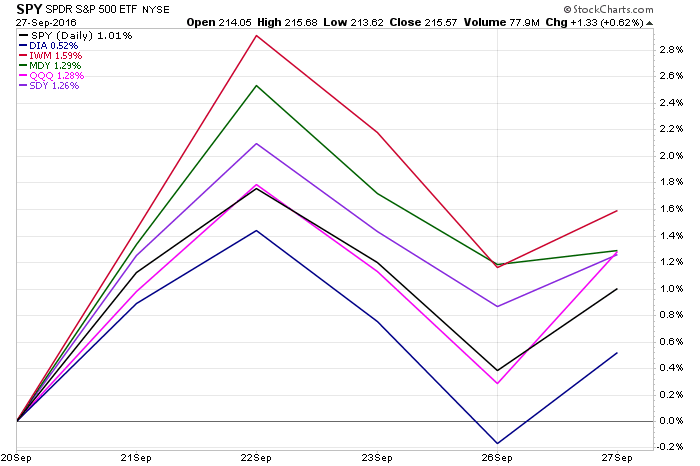

SPDR S&P 500 (SPY)

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P MidCap 400 (MDY)

iShares Russell 2000 (IWM)

The bulls have dominated the week, with only the Dow Jones Industrial Average briefly dipping into negative territory. The Russell 2000, Nasdaq and S&P 400 Midcap delivered the best returns, while the S&P 500 and Dow trailed. Dividend funds, such as SPDR S&P Dividend (SDY), outperformed the blue chip indexes as interest rates fell.

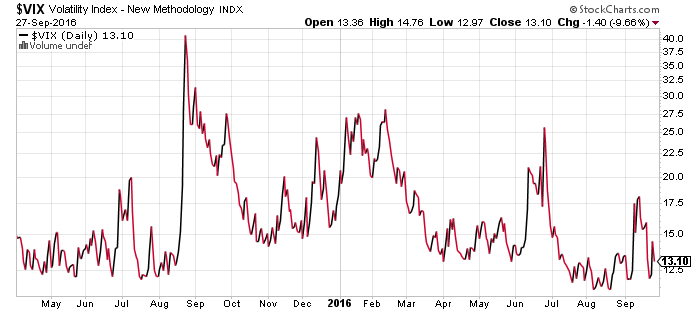

The CBOE Volatility Index has returned to the low teens and is at the ideal level for a slow and steady bull market.

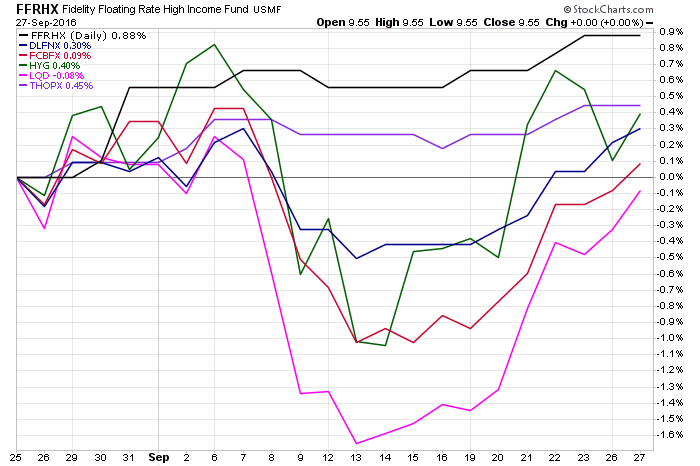

Fidelity Floating Rate High Income (FFRHX)

DoubleLine Core Fixed Income (DLFNX)

Thompson Bond (THOPX)

Fidelity Corporate Bond (FCBFX)

iShares iBoxx Investment Grade Bond (LQD)

Interest rate-sensitive bond funds rebounded over the past week following the Federal Reserve and Bank of Japan meetings. Corporate and investment-grade bonds led performance. Floating rate funds continued to outperform.

