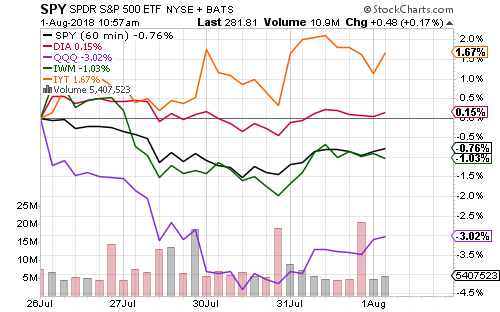

The Dow Jones Industrial Average led major indexes this week following transportation subsector strength and a significant rotation from growth to value.

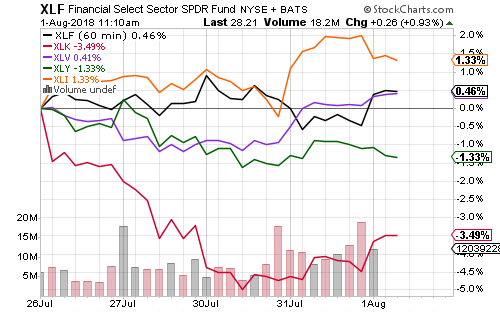

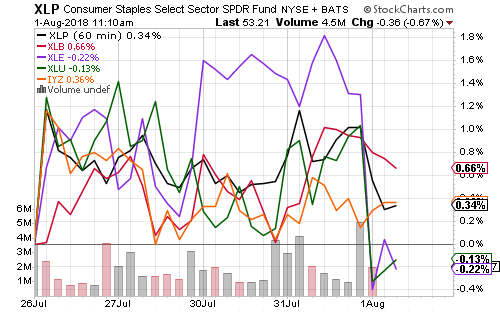

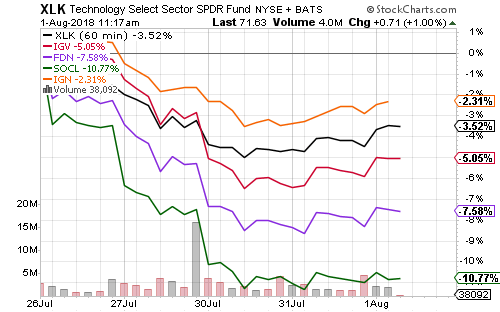

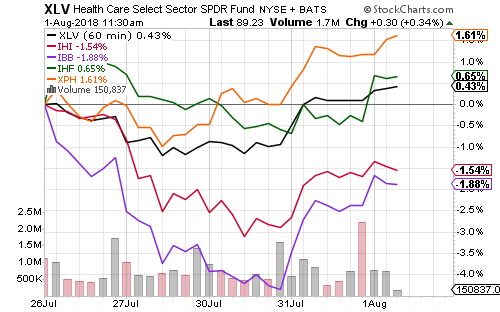

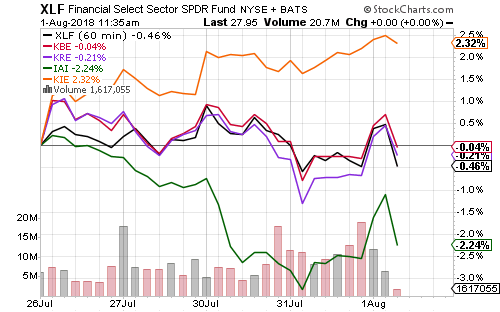

Industrial stocks were last week’s best performers, while technology stocks were the weakest. Consumer discretionary also declined with its substantial technology exposure. Financials and healthcare were strong on the week.

Of the smaller S&P 500 sectors, only energy was volatile. On Wednesday, Devon Energy (DVN) and Anadarko Petroleum (APC) missed earnings and revenue forecasts, respectively.

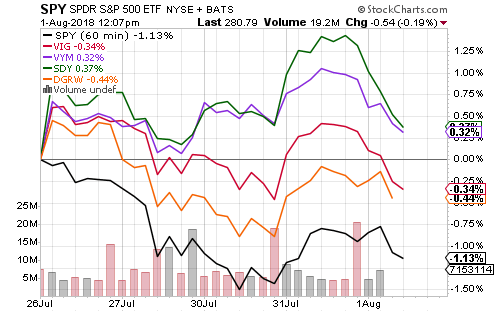

A rally value-oriented funds benefited dividend funds. Value funds outperformed the funds with growth-tilts, but all outperformed the S&P 500 Index by a substantial margin.

Semiconductors outperformed the broader tech sector on the week as China stopped Qualcomm’s (QCOM) takeover of NXP Semiconductors (NXPI). Qualcomm rallied strongly on the news, more than offsetting the drop in NXPI.

Social media shares, namely Facebook (FB) and Twitter (TWTR), saw the largest losses, but even Microsoft (MSFT) slid more than 4 percent on the week. Apple (AAPL) delivered a strong earnings report after-the-bell on Tuesday, lifting Apple stock and providing much needed support for the sector.

