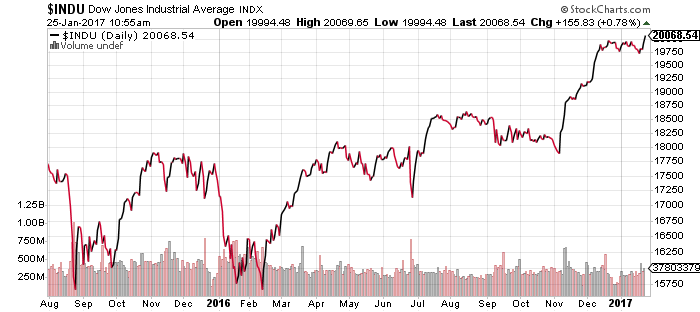

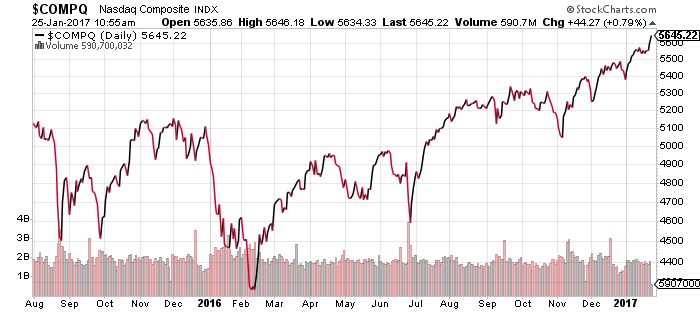

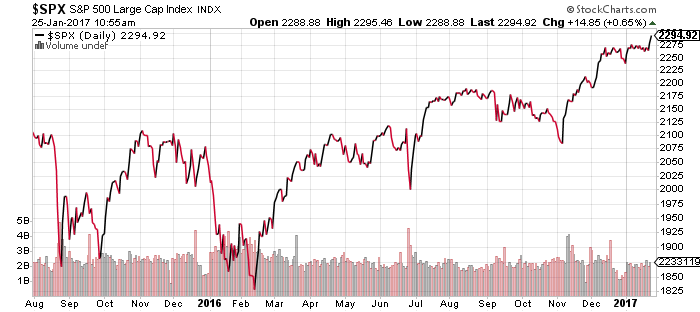

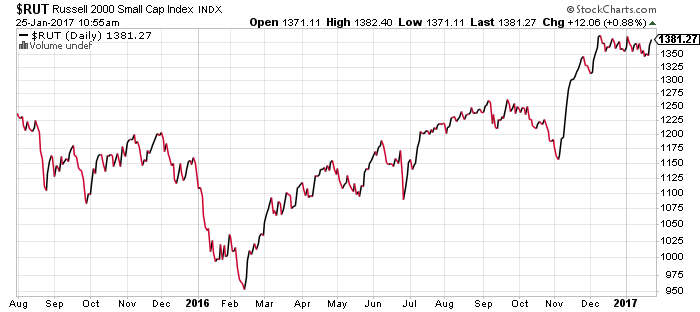

The Dow Jones Industrial Average finally broke through the 20,000 level today on a nice rise in volume. The Nasdaq and S&P 500 Index, which were already in record territory, also climbed substantially on Wednesday. The Russell 2000 is still below its all-time high, but closing in fast on a new record.

