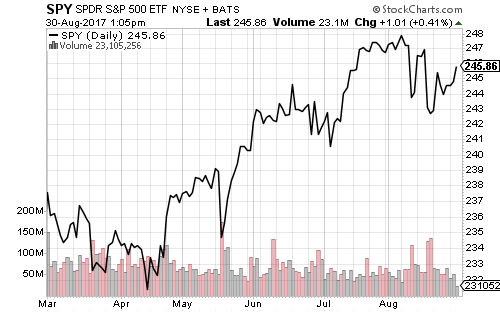

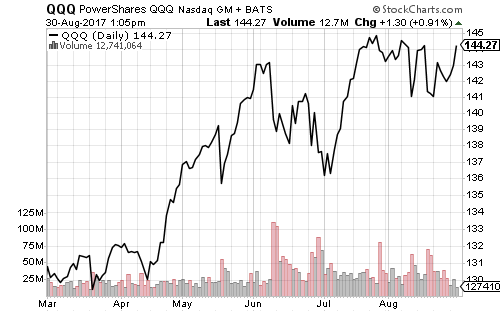

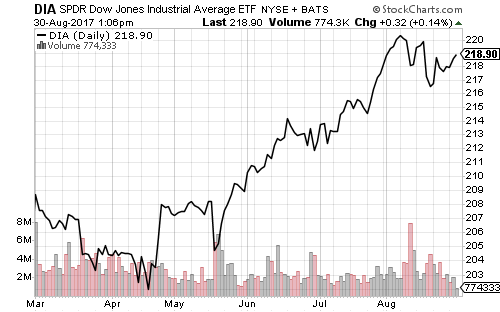

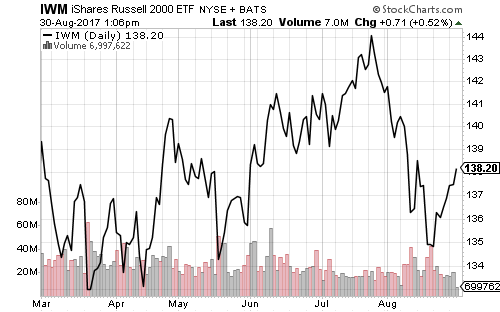

Major indexes rallied this week, led by large-cap tech in the Nasdaq.

