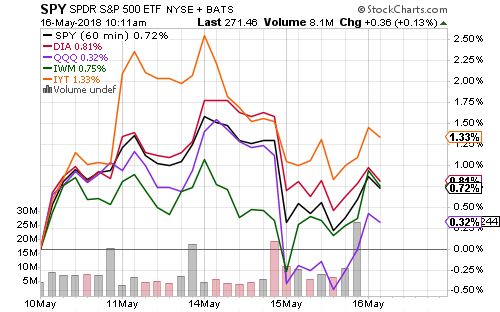

Equities rallied this week. The Dow, S&P 500 and Russell 2000 all saw similar returns, while the Nasdaq gained about half as much.

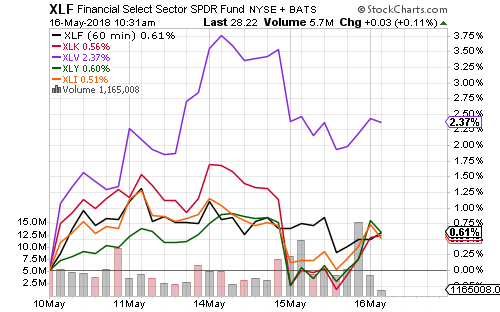

Healthcare was by far the week’s best performing sector, led by pharma.

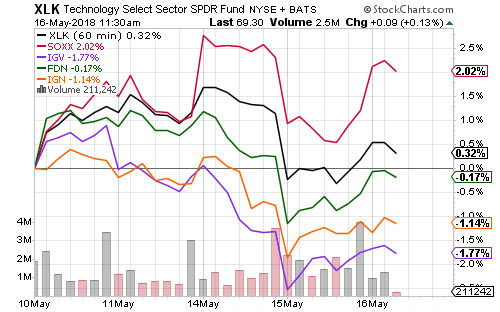

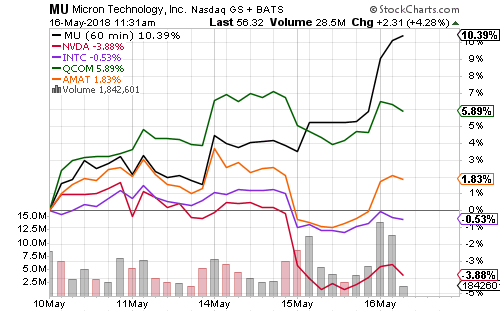

Micron (MU) and Qualcomm (QCOM) outperformed to boost technology gains on the week.

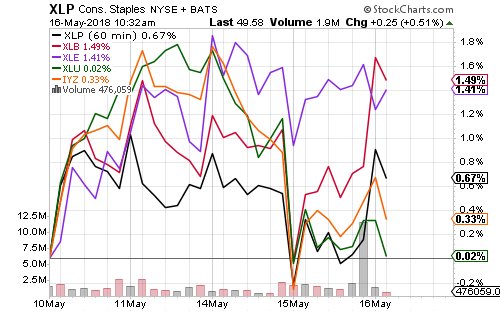

Materials and Energy were the strongest performers among the smaller S&P 500 sectors. Rate-sensitive sectors such as utilities underperformed.

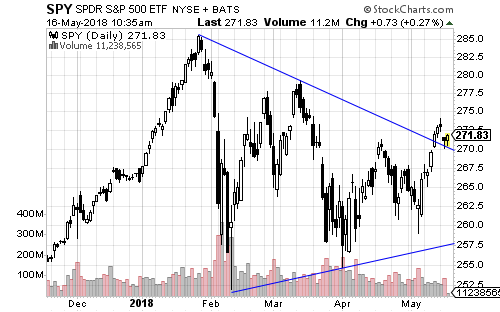

The S&P 500 breached resistance last Thursday, as we had anticipated. Shares bounced on Monday and Tuesday.