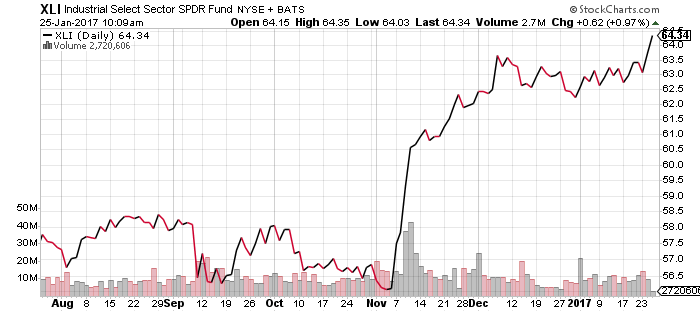

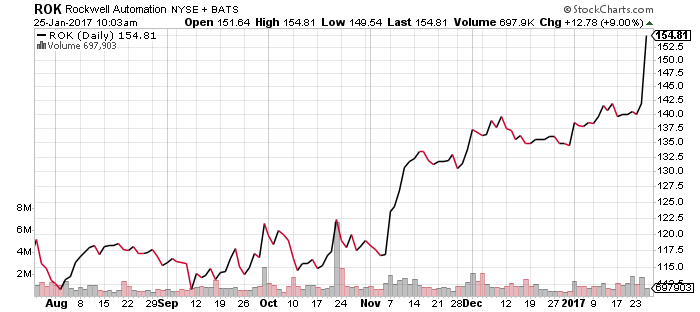

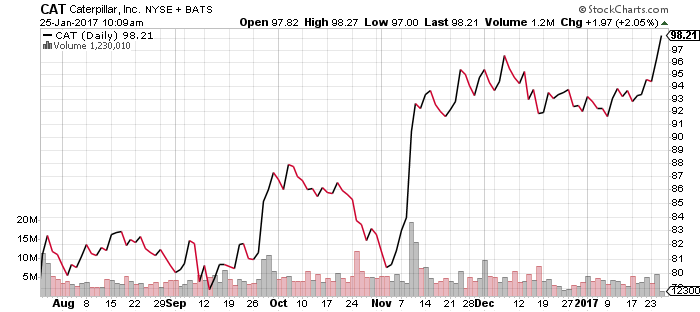

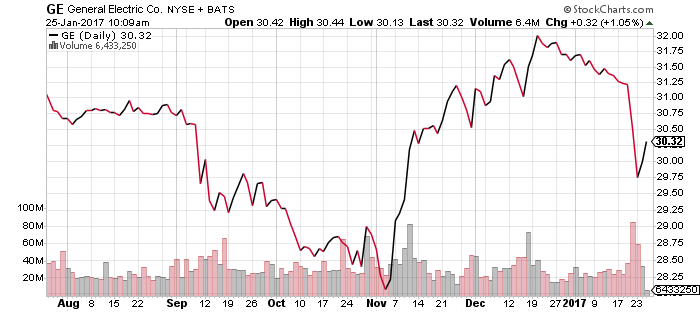

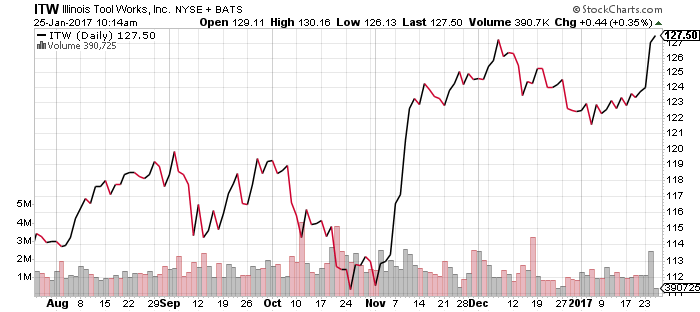

General Electric (GE) kicked things off on Friday, hitting estimates, but missing on revenues due to weakness in its oil services business. Caterpillar (CAT) reports tomorrow. Today, CAT announced declining monthly sales for the 46th consecutive month, but shares rallied on hopes that Congress will pass an infrastructure bill. Rockwell Automation (ROK) beat earnings and sales estimates, sending shares sharply higher. Illinois Tool Works (ITW) beat earnings and met sales estimates.

