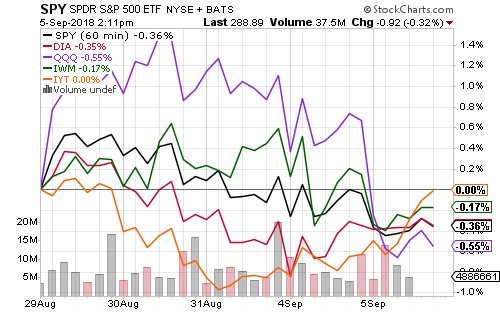

Domestic stock indexes rallied in late August, while emerging-market weakness dragged global stocks lower this week. Those with the least exposure to foreign markets, the small-cap Russell 2000 and the Dow Industrials, were the best performers into midday Wednesday. The Dow Industrials and Dow Transports are both positive for September.

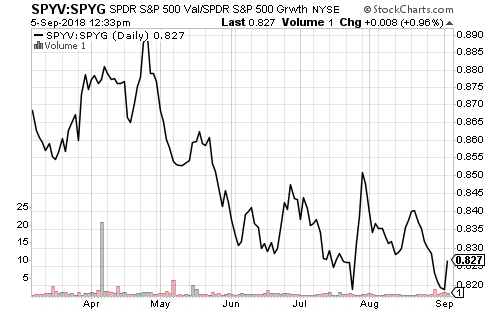

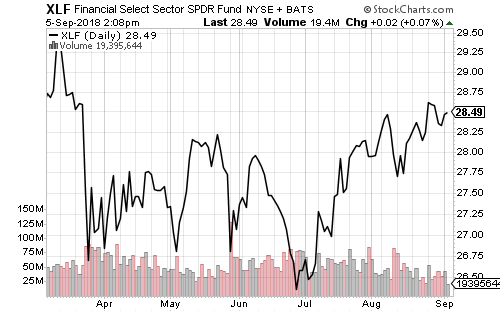

Strength in the two Dow indexes reflects value stocks’ relative outperformance. Growth stocks peaked in late July.

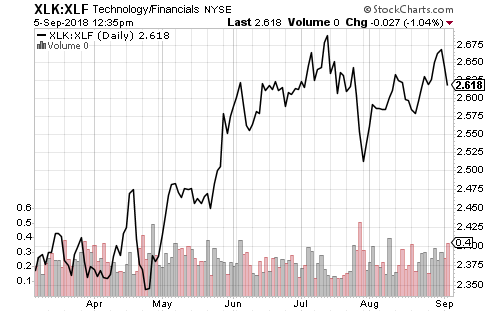

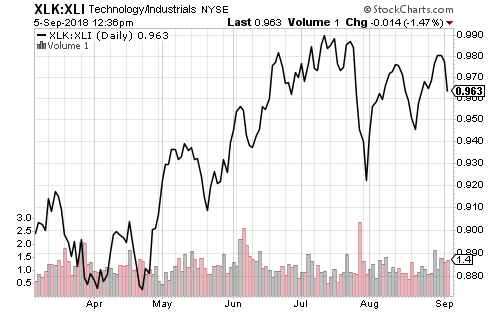

Technology and Industrials peaked versus financials in mid-July.

