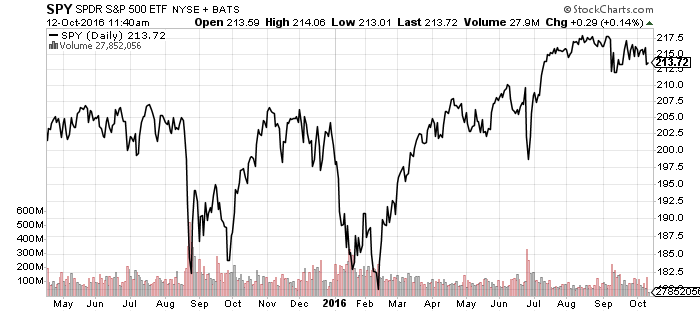

SPDR S&P 500 (SPY)

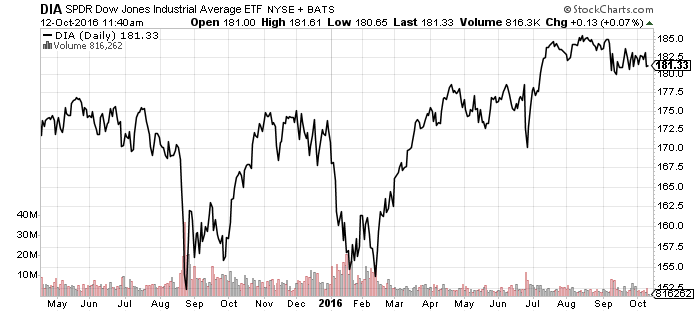

SPDR DJIA (DIA)

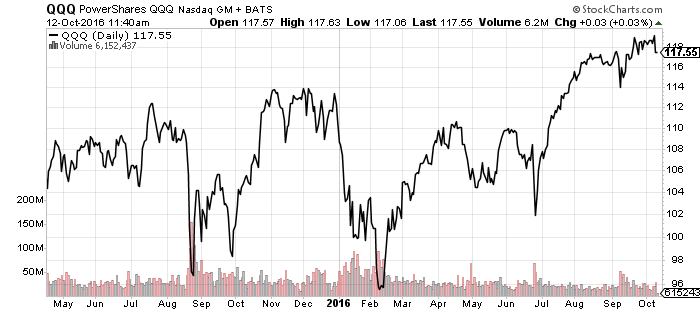

PowerShares QQQ (QQQ)

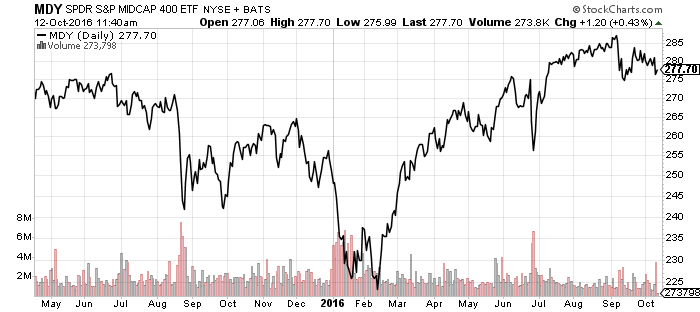

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

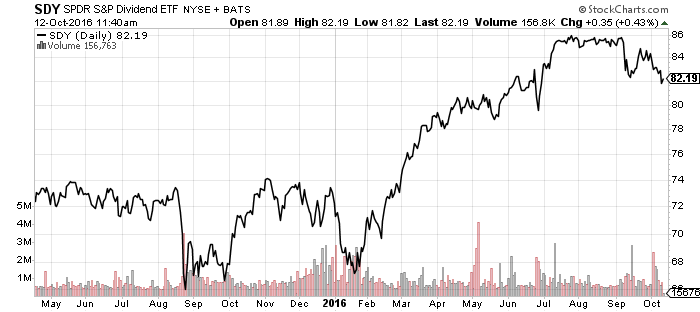

SPDR S&P Dividend (SDY)

Equities have been in a sideways pattern since July as short-term interest rates price in an interest rate increase. The odds now exceed 70 percent and, while this doesn’t guarantee a December hike, the market is giving the Fed the green light.

