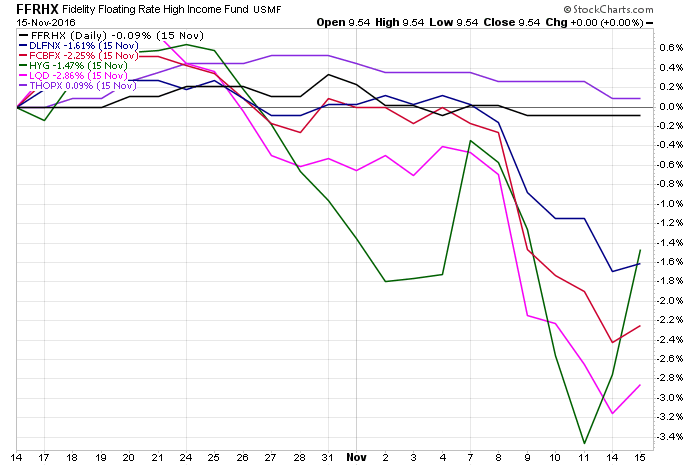

iShares iBoxx High Yield Corporate (HYG)

iShares iBoxx Investment Grade Bond (LQD)

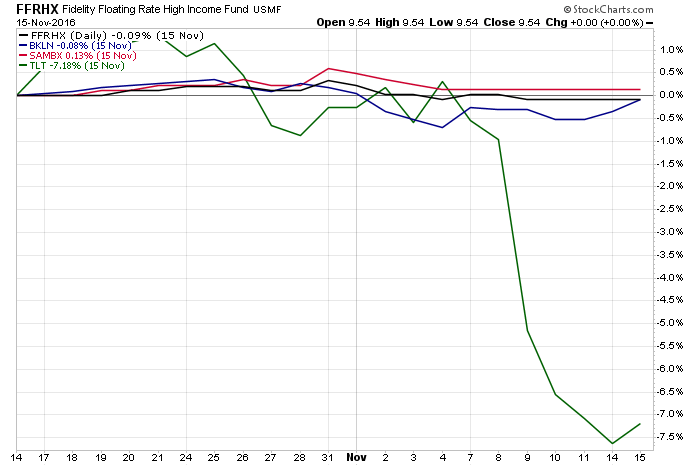

PowerShares Senior Loan Portfolio (BKLN)