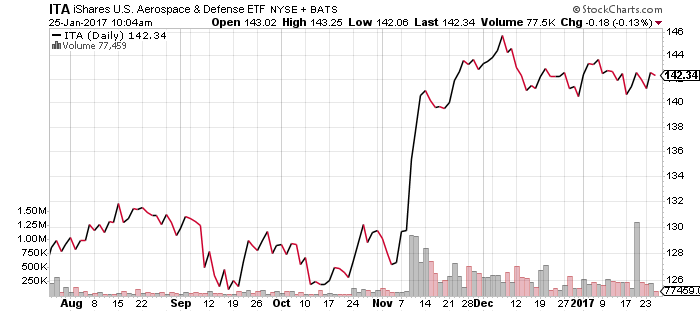

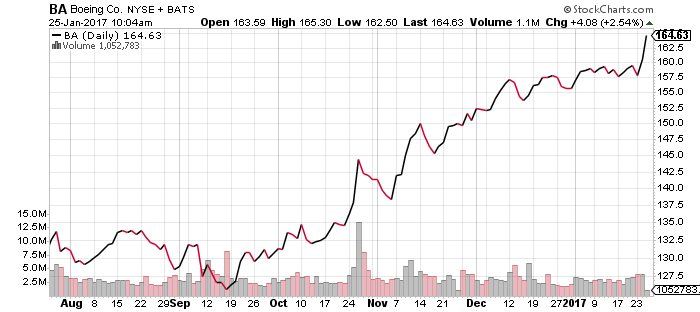

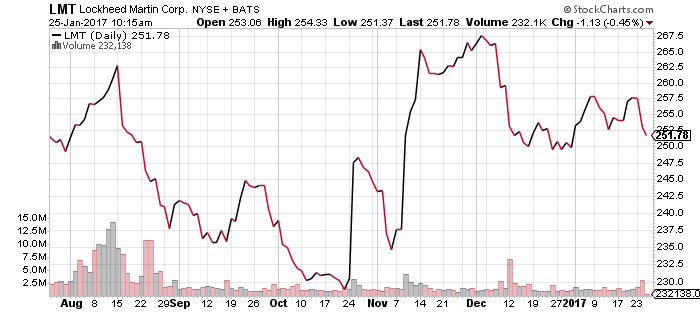

A sub-component of the industrial sector, aerospace and defense companies are reporting in bulk this week. Boeing (BA) beat both earnings and revenue estimates, but shares of defense contractors such as Lockheed Martin (LMT), who reported strong earnings and delivered positive guidance, slipped.