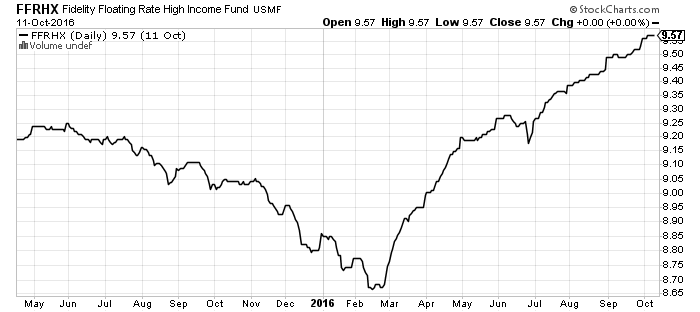

Fidelity Floating Rate High Income (FFRHX)

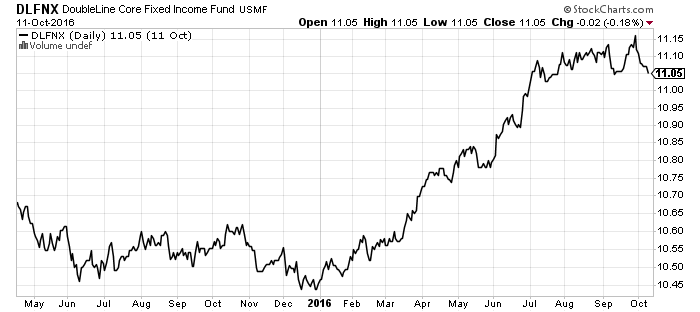

DoubleLine Core Fixed Income (DLFNX)

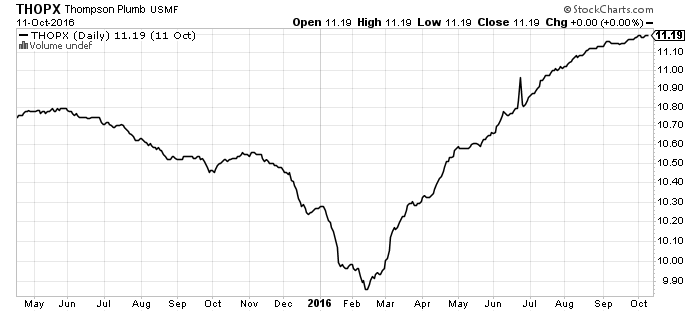

Thompson Bond (THOPX)

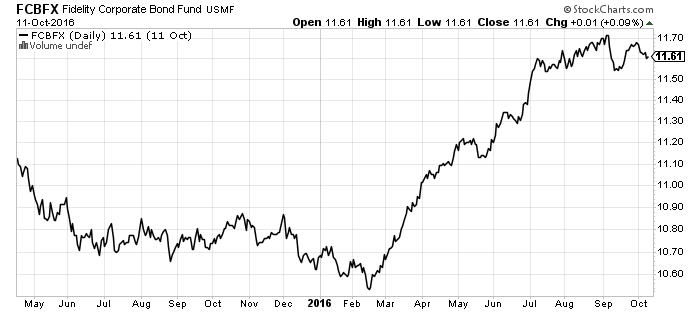

Fidelity Corporate Bond (FCBFX)

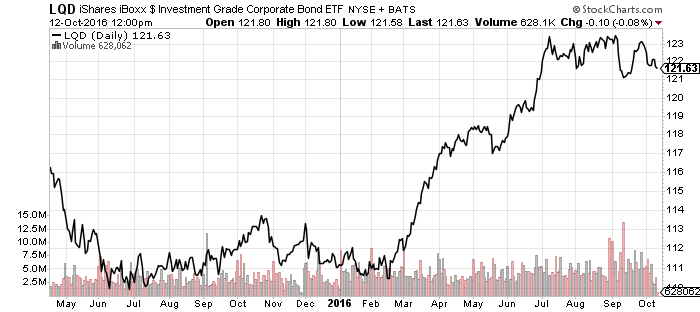

iShares iBoxx Investment Grade Bond (LQD)

