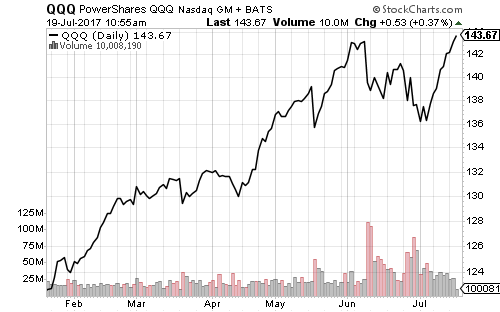

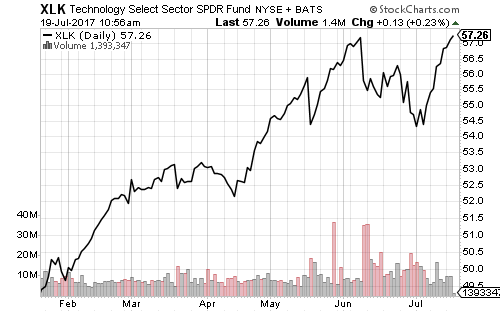

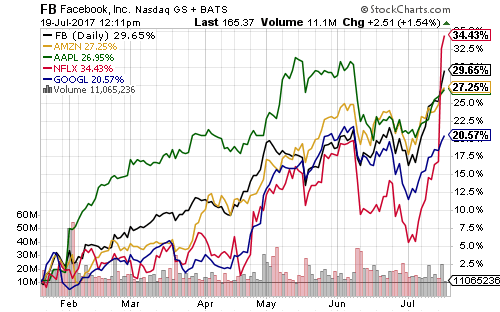

The Nasdaq and SPDR Technology (XLK) both climbed to new all-time highs on Wednesday. Shares of Amazon (AMZN) moved back above $1000 per- share and Netflix (NFLX) jumped after reporting earnings. AMZN, NFLX and Facebook (FB) all traded at new highs. Microsoft (MSFT) will report earnings on Thursday.

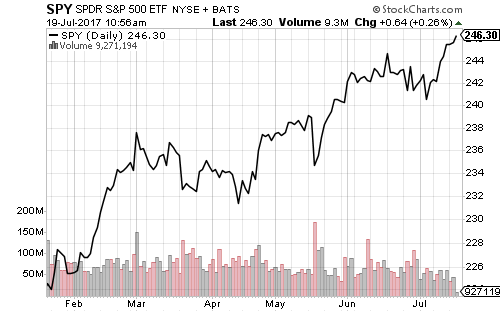

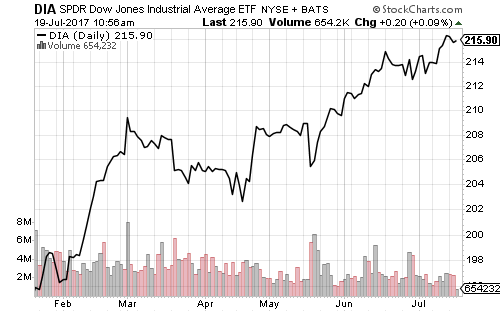

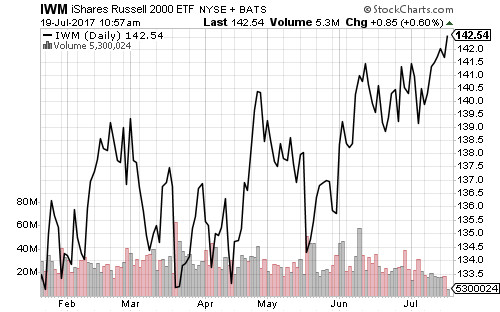

The Dow Jones Industrial Average, S&P 500 Index and Russell 2000 have also hit new all-time highs in the past week.

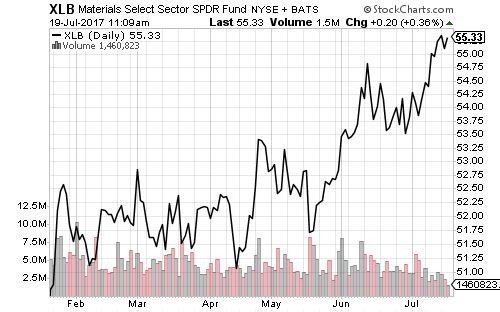

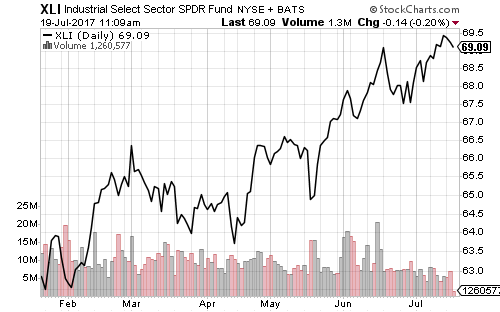

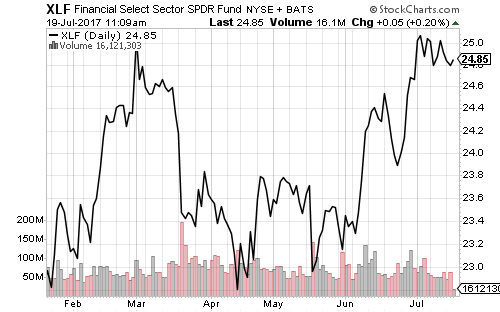

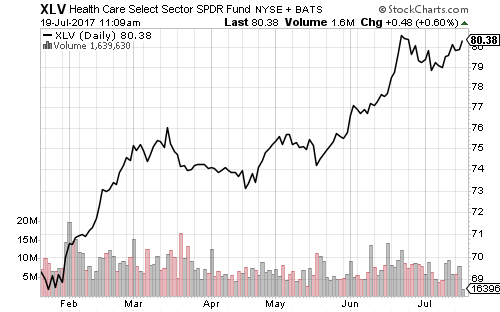

Industrials and materials hit new 52-week highs. Financials and healthcare are within striking distance of new records.

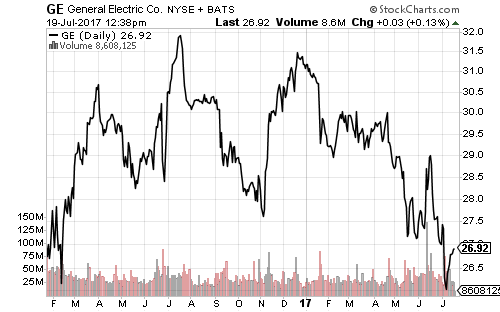

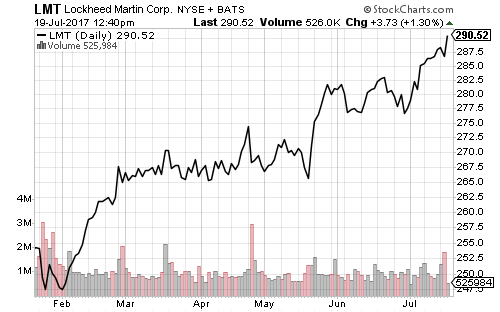

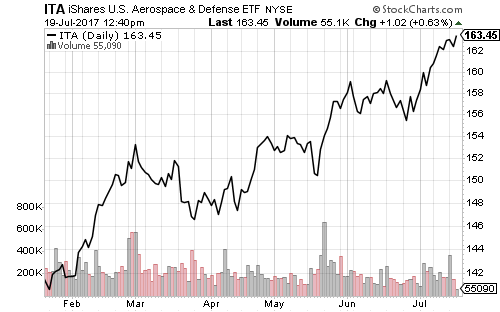

There will be two key earnings reports this week in the industrial sector. General Electric (GE) will report earnings on Friday. Lockheed Martin (LMT) beat earnings and raised guidance on Tuesday, pushing the stock and the defense subsector ETF to new 52-week highs.

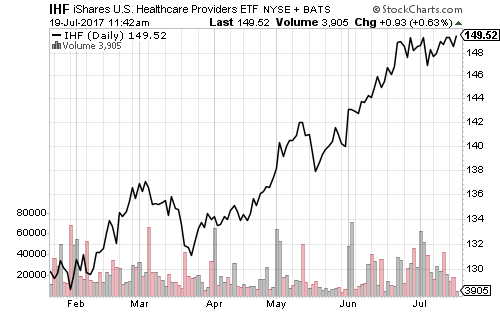

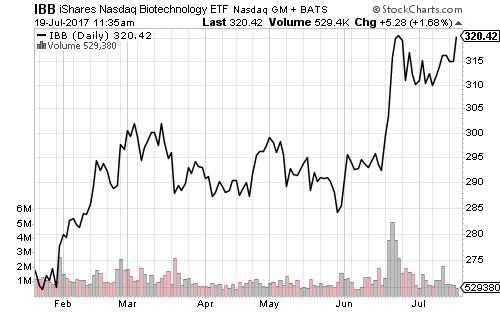

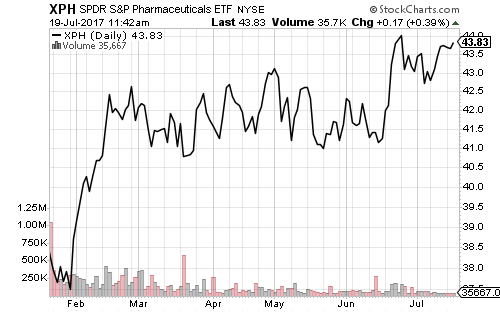

Although IHF briefly dipped following ACA roadblocks, news of the failure, it was trading at a new all-time high on Wednesday. Several large-cap names such as Celgene (CELG), Gilead (GILD), Amgen (AMGN) and Abbvie (ABBV) will report earnings next week.

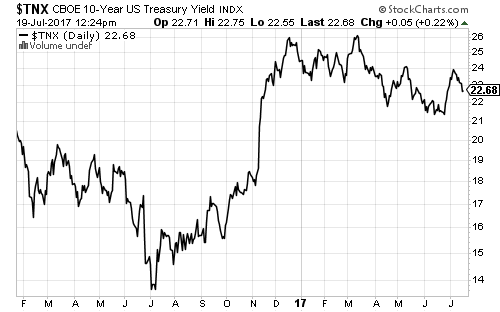

Long-term bond yields came down over the past week, with the 10-year Treasury yield sliding below 2.3 percent. The 10-year yield has remained in a downtrend over the past eight months.

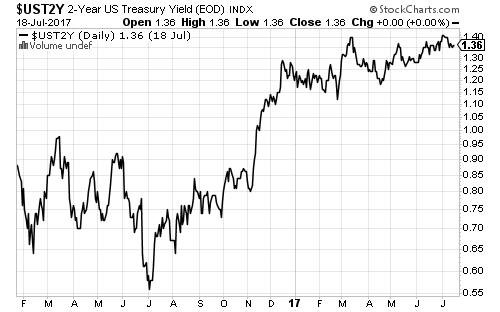

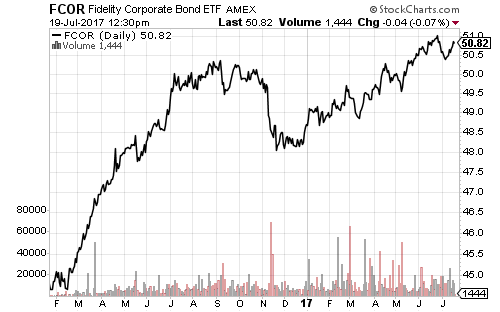

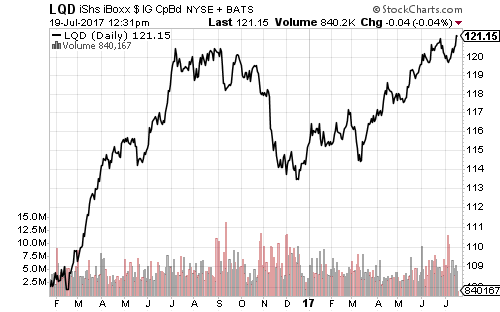

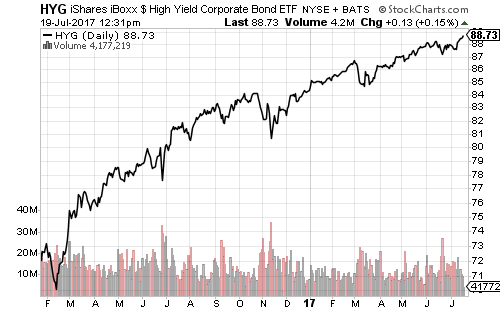

Short-term rates have continued to climb. The 2-year Treasury yield recently crossed 1.40 percent. The dip in yields lifted Fidelity Corporate Bond (FCOR) and iShares High Yield Corporate Bond (HYG) which hit a new 52-week high.

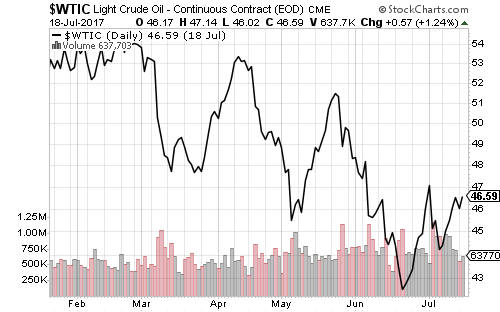

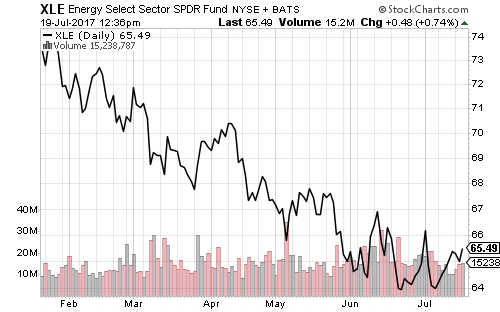

Oil prices have rebounded over the past week, nearing $47 a barrel on Wednesday. A large draw in inventory over the past two weeks has lifted prices.

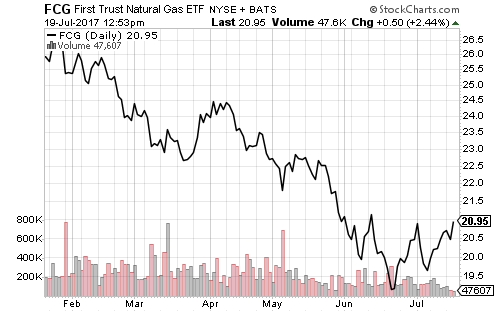

Broad energy funds such as SPDR Energy (XLE) have yet to break out of their downtrend. First Trust ISE Revere Natural Gas (FCG) and SPDR Energy Services (XES) have broken their downtrends, but don’t have a clear uptrend in place. Oil services giant Schlumberger (SLB) will report earnings on Friday.

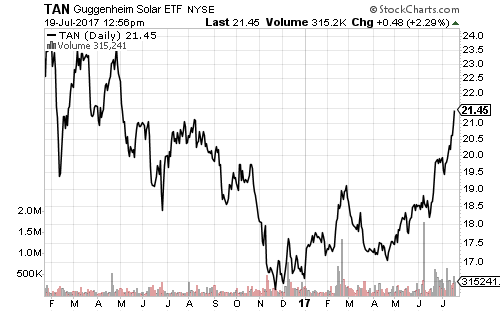

Solar energy has benefited from the technology rally this year. Guggenheim Solar (TAN) broke out to a 52-week high this week. China’s government increased incentives for solar installation this year as part of the effort to increase economic growth. Nearly half of total demand could come from China this year.

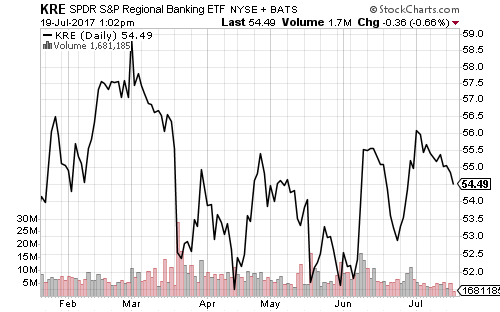

U.S. Bancorp (USB) beat earnings on Wednesday. Later this week, SunTrust Banks (STI), Fifth Third Bancorp (FITB), Citizens Financial (CFG), Regions Financial (RF) and Huntington Bancshares (HBAN) will deliver results.

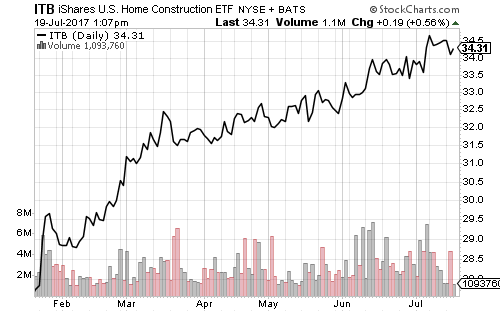

Housing starts and building permits were higher than expected in June. May’s figures were also revised higher. Homebuilders hit a new 52-week high this past week.

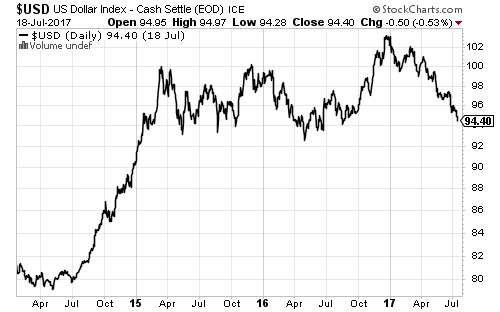

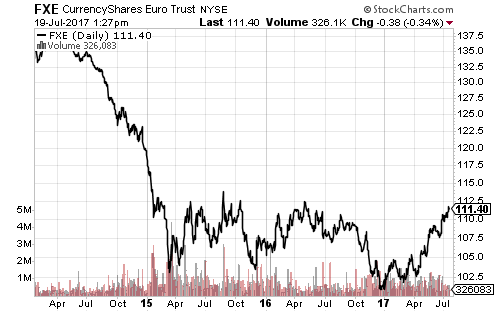

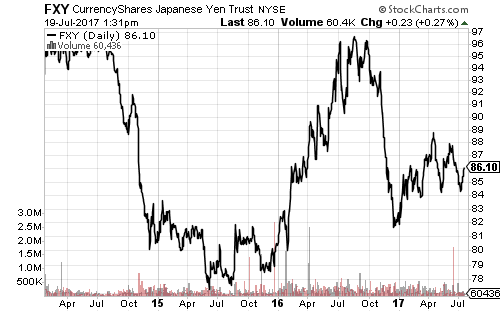

The U.S. dollar stayed in a downtrend last week. It is now approaching its long-term support range. The euro is threatening to break overhead resistance, with FXE having failed multiple times around $112.5.

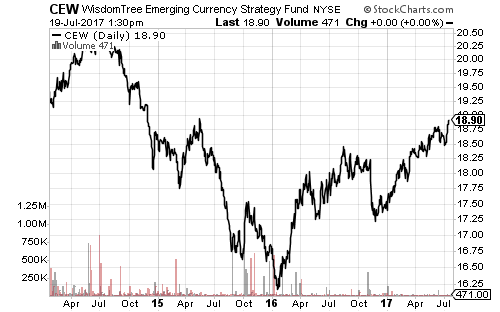

Emerging-market currencies are nearing 2-year highs.