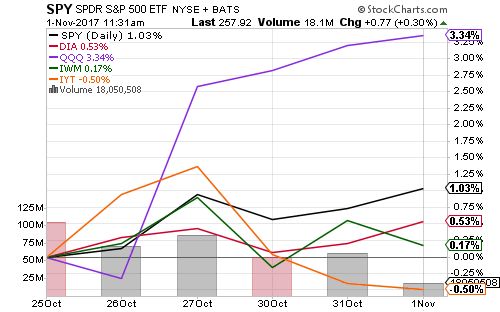

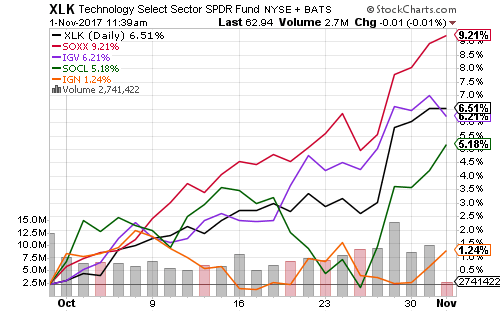

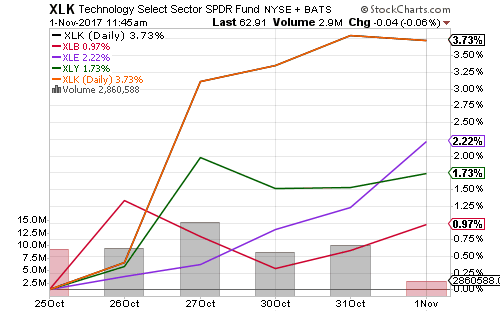

Microsoft (MSFT), Alphabet (GOOGL) and Intel (INTC) powered last week’s technology sector rally. Facebook (FB) and Apple (AAPL) will report this week. Both are top-ten holdings in funds such as SPDR Technology (XLK).

Semiconductor stocks have led performance over the past month. Intel (INTC) recently boosted an already strong earnings season.

Consumer discretionary derived a great deal of strength from Amazon’s (AMZN) cloud services division. Energy, materials and utilities also rallied last week.

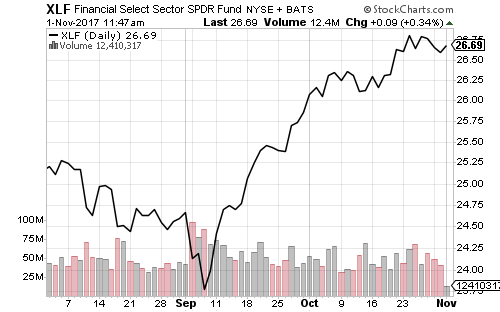

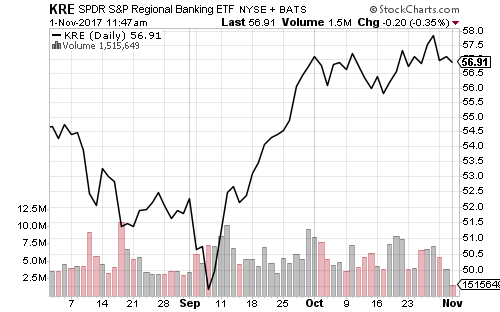

Financials were flat on the week, extending the consolidation phase to two weeks.

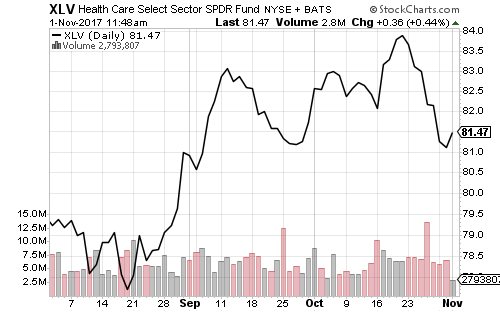

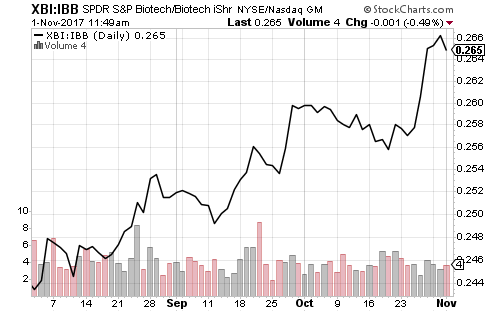

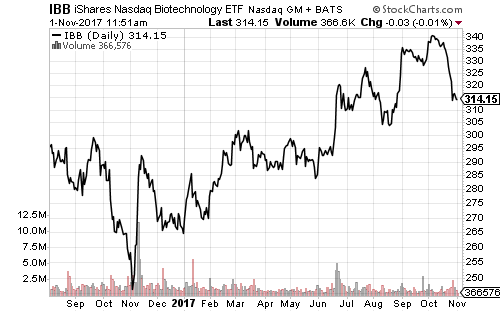

Earnings misses stung the healthcare sector last week. The weakness was concentrated in large-cap stocks, as evidenced by SPDR S&P Biotech (XBI) versus the market-cap weighted iShares Nasdaq Biotechnology (IBB). As the longer-term chart of IBB shows, the drop was one of the largest in the past year, but not out of the ordinary for this highly volatile sector.

