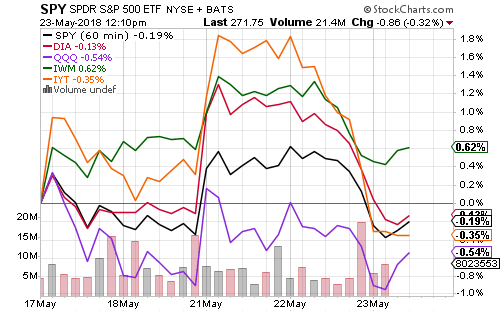

The Russell 2000 Index continued its outperformance this week. Small-caps typically outperform during periods of U.S. dollar strength as they have less foreign exposure. The rest of the market is likely to follow to new highs, as the Russell typically leads in bull markets.

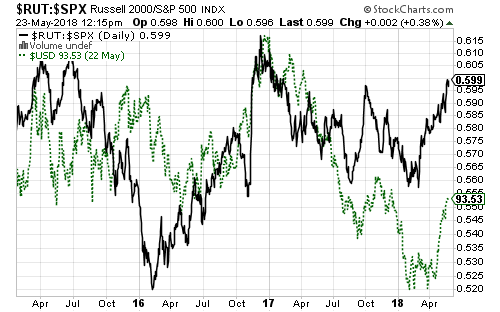

The relative performance of the Russell 2000 versus the S&P 500 illustrates the stronger dollar’s impact on small-caps in recent months.

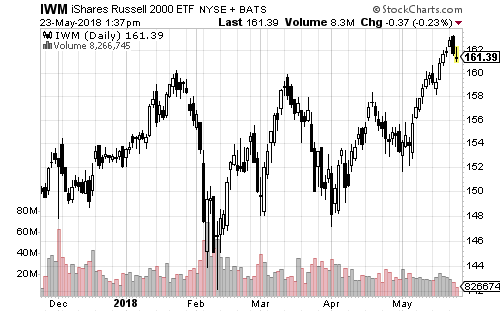

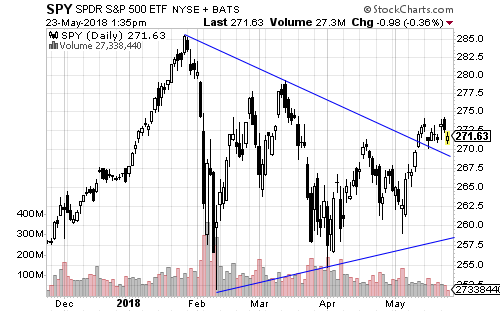

The Russell 2000 also achieved a bullish breakout in the past week to a new all-time high. The S&P 500 broke out of its downtrend two weeks ago.

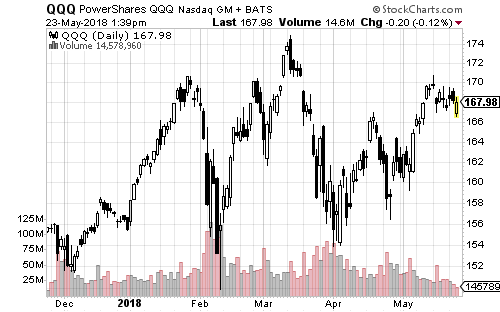

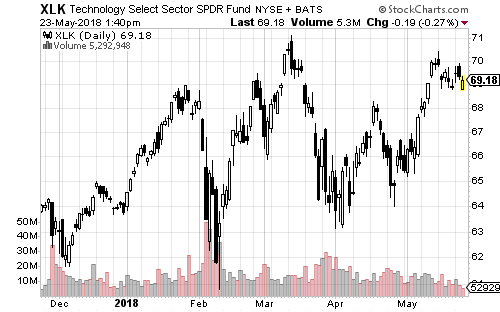

PowerShares QQQ (QQQ) needs to crack $170 per share to close the gap created in March. SPDR Technology (XLK) closed that gap in the past two weeks and QQQ should follow. QQQ is about 3 percent off its highs.