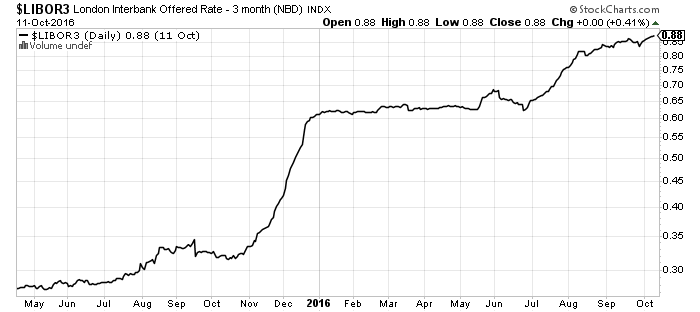

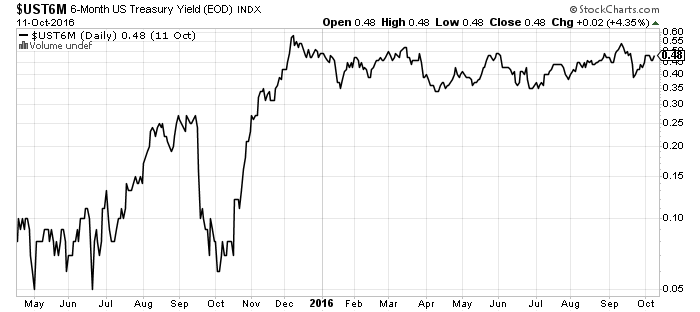

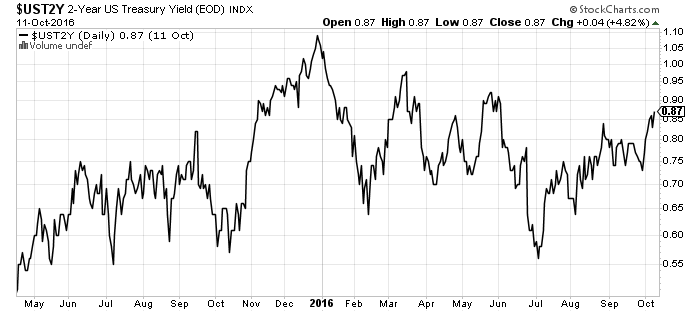

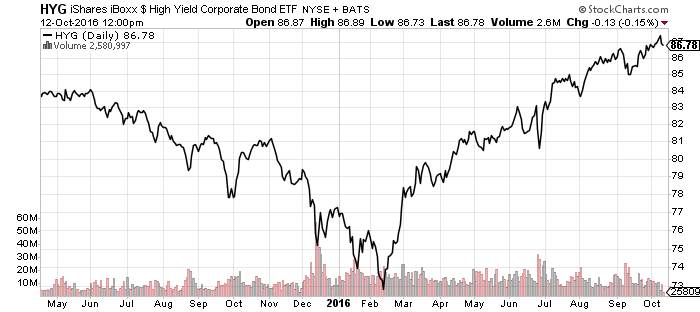

Rising interest rates weighed on investment-grade and high-yield funds over the past week, but floating rate funds pushed higher as the prospects of rising payouts increased. The 3-Month LIBOR, the benchmark for many variable-rate loans, hit 0.88 percent, while the 2-year Treasury yield reached 0.87 percent, nearly 60 percent higher than the yield at the start of July.

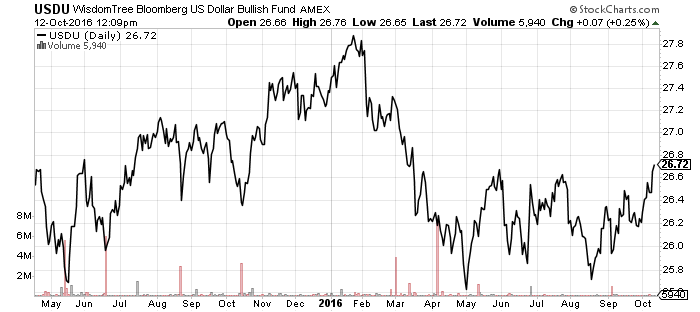

WisdomTree US Dollar Bullish (USDU)