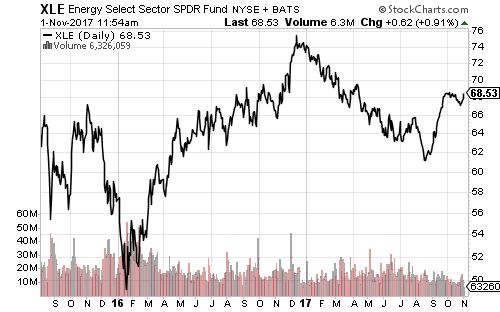

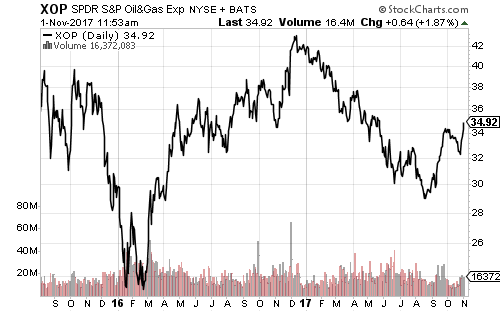

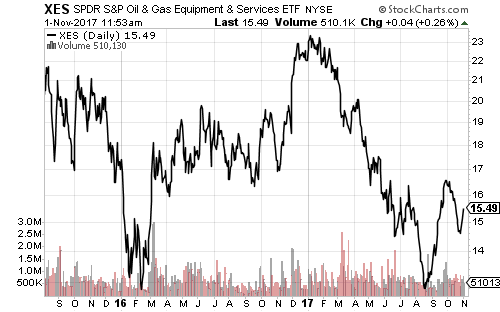

Energy stocks and crude oil are both on the verge of short-term bullish breakouts. SPDR Oil & Gas Exploration & Production (XOP) has already achieved a short-term breakout. SPDR Energy (XLE) should follow in the next week, while SPDR Oil & Gas Services (XES) is trailing. Long-term, however, the picture remains bearish.

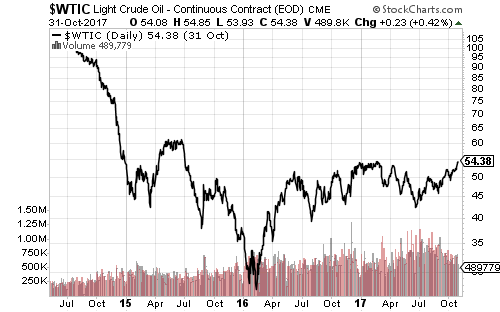

West Texas Intermediate crude hasn’t traded above $55 for more than a few hours since it lost that level in July 2015. It traded above $55 on Wednesday morning before falling back. If oil can climb above $55, it will be a short move to $60.

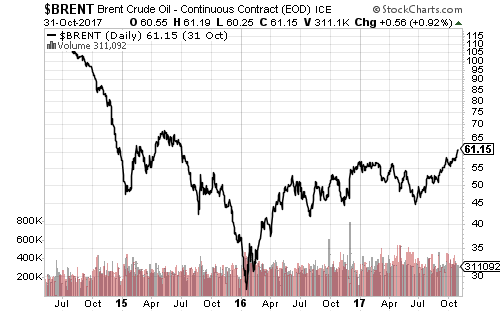

Brent crude has already shown a short-term breakout.

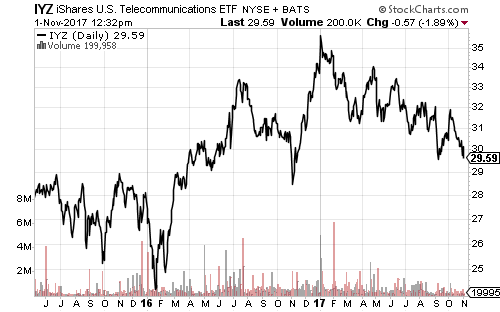

Telecom shares slumped this week after Softbank (SFTBY) called off a proposed merger between its Sprint (S) division and T-Mobile (TMUS). Shares of all three companies fell on the news.

