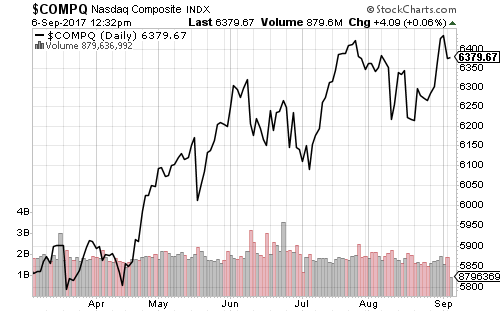

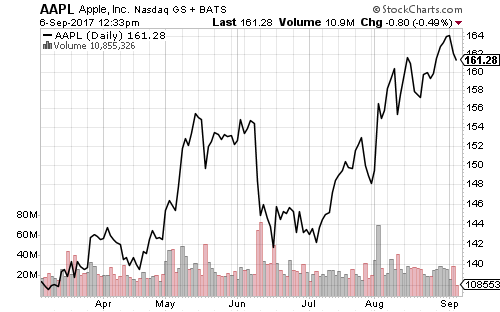

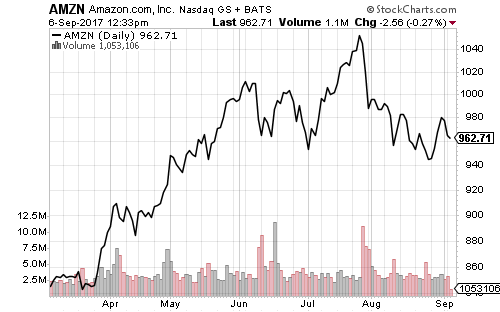

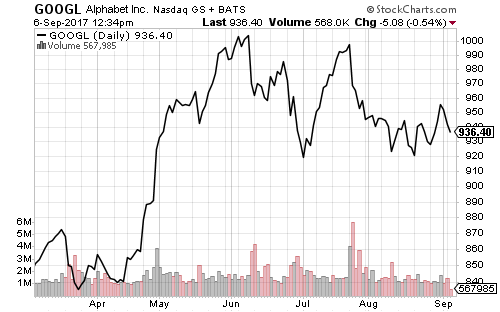

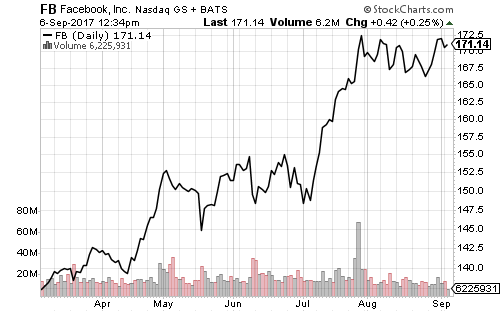

Apple (AAPL) shares pushed the Nasdaq to a new all-time high over the past week. Facebook (FB) approached its all-time high, while Google (GOOGL) and Amazon (AMZN) remained in consolidation.

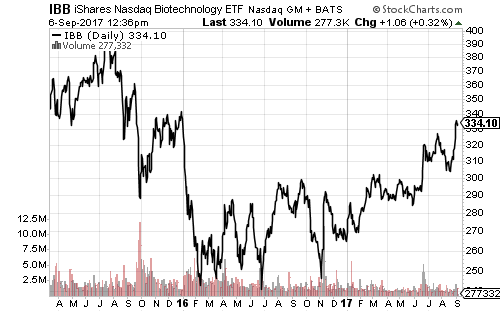

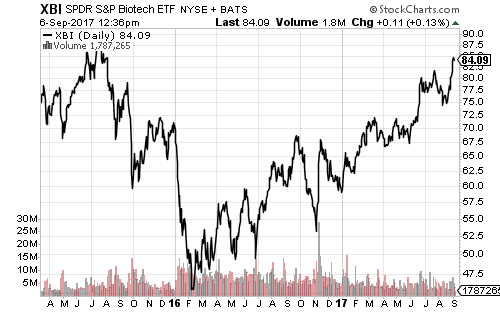

Biotechnology’s breakout held up this week. SPDR S&P Biotech (XBI) is closing in on its all-time high as small- and mid-cap funds continue to outperform. The rally also carried the broader healthcare sector to a new all-time high.