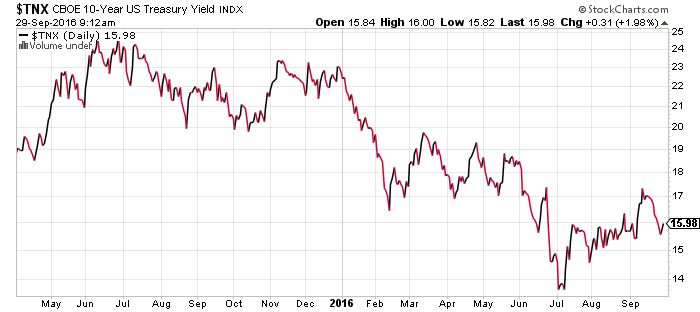

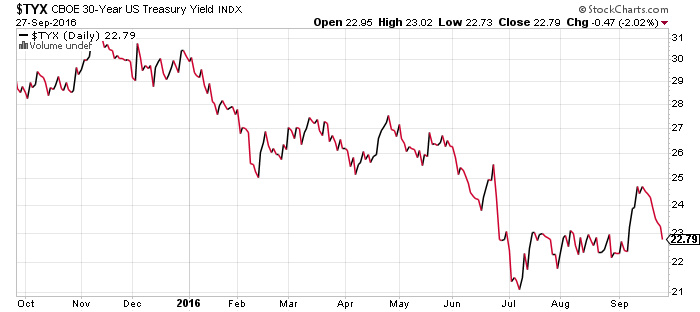

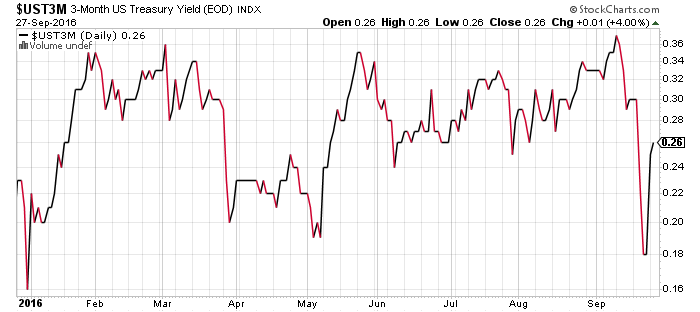

The 10-year and 30-year Treasury yields returned to early-September lows, fully reversing the month’s gains. The 3-month Treasury bill yield dropped more drastically, from 0.36 percent to 0.18 percent as rate hike expectations were pushed back to December.