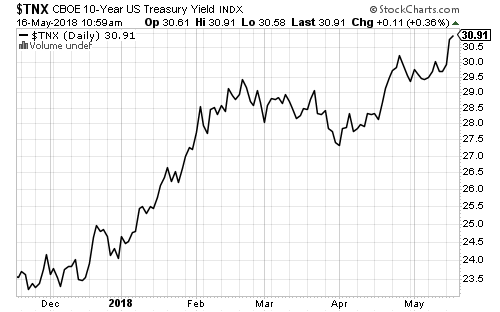

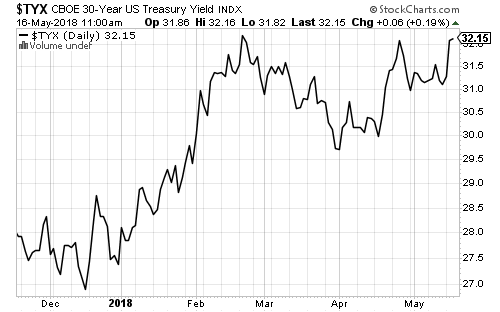

The 10-year Treasury yield broke through the 3.05 percent level watched by technical traders and hit a high of 3.095 percent. The 30-year yield is on the cusp of a breakout.

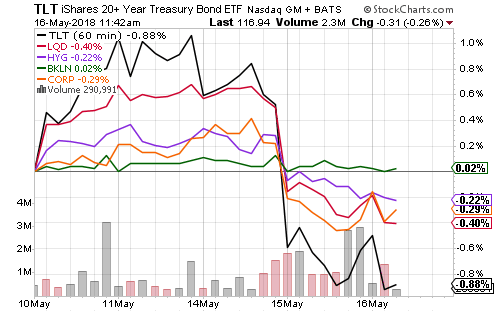

Bond funds lost ground as interest rates increased. Floating-rate funds held steady and high-yield bonds outperformed. Long-dated treasuries underperformed.

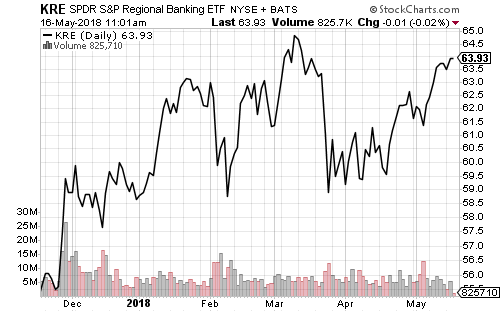

Rate-sensitive stocks fell with higher interest rates, while financials benefited from the rise.

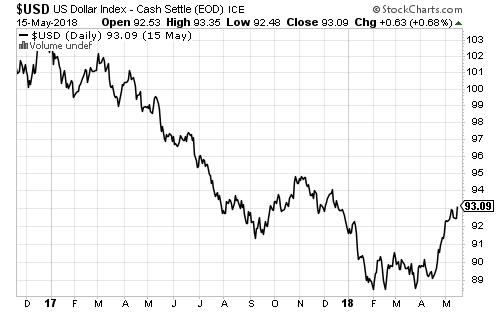

Rising interest rates boosted the U.S. dollar again in the past week. In the near-term a pullback in the dollar seems likely. The next target for a larger bullish move is the 95 level that served as resistance in November.

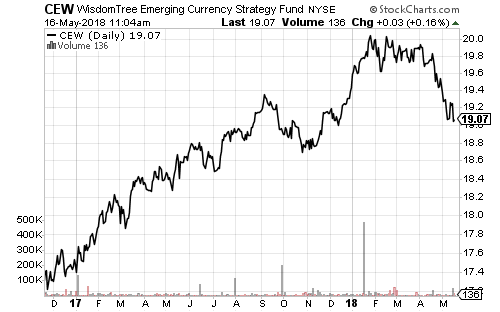

Emerging-market currency losses have weighed on emerging market stock funds. iShares MSCI Emerging Markets (EEM) has support in the $45-$46 range.

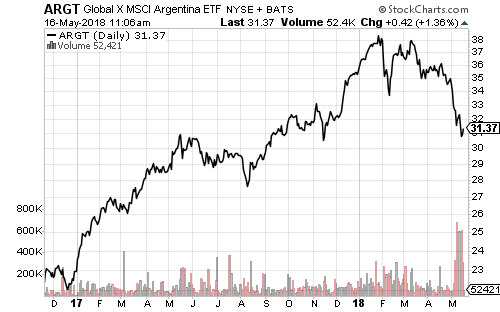

Turkey and Argentina are at the center of emerging-market weakness. In Argentina, a $30 billion IMF bailout failed to stop the peso’s decline.