The transition from growth to value was underway within sectors as well. In healthcare, the pharmaceutical sector has been underperforming the overall healthcare sector since the middle of 2015. This week it was the best performing subsector.

It was the same story in the financial sector. Insurance has lagged since late 2016 and it was the leading subsector on the week.

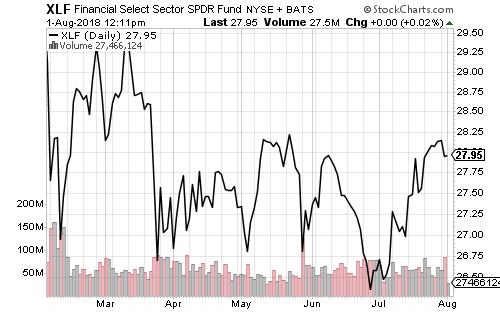

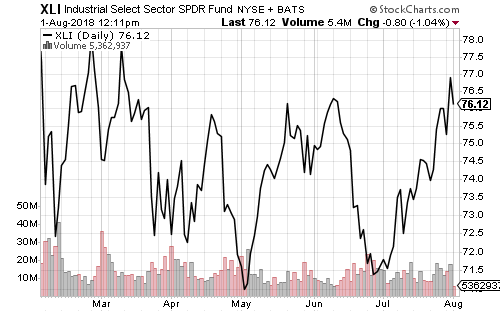

The rally in industrials this week pushed SPDR Industrial (XLI) above its four-month trading range. SPDR Financial (XLF) has yet to break out from its trading range.

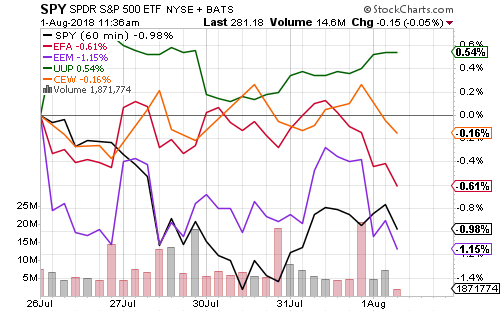

The U.S. Dollar Index enjoyed a solid rally this week as emerging-markets currencies struggled. President Trump announced tariffs on $200 billion of Chinese goods might increase from 10 percent to 25 percent. Chinese stocks and the yuan weakened on the news.

Since the U.S. market is heavily weighted towards technology shares, the stronger U.S. dollar outperformed emerging markets, but not developed markets.

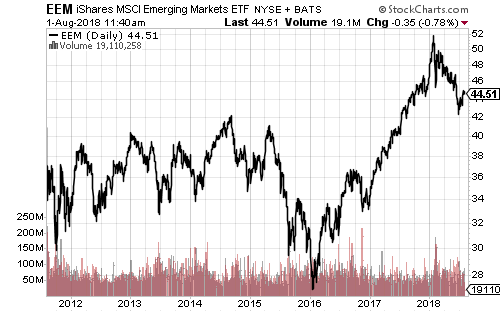

Emerging markets bounced near $42 in late June. The rebound since then has been relatively weak. The low hit in February was $45 and the rally was repelled at $45 in July. EEM must break above $45 to extend the short-term bullish picture.

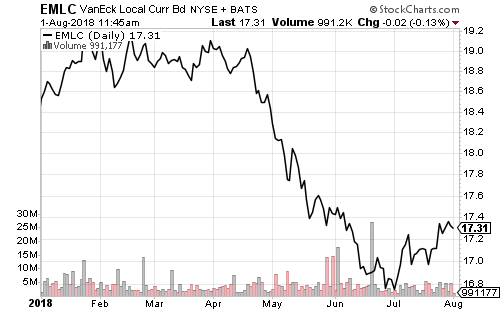

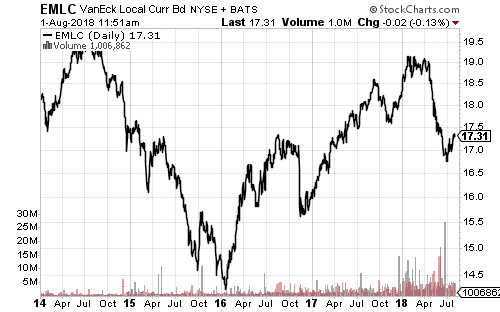

One of the most important funds to watch for a turn in emerging markets is VanEck Local Currency Bond (EMLC). This fund’s rally also slowed over the past week, but it has not turned lower.

The last prior slowdown in the Chinese economy started in 2014 and emerging market bonds fell for two straight years. With China’s economy beginning another slowdown in 2018, more downside is likely.

The U.S. Dollar Index has been in a trading range since late May. The euro is the key currency for this index.

UUP