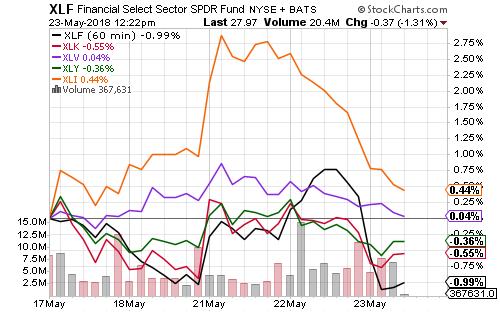

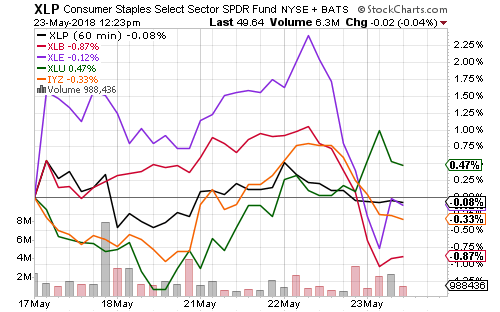

The largest S&P 500 sectors were flat over the past week. Industrials rallied strongly on Monday after China and the U.S. released a positive statement on trade, but there was no deal.

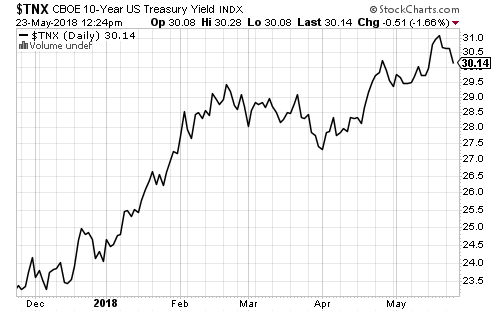

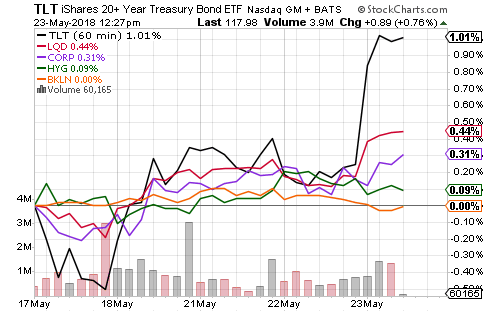

Utilities were among the best performing sectors after long-term interest rates consolidated.

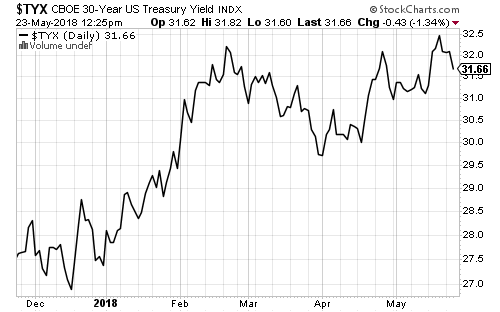

Both the 10- and 30-year treasury yields fell below their breakout levels. The consolidation benefited rate-sensitive stocks and bonds.

