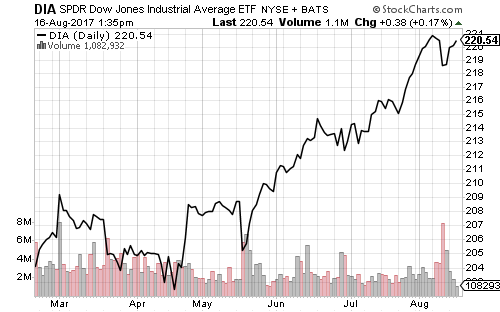

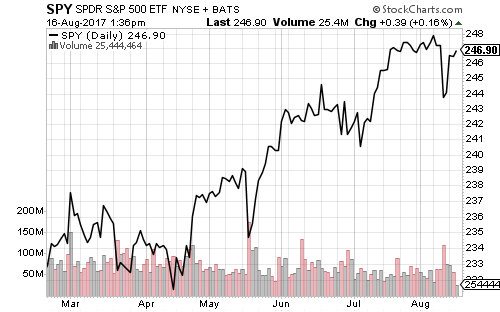

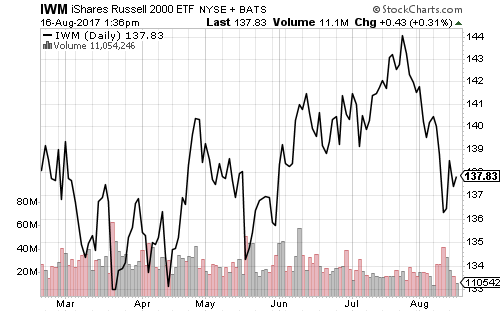

The Dow Jones Industrial Average has led index performance over the past week as stocks continue to rebound. Small-caps bounced at a crucial support level during the rally, which should continue in the week ahead.

