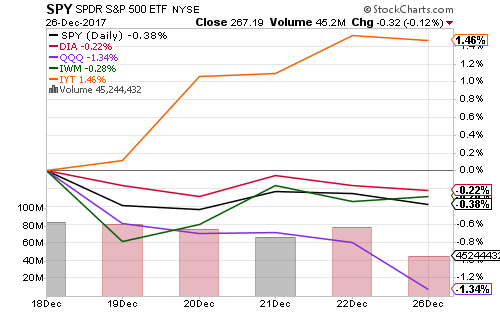

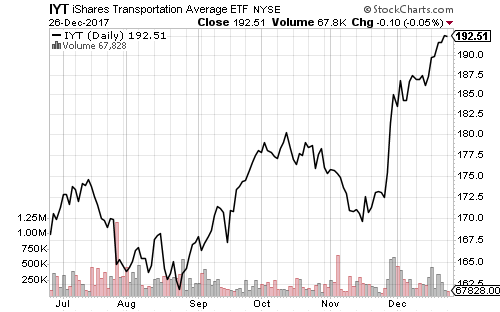

Tax reform drove the Dow Transports to wide outperformance, followed by a small outperformance by the Dow Industrials. The Nasdaq underperformed.

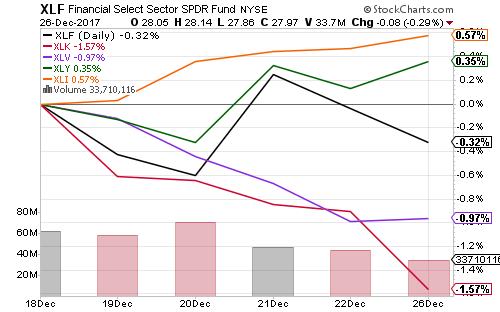

Industrials led the larger sectors, followed by consumer discretionary and financials, while technology trailed.

