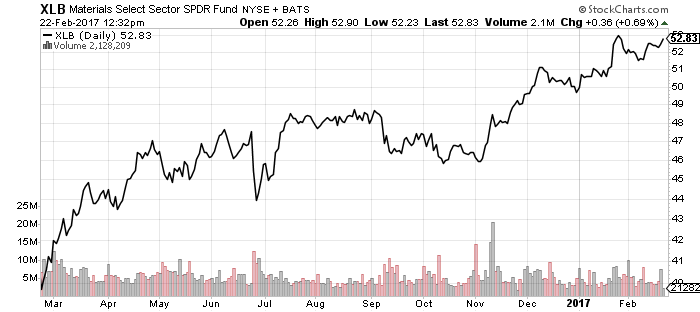

Some natural resource funds have formed bullish consolidation patterns. VanEck Steel (SLX) has already broken out of its consolidation pattern and moved higher, but VanEck Coal (KOL) has yet to break out of its larger pattern. SPDR Materials (XLB) has a similar smaller pattern.

Utilities were a surprisingly strong performer as rate hike expectations rose over the past week.

Healthcare and technology have been strong performers this year and both turned in solid gains for the week.

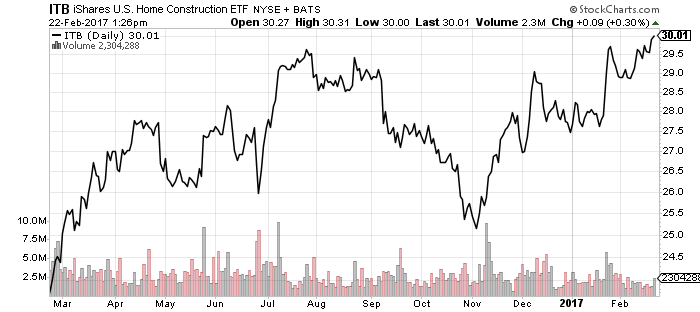

Homebuilders are trading at a new 52-week high and their highest level since 2007. Since late 2016, investors have wondered if economic optimism would trump rising interest rates in the housing market. Right now, investors are betting on growth and data backs them: existing home sales for January were 5.69 million, higher than December’s 5.51 million and the forecast of 5.57 million. January new home sales are out on Friday. Forecasts call for 586,000 new homes, up from December’s 536,000.

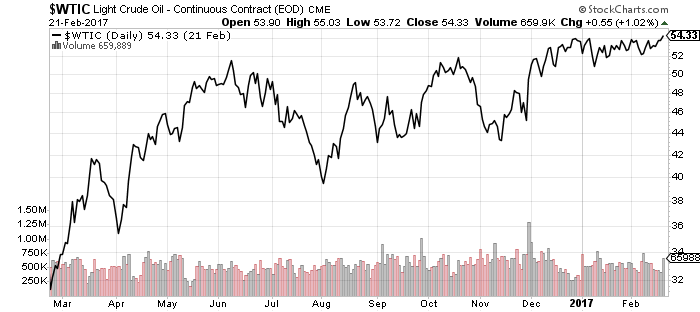

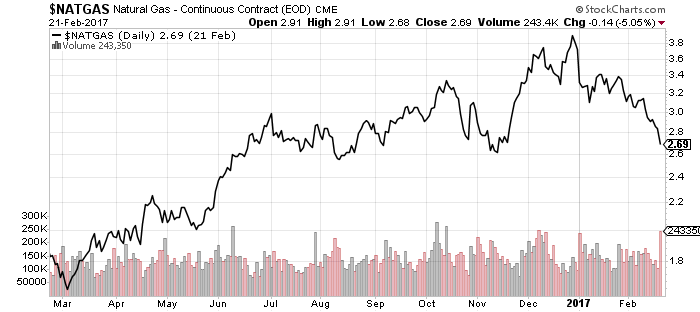

Oil prices have been steady since December, with the $54 area serving as a hard resistance. Natural gas prices have declined; $2.60 area is an important zone of near-term support.

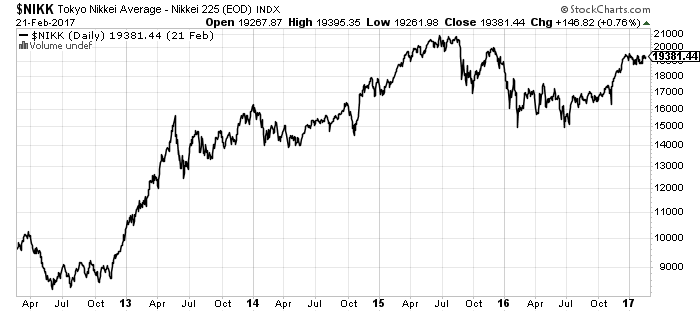

The Japanese economy hit an important milestone this past quarter when its nominal GDP exceeded the old high set in 1997. The Japanese economy has done well in recent years, performing similarly to the United States and Europe when measured by real per-capita GDP.

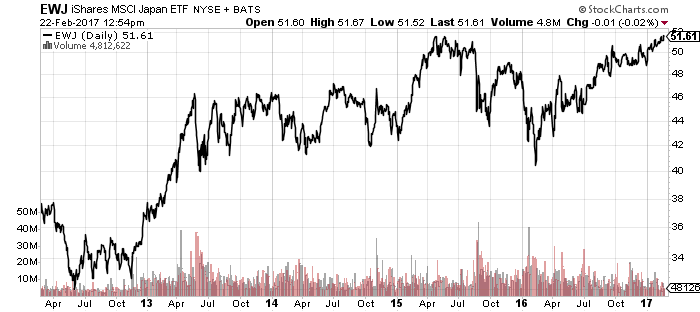

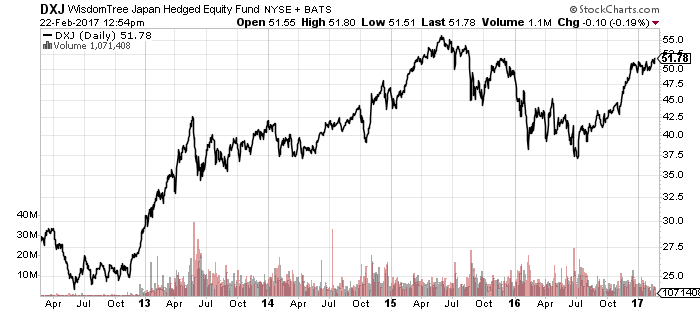

The Japanese stock market is hovering about 9 percent below its 52-week high, but iShares MSCI Japan (EWJ) is nearing its 52-week high thanks to a stronger yen. WisdomTree Japan Hedged (DXJ) hedges out yen exposure and behaves more similarly to the Nikkei. Japan will need a weaker yen if it wants to keep nominal GDP growing.