The Investor Guide to Fidelity Funds for December 2022 is AVAILABLE NOW! December Data Files Are Posted Below Market Perspective: Value Stocks Continue to Lead Equities extended their rally to more […]

The Investor Guide to Fidelity Funds for December 2022 is AVAILABLE NOW! December Data Files Are Posted Below Market Perspective: Value Stocks Continue to Lead Equities extended their rally to more […]

Global X Copper Miners (COPX) +38

iShares Silver Trust (SLV) +28

VanEck Steel (SLX) +27

VanEck Gaming (BJK) +26

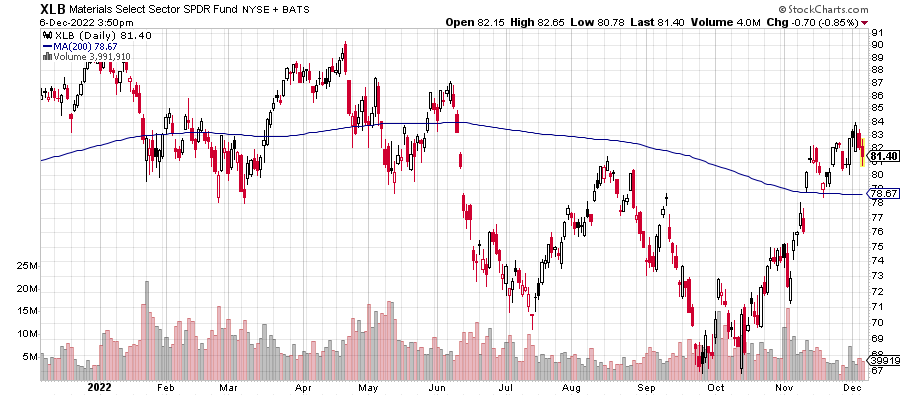

SPDR Basic Materials (XLB) +26

The month of November saw materials stocks lead the market higher. SPDR Materials (XLB) gained 13 percent in December 2, more than double the 5.5 percent rise in SPDR S&P 500 (SPY). Sectors such as copper and steel rallied as well, but oil, palladium and agricultural commodities were among the largest momentum losers. What explains this divergence?

In one word: China. Although one can look at the above funds and maybe guess China was the driver, the presence of VanEck Gaming (BJK) gives it away. Gaming stocks in that portfolio are heavily influenced by Chinese gamblers. As for the commodities, copper and steel are two of the main metals in demand when China increases stimulus spending.

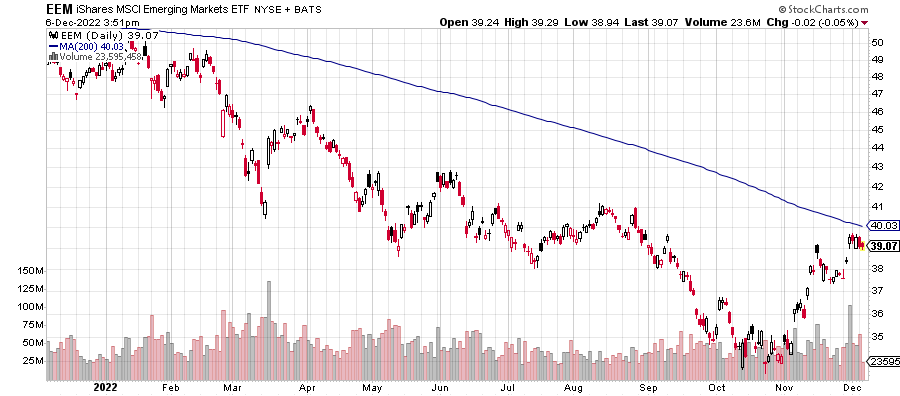

The past month saw several rumors of China reopening along with large protests against lockdowns in some cities. Combined with the general rally since October, it delivered substantial gains in equities with China exposure. Invesco China Technology (CQQQ) climbed 43 percent from its October low. As a large component in emerging market funds, China and Chinese tech stocks helped emerging markets outperform U.S. markets, as did the weaker U.S. dollar.

What’s next for these sectors will be an important signal for markets and the world economy.

