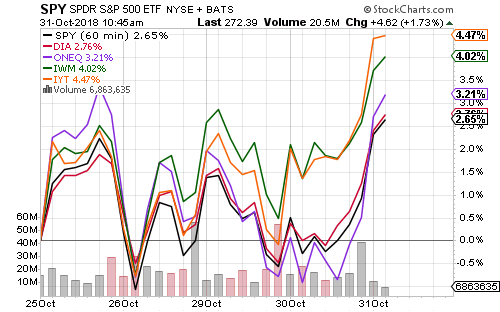

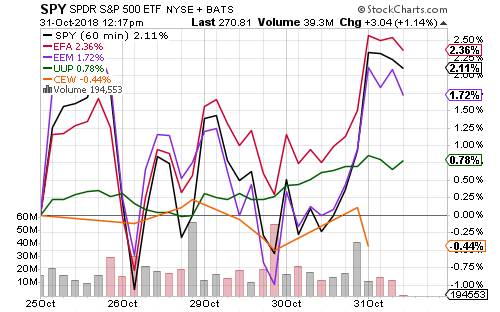

Aside from the Nasdaq, the major indexes bottomed on Friday morning. Buying accelerated into a roaring recovery on Tuesday and Wednesday.

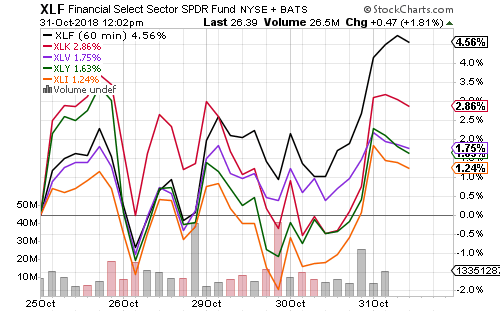

Financials outperformed the large sectors. Healthcare was strong during the decline and rebounded less significantly. Amazon’s (AMZN) subdued guidance weighed on consumer discretionary.

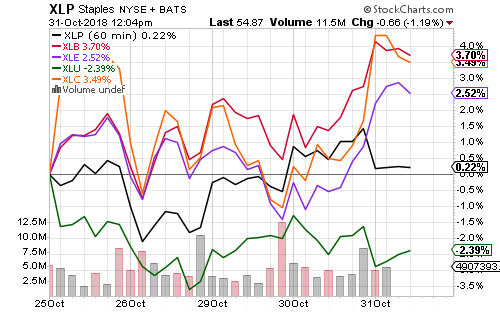

Consumer staples were solid in the past week despite trades shifting out of defensive holdings. Utilities were not as lucky as interest rates increased.

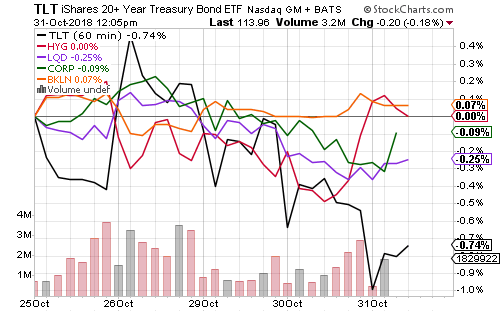

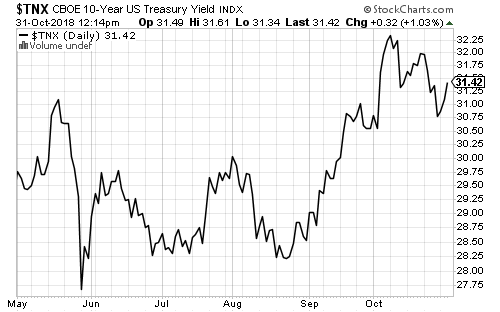

Rising interest rates also weighed on long-term bonds. High-yield and floating-rate funds were mostly flat on the week, although high-yield dipped mid-week when credit risk ticked up.

