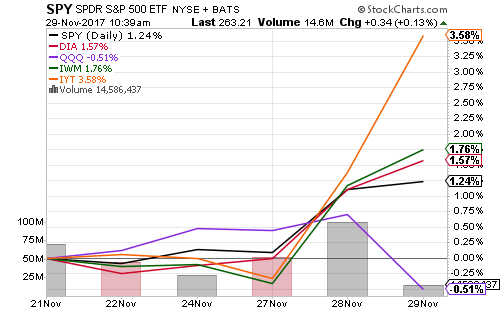

Equities rallied to new all-time highs after Senate Republicans on the Budget Committee voted unanimously in favor of the tax bill ahead of Thursday’s anticipated final vote.

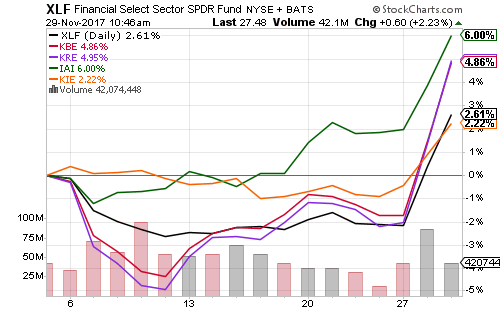

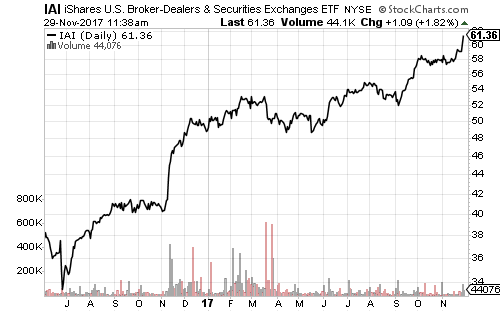

Positive news around tax reform jolted financial sector activity, with big gains in banking and brokerage sectors.

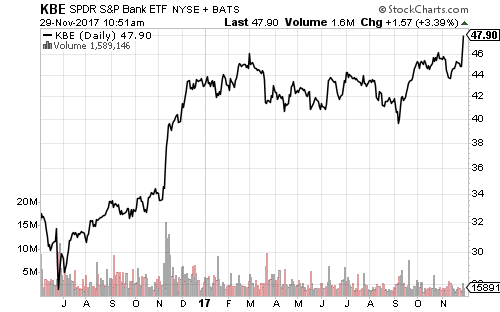

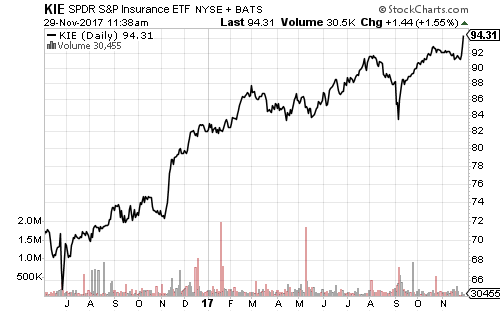

SPDR S&P Regional Banking (KRE) and Bank (KBE) made major bullish breakouts from their 2017 trading ranges. Insurance and brokerage stocks were trading at new highs prior to this latest rally.

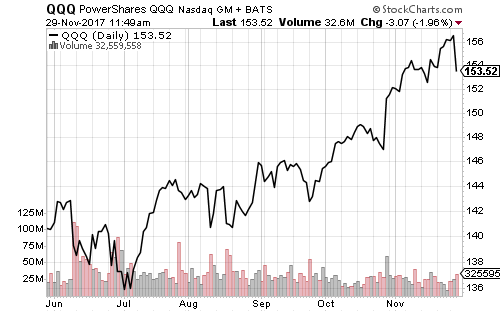

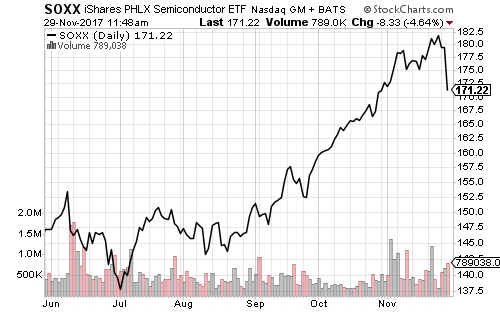

Major sector rotation is also underway. Technology stocks, such as PowerShares QQQ (QQQ) and iShares Semiconductors (SOXX) tumbled. The one-day loss in SOXX reversed all the gains in November.