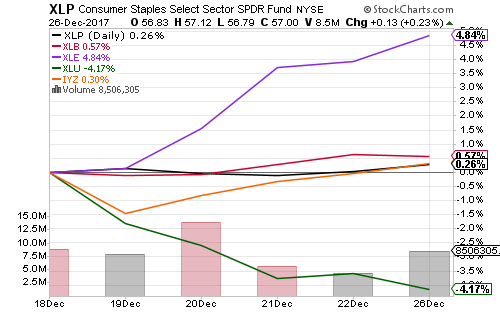

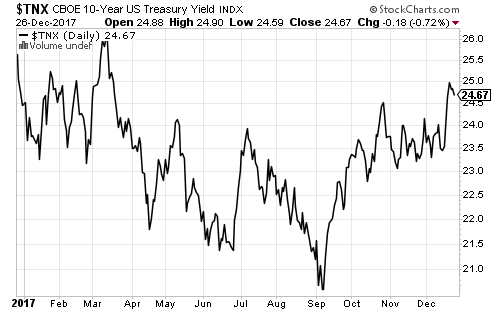

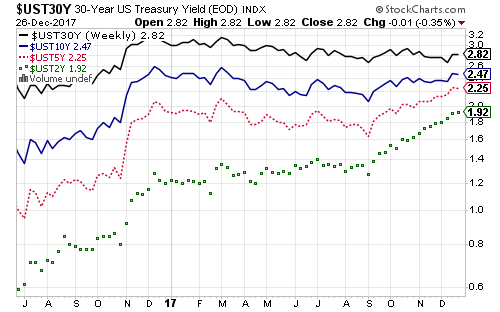

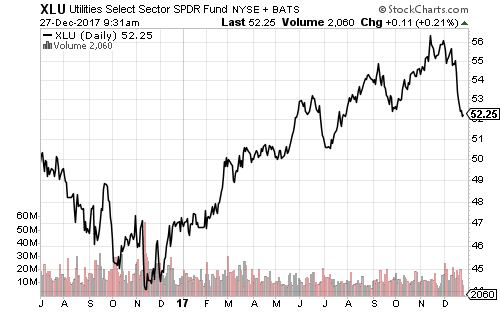

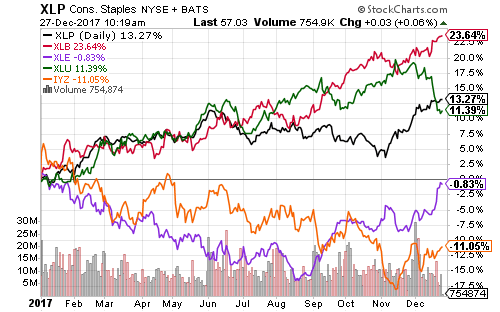

Rising oil prices brought energy to the top of sector performance, while utilities were stung by rising interest rates.

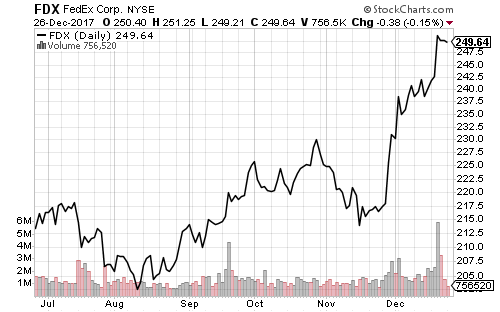

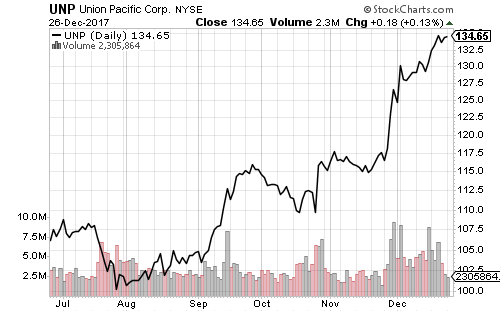

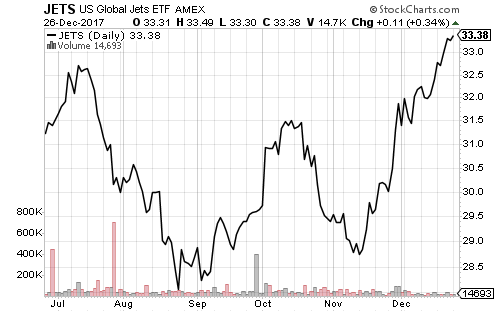

The transportation sector rose on continued FedEx (FDX) strength, airline and railroad shares.

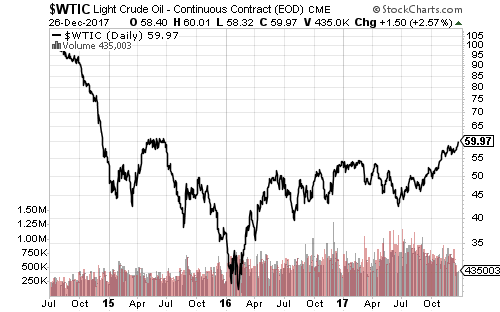

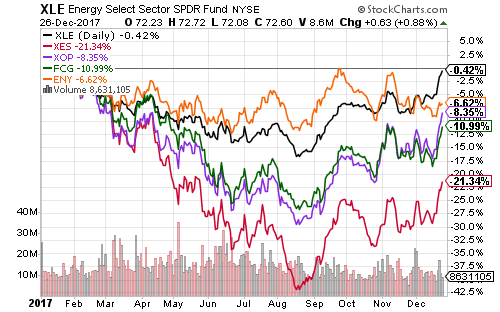

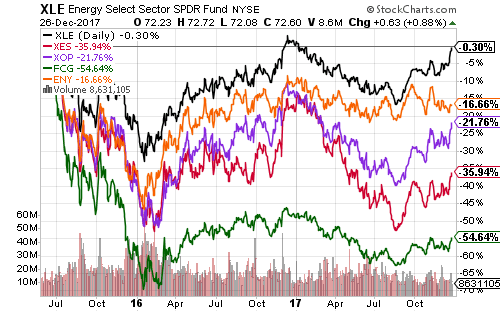

West Texas Intermediate crude oil briefly touched $60 over the past week. Energy stocks have performed poorly in 2017, but they bottomed in August.

