The Nasdaq was lifted by Apple (AAPL), Qualcomm (QCOM), Advanced Micro Devices (AMD) and Intel (INTC) over the past week.

The financial sector rallied sharply in September and October before experiencing a pullback over the past week as markets priced in an almost certain December rate hike.

Long-term interest rates fell over the past week. The Federal Reserve only controls short-term interest rates. There’s no sign of a sustained breakout in long-term rates. The 10-year Treasury yield is near a 3-year high, but remains in a long-term downtrend. Low-duration funds have continued to perform well while corporate bonds have benefited from stable long-term rates.

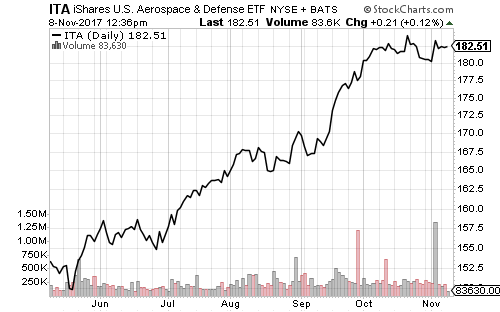

Weakness in transports has weighed on the industrial sector, while the aerospace & defense subsector has traded sideways. President Trump’s visit to Asia is going smoothly and North Korea has kept itself off the front page.

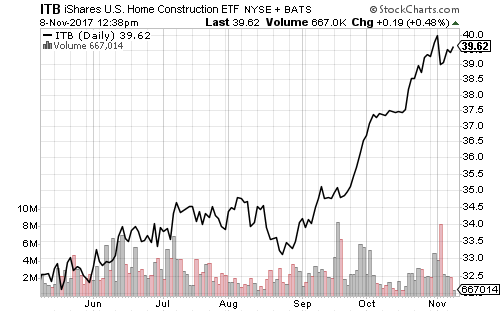

Homebuilders slipped last week in response to the House GOP tax bill proposal to cut the mortgage interest deduction from $1 million down to $500,000.

The oil market experienced higher volatility this week after Saudi Arabia’s corruption. West Texas Intermediate crude oil climbed above $57 for the first time since July 2015. The spike faded on Wednesday after U.S. production hit a new all-time high, reversing a very brief plunge that followed Hurricane Harvey. The next stop for the bulls is $60 a barrel, while the bears want to see crude back below $55.

Energy equities followed crude higher to levels last seen in July 2015. The next upside target for SPDR Energy (XLE) is $75.

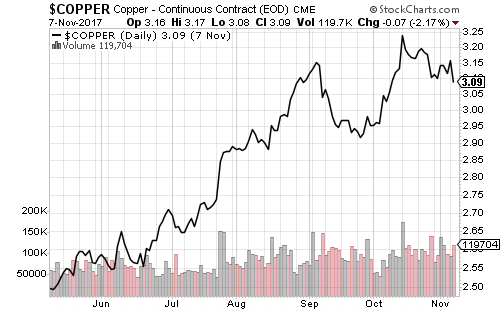

The commodities rally has remained in effect, though physical commodity and equity prices have slowed the ascent. Chinese inflation and loan data for October will be out later this week. Economists expect both will slow. Rising interest rates will weigh on the property market moving forward. New home prices in major cities are already showing signs of topping. Real estate drives Chinese GDP growth, and in turn demand for many industrial commodities such as copper.

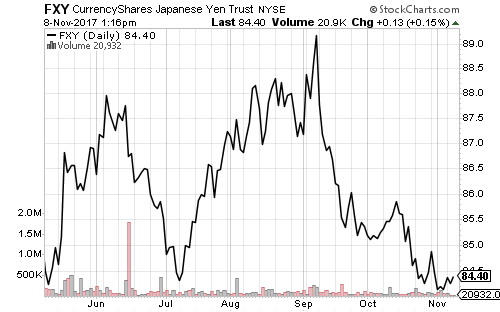

The U.S. Dollar Index extended its rally last week, despite rising interest rates and a small rally in the Japanese yen. Weakness in the euro underpinned U.S. dollar strength.

The Canadian and Australian dollars both indicate short-term tops.

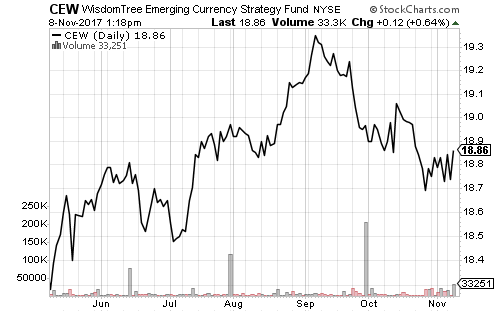

Emerging markets are also tied to Chinese demand and show a similar topping pattern. WisdomTree Emerging Currency Strategy (CEW) has a downside target of $18.40.

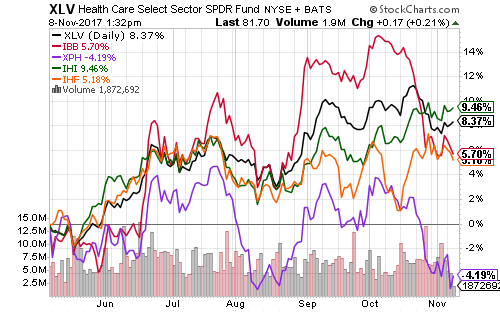

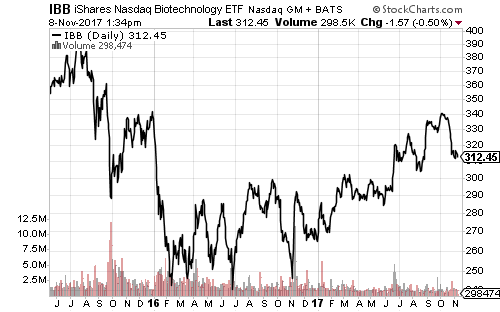

Biotech and pharma rallied this summer. Biotech has held its gains, even accounting for an earnings season dip following a couple of misses by large-cap firms. The same cannot be said of the pharma sector. The long-term chart reflects the difference.