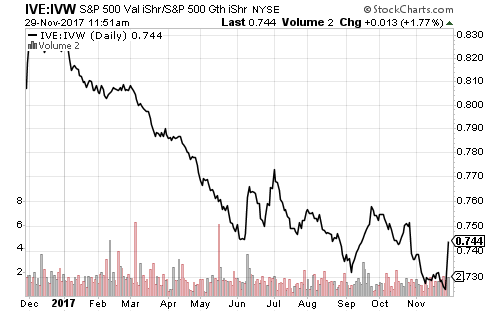

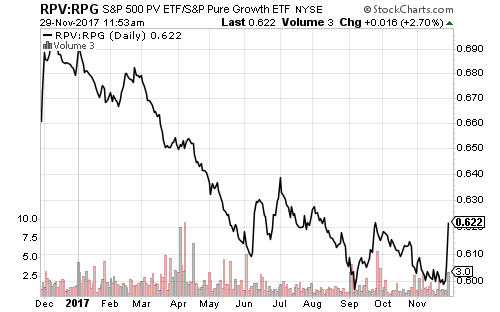

Today’s shift, however, it may not last. The current spike in value and drop in growth happened in June, followed by a smaller and shorter spike in September. The Pure Growth (RPG) and Value (RPV) ETFs from Guggenheim shows value approaching the September relative price peak.

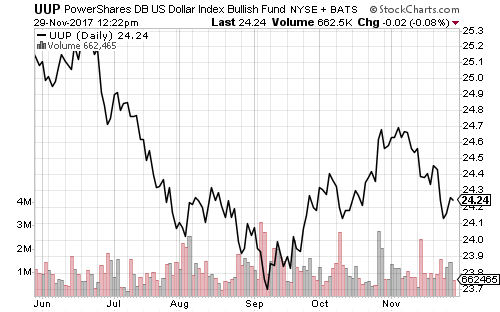

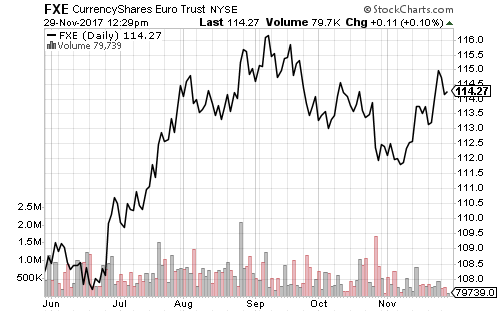

The U.S. dollar will also benefit from tax reform.

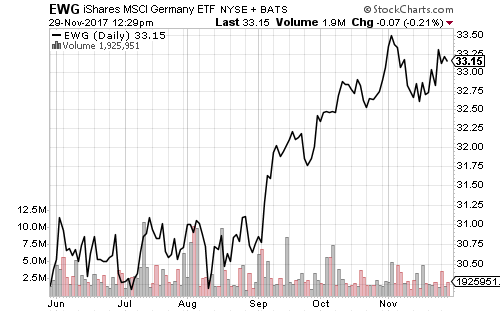

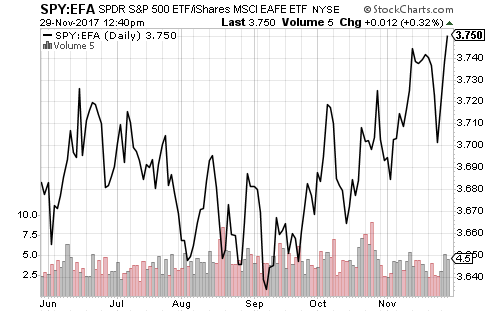

The U.S. stock market extended its outperformance versus the MSCI EAFE following the tax cut news. A stronger U.S. dollar has underpinned the move.