SPDR S&P Oil & Gas Equipment & Services (XES) remains down 38 percent and SPDR S&P oil & Gas Exploration & Production (XOP) 21 percent, since January 1, 2015,

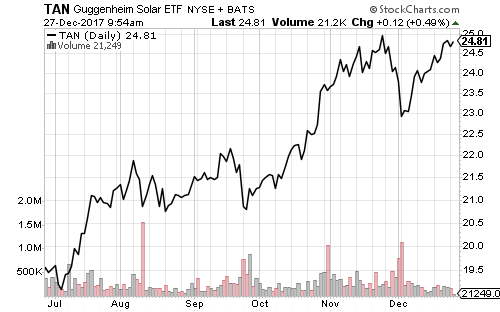

Natural gas prices have remained depressed due to high supply. Solar stocks have moved higher with energy prices. Guggenheim Solar (TAN) is near its 52-week high.

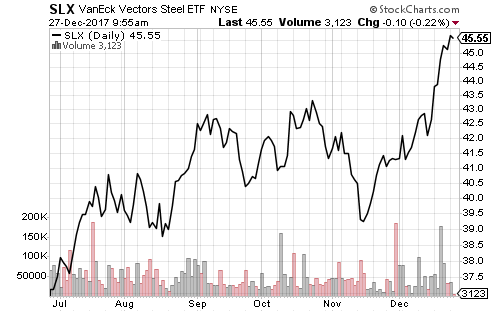

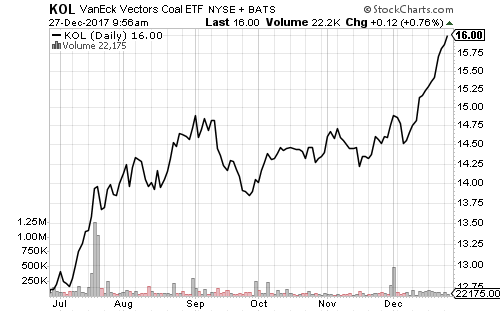

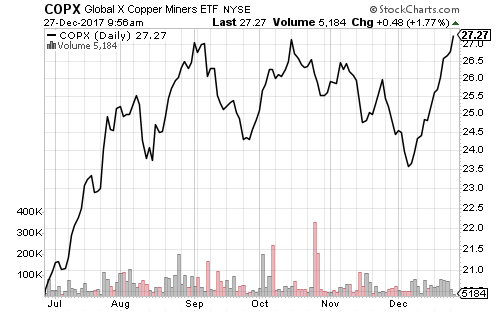

Commodities stocks are also signaling increased economic activity in 2018. Steel, coal and copper producer ETFs, as well as SPDR Materials (XLB), have all hit new 52-week highs.

SPDR Utilities (XLU) has erased six months of gains over the past six trading days since tax reform was passed.

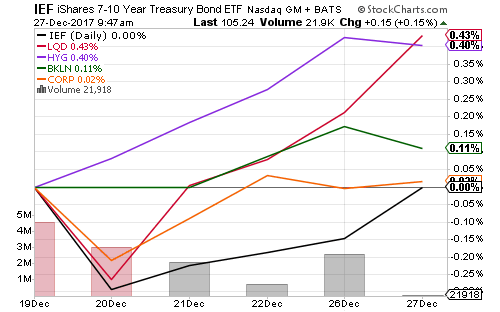

Most bond funds have moved higher as interest rates eased, with investment-grade and high-yield bonds enjoying the largest increase.