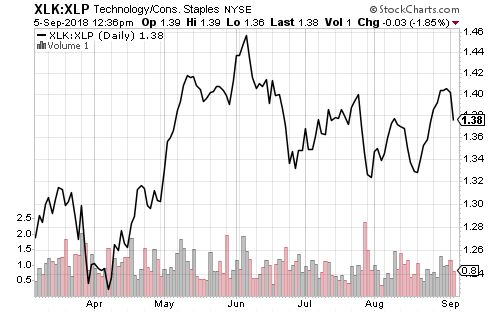

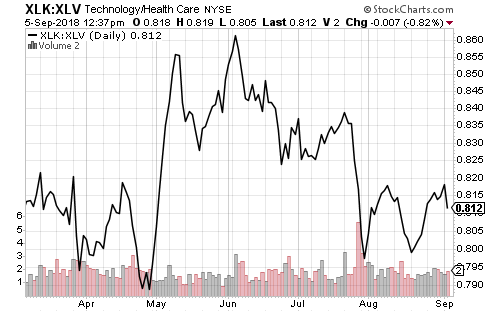

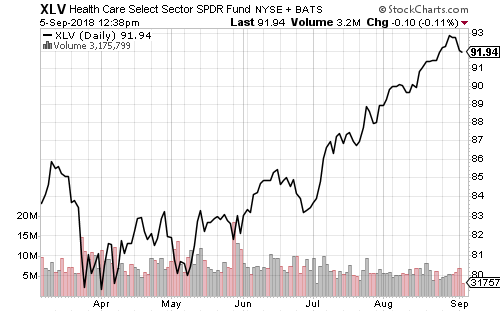

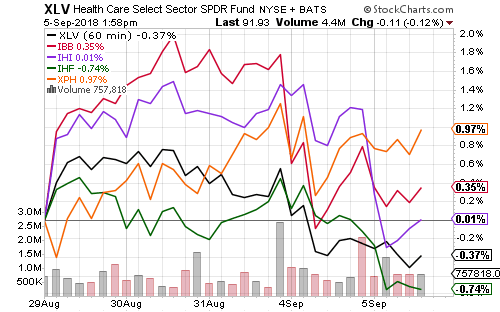

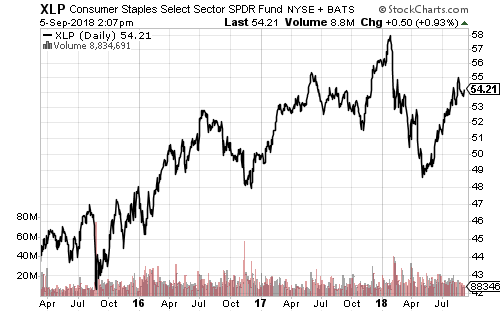

Tech peaked versus consumer staples and healthcare in June. Healthcare is closing in on market leadership.

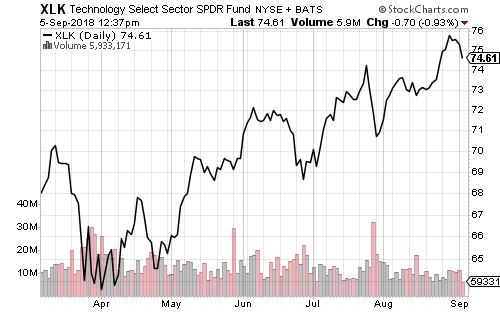

Investors holding technology stocks have enjoyed a steady, though more volatile uptrend.

Pharmaceuticals, medical devices and biotechnology have outperformed the overall healthcare sector this week.

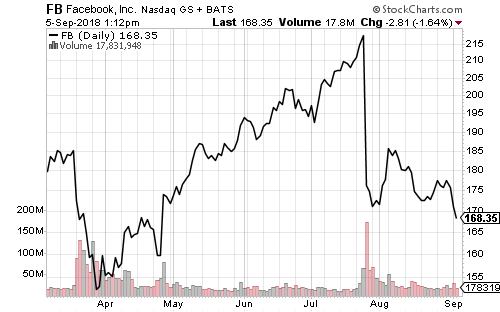

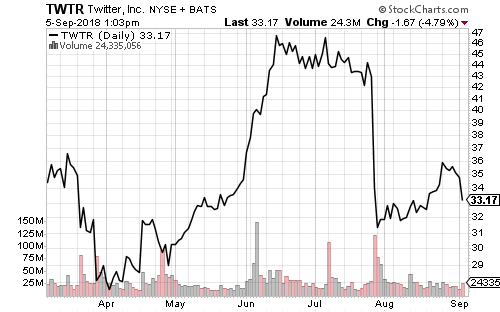

Technology has relied heavily on a few companies this year. Social media stocks such as Facebook (FB) and Twitter (TWTR) have weighed on tech as Congress grills Twitter’s CEO on censorship.