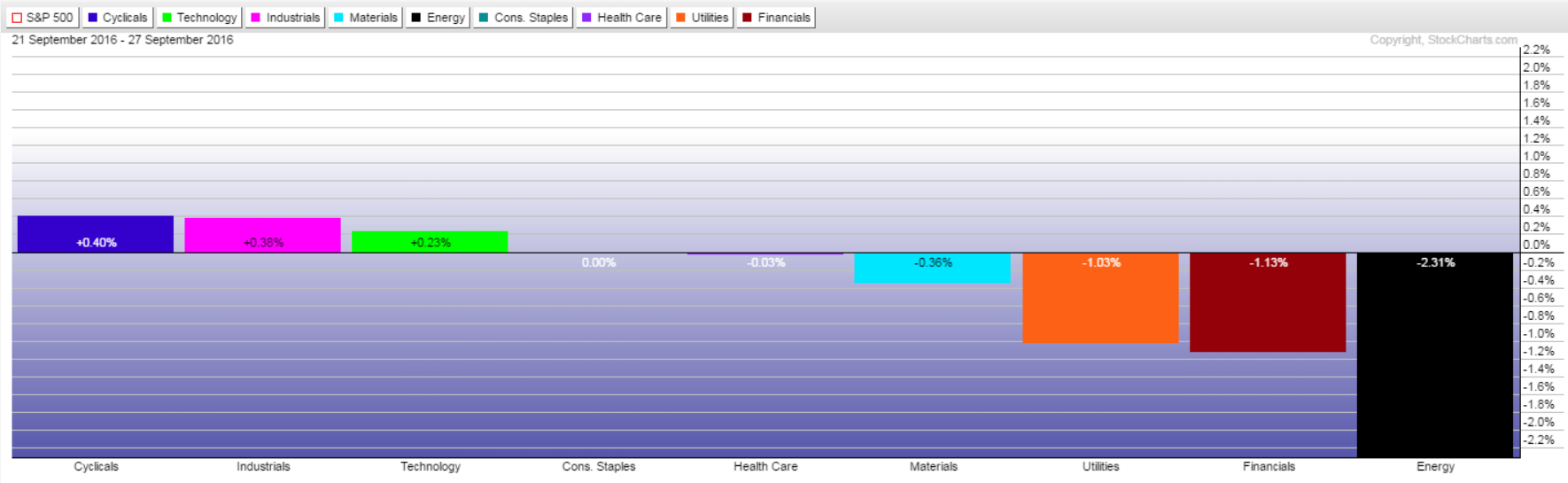

Sector Performance

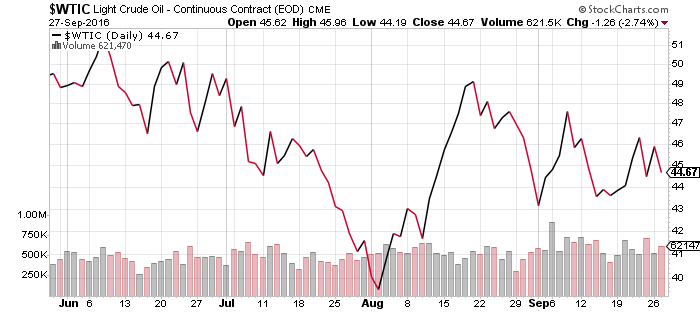

Energy followed oil prices lower last week as financials corrected with revised interest rates. Utilities also fell, though cyclicals and industrial sectors rallied to small gains.