If stocks continue to rally over the next week, we could see the 10-year treasury challenge its high for the year.

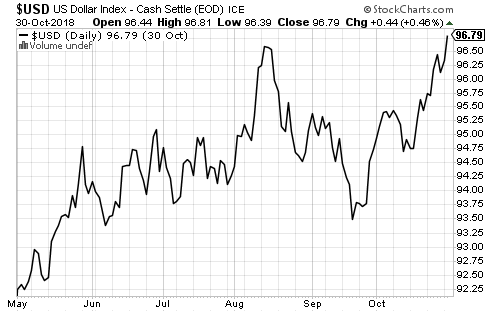

International funds rallied with the U.S. market. The U.S. dollar unexpectedly rose versus developed and emerging market currencies. Normally the U.S. dollar declines when global asset prices recover. The dollar should come down in the next week if international stocks continue recovering as quickly as U.S. shares.

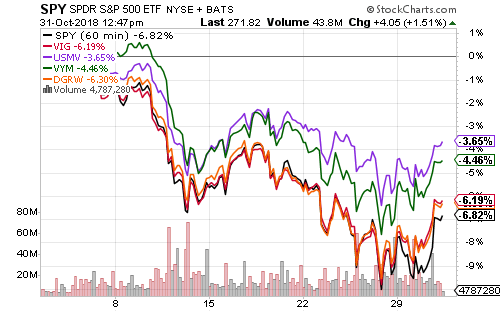

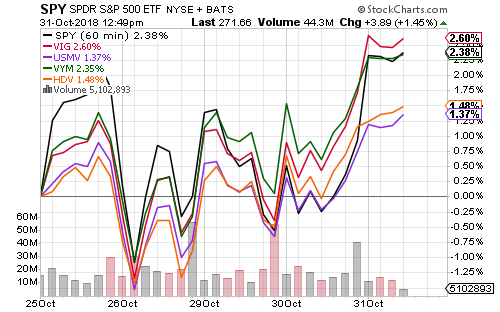

Dividend funds have outperformed the stock market over the past month and they’ve generally rebounded with the market in the past week. The more defensive funds outperformed, as did the low volatility strategy of iShares Edge MSCI Minimum Volatility USA (USMV). Growth-oriented funds such as Vanguard Dividend Appreciation (VIG) saw smaller outperformance.

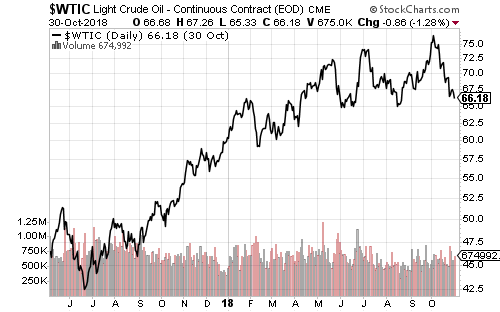

Crude oil declined in October. The $65 level could become a battle line for bulls and bears in November. Inflation expectations have held steady in October. As the chart below shows, crude oil advanced rapidly in the latter half of 2017. The year-on-year increase in energy prices will start collapsing in November if crude oil doesn’t rally back above $70.

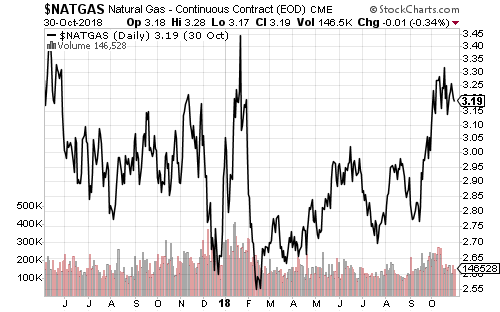

Natural gas has remained below $4 for years, but it is showing signs of life. Domestic economic forces are more important for natural gas than oil, and thus gas could rise even as oil declines.