The Federal Reserve raised interest rates a quarter point today, as expected. The accompanying policy statement was hawkish on rate hikes in 2019.

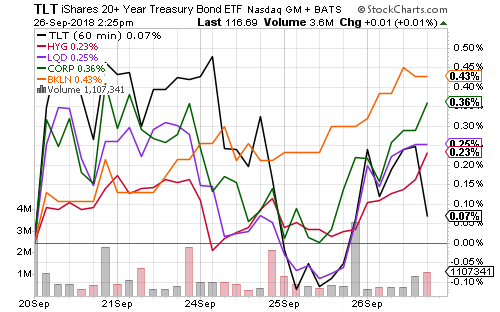

Bonds reacted favorably to the Fed’s statement, except for long-term U.S. treasuries. iShares 20+ Year Treasury (TLT) slumped as traders digested the news.

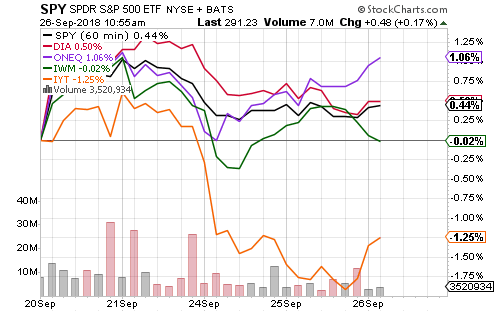

The Nasdaq was the best performing index over the past week. Transportations stocks consolidated after a strong multi-week rally.

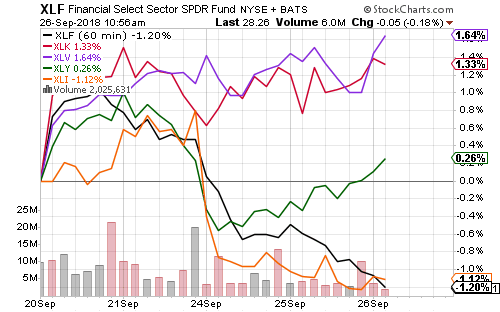

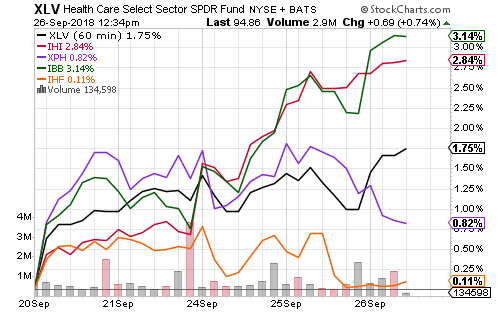

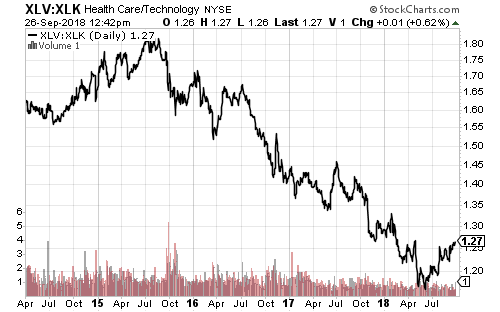

Healthcare and technology led the week’s sector performance. Industrial and financials trailed after outperforming last week. Energy also performed well following crude oil’s rally past $72 a barrel.

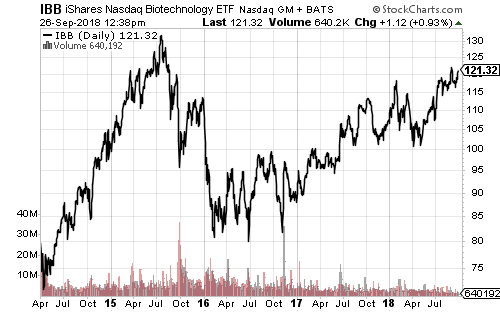

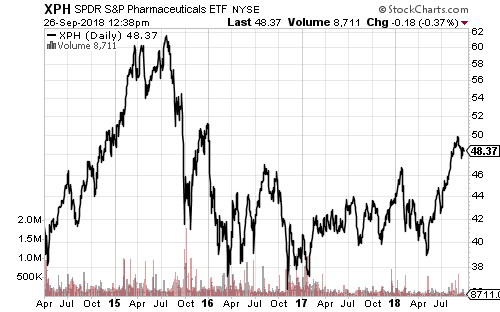

Large-cap biotechnology and pharmaceuticals remain below their 2015 highs, but they’ve stopped dragging on healthcare performance. The sector has been outperforming technology since late spring.

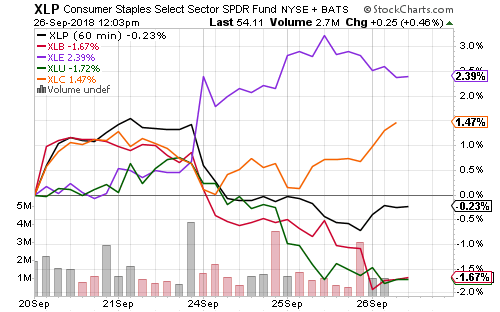

Media powered the communication services sector this week. Comcast (CMCSA) fell after winning a bid for Sky Broadcasting over the weekend.

