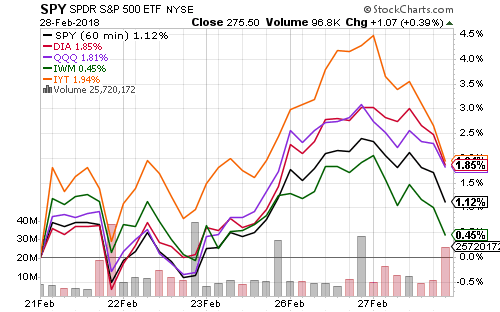

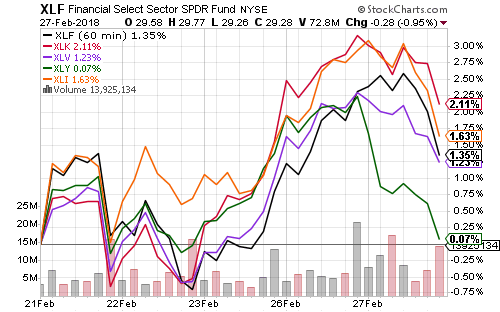

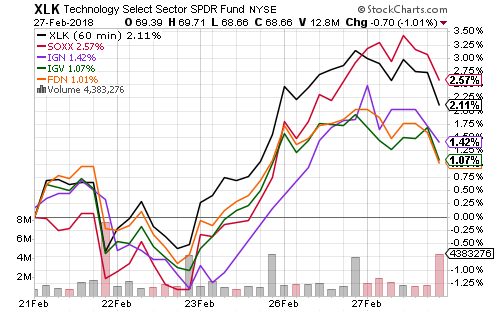

Technology, industrials, and transportation pulled indexes higher this week. The Nasdaq, Dow Jones Industrial Average and Dow Transports led performance.

Consumer discretionary was the week’s lone large sector underperformer. Comcast (CMCSA) and Disney (DIS) shares fell following Comcast’s bid for Fox’s Sky Broadcasting, igniting a bidding war.

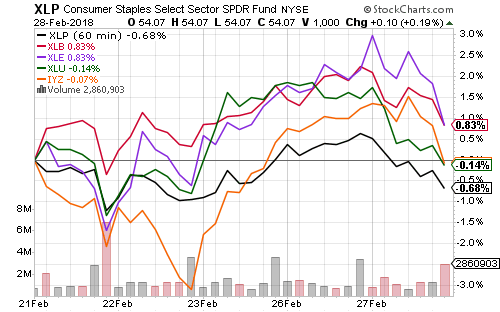

Wal-Mart (WMT) continued to weigh on consumer staples more than a week after weaker-than-expected earnings. Rising interest rates sent utilities lower.

iShares PHLX Semiconductors (PHLX) led the technology sector higher after Qualcomm (QCOM) upped its bid for NXP Semiconductors (NXPI) to fend off Broadcom’s (AVGO) hostile bid for Qualcomm. Broadcom responded by lowering its bid for Qualcomm.

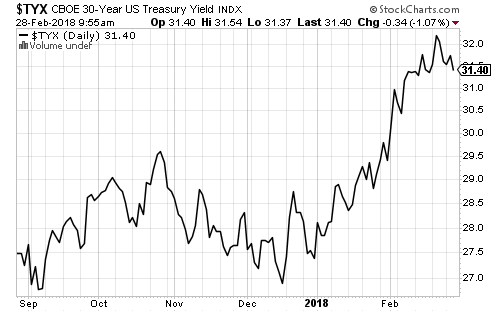

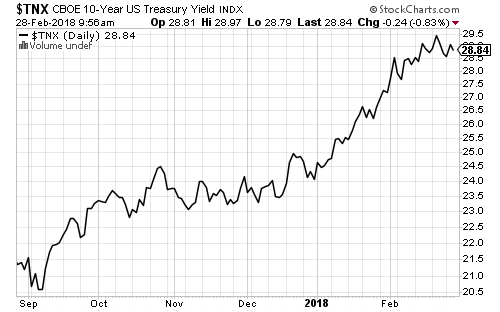

Federal Reserve Chairman Jerome Powell testified before Congress on Tuesday. Speculators pushed the odds of a third interest rate hike in September to above 60 percent and the odds of a fourth hike in December past 36 percent.

Although long-term bond yields rallied on the Fed chair’s comments, both finished the week lower.