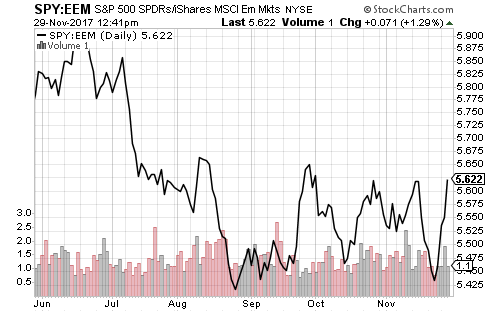

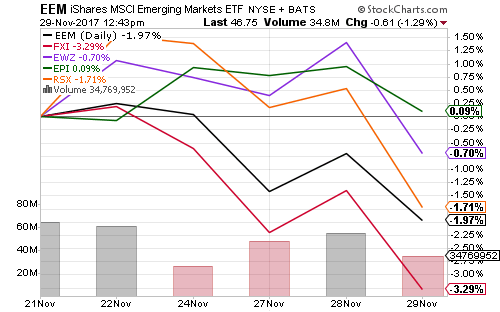

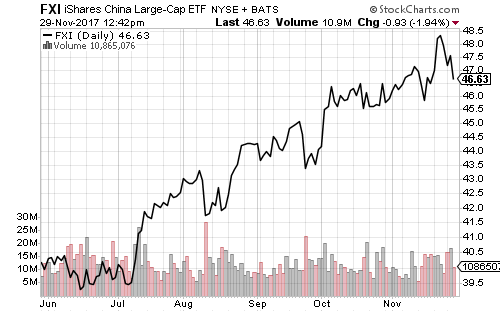

The U.S. market is also on the verge of breaking out versus emerging markets. Weakness in the Chinese market has weighed on emerging markets over the past week. Despite the drop in China, the chart remains in an uptrend. A look at the fundamentals warrants more caution. Chinese interest rates are rising as the government lowers credit growth and targets the shadow-banking sector.

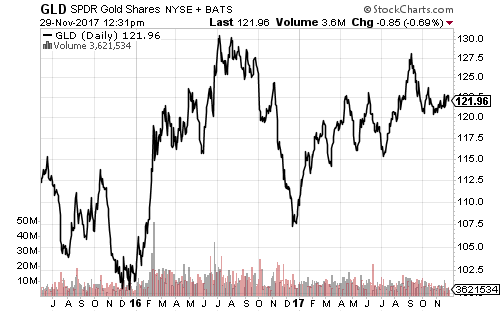

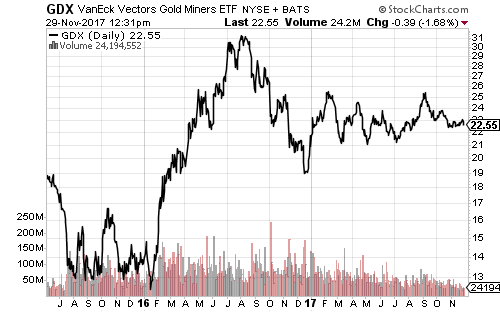

Gold is likely to lose from tax reform. The Federal Reserve will hike rates as economic growth picks up and financial conditions ease, even as inflation remains relatively low.

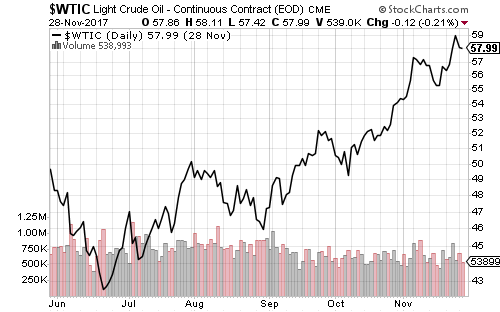

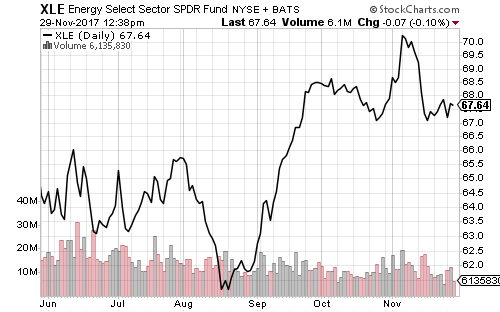

Crude oil touched $59 a barrel before pulling back this week. United States shale oil producers could be the main beneficiaries of an extended cut. West Texas Intermediate crude weakened to $57 following the news. Oil-related equities spiked in early November, but have been down over the past two months.