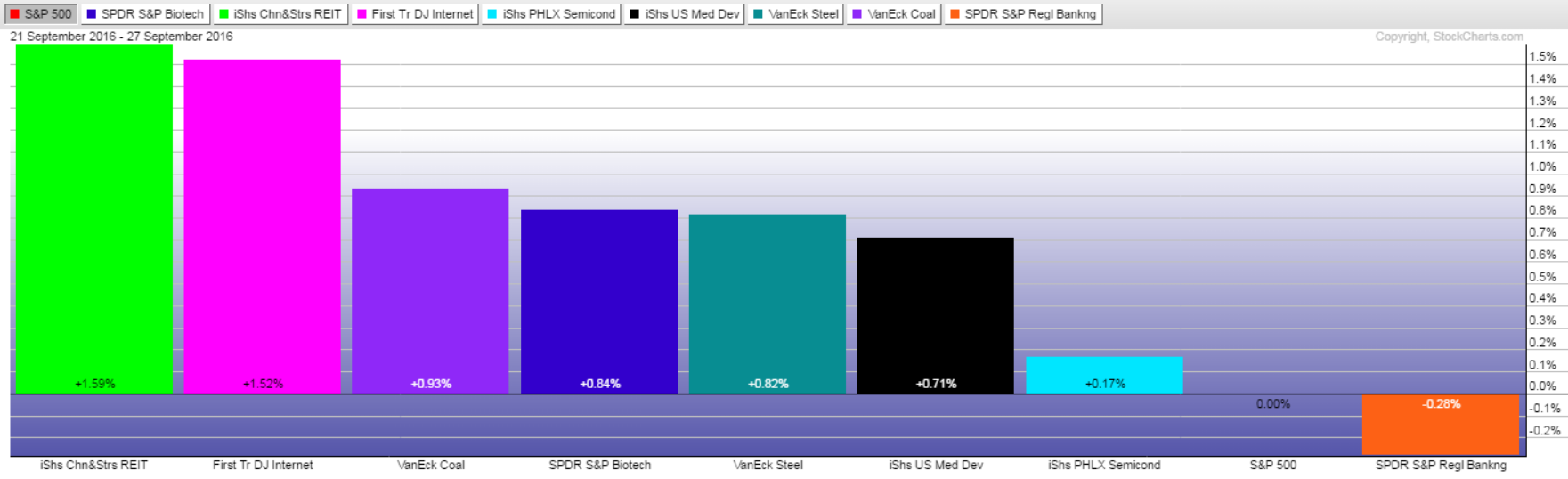

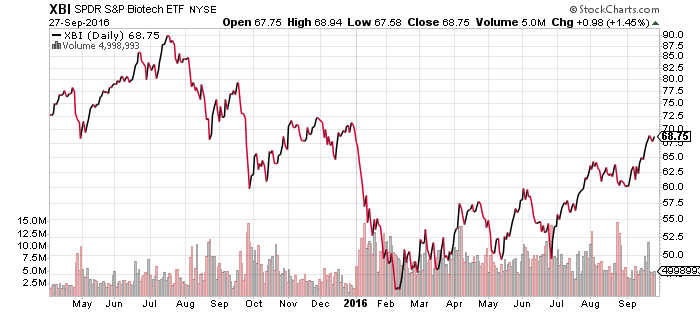

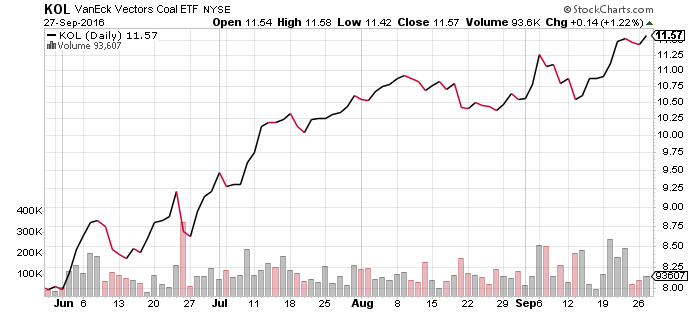

Subsectors performed far better last week. iShares Cohen & Steers Realty Majors (ICF) advanced as the REIT sector captured the upside from lower interest rates. First Trust Dow Jones Internet (FDN) rallied and VanEck Coal (KOL) added another small weekly gain. SPDR S&P Biotech (XBI) is almost back to its highs of 2016. SPDR S&P Regional Banking (KRE) substantially outperformed the overall financial sector with a small decline.

Fed Ex (FDX) propelled the transportation sector to gains last week, though the Dow Transportation Index, tracked by iShares Transports (IYT) remains stuck in its trading range.

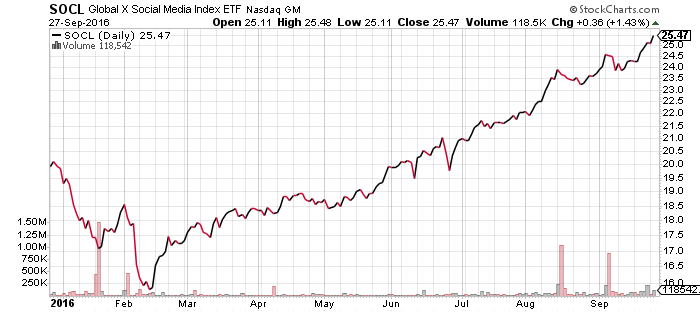

Social media shares rallied this week as Google (GOOG), Disney (DIS) and Microsoft (MSFT) were all named as potential acquirers of Twitter (TWTR) this past week. Shares of the social media company rallied from a low of $18 this month up to $23.

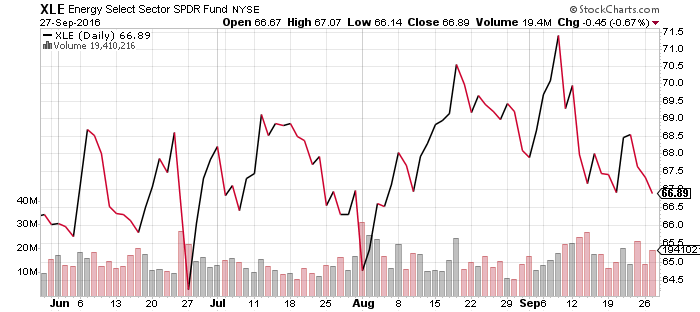

SPDR Energy (XLE)