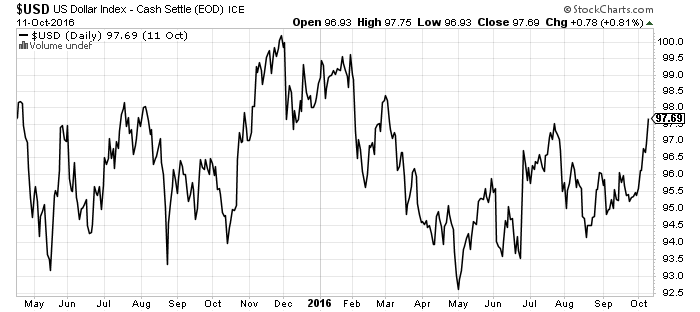

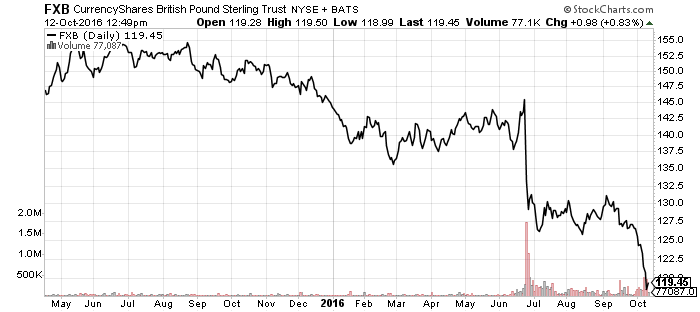

The U.S. dollar has broken out to the upside, trading at its highest level since March. A plunge in the British pound over the past week helped push the greenback through short-term resistance. The euro is the big component in U.S. dollar indexes and it is about 3 percent above its 52-week low. Trouble at Deutsche Bank (DB), the slide in the pound, and an upcoming Constitutional reform vote in Italy are all weighing on the euro, but it will take a break of those lows to push the dollar to a new 52-week high.

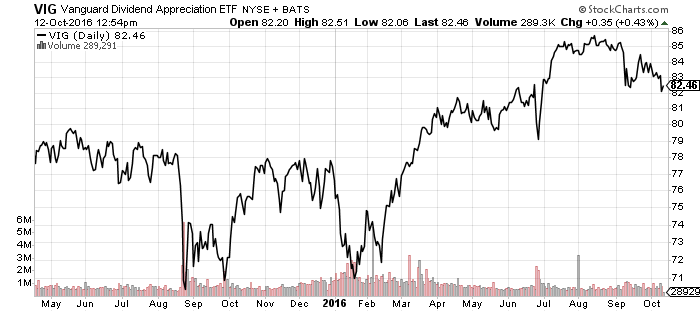

Vanguard Dividend Appreciation (VIG)

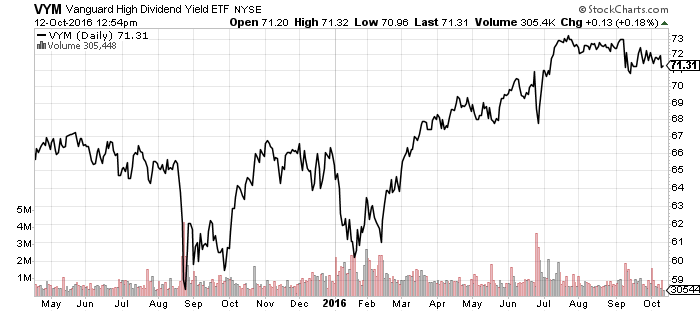

Vanguard High Dividend Yield (VYM)

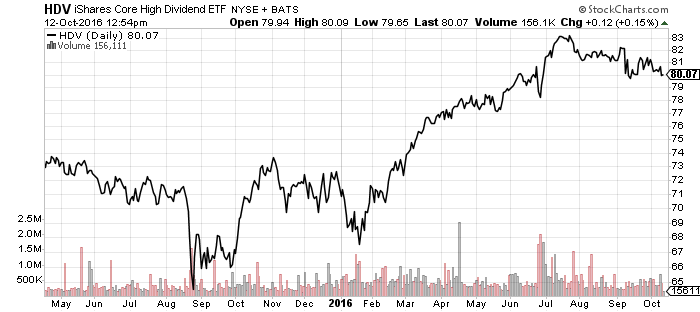

iShares Core Dividend (HDV)

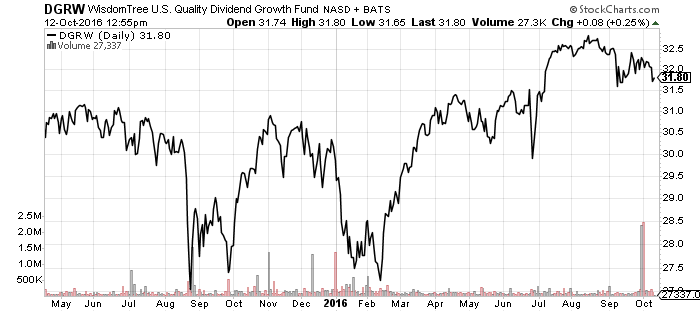

WisdomTree U.S. Quality Dividend Growth (DGRW)