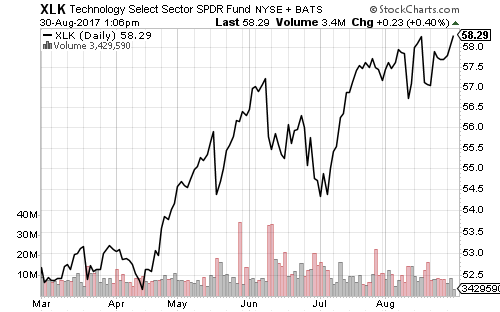

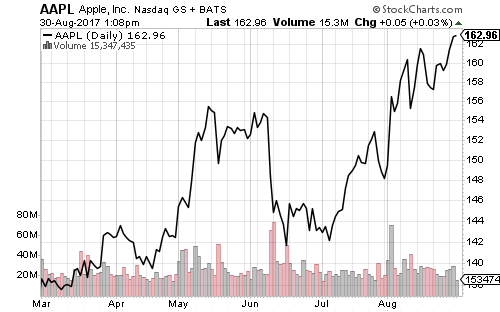

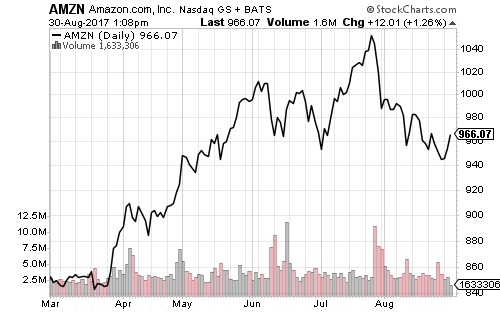

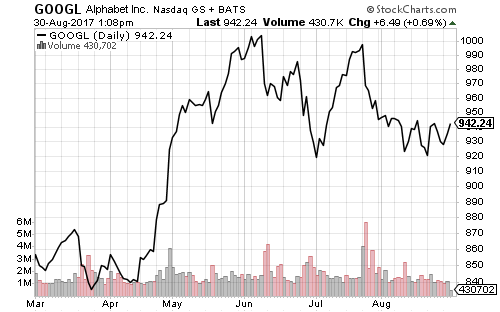

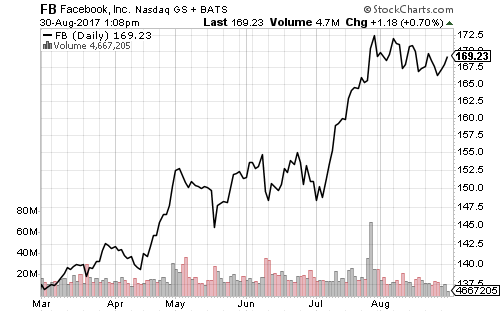

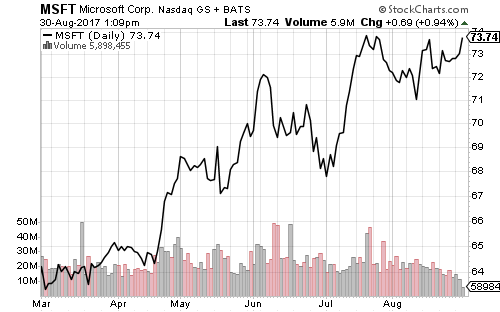

SPDR Technology (XLK) is on the cusp of a new all-time high and Vanguard Information Technology (VGT) hit a new record as traders anticipate Apple’s (AAPL) launch of the iPhone 8 on September 12. Microsoft (MSFT) and Facebook (FB) are also approaching highs, while Google (GOOGL) and Amazon (AMZN) have been slower to rebound. SPDR Consumer Discretionary (XLY) bounced over the past week, but remains below its all-time high.

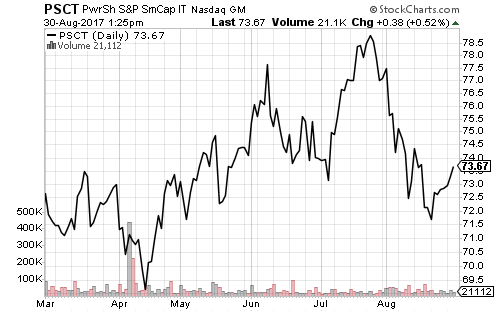

Apple, Microsoft and Facebook combine for 33.6 percent of assets in SPDR Technology (XLK). The narrow rally in XLK is contrasted by the underwhelming performance of PowerShares S&P Small Cap Information Technology (PSCT). The risk of a pullback is now elevated as the sector relies on fewer stocks.

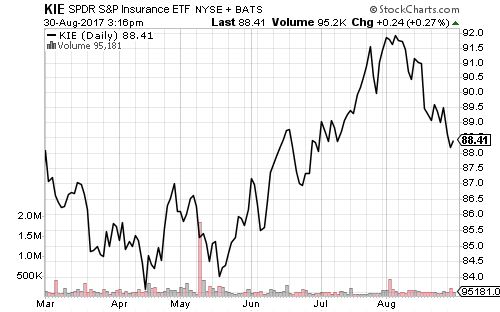

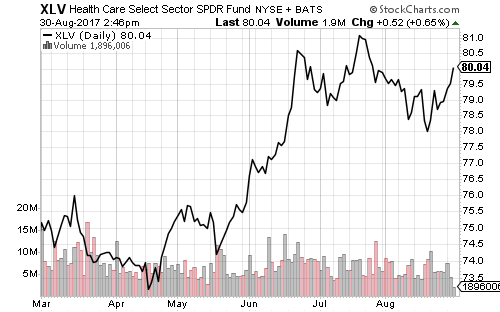

Although insurers have large cash cushions to deal with the aftermath of Hurricane Harvey, traders reacted to the storm by selling insurance stocks.

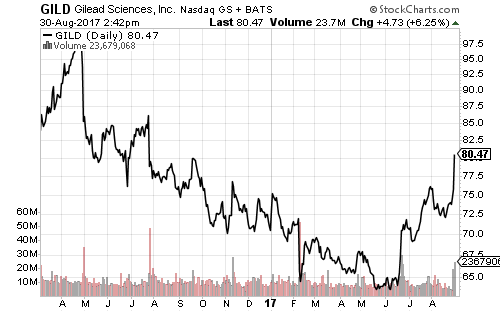

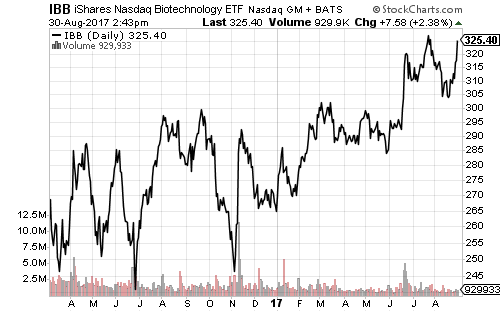

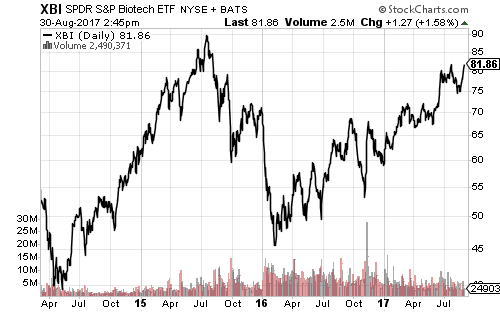

Gilead Sciences (GILD) boosted biotechnology and the larger healthcare sector with its offer for Kite Pharma (KITE). Gilead had been one of the worst performing major biotech stocks coming into 2017 and it stayed in a downtrend until mid-June. The bounce pushed iShares Nasdaq Biotechnology (IBB) near its 52-week high. SPDR S&P Biotech (XBI) was at a new 52-week high on Wednesday. The fund is also within striking distance of its all-time high.