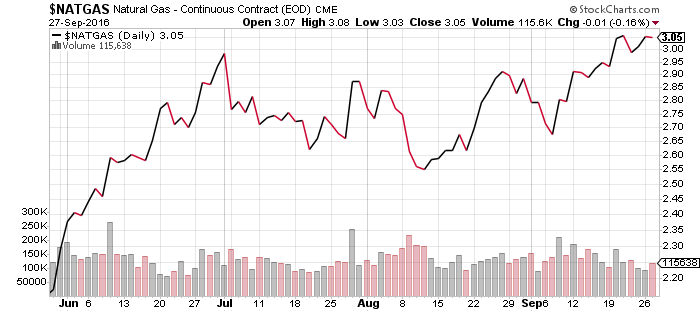

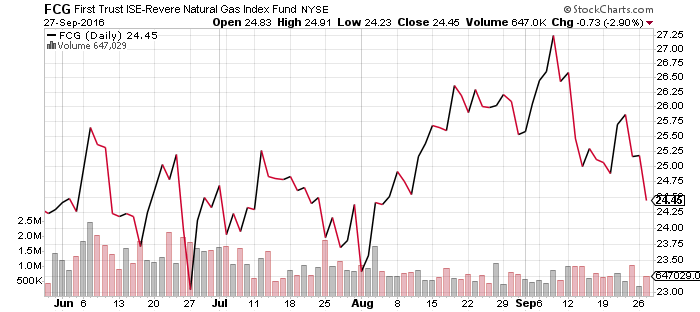

First Trust ISE-Revere Natural Gas (FCG)

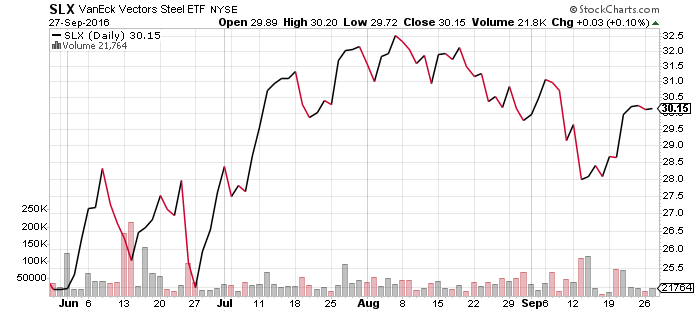

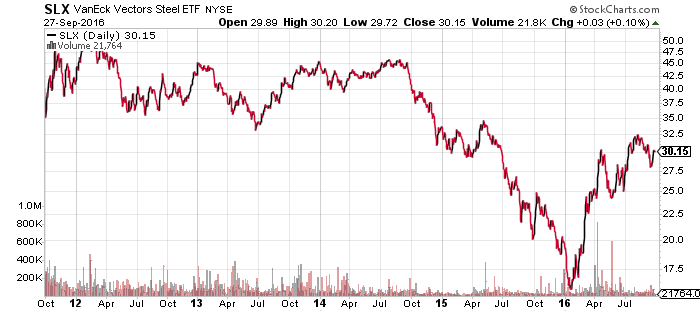

Market Vectors Steel (SLX)

Market Vectors Coal (KOL)

Oil prices have trended downward in a volatile pattern since August and is likely to remain in a bear market. OPEC is meeting this week, though any production deal is unlikely given the strained relations between Iran and Saudi Arabia.

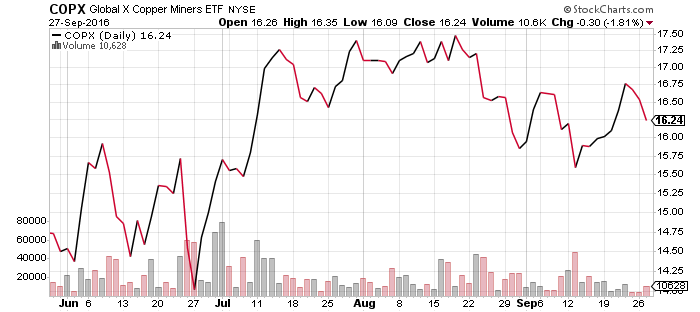

Although commodity funds enjoyed a nice bounce last week, only coal remains in a short-term uptrend. Both SLX and COPX are below August highs and the bounce could be a counter-trend rally within a larger correction. SLX is also trading an important resistance area. Shares stabilized in the low $30s in early 2015 before plunging 50 percent. If the SLX bull rally of 2016 is going to stall or end, this is where it will happen. On the flip side, a breakout here could carry SLX up to the mid-$40s.

Vanguard Dividend Appreciation (VIG)

Vanguard High Dividend Yield (VYM)

iShares Core Dividend (HDV)

WisdomTree U.S. Quality Dividend Growth (DGRW)

SPDR S&P Dividend (SDY)

iShares Select Dividend (DVY)

DVY and SDY, are still the best performing dividend funds in 2016 due to utilities exposure, while the more growth-oriented funds such as VIG and DGRW are still beating the broader S&P 500 Index. DGRW is leading three-month performance, however, ahead of HDV.