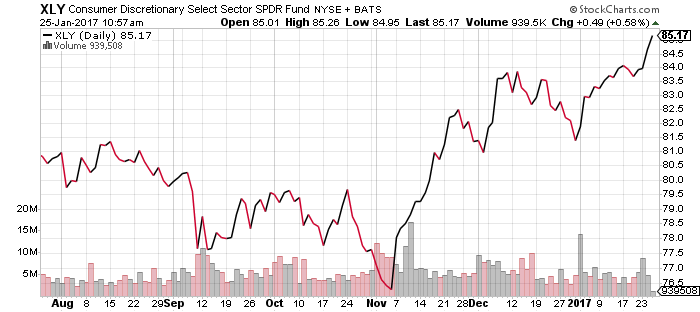

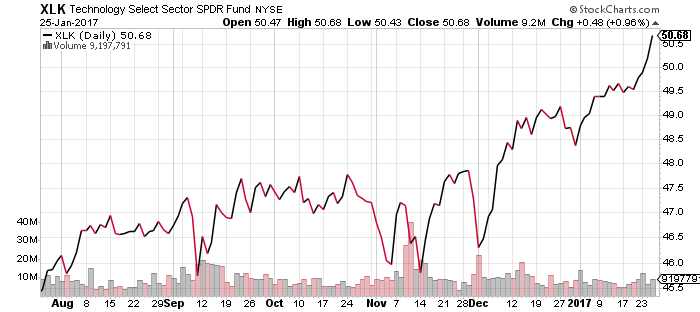

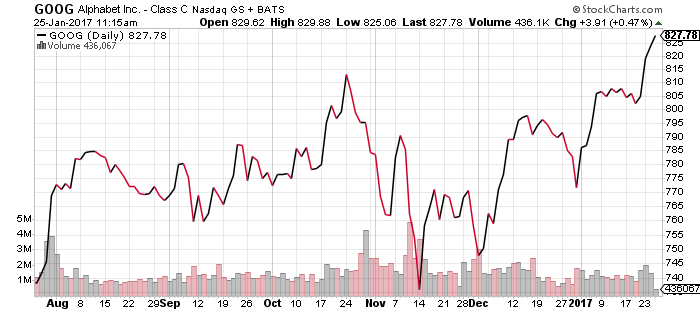

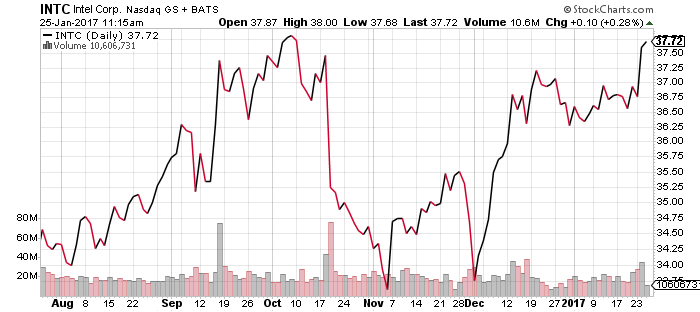

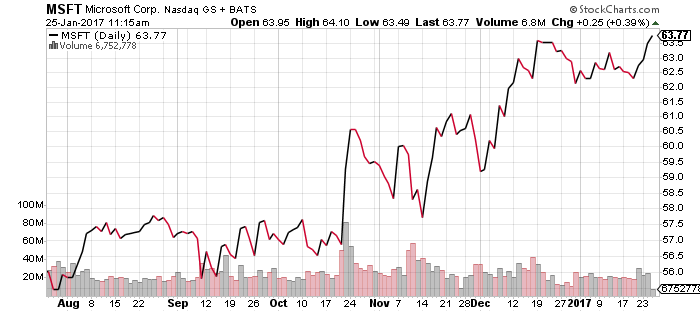

Consumer discretionary and technology both pushed to new highs this week. Technology companies reporting this week include Alphabet (GOOG), Microsoft (MSFT) and Intel (INTC). Investors have bid shares up in anticipation of strong reports.

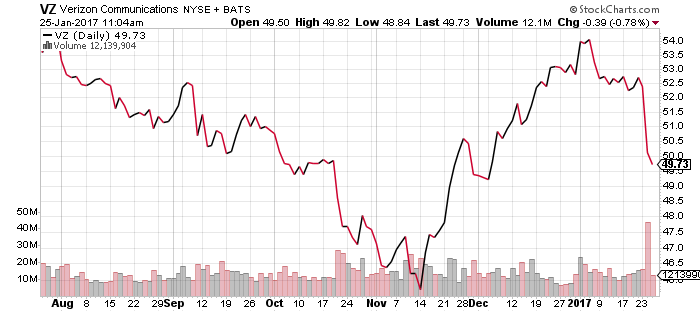

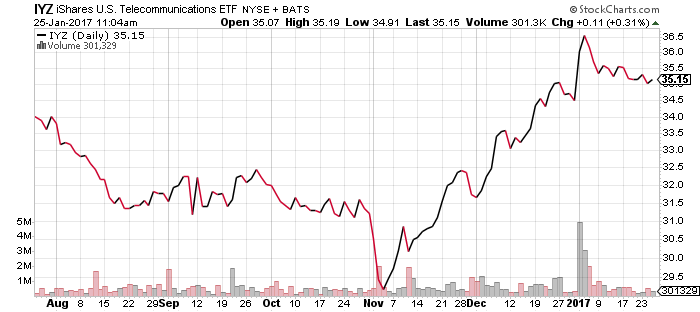

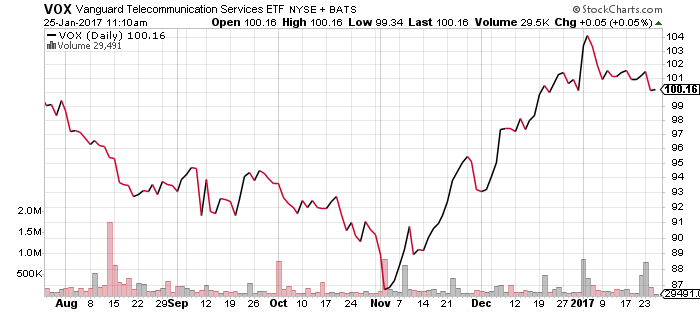

Verizon’s earning and subscriber growth disappointed investors, sending shares down 4 percent on Tuesday. The loss sent iShares U.S. Telecommunications (IYZ) down 0.7 percent. Vanguard Telecommunications (VOX) has double the exposure to VZ and fell 1.4 percent.