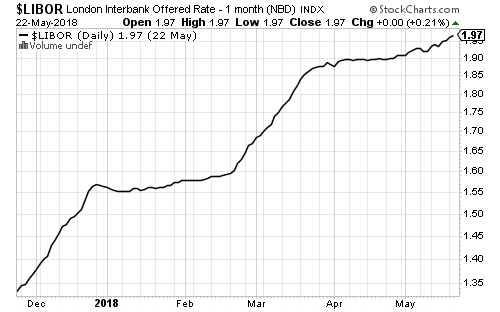

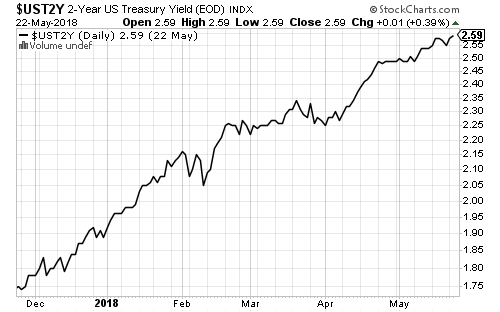

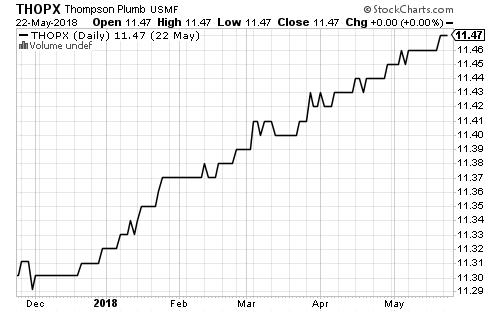

Short-term interest rates have begun rising ahead of the Fed’s June 13 meeting. The odds of a rate hike are 100 percent. The rise in rates is good news for short-duration funds and floating-rate funds.

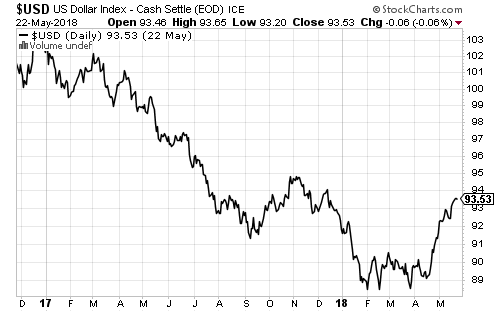

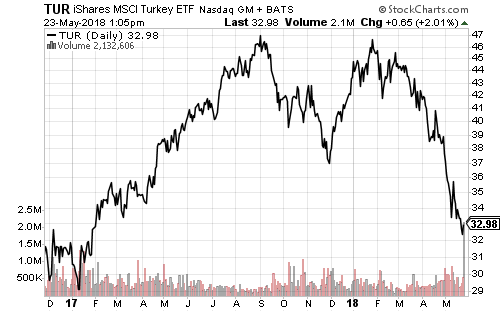

The rally in the U.S. dollar may finally pause this week after Turkey moved to defend its currency. The central bank hiked short-term interest rates after the lira tumbled more than 5 percent overnight, causing the currency to reverse its losses.

The key level for the U.S. Dollar Index in the coming weeks is 95.

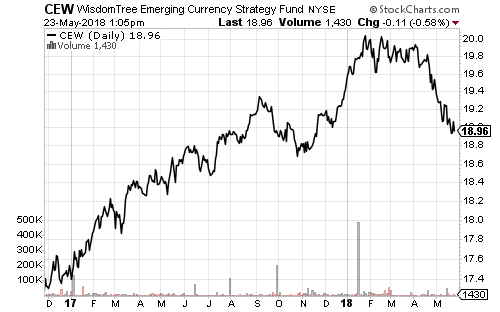

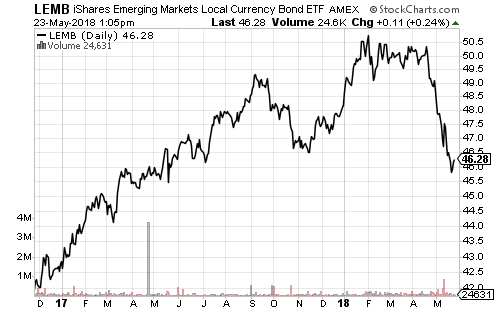

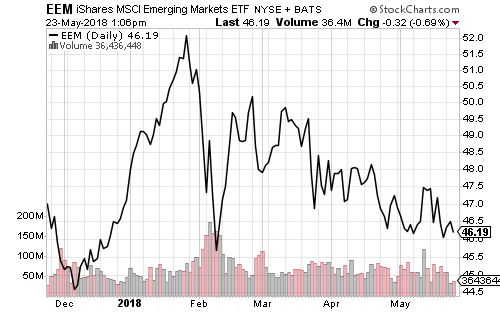

Extreme currency weakness in Turkey (and Argentina) highlights the risk of a rising dollar to emerging markets. iShares MSCI Emerging Markets (EEM) has been bouncing off the $46 level. If the dollar index breaks through 95, emerging markets will experience a significant breakdown. Emerging market bond and currency funds have already broken to the downside.