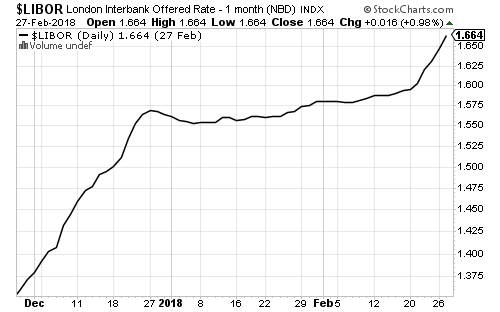

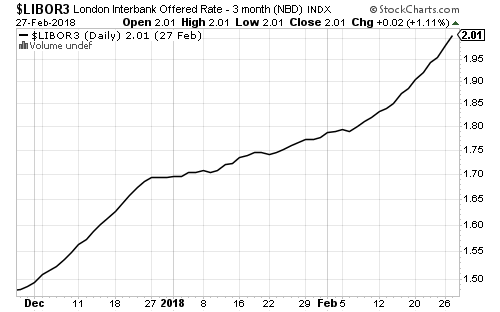

One- and three-month Libor extended their gains as investors priced in rate hikes. Three-month Libor climbed above 2 percent.

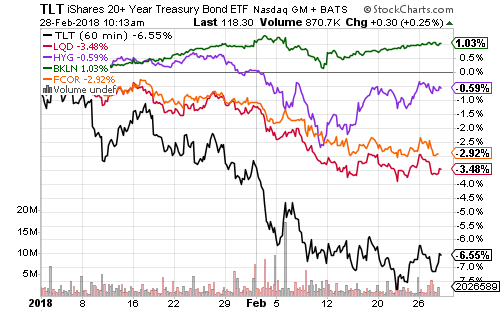

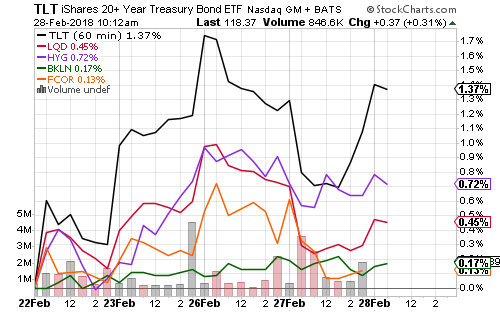

Long-duration treasuries and high-yield bonds were the best-performing funds on the week. Floating-rate funds continued to perform steadily with another week of gains. Year-to-date, PowerShares Senior Loan Portfolio (BKLN) has increased 1 percent versus losses in the other major bond categories.

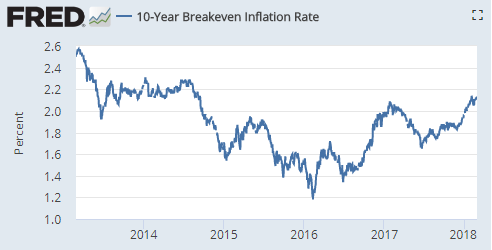

Despite inflation concerns, inflation break-evens remain below 2014 highs.

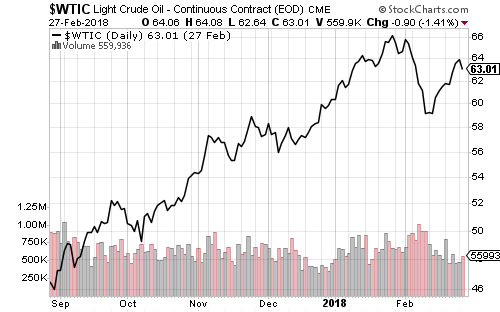

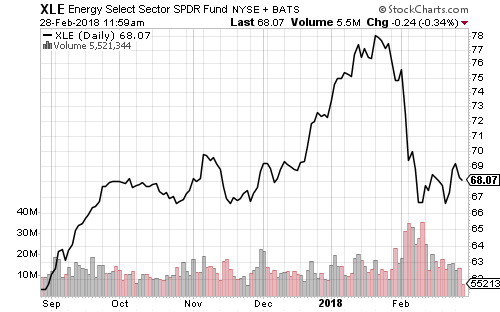

West Texas Intermediate crude held above $60 a barrel last week, but rising inventory sent prices lower on Wednesday. Energy equities are back to September levels after investors bid up prices on the expectation of $70 oil.

Next Monday, the head of OPEC is meeting with U.S. shale producers in Houston.

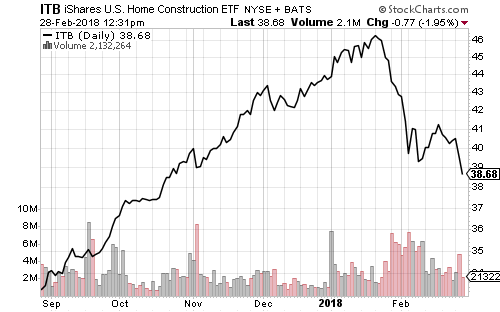

Housing data pulled back in January. New home sales remain within the current uptrend, but the annual sales pace slowed to 593,000. The sales spike seen in late 2017 was likely hurricane-related. Existing and pending sales slowed as well. Sales growth could slow further in the next month or two as rate hikes filter through to mortgage rates and home buying decisions.