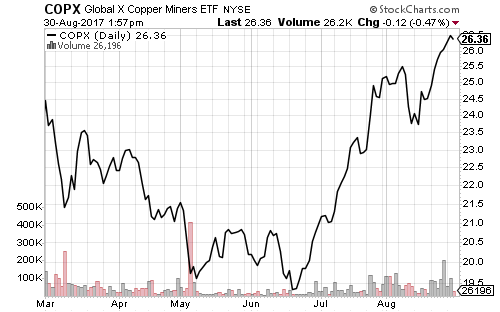

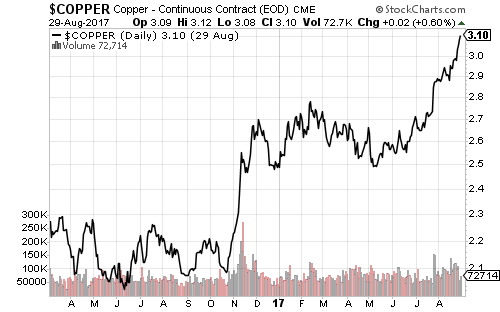

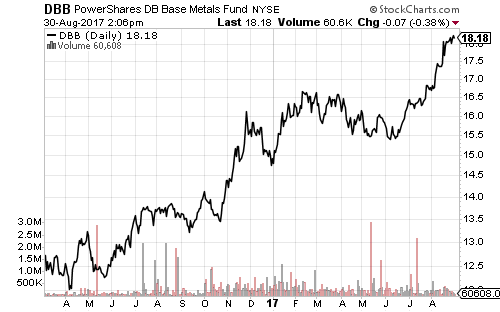

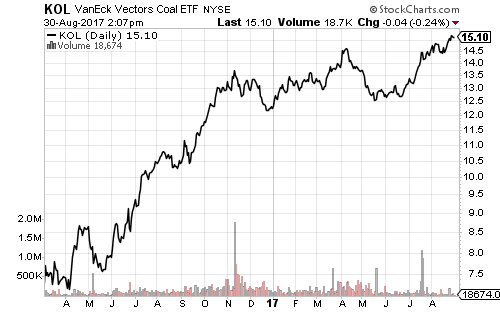

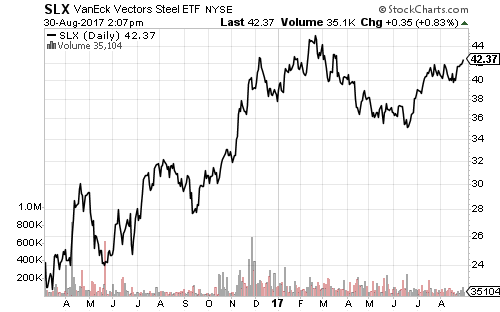

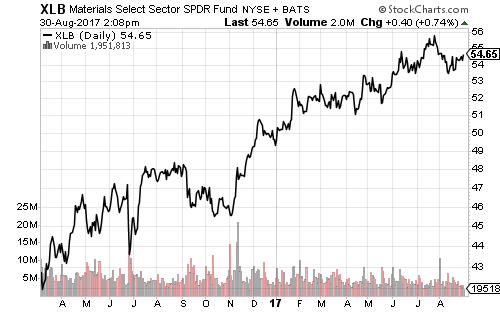

Industrial commodities pushed to new 52-week highs this week. Copper miners (COPX) and coal (KOL) achieved new highs, while steel (SLX) consolidated. The broader materials sector is still off its late-July high. Important Chinese economic data will be out next month. July’s data shows slowing real estate and fixed-asset investment.