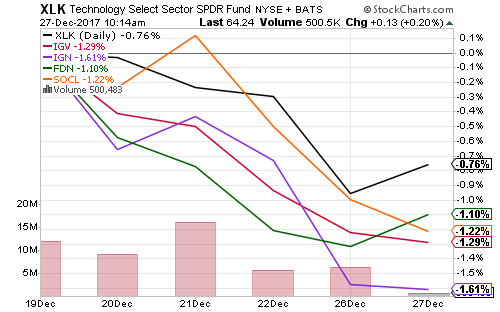

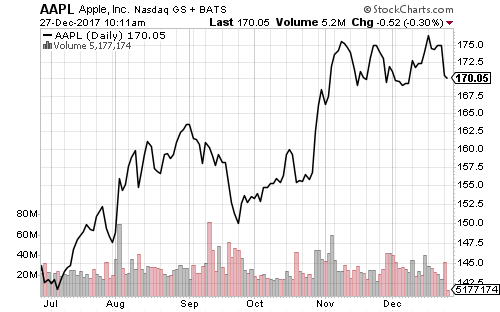

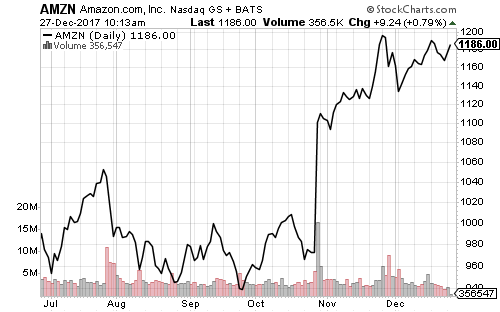

Apple (AAPL) dipped on Tuesday following reports of slower-than-expected iPhone X sales. Apple shares have traded sideways over the past two months. Amazon (AMZN) pushed towards a 52-week high following a strong holiday sales season. Networking has led the overall tech decline.

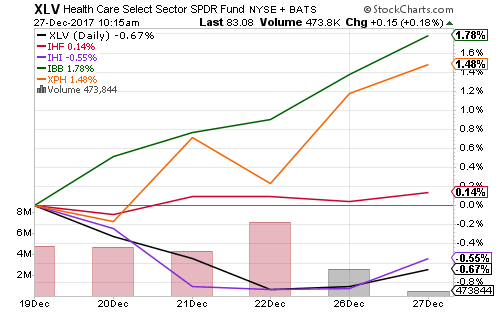

Healthcare fell with medical device shares last week. Biotechnology and pharmaceuticals both rallied.

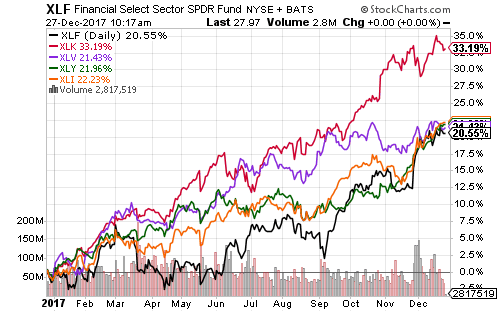

Technology has been the best performing sector in the stock market this year. Technology select Sector SPDP (XLK) has a 33- percent gain heading into the final trading days. It is also the largest sector in the Nasdaq and S&P 500 indexes. Other top sectors in the S&P 500 Index all clustered between 20 and 22 percent returns.

The other S&P 500 sectors saw much smaller gains, and losses in energy and telecom. Since these sectors have lower weights in the indexes, they didn’t impact overall returns as much.

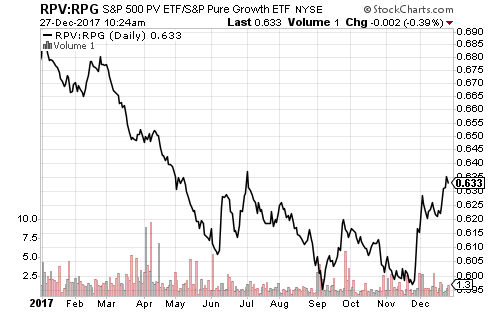

Financials, industrials and energy year-end rallies have lifted the performance of value relative to growth.