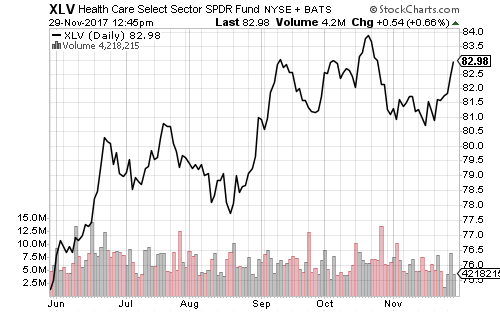

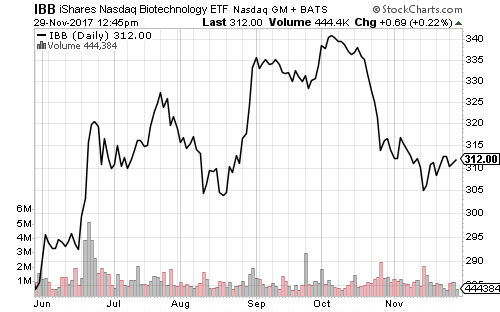

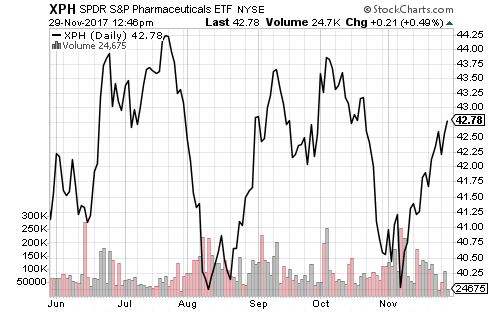

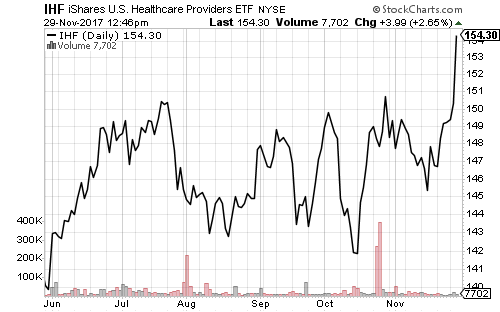

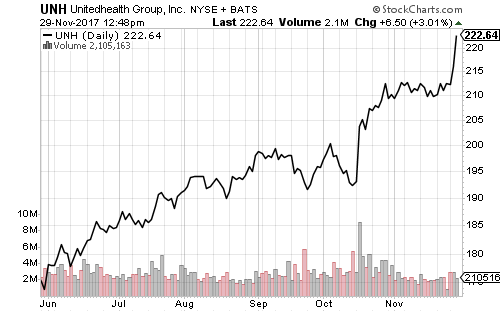

The biotechnology sector continues to weigh on healthcare, but pharma and healthcare providers have rallied strongly this month. Medical devices remain the strongest subsector. UnitedHealth Group (UNH) lifted the provider subsector today after strong earnings and guidance for 2018.

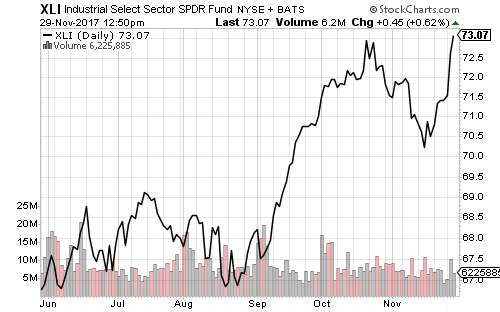

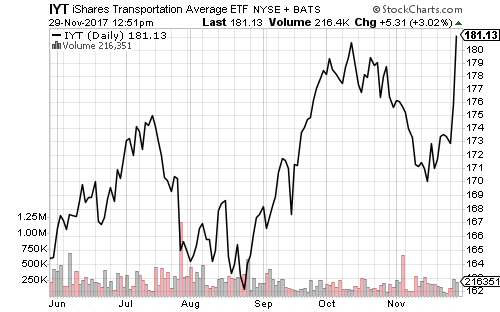

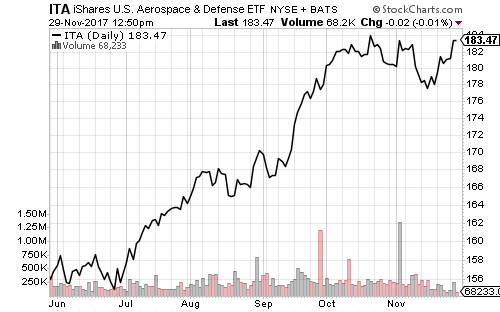

Transportation stocks led the industrial sector to a new all-time high today. Defense shares are nearing a breakout.

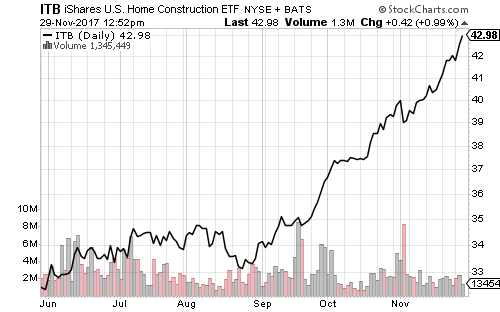

Strong housing data sent iShares U.S. Home Construction (ITB) to another 52-week high. New homes sales jumped to an annualized pace of 685,000 in October, well above expectations and consistent with a robust economic expansion. Shares have gained 30 percent over the past three months.