Today, Federal Reserve officials left interest rates unchanged as expected. Officials see core inflation close to 2 percent. Rate hike odds were unchanged following the release of the policy statement. Speculators are still split nearly 50-50 on two or three more hikes this year.

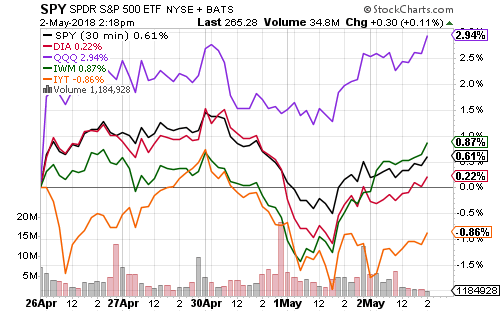

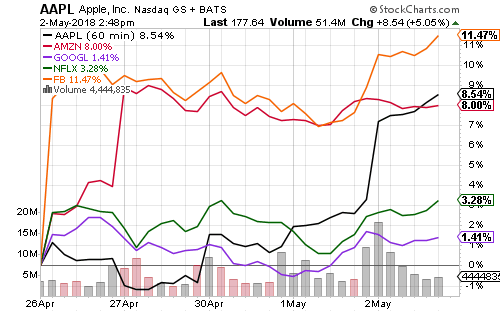

The Nasdaq was the best performing index on the week. PowerShares QQQ (QQQ) led the market by a wide margin following strong earnings reports from Amazon (AMZN) and Apple (AAPL).

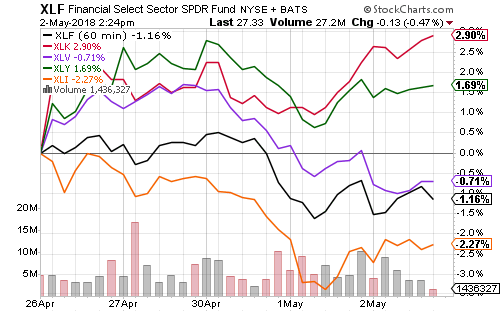

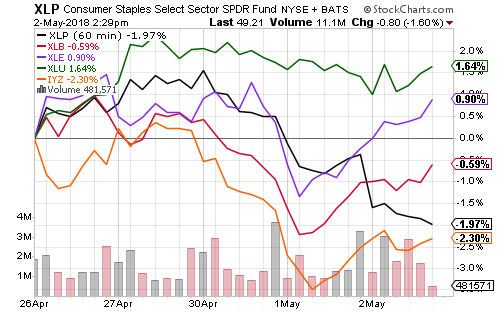

Technology and consumer discretionary led the large sectors. Financials, healthcare and industrials all declined on the week. Pfizer (PFE) beat earnings on Tuesday, but a small revenue miss sent shares down 3.3 percent.

Utilities benefited from the dip in long-term interest rates, while energy climbed with oil prices.

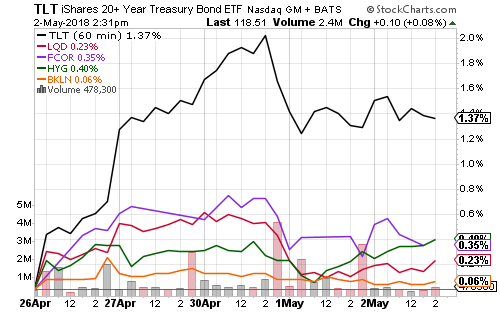

The 10-year Treasury climbed above 3 percent last week and then pulled back with the 30-year bond yield. This dip in yields boosted bonds across the board.

The FAANG stocks pulled technology higher over the past week.

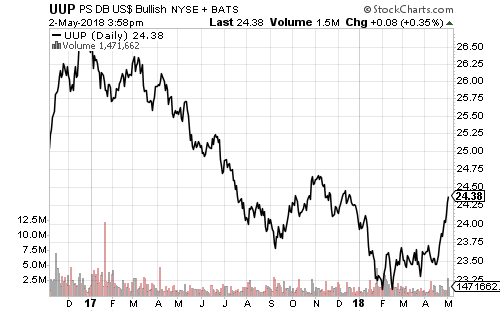

The U.S. Dollar Index decisively broke out of the downtrend in place since the start of 2017.

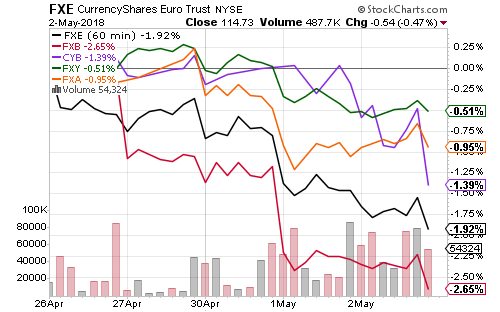

The British pound, euro and Chinese yuan have been the weakest major currencies.

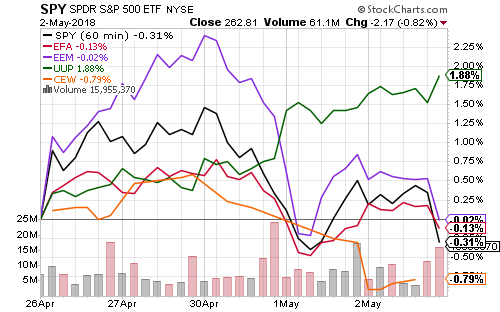

The rising U.S. dollar has weighed on emerging and developed market stocks. Although they performed about as well as the S&P 500 Index in the past week, iShares MSCI Emerging Markets (EEM) went from a gain of 2.3 percent to flat over the past three trading days as the dollar rally accelerated.