The November Issue of the ETF Investor Guide is AVAILABLE NOW! Links to the November Data Files have been posted below. Market Perspective: Inflation May Not Be Over Yet The […]

The November Issue of the ETF Investor Guide is AVAILABLE NOW! Links to the November Data Files have been posted below. Market Perspective: Inflation May Not Be Over Yet The […]

On Thursday, weekly unemployment claims data was released, and it revealed that 213,000 people applied for benefits over the past seven days. This was compared to an expected 220,000 claims and was also slightly lower than last week’s 219,000 requests for benefits.

On Friday, the Flash Manufacturing PMI and Flash Services PMI reports were made public. The Flash Manufacturing PMI came in at 48.8, which matched analyst expectations prior to the release. Meanwhile, the Flash Services PMI came in a 57, which was higher than the projected 55.2.

The figures continue to suggest that manufacturing is still struggling to gain traction in the United States, while demand for services is flourishing. Any figure below 50 indicates a contraction in the industry while figures above 50 represent expansion.

Ultimately, this could drive another period of inflation or at least prevent prices from coming down to the Fed’s 2 percent target. Depending on what future data says, the Fed may decide to hold off on future rate cuts or slow the pace of cuts over the next 12 months. Last week, Jerome Powell said that future cuts would be data dependent and that the road to 2 percent inflation would be a bumpy one.

Currently, it’s expected that the Fed will cut interest rates another 25 basis points when the Federal Open Market Committee (FOMC) meets on Dec. 18. However, recent data suggests that this is not a guarantee, and there has been speculation that other central banks may consider holding off on rate cuts as well.

The University of Michigan released its inflation expectation report on Friday morning, and respondents said that inflation would be at 2.6 percent at this point next year. Consumer sentiment came in at 71.8 compared to 74 earlier in November.

For the week, the S&P 500 increased 1.48 percent. The market made a low of 5,862 on Tuesday morning before reversing and hitting a high of 5,972 on Friday.

As with the S&P, the Dow was also up this week as it closed 1.92 percent higher at 44,296. The Dow would make its low of the week on Tuesday of 42,970 before reversing and closing at the high of the week.

Finally, the Nasdaq also finished higher over the past five trading days closing at 19,003. That represents an increase of 266 points or 1.42 percent. Unlike the S&P and Dow, the Nasdaq had a flatter curve as it opened at its lowest point of the week at 18,694 and would test that low two more times by Thursday.

In international news, Canada and Great Britain announced their inflation figures for October with both countries experiencing a slight uptick in CPI data. Great Britain also revealed that retail sales were down .7 percent in October while Canada announced its retail sales figure increased .4 percent.

The upcoming week features the Thanksgiving holiday on Thursday as well as Black Friday, which generally serves as an extension of that holiday. The week will be front-loaded to include the CB Consumer Confidence report on Tuesday as well as the preliminary gross domestic product (GDP) figures on Wednesday. Unemployment claims and the monthly Core PCE Price Index data will also be released on Wednesday morning.

The Investor Guide to Vanguard Funds for November is AVAILABLE NOW! Links to the November data files are posted below. Market Perspective: Stocks Jump On Election Hopes Stocks jumped following […]

The week after the election was a pivotal one for the market as a slew of important data was released. The first important piece of news came out on Tuesday as inflation figures for the month and year were made public. Over the past month, core inflation rose by .3 percent, which was in line with expectations. Overall inflation rose .2 percent on a monthly basis. On an annual basis, inflation rose by 2.6 percent, which was expected but still higher than the 2.4 percent figure in October.

On Thursday, both the Core Price Producers Index (PPI) and the overall PPI were released. Core PPI came in at .3 percent on a monthly basis while overall PPI came in at .2 percent on a monthly basis. Both of these figures were in line with expectations prior to their release.

Thursday also saw the release of unemployment claim data for the past seven days. There were 217,000 requests for benefits during this time compared to an estimated 224,000. Federal Reserve Chair Jerome Powell spoke on Thursday afternoon, and his comments caused some to doubt whether there would be a further rate cut in December.

Although it’s still likely to see another cut of 25 basis points next month, Powell said that there was a need for caution amid uncertainty. The election of President Trump is expected to usher in policies that may be inflationary in nature, which could make it unwise to change rates until more data can be scrutinized.

On Friday, retail sales data for October came out that showed a .4 percent increase over the past month while core retail sales were up .1 percent. It was believed that both core and overall retail sales rose .3 percent over the past month. When taken together, CPI, PPI and retail sales data indicate that there is still demand in the economy that could place upward pressure on prices in the future. As economists like to say, inflation is sticky and may not be going away anytime soon.

The S&P 500 finished the week down 2.41 percent to close at 5,870 just a week after if broke 6,000 for the first time ever. The market opened on Monday morning at its weekly high of 6,014 before spending most of the week losing ground. On Friday, the S&P made its low of the week at 5,854.

The Dow finished the week down 2.07 percent to close at 43,444. It would also open at its high of the week of 44,441 before sliding back to its weekly low of 43,354 on Friday morning. Roughly one-third of the index’s weekly losses came on Friday when it lost nearly 300 points on the day.