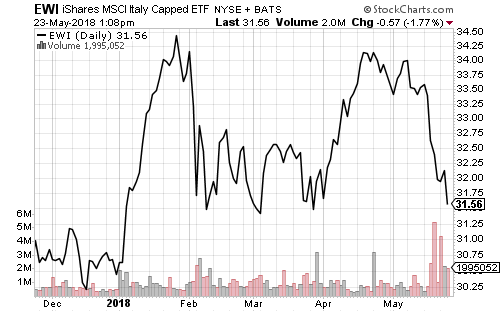

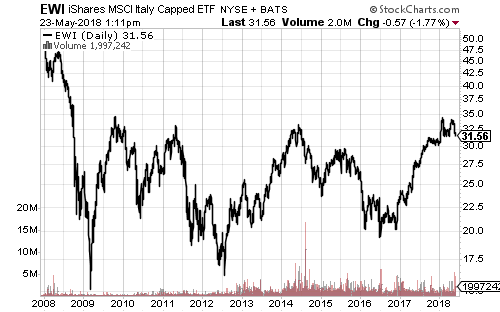

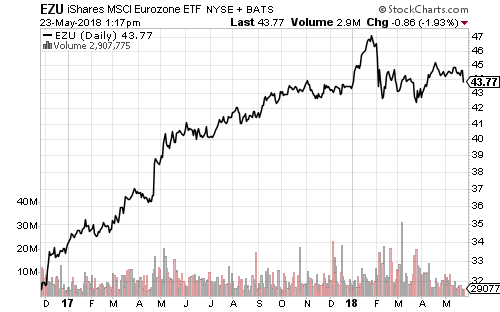

Italy formed a nationalist coalition government a week earlier and then laid out its plans over the weekend. It is a nightmare for Brussels. The left gets increased social spending and the right gets tax cuts. They’ve floated a plan (mini-BOTs) for increasing debt outside of limits imposed by the European Union and European Central Bank.

Italian 2-year bond yields soared in the past week from negative 0.03 percent on May 16 to positive 0.27 percent today.

Italy’s stock market has gone sideways since 2009 and its economy has contracted.

Weakness in Italy is weighing on the euro more than European equities. WisdomTree Europe Hedged Equity (HEDJ) hit a new 52-week high last week.

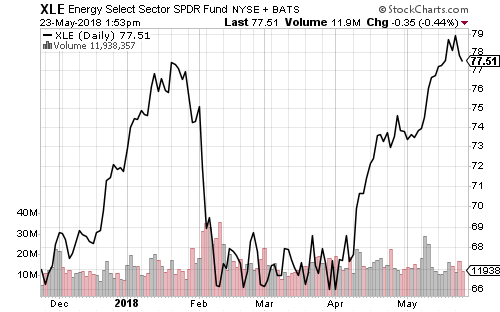

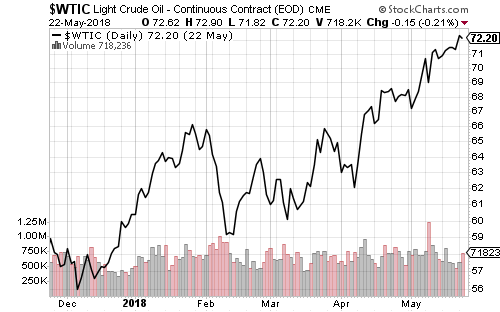

Energy broke out to a new 52-week high this past week. Crude oil climbed past $72 a barrel. Oil is starting to hit some resistance now as gasoline prices crossed $5 in New York City. The national average is on the verge of crossing above $3 a gallon.