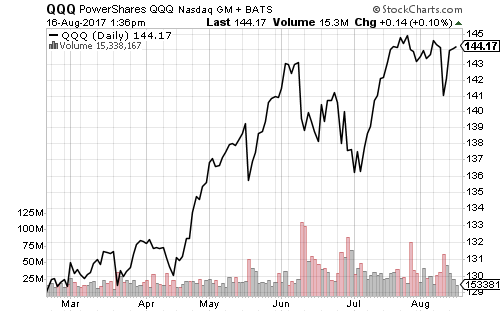

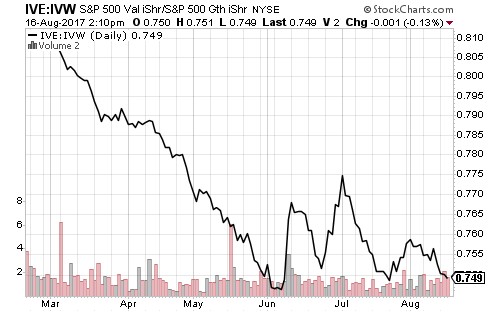

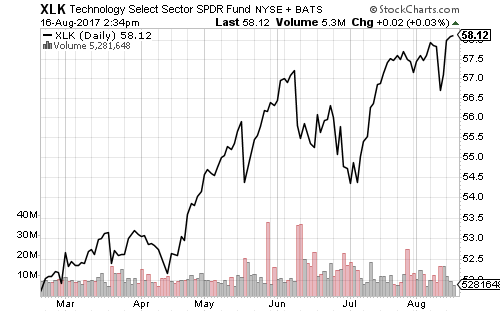

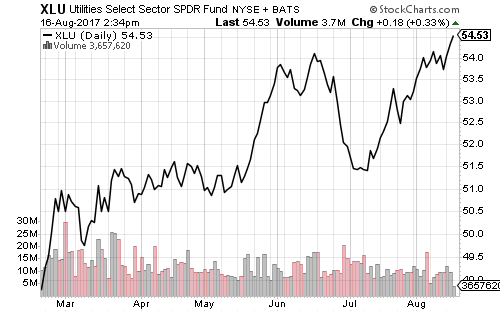

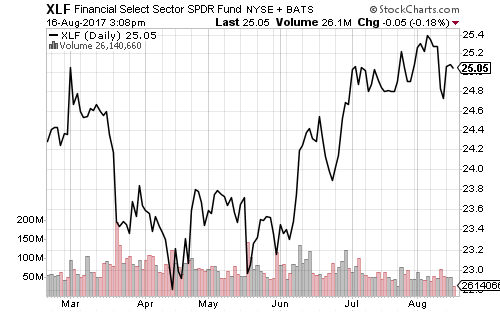

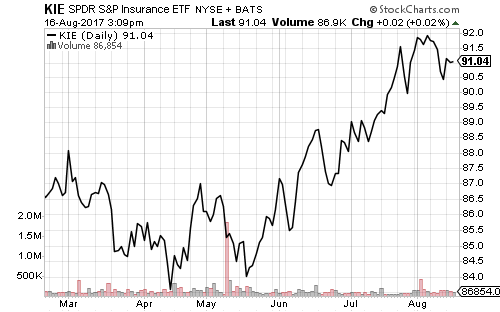

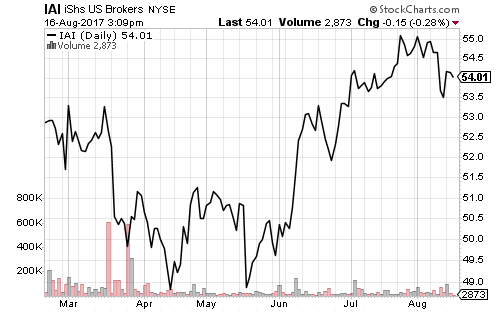

Technology lifted growth funds, while consumer staples, finance and utilities were the week’s strongest value performers.

Technology and utilities both traded at record 52-week highs on Wednesday.

Financials are within striking distance of a 52-week high.

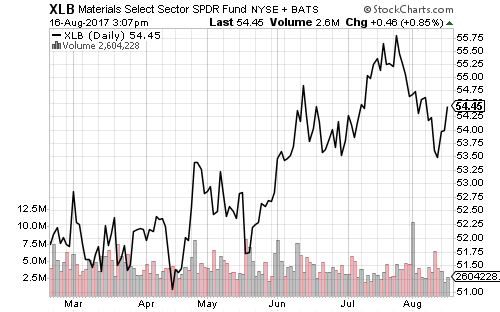

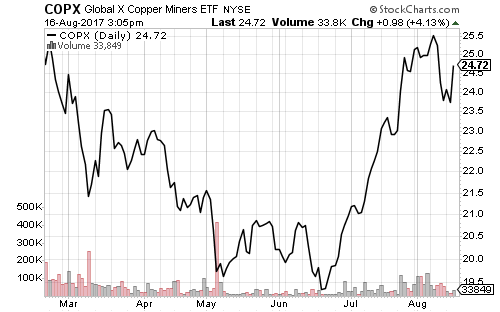

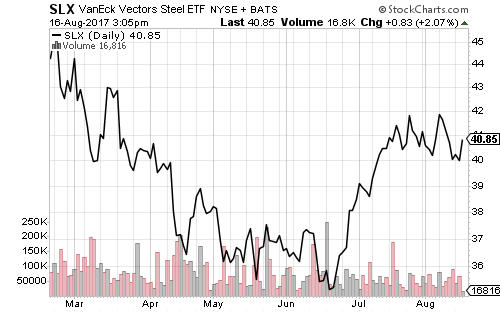

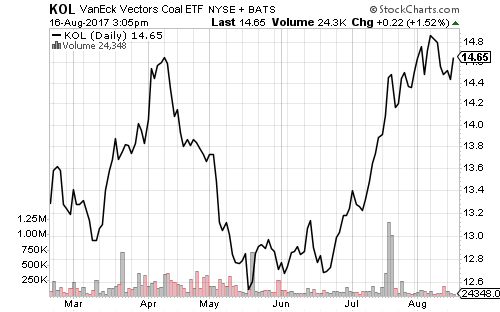

Copper and basic materials rebounded on Wednesday, sending miners, coal and steel ETFs higher.