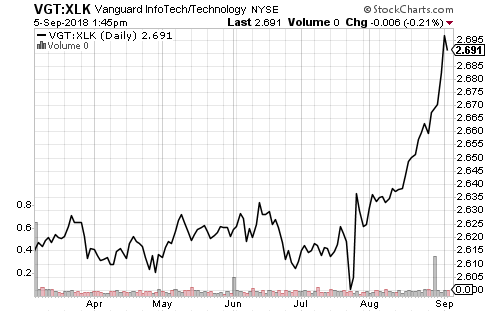

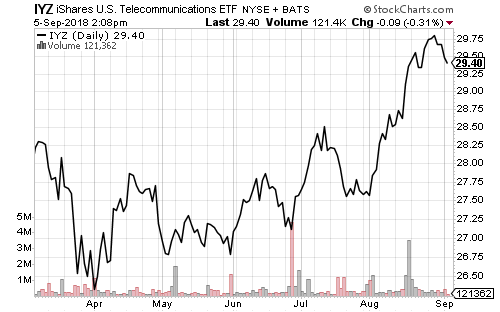

On September 28, some technology and consumer discretionary sector firms will move into the telecommunications sector. Among the tech companies moving are Google (GOOG), Facebook, Twitter and Netflix (NFLX). SPDR Technology (XLK) will transition later this month, but Vanguard has been slowly transitioning its ETFs in recent months. Since these social media stocks have recently weighed on tech, VGT has been outperforming XLK over the past three weeks.

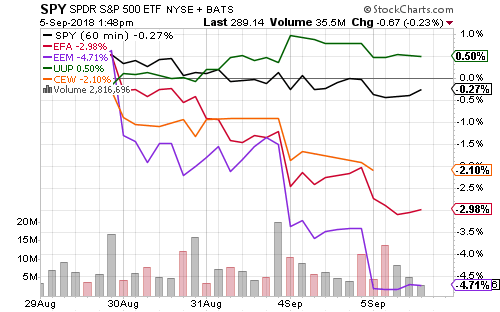

Emerging markets sank international markets this week. The U.S. dollar strengthened and the SPDR S&P 500 (SPY) outperformed both iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM) by wide margins.