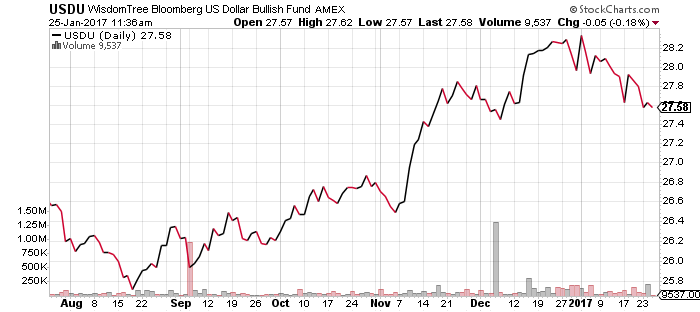

WisdomTree US Dollar Bullish (USDU)

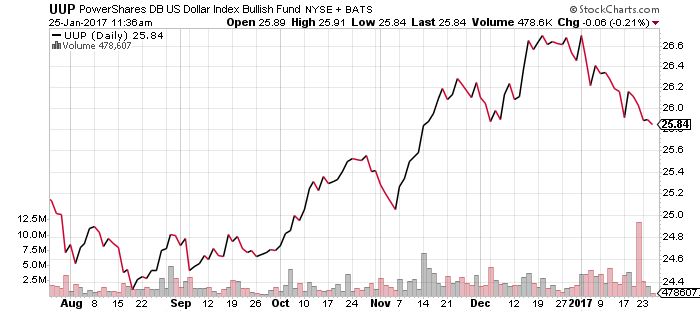

PowerShares DB US Dollar Bullish (UUP)

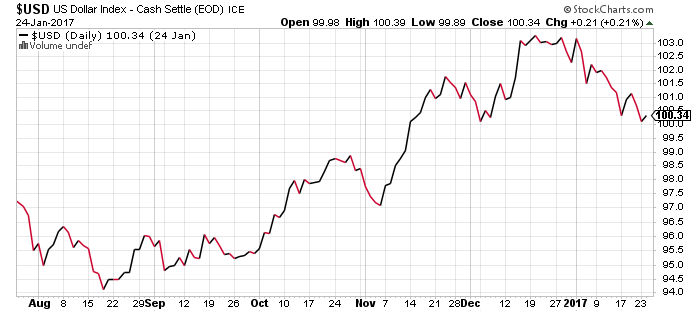

The key level to watch in the week ahead is 100 on the U.S. Dollar Index. A break below would open the index up for a correction down to about 97. This would not threaten the long-term bull market, but might keep the dollar in a trading range until the spring.