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

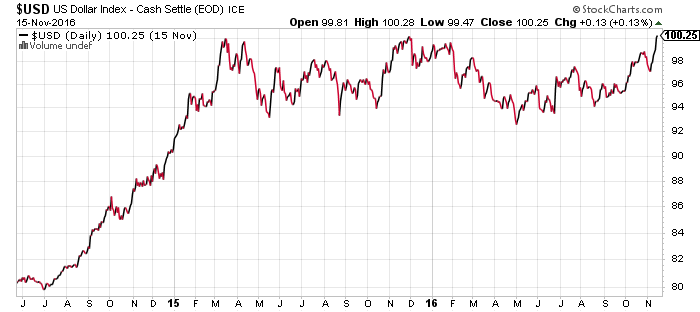

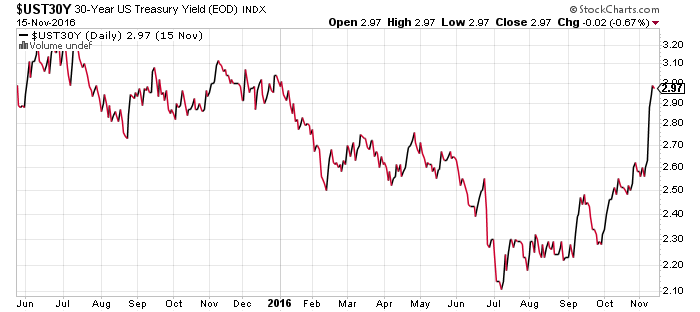

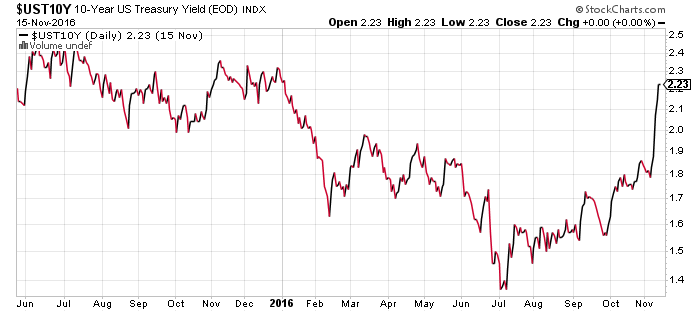

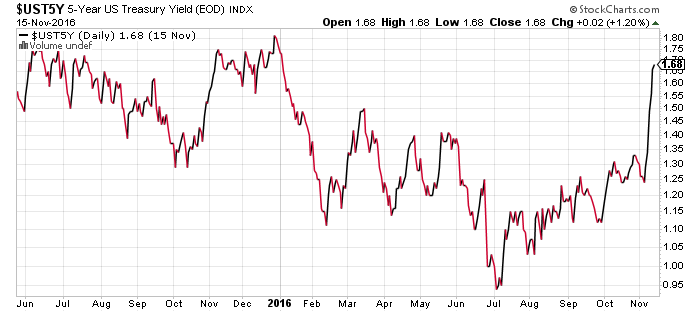

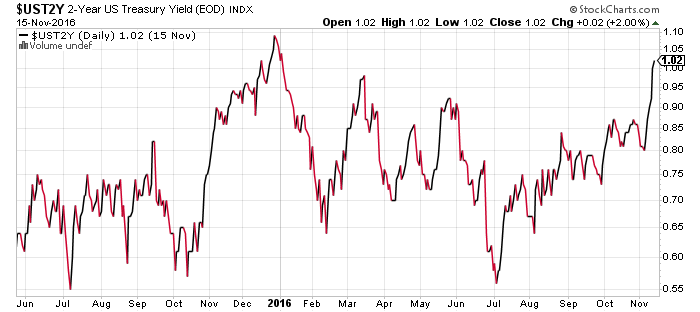

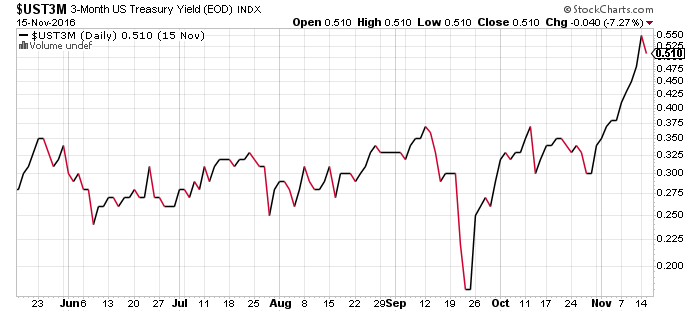

The major fundamental change in the financial markets over the past week was in interest rates. A rally in yields could be the initial step in a long-term reversal.

The best positioned fund for this reversal was and is Thompson Bond (THOPX). With higher yielding credit in the portfolio, the fund has lower duration than similar funds holding government bonds, but the main reason for a strong performance is positioning. THOPX managers expected rising rates going back to the start of 2015, which is why this week’s rise in rates didn’t dent the fund one bit. In contrast, DLFNX slipped a bit due to manager Jeff Gundlach anticipating rates would stay flat at the long-end. However, his relatively conservative approach has served DLFNX well in a very tough week for fixed income.

Floating rate funds have also done well, as expected. Bonds with fixed rate coupons must drop in price in order to match rising bond yields, but the interest rate on floating rate securities can increase instead, leaving the price of the bonds unchanged. Floating rate mutual funds and ETFs all did their jobs last week.

The worst performing bonds were long-term government bonds. iShares Barclays 20+ Year Treasury (TLT) was the best example, the fund tumbled as interest rates advanced.

Interest rates rallied across the board though, as the charts below show. Even the 3-month Treasury yield climbed from 0.30 to 0.55 before pulling back on Wednesday. The advance began before the election because it reflects rising rate hike expectations. The odds of a December rate hike are now at 90 percent in the futures market, as close to certainty as we get in the financial markets. Traders have fully priced in a rate hike and we should see some stabilization or even a mild correction in the market moving forward.

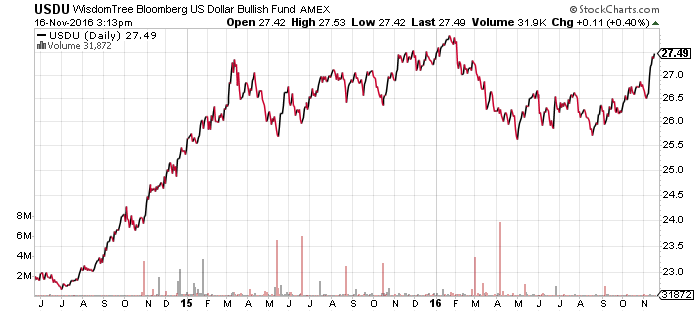

WisdomTree US Dollar Bullish (USDU)

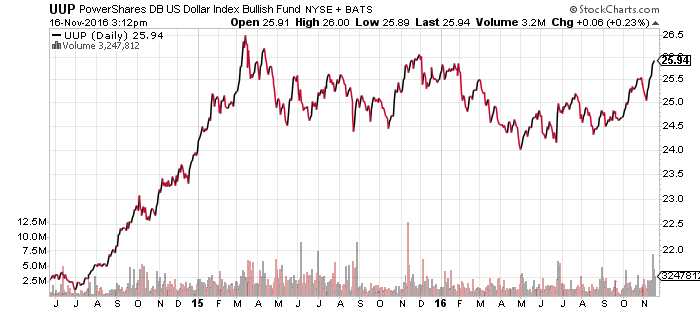

PowerShares DB US Dollar Bullish (UUP)

Along with rising bond yields is the rising U.S. dollar. Thanks to futures markets, it is possible to hedge away currency risk and invest solely on the basis of interest rates. When interest rates in the U.S. dollar rise, speculators buy U.S. dollars and sell foreign currencies such as euros, until the profit from higher interest rates is eliminated. Rising rates immediately translate into a rising currency in the short-term.

In the long-term, a rising currency requires fundamental factors. Even before President-elect Trump, the U.S. dollar benefited from a relatively strong economy, rising domestic energy production (which reduced imports and thus the flow of dollars overseas), and relatively high interest rates. Trump plans to increase fiscal spending, which will increase GDP growth and increase interest rates. Both will add bullish pressure to the U.S. dollar. The new Trump administration is also expected to make domestic manufacturing more attractive, as well as make U.S. assets more attractive thanks to tax cuts. This should further cut imports and increase capital flows from abroad. Finally, on Wednesday, the U.S. Geological Survey announced it found the largest oil deposit ever discovered in Texas. Energy imports will stay low and even fall further in the years ahead.

Put it all together and it is a potent bullish combination for the U.S. dollar. The U.S. Dollar Index closed at a 13-year high on Tuesday and finished Wednesday at another high. If the index continues building on this breakout, an upside target of 120 could be in the cards, or a gain of 20 percent versus major currencies. More volatile emerging market currencies could fall 40 percent to 50 percent in such an environment. The last time we saw a similar rally in the dollar was in 1999 and it lasted until 2002. If we get a bullish breakout and rally all the way to 120, the dollar may not top until 2019 or 2020.