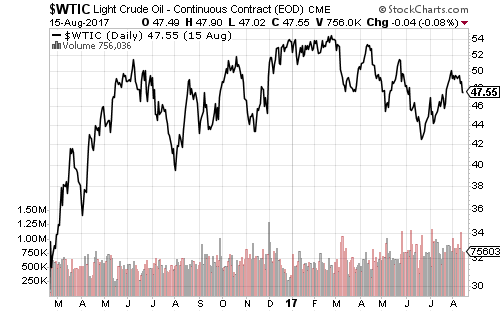

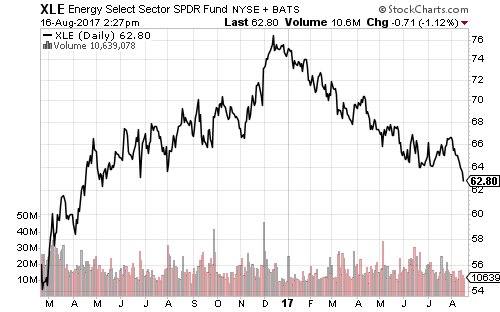

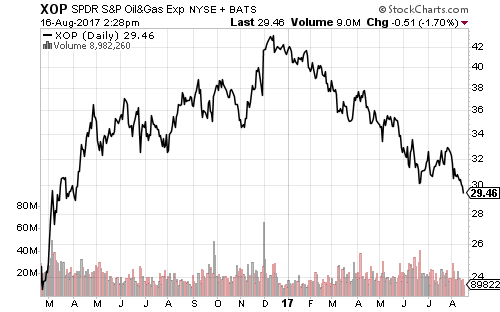

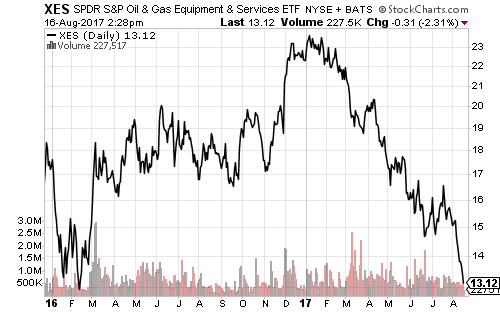

Energy funds fell to new 52-week lows over the past week. Crude oil reversed at $50.

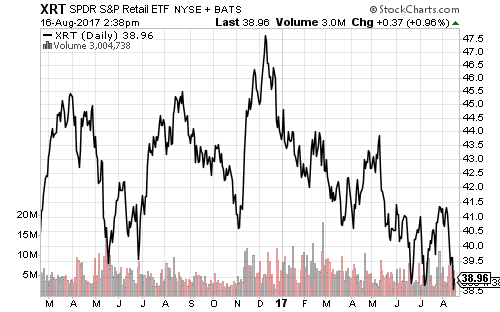

Overall, retail sales in July were stronger-than-expected by 0.2 percent. Earnings season has been rough on brick-and-mortar, yet again.

Target (TGT), however, delivered positive earnings on Wednesday to lift XRT from a 52-week low. Wal-Mart (WMT) will report on Thursday.

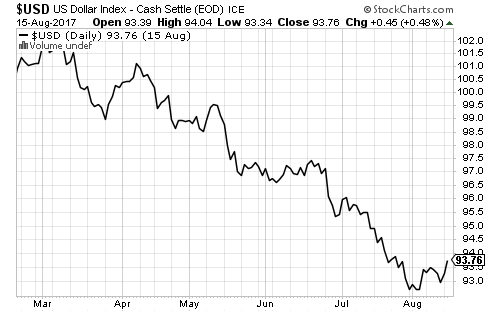

The U.S. dollar rebound continued this week, though the greenback softened on Wednesday.

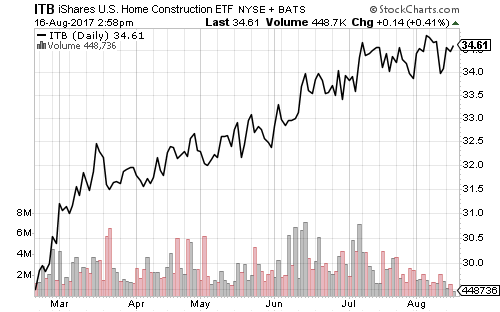

The homebuilders index climbed to 68 in August. The industry reports strong demand for new homes, and rising customer traffic. Homebuilder stocks remain in a slow-and-steady uptrend.