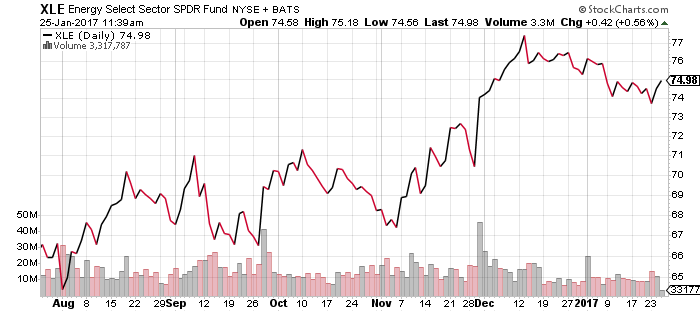

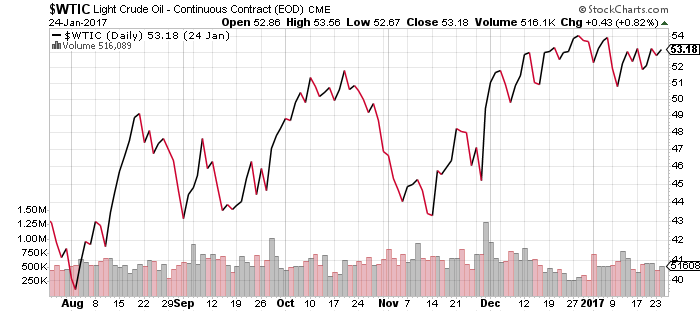

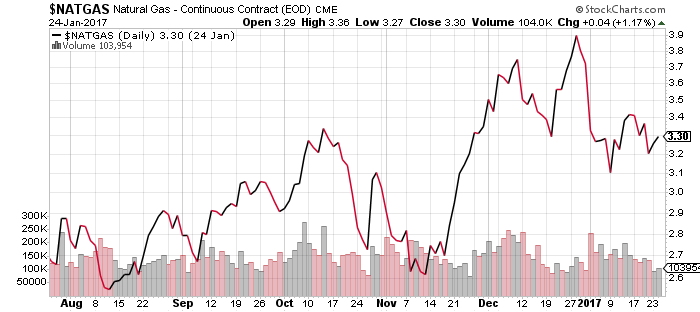

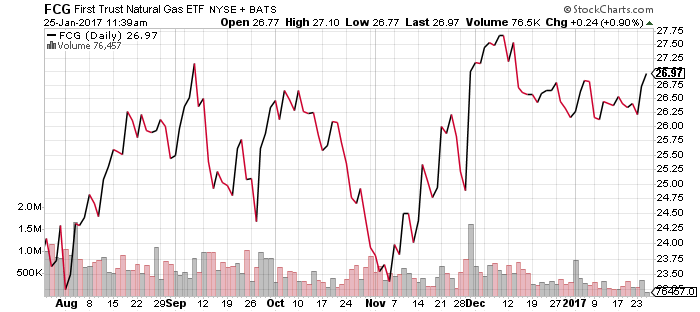

Energy is one of the few sectors that hasn’t broken out to upside. Crude inventories rose more than expected this week, shale oil rig counts are rising sharply, despite bullish market sentiment.

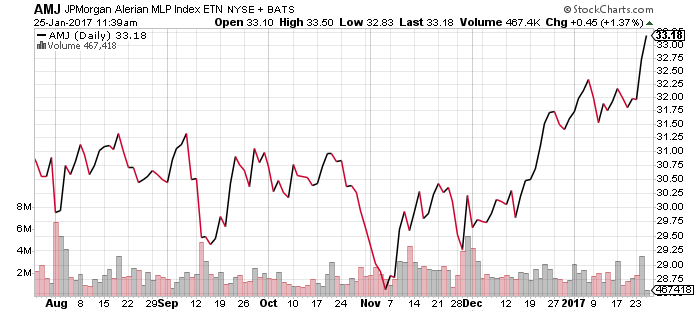

The best performing energy stocks this week are those tied to energy infrastructure. JPMorgan Alerian MLP Index (AMJ) spiked on news that the Keystone and Dakota pipelines are moving forward. These firms can benefit from increased energy production and activity in the United States even if energy prices remain low.

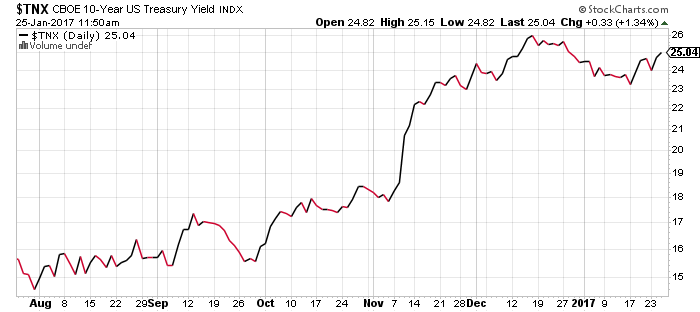

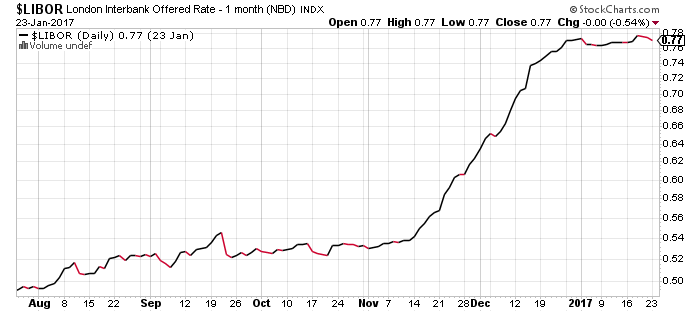

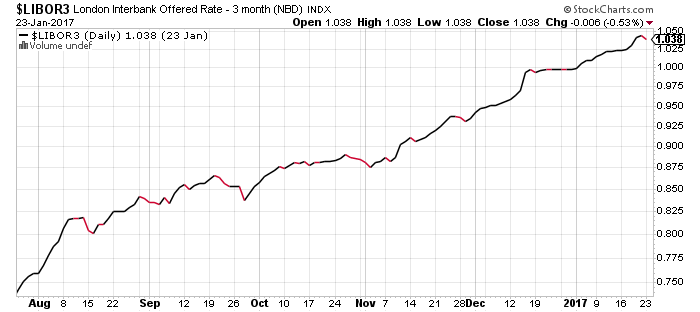

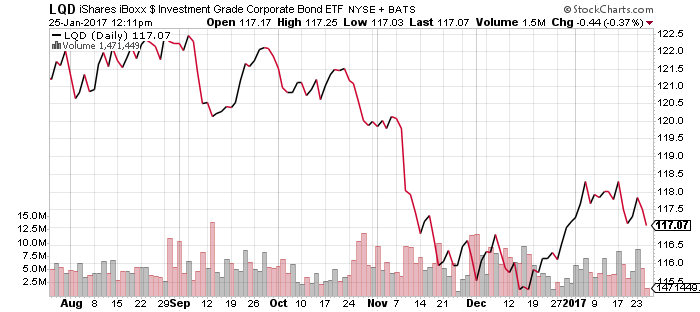

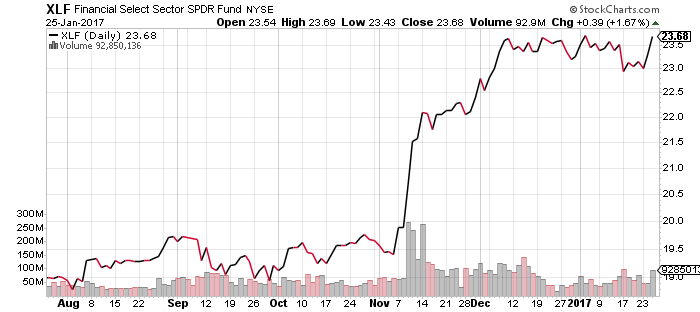

LIBOR and 3-month LIBOR steadied in the past week, but the 10-year Treasury yield started climbing again. An upside breakout in interest rates would impact both bonds and stocks.

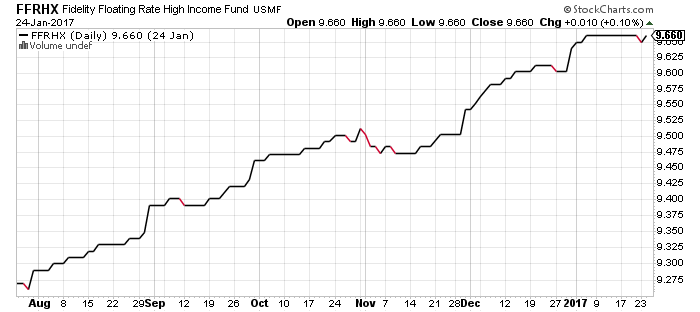

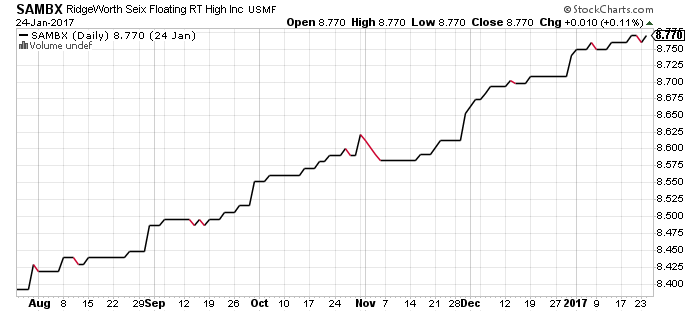

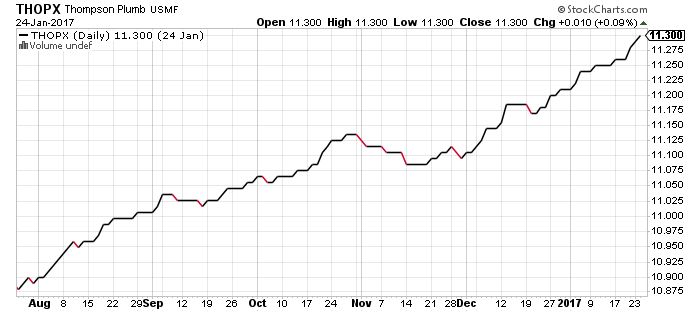

Fidelity Floating Rate High Income (FFRHX), PowerShares Senior Loan (BKLN) and RidgeWorth Seix Floating Rate High Income (SAMBX) held steady for another week, while Thompson Bond (THOPX) continued to advance.

On Friday, the government will announce the first estimate of 2016 Q4 GDP growth. Economists’ consensus forecast calls for 2.2 percent growth, but the Atlanta Federal Reserve’s GDP Now Model is calling for 2.8 percent growth. Look for GDP growth to surprise on the upside.