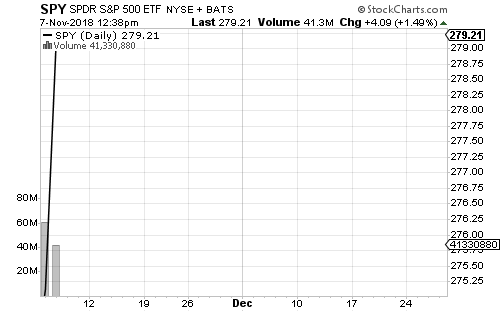

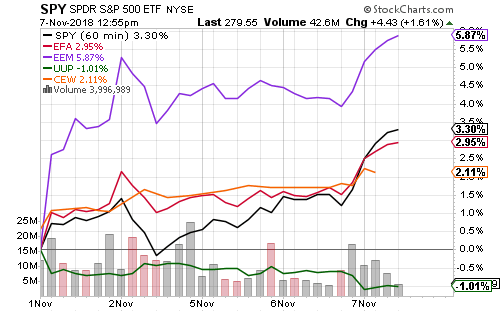

Stocks rallied in the wake of the midterm election, as they have historically.

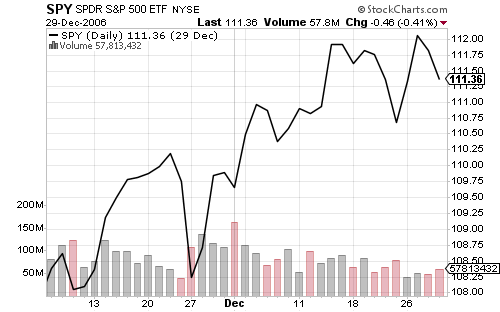

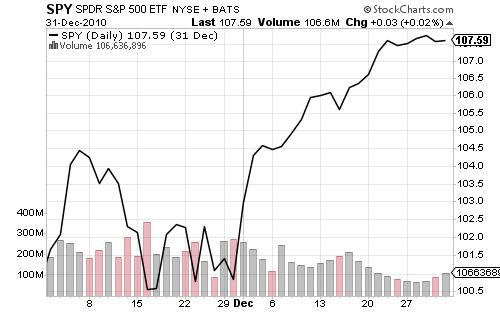

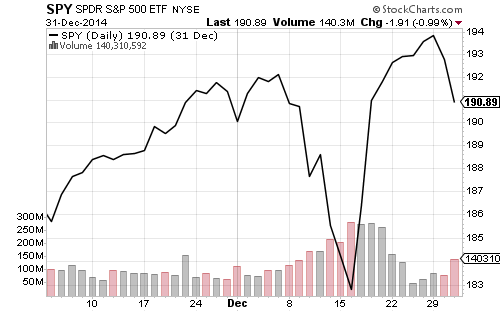

In 2002’s bear market the S&P 500 Index rallied until December. The 2006 midterm election was followed by a much stronger rally as the S&P added 2.8 percent to an already strong market cycle. The S&P 500 Index gained 6 percent in December 2010 following midterms, and the S&P ended the year with a 2.6 percent gain after the 2014 midterm election, despite the end of quantitative easing.

The S&P 500 Index’s seasonal effect should deliver a solid rally with plenty of room to rally from October lows.

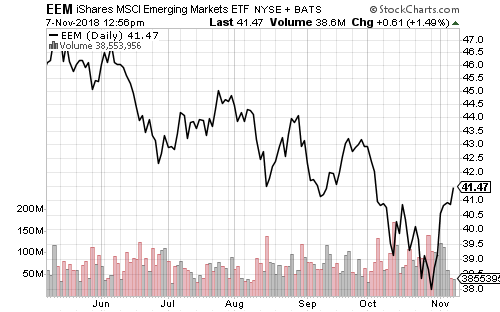

The U.S. dollar fell following the election, but it was already experiencing a correction. This past week was strong for emerging markets. The emerging market indexes are at resistance lines for 2018. A break of this resistance line would raise the prospect of an extended rally and potentially larger pullback in the U.S. dollar.

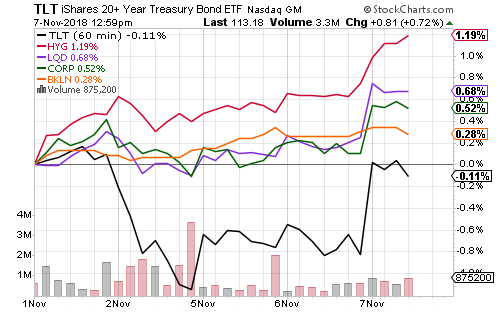

Bonds rallied as credit risk lifted this week, but a rise in interest rates in the past few days weighed on long-term government bonds. Rates fell on Wednesday after the election, but with stocks rallying and economic data consistently strong they may not hold. The odds of a December rate hike climbed on Wednesday.

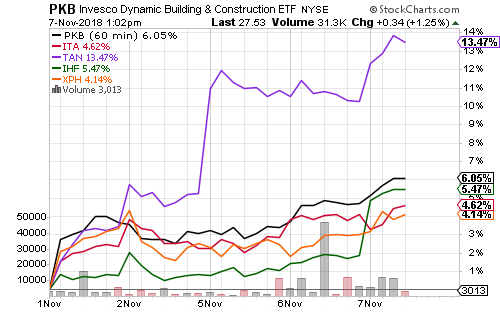

Solar stocks popped double digits as the outlook for subsidies rises with Democrats in control of the House. A potential infrastructure deal boosted materials and construction stocks. Potentially higher healthcare spending lifted healthcare providers. Although defense spending might come under some pressure, with the GOP holding the Senate there will not be major spending cuts.