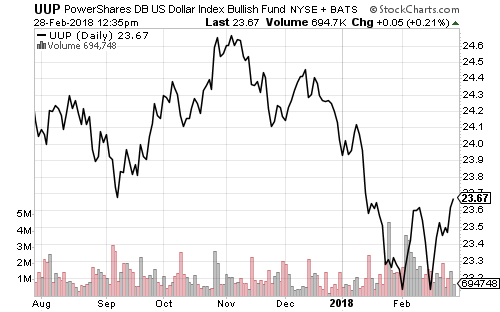

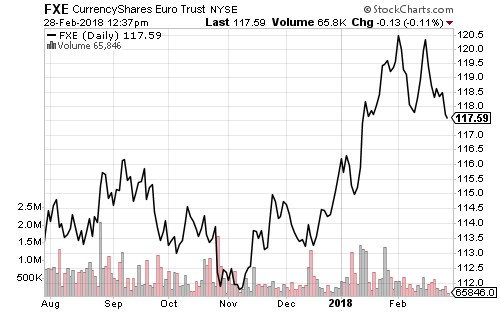

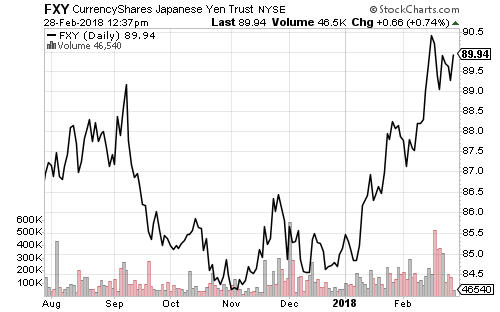

The U.S. Dollar Index hit a 6-week high this week. It is approaching the September 2017 low. The short-term outlook will remain bullish if the greenback can take out this level. The euro has much farther to fall to reach its September high. The yen continues to weigh on the Dollar Index.

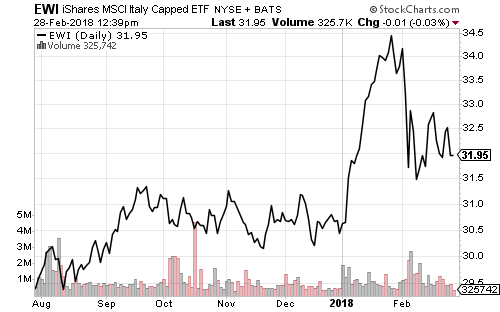

Italian elections could prove to be a wildcard for the euro. iShares MSCI Italy (EWI) will be one fund to watch on Monday in case there’s an electoral surprise.

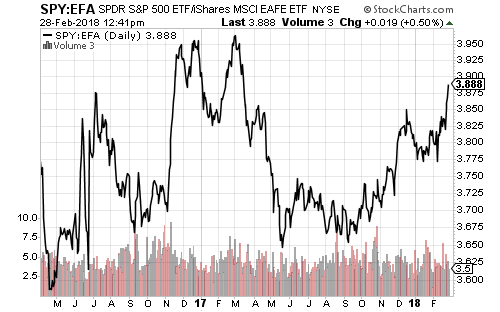

The stronger dollar helped SPDR S&P 500 Index (SPY) outperform the iShares MSCI EAFE Index (EFA) last week. The relative price of SPY to EFA is back the 2017 high, a level that was achieved when the U.S. Dollar Index was 14 percent higher. If the dollar extends its rally it will widen the performance gap.

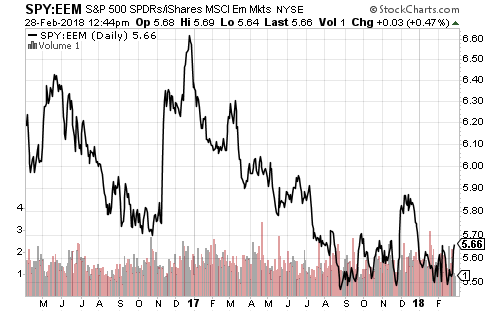

iShares MSCI Emerging Markets (EEM) failed to extend its relative outperformance again this month. EEM has failed repeatedly since August. Over the past 7 months, SPY has gained 12.45 percent and EEM 12.72 percent. This could be a consolidation, but given the performance of the dollar and developed markets, it is starting to look like a turning point for the U.S. dollar and domestic equities.