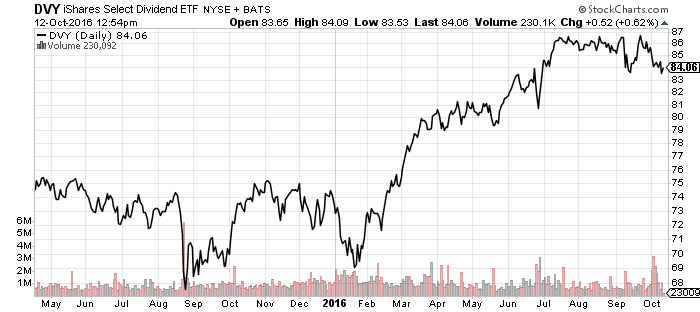

iShares Select Dividend (DVY)

Dividend funds made a short-term peak in July and August when interest rates bottomed. This move could continue until the market fully prices in rate hikes. Dividend funds with high exposure to utilities, such as DVY, are more vulnerable to secular shifts. Dividend funds with low utilities exposure, however, will remain attractive even if rates rise.

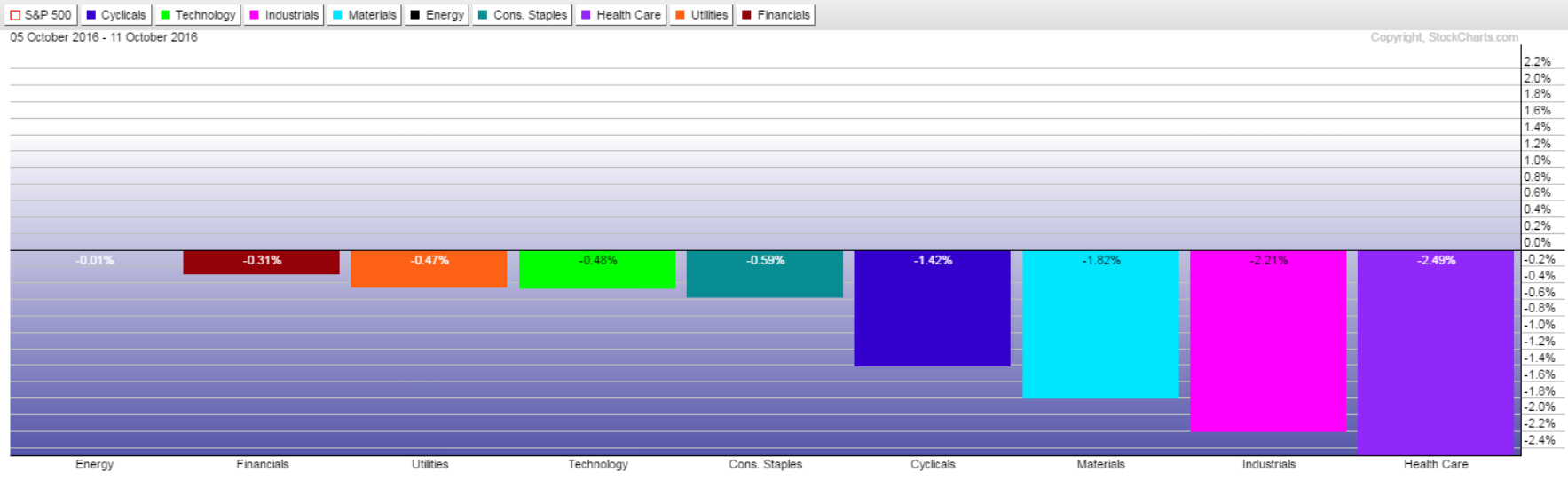

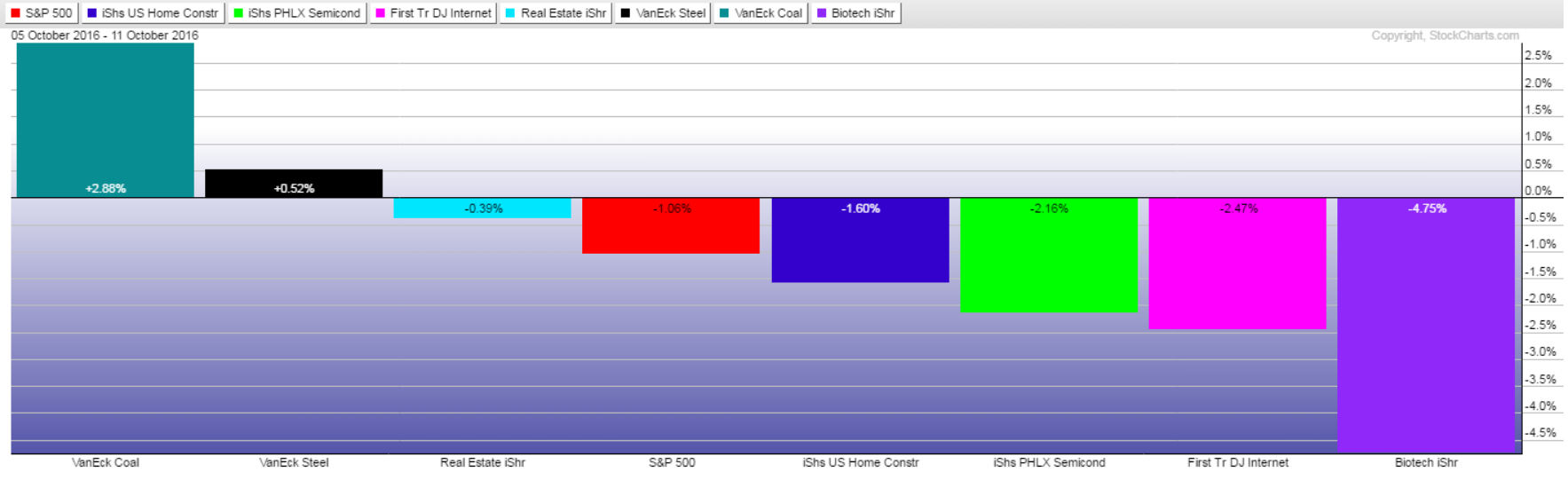

Sector Performance