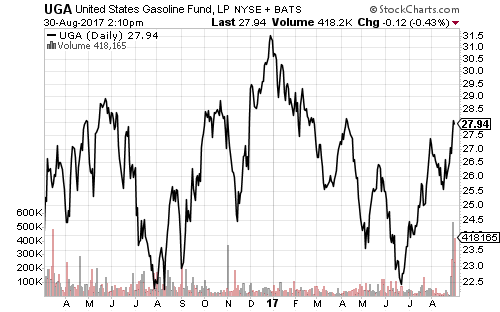

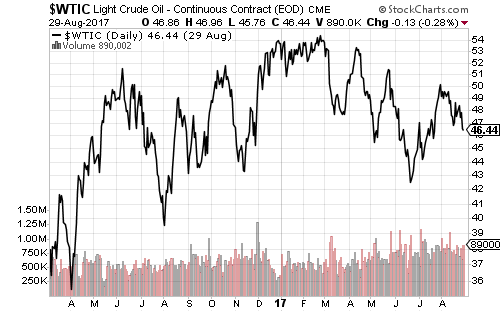

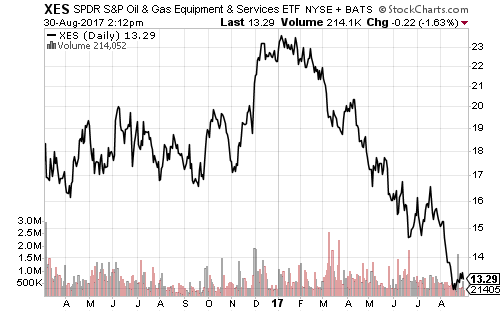

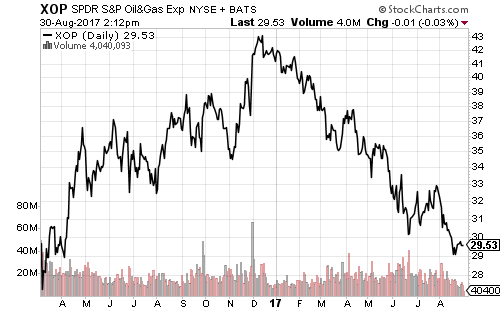

Although Hurricane Harvey wreaked havoc in a major energy hub, oil prices fell and gasoline prices likely peaked as Valero (VLO) announced it will restarted refineries. Notice the spike in volume for United States Gasoline (UGA) over the past week. This rise in prices is unsustainable if oil prices keep sliding and gasoline inventory remains high. As for energy shares, they seem overdue for a bounce, but last week’s rebound has already begun to fade.

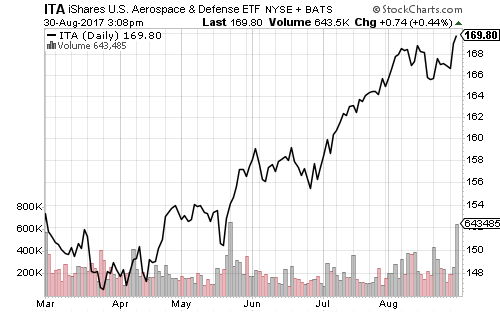

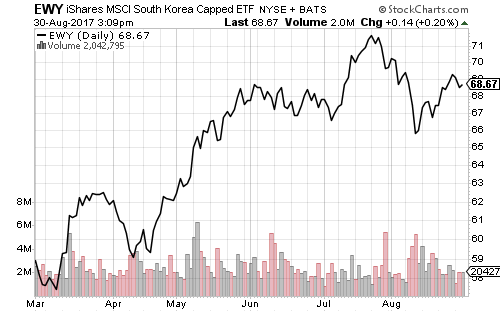

North Korea launched another missile this week. The financial markets briefly dipped in response, but the net result several days later is a new 52-week high in iShares U.S. Aerospace & Defense (ITA). Tensions have weighed on South Korea’s stock market, but iShares MSCI South Korea (EWY) has kept pace with the SPDR S&P 500 (SPY) since June.

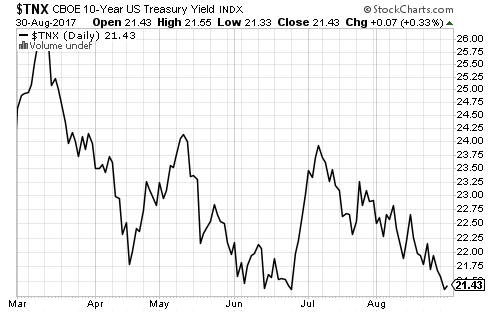

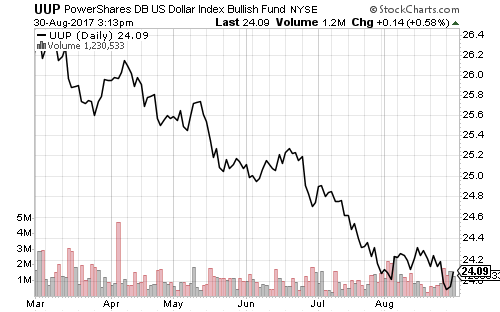

The 10-year Treasury yield is near its lows in 2017 and the U.S. Dollar Index broke to a new low this week before rebounding. The dip in the U.S. Dollar Index came in the wake of North Korea’s missile test. If this is a blip and not a trend, the dollar should rebound strongly as it has over the past two days and eventually exceed its August high.