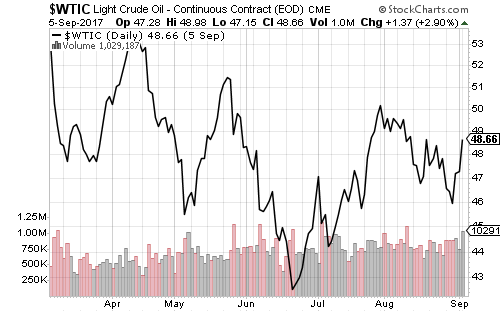

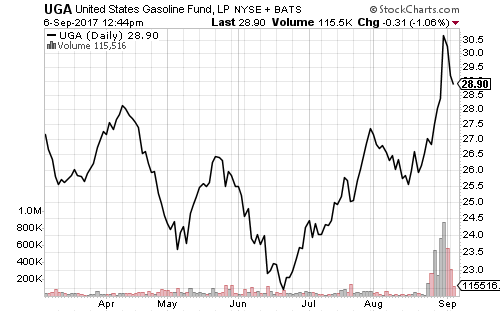

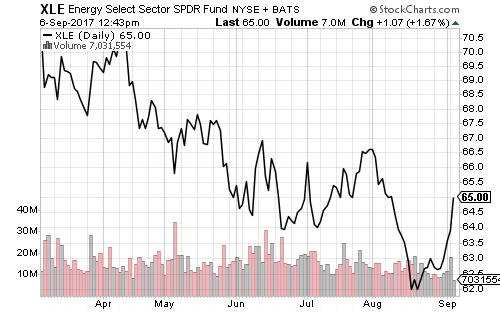

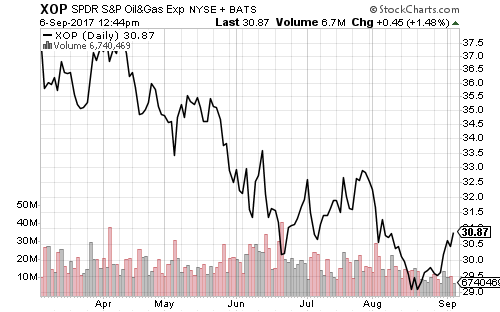

Energy volatility will continue with further intense weather over the coming week.

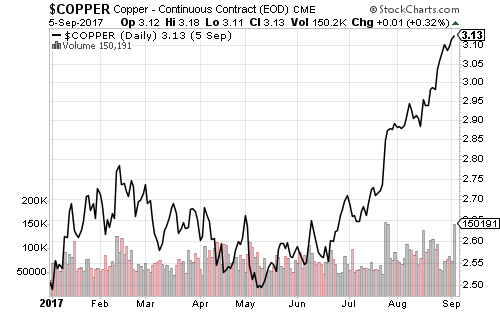

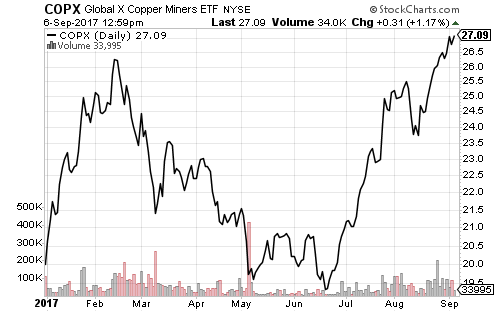

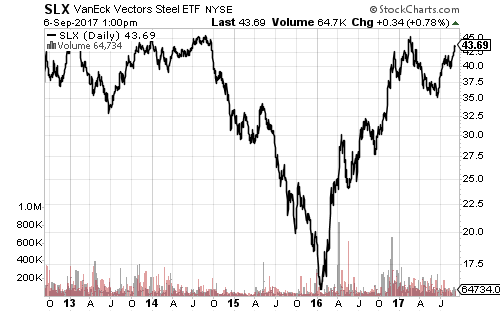

