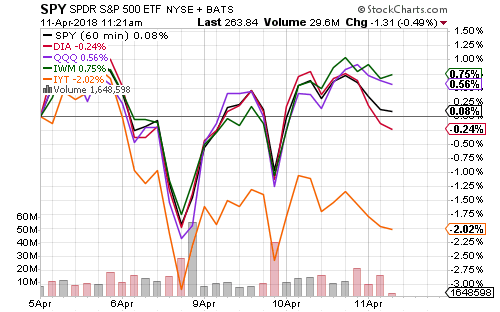

Equities were choppy over the past week, but most major indexes rose into Wednesday trading. The Dow Jones Industrial Average underperformed.

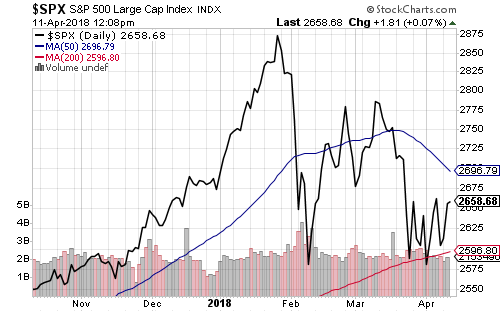

The S&P 500 Index has bounced off its 200-day moving average four times in April, historically consistent with mild corrections. Larger corrections over the past decade (2010, 2011, 2015 and 2016) have finished with a dip below the 200-day.

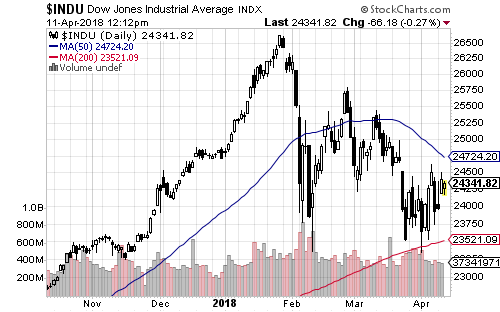

The Dow Industrials also bounced off its 200-day moving average.

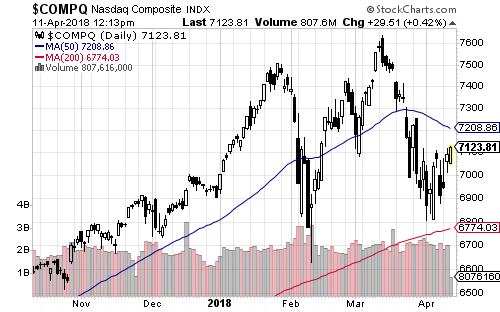

Although the Nasdaq has suffered in recent weeks, it’s strength earlier in the year has kept it above its 200-day MA.

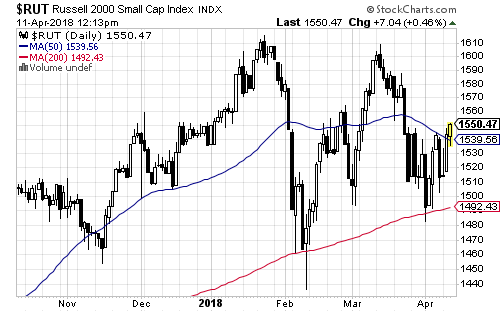

The Russell 2000 tends to outperform in bull markets and it’s above its 50-day moving average. If we’ve seen the bottom of this correction, the other indexes will soon follow.

Technology led the largest S&P 500 sectors. Facebook (FB) rebounded strongly on Tuesday as CEO Mark Zuckerberg testified before the Senate.

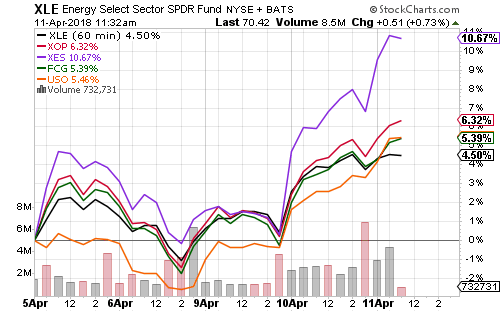

Energy, telecom and materials were among the best performing sectors.

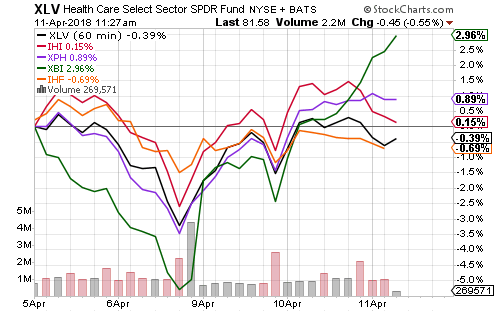

Biotechnology lifted the healthcare sector. Pharmaceuticals performed well, and medical devices outperformed the overall sector. Healthcare providers underperformed.

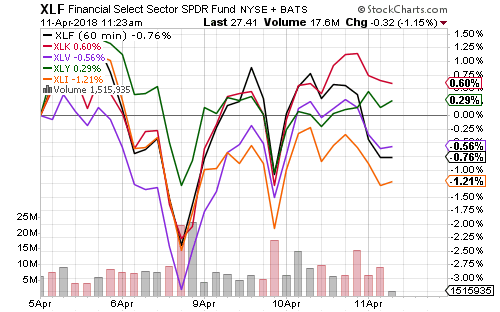

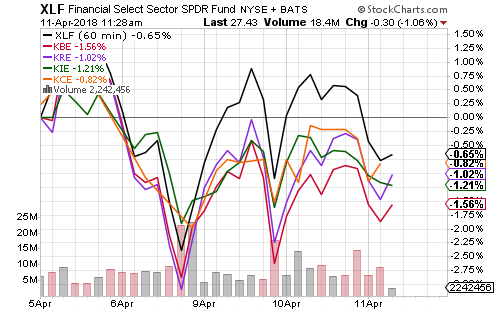

On Friday, Citigroup (C), J.P. Morgan (JPM) and Wells Fargo (WFC) will report earnings. Analysts predict solid earnings increases for all but Wells, which is still recovering from its accounting scandal.