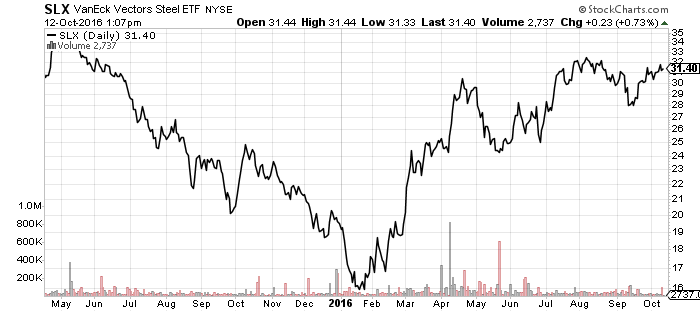

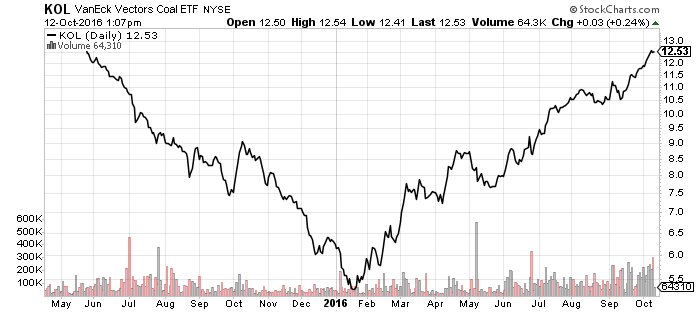

The broad market and all major S&P 500 sectors were down over the past week, though VanEck Coal (KOL) and Steel (SLX) rallied.

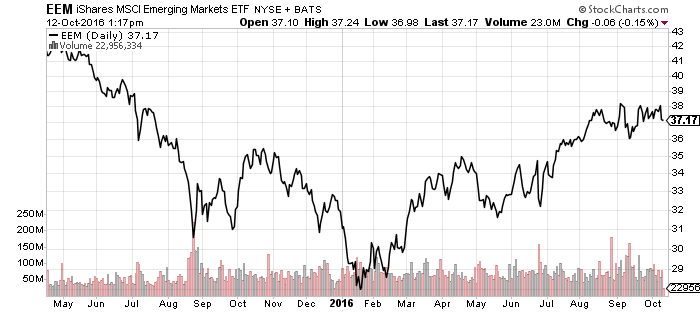

Coal has experienced brief and small corrections amid a steady rise this year. KOL is 26 percent invested in China, with 18 percent of assets in the U.S. and 17 percent are in Australia. Up until September, the rise in KOL was largely due to the rally in emerging markets.