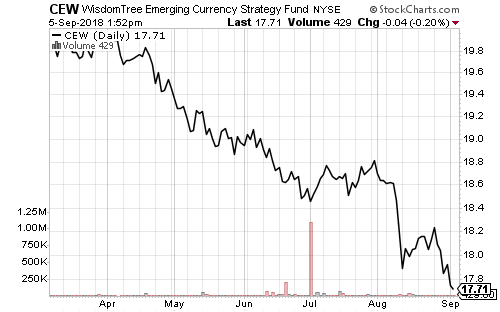

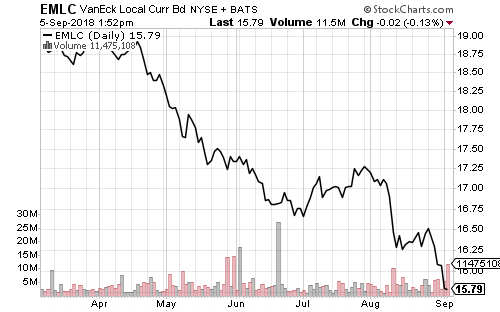

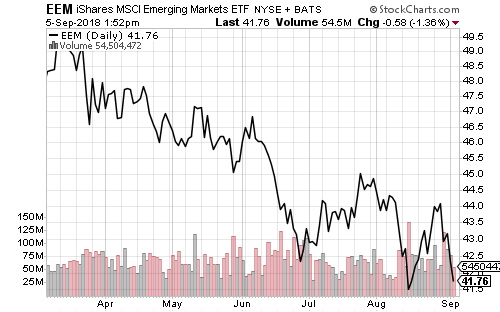

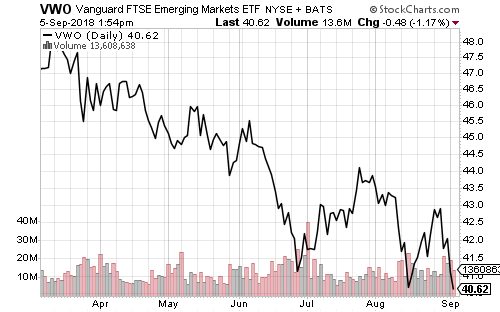

Emerging market currencies and local currency bonds fell to new 52-week lows. Only equities, as tracked by EEM, are above their 52-week low. Vanguard’s emerging market ETF (VWO) could close at a new 52-week low this week.

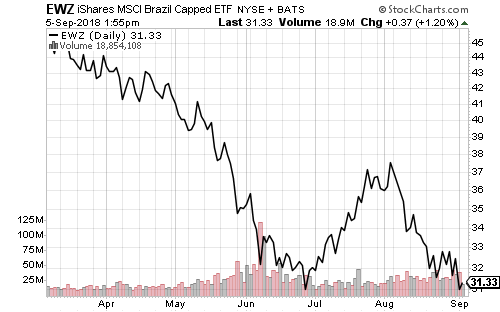

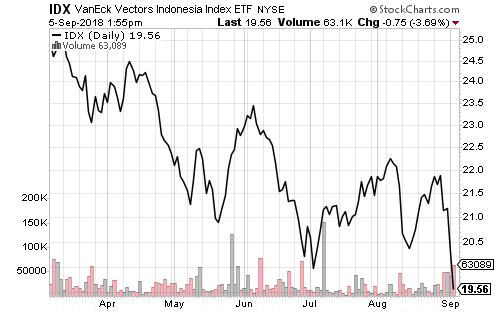

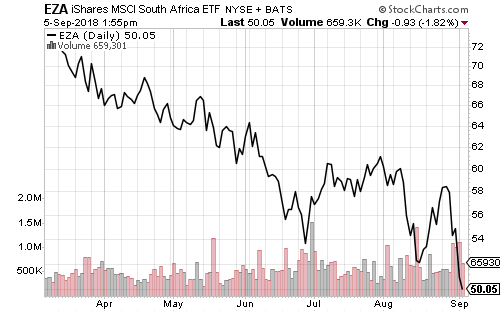

Until recently, Turkey and Argentina led the emerging market sell-off. These are small countries with low weighting in various emerging market indexes. South Africa, Indonesia and Brazil are among the countries starting to decline, and their weightings are more substantial. They combine for more than 12 percent of EEM.

Commodities have been declining with emerging markets. Many emerging markets are resource exporters. A longer-term look at PowerShares DB Commodity (DBC) shows it could have much farther to fall. Gold and gold miners are both performing far worse, with gold miners recently falling below its 2-year trading range.

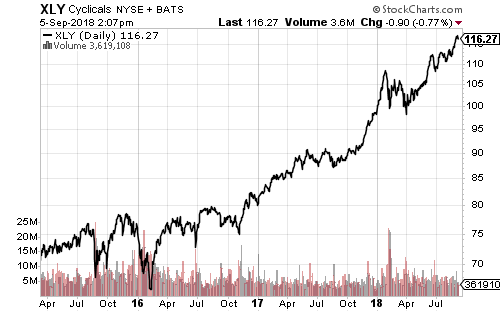

Weakness in commodities and emerging markets, plus U.S. dollar strength, is positive for domestic U.S. service sectors. Financials, telecom, consumer staples, consumer discretionary and healthcare are all rising.