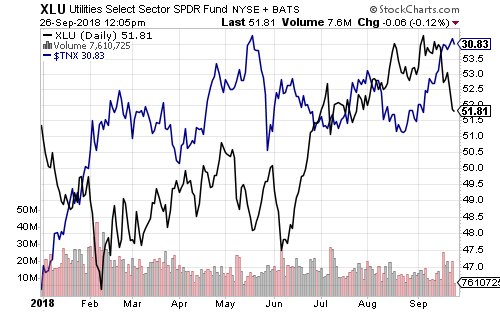

Utilities underperformed last week as long-term interest rates increased. Today’s Federal Reserve meeting will be a key factor for interest rates and utilities moving forward. Utilities typically move inverse to interest rates over the long-term, but with greater variability in the short-term. Utilities held steady as long-term rates increased in August, but only started dropping in recent weeks.

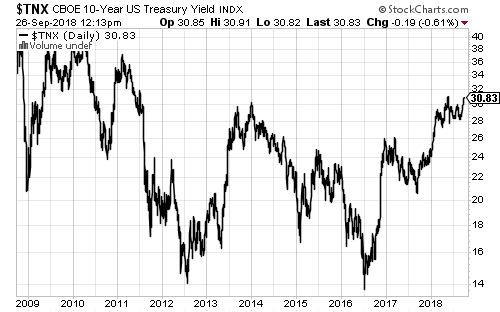

The 10-year Treasury yield came into Wednesday near 3.10 percent, slightly above its high in 20

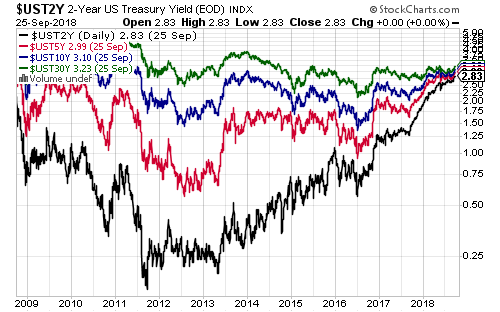

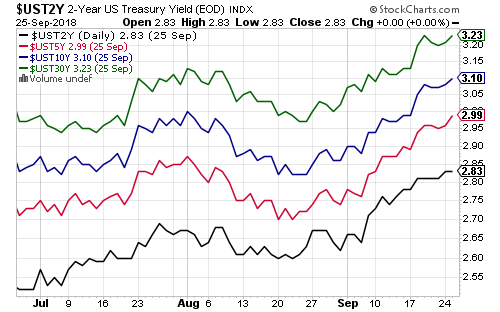

The yield curve has compressed as the Federal Reserve hikes short-term interest rates. At 2.83 percent, the 2-year Treasury yield is only 0.40 percentage points away from the 30-year Treasury.

Assuming the yield curve doesn’t invert in response to Fed rate hikes, the 10-year treasury yield should breakout to the upside in the next few months as rate are priced into the curve.

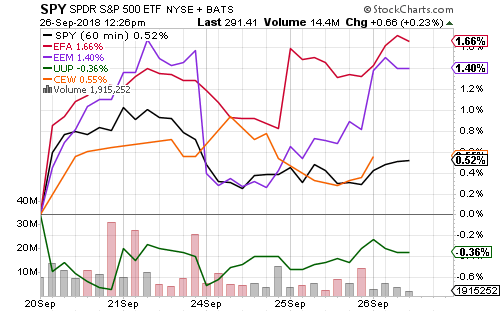

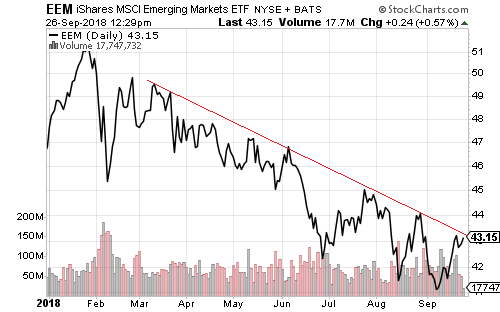

Developed and emerging markets outperformed the S&P 500 this week as the weaker U.S. dollar boosted their returns. iShares MSCI Emerging Markets (EEM) has failed to break out of a downtrend this year, though it is testing resistance this week.

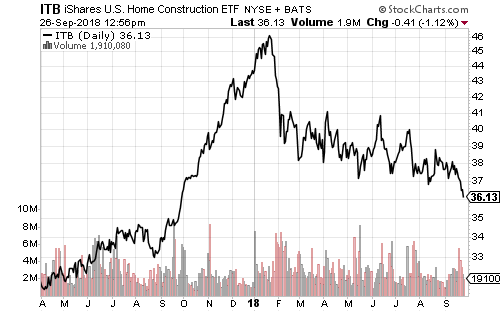

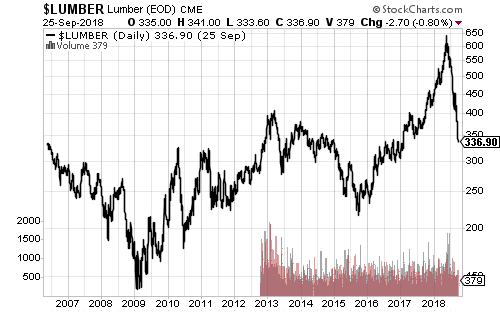

August new homes sales were in line with estimates, but homebuilders continued moving lower this week. KB Home (KBH) initially rallied in the morning following strong earnings, but it quickly reversed those gains. Lumber prices soared from a long in 2015 after hurricane damage in 2017 fueled demand for housing materials but has reversed.