VanEck Steel (SLX) is the only fund ranked high enough in our relative momentum rankings to be a possible portfolio addition anytime soon. Often times, sectors come close to making into the top-10 of the rankings only to fizzle out though. Is it headed for leadership or will this be another fizzle?

Overlaying technical signals such as the 200-day moving average on the major indexes shows the markets at a major decision point. Rallies in 2022 have ended around this level. Will this be the third major reversal or has the bottom been made?

A breakout in all assets will signal this past year was more like a large correction than a bear market. At the very least, it would signal extended rallies into the end of 2022. If optimism around China remains, then the momentum indicates China-related sectors should extend their momentum gains.

If sectors such as copper, steel, industrials and emerging markets extend their rallies, it could create a bifurcated market. If these shares are doing well, it doesn’t confirm inflation will be higher. Investors will make that assumption though, and it could be why stocks such as Amazon (AMZN) are lower now than they were in October. Strong growth amid higher inflation would weigh on technology-heavy indexes such as the Nasdaq.

Finally, it’s possible history repeats. Most assets turn lower from here and resume the downward trend that has dominated 2022. In that case, it’s possible some of the above sectors underperform as traders who piled in and created the upward momentum find themselves scrambling out.

When the market finally tips its hand, the momentum rankings will tell us which sectors are primed for leadership.

Click Here to view today’s Global Momentum Guide The Nasdaq gained 2.09 percent last week, the Russell 2000 Index 1.27 percent, the S&P 500 Index 1.13 percent, the MSCI […]

The stock market faced a challenging Monday and Tuesday, but the three major indexes rallied hard after Federal Reserve Chairman Jerome Powell delivered a speech at the Brookings Institution. He reiterated that the pace of rate hikes would slow in December and while there was little new information, the market took the opportunity for a volatile short-squeeze that sent the major indexes up on the day. The NASDAQ led the week with a gain of 2.09 percent. The S&P 500 rose 1.13 percent. The Dow Jones Industrial Average, which has been the stronger index this year, gained 0.24 percent. It is down 5.25 percent for the year.

Apple (AAPL) fell slightly on the week, but Netflix (NFLX) and Meta (META) gained more than 10 percent each., Other BigTech stocks saw gains ranging from 1 to 6 percent.

Volatility in the U.S. stock market fell again last week, hitting levels last seen in April and August. Both prior lows in volatility saw stock market rallies lose steam and reverse. The upcoming week will be important for short-term market direction because the major indexes are also at important technical levels. The S&P 500 Index is at the 200-day moving average. A breakout higher in stocks and break down in volatility will confirm for traders that markets will likely drift higher into year-end.

The 10-year U.S. Treasury bond yield tumbled to its lowest level since September. It settled at 3.51 percent on Friday, down from the 4.30 percent peak in October. iShares 20+ Year Treasury (TLT) gained 4.32 percent last week as weaker inflation and a more dovish-sounding Fed boost bonds.

The S&P 500 gained 5.38 percent in November. All 11 sectors were green, with materials up 11.70 percent. Financials and technology rose more than 6 percent each, industrials nearly 8 percent. Consumer discretionary was the weakest, up less than 2 percent.

Job openings in the United States fell from 10.7 million in September to 10.3 million in October. New jobs were higher than expected in November, with 263,000 new hires. Wage growth was surprisingly high at 0.6 percent, double forecasts. This high rate of wage growth briefly sent stocks sharply lower and hints at how inflation be elevated longer than anticipated.

According to the Department of Labor, weekly jobless claims dropped to 225,000 from 237,000 in the week ended November 25.

The U.S. Bureau of Economic Analysis reported personal income in the United States rose 0.7 percent in October, 0.4 percent after inflation and in line with expectations.

The upcoming week is light on domestic data. The ISM services report on Monday will highlight the early week data. Friday will bring the producer price index for November along with the University of Michigan consumer sentiment survey early read on December. Analysts expect the PPI rose 0.2 percent. China’s balance of trade and inflation readings are also out this week.

Upcoming earning reports: The large-cap earning reports are few this week. The most important will be Thursday’s report from Costco:

• Monday: Gitlab (GTLB)

• Tuesday: AutoZone (AZO)

• Wednesday: Brown-Forman (BF.B)

• Thursday: Broadcom (BRCM), Costco (COST)

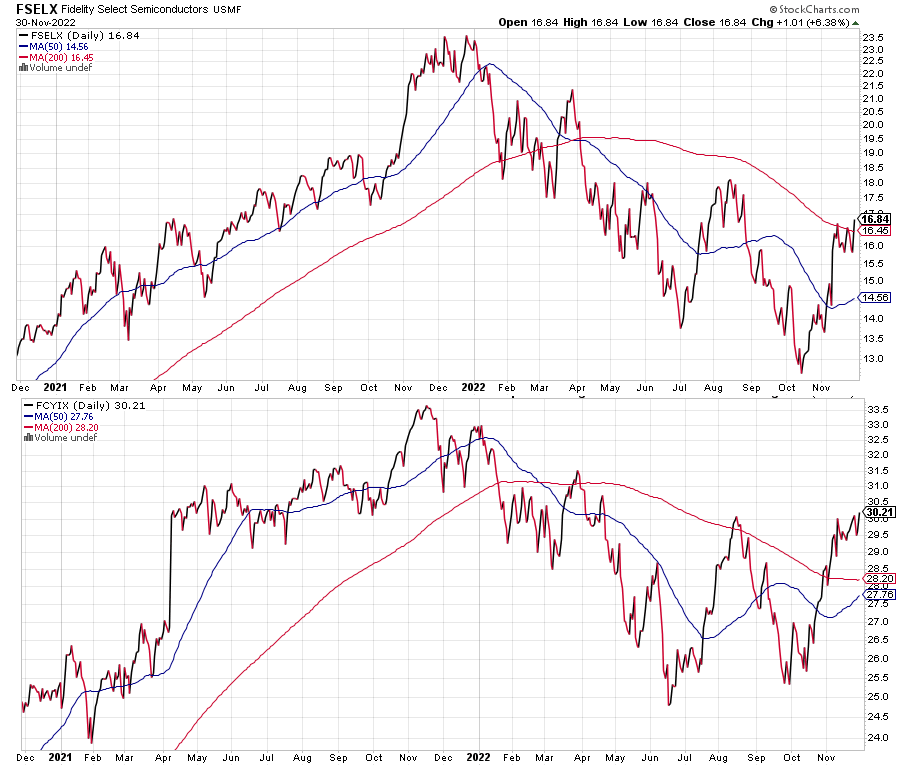

Fidelity Select Semiconductors (FSELX) +8

Fidelity Select Industrials (FCYIX) +7

Semiconductors and industrials have been two of the strongest sectors in the past month, with both experiencing rising relative momentum. Fidelity Select Semicondcutors climbed eight positions, while FCYIX rose seven. Their moves are similar in size, but different in character.

FSELX rebounded from a loss of 45 percent this year. It has since rallied about 30 percent off its low, but it is still down more than 25 percent this year.

The top holding in FSELX is Nvidia (NVDA), with 22.41 percent of assets as October 31. Nvidia helped sink the fund this year, falling more than 60 percent at the October low before rebounding. The company’s graphics processing chips are popular with cryptocurrency miners, but the bear market in cryptocurrency has crimped demand.

As with the entire semiconductor sector, the bounce in FSELX has generated a strong relative momentum move, but the sector remains in the lower half of the momentum rankings. FSELX didn’t gain much absolute momentum as it moved ahead of very weak funds, but hasn’t yet established a bullish footing.

By contrast, Fidelity Select Industrials has ridden the strength in the Dow Jones Industrial Average. There are multiple ways of determining whether a bear market takes place or not, but the industrial-heavy Dow Jones Industrial Average barely qualified this year with a loss of around 20 percent at its low.

This year qualifies as a correction for industrial stocks. FCYIX is down less than 10 percent this year. After the post-Powell speech rally on November 30, the DJIA is down less than 5 percent on the year. All-time highs are possible by the end of the year if the rally continues at its recent pace.

FCYIX is a much more diversified fund than FSELX. Roper Technologies (ROP) is the largest holding with 9.73 percent of assets as of October 31. It is a mid-cap growth fund with an average market capitalization of $21 billion.

Also unlike FSELX, FCYIX is ranked among the top-10 Fidelity Select Sector funds for relative momentum. If the broader stock market rallies in 2023, the industrial sector is a high probability candidate for bull market leadership.