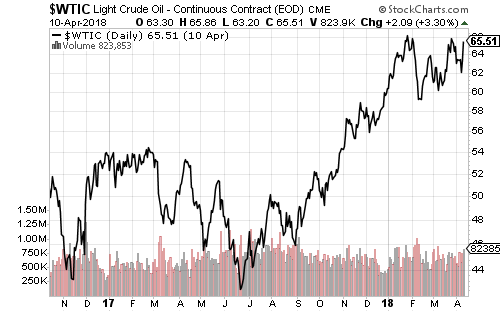

Energy shares rallied strongly last week as crude oil climbed more than 5 percent. Crude oil is close to a new 52-week high. Energy stocks underperformed in 2018 relative to oil prices. This week’s move indicates some traders are positioning for a breakout.

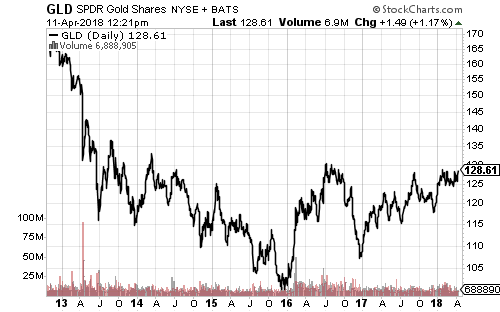

Gold moved up sharply on Wednesday and has about 2 percent to go before it completes a long-term consolidation.

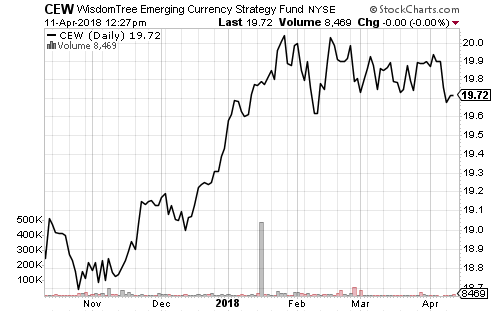

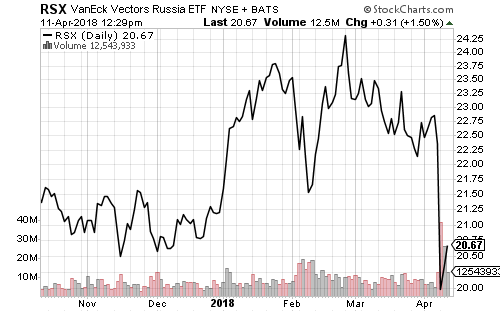

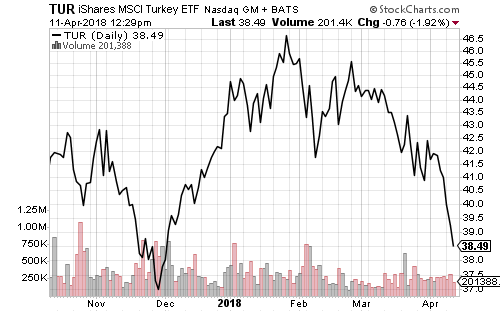

Emerging-market currencies weakened over the past week. The Turkish lira and Russian ruble both fell following U.S. sanctions. WisdomTree Emerging Currency (CEW) needs to hold above $19.60 to avoid a short-term bearish outlook.

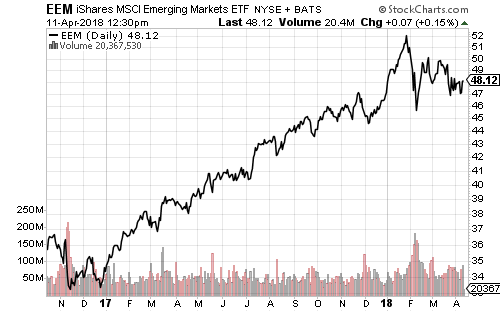

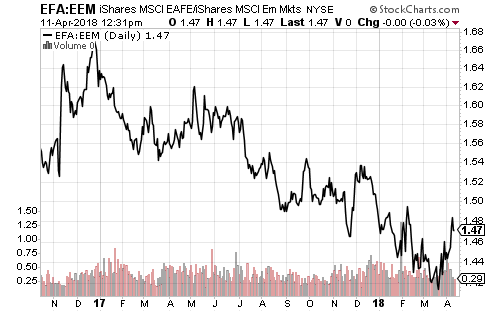

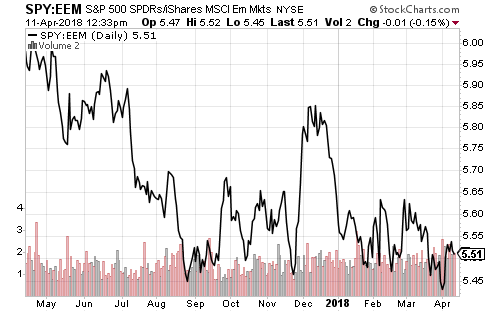

Developed markets have steadily underperformed emerging markets since the start of 2017. They are now testing this down trend. The S&P 500 Index has performed as well as emerging markets since September.