Rising interest rates and AT&T’s (T) earnings miss have weighed on IZY. A new low will be likely as interest rates rise.

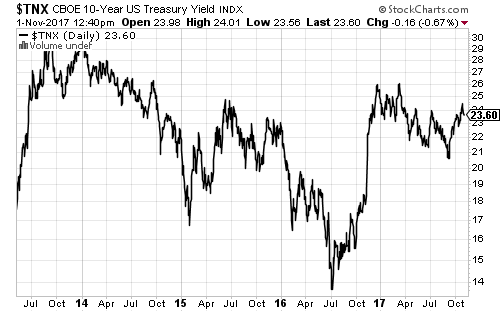

The 10-year Treasury yield climbed above 2.4 percent over the past week. Predictions of a bond market breakdown have increased, but as the long-term chart shows, rates are below 2014 levels.

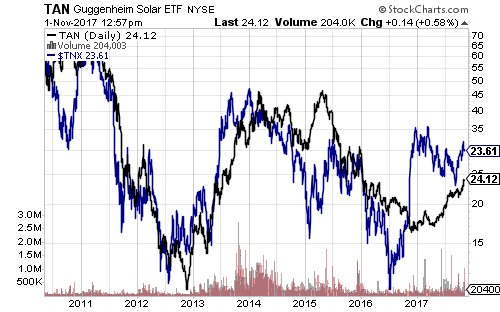

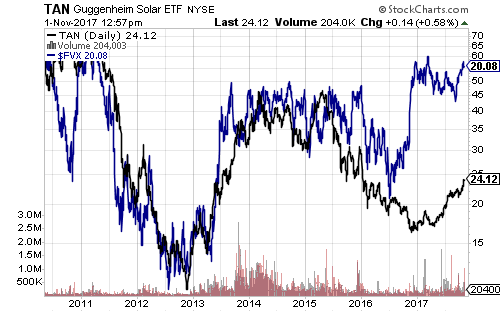

Solar stocks have historically moved with interest rates. Guggenheim Solar (TAN) has closely tracked the 5- and 10-year yields over the past several years. If interest rates continue to climb, history suggests that would be bullish for solar.

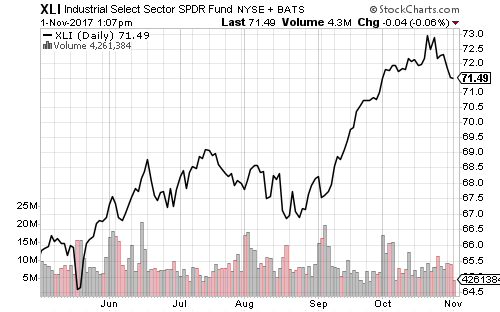

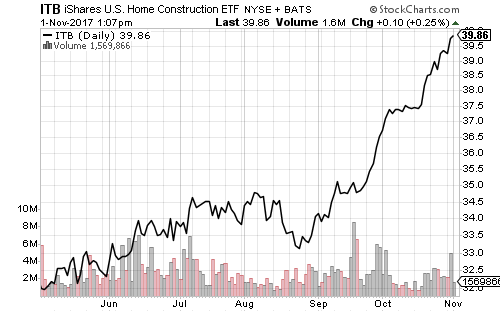

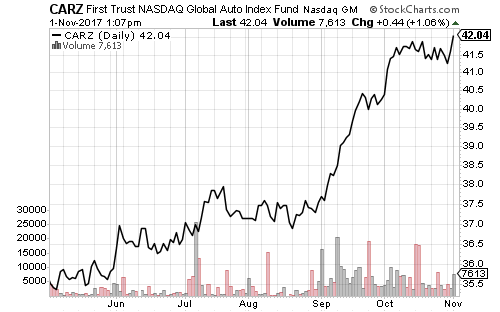

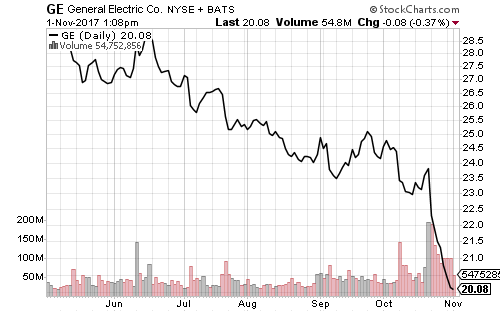

Automakers and homebuilders extended their gains in the past week, even as the industrial sector corrected. General Electric (GE), once the largest holding in SPDR Industrials (XLI), fell to third place behind 3M (MMM) GE has shaved more than 2 percent from XLI’s 2017 return, currently 16.5 percent.