The Nasdaq lost 3.51 percent this week to close at 18,680, which was a loss of 678 points over the last five trading days. On Wednesday afternoon, the market made its high of 19,350 before reversing and making its weekly low on Friday afternoon. At that point, the Nasdaq was at 18,605 before gaining back some ground into the close of the week.

A few key pieces of news were released by Great Britain and Australia throughout the course of the last week. Great Britain announced on Friday that its gross domestic product (GDP) over the past month fell by .1 percent. On Tuesday, Australia announced that wages grew by .8 percent over the past quarter while announcing on Wednesday that its unemployment rate was at 4.1 percent.

The upcoming week is going to feature only a couple of key news releases in the United States. On Friday, Flash Manufacturing PMI and Flash Services PMI will be made public in addition to the University of Michigan’s revised consumer confidence and inflation expectation figures.

If you have exposure to international markets, there will be a lot of news to keep your eye on. Early Friday morning, most developed nations in Europe will release their Flash Manufacturing PMI and Flash Services PMI. Great Britain and Canada will release inflation data as well as retail sales data.

The first full trading week of November will have consequences for traders both now and well into the future. Early on Wednesday morning, Donald Trump was declared the next president of the United States, and his proposed policies will have a significant impact on the market and the economy.

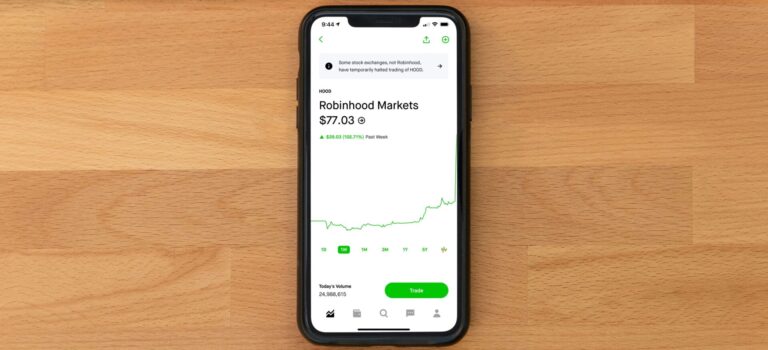

His election is seen as a boon for crypto, as Bitcoin prices soared to almost $77,000 on Wednesday. Bank, energy and other stocks also performed well this week with the Dow itself opening up over 1,300 points on Wednesday morning. Trump’s election is seen as a win for business as he is likely to rollback or ease existing regulations.

However, he is also expected to impose tariffs on goods from China and other countries, which are expected to have an inflationary effect. He is also expected to push for a reduction in the corporate tax rate from 21 percent to 15 percent, which may also sap the government of revenue.

If inflation does get going again, it could significantly impact the Fed’s plan to reduce interest rates in 2025. On Thursday, the Fed voted to lower the funds rate by 25 basis points and did not comment on how changes in the White House might influence its policy decisions going forward.

Jerome Powell also said during the Fed press conference on Thursday that he would not step down from his position if asked by Trump. He also reiterated that he couldn’t be fired or otherwise removed if he refused.

While the election certainly played the biggest role in shaping market sentiment this week, it was not the only major event on the calendar. On Tuesday, the ISM Services PMI was released and came in at 56, which was higher than the expected 53.8. It means that the service sector is still in a period of expansion, which could continue to put upward pressure on prices.

On Thursday, unemployment claims data for the past seven days was made public, and it revealed that 221,000 people filed for benefits over the last week. This was compared to an expected 223,000 claims and 218,000 claims filed in the previous tracking period.

Finally, on Friday, the University of Michigan released its consumer confidence and inflation expectation data. Consumer confidence came in at 73 compared to an expected 71 while respondents said that inflation would be at 2.6 percent 12 months from now.

The Dow finished up nearly 5 percent this week to close at 43,988, which was an increase of 2,082 points. The low of the week occurred on Monday when the market dipped to 41,679 while the high was made at 44,142 on Friday afternoon. The Dow is up over 16 percent year-to-date (YTD) after this week’s post-Trump bounce.

The Nasdaq rose 5.9 percent this week to close at 19,286, which was an increase of 1,073 points for the last five trading days. On Monday, the market reached its low of the week at 18,163 while it made its high of the week on 19,310 late on Friday afternoon.

Finally, the S&P 500 also finished significantly higher this week gaining 4.68 percent to close at 5,995.

In international news, Australia decided to keep its interest rate steady at 4.35 percent on Monday night. On Tuesday, New Zealand announced that its unemployment rate was 4.8 percent while there was a negative .5 percent change in the country’s employment numbers. On Thursday, Great Britain announced that it would lower its interest rate by 25 basis points to 4.75 percent.

Next week features a number of key reports in the United States as inflation data will be revealed on Wednesday. On Thursday, unemployment claims data as well as the PPI report will be released while retail sales data for October will be released on Friday. In addition, Jerome Powell is scheduled to speak on Thursday afternoon in what should be a closely followed speech.