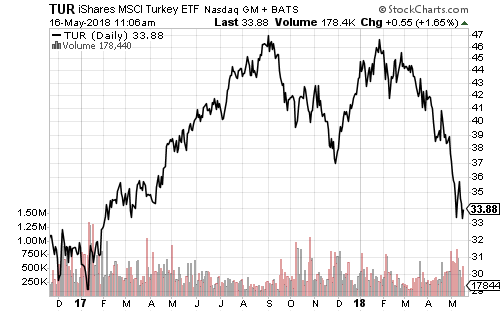

In Turkey, President Erdogan said he will take control of monetary policy after elections in June. The central bank chief wants to raise interest rates to combat inflation. Erdogan wants to cut interest rates. Unlike Argentina, Turkey is a major political player in the Middle East and many European banks are exposed to its economy.

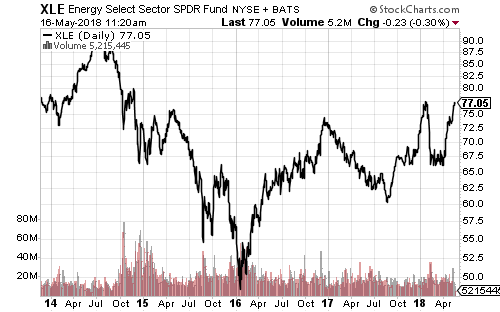

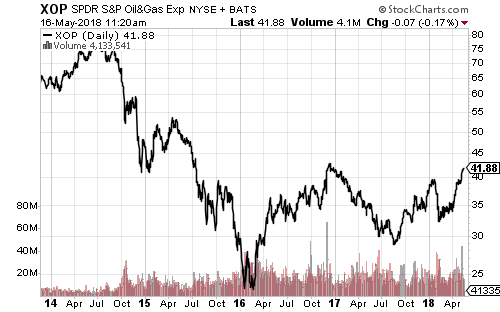

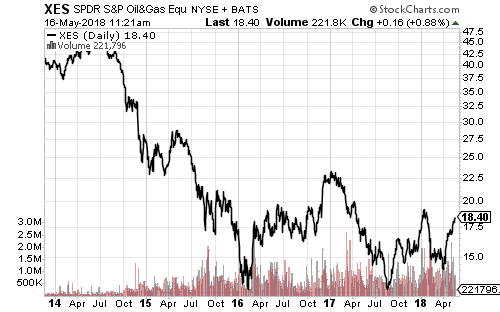

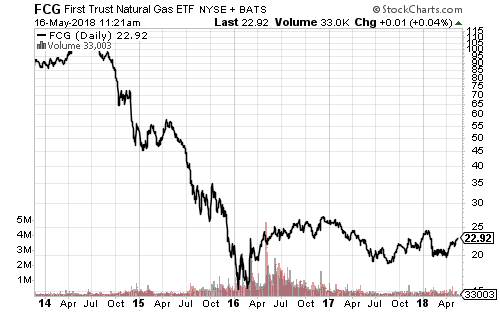

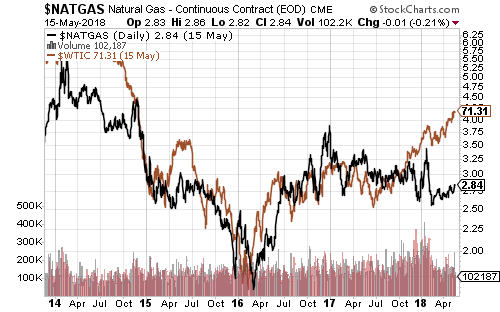

Energy stocks rallied this week. SPDR Energy (XLE) is near a 52-week high and could hit a 4-year high. The exploration and services ETFs (XOP and XES) remain relatively depressed. Natural gas producers are still 50 percent below where they were 3 years ago. While natural gas prices are still trading the same as 3 years ago. It will take a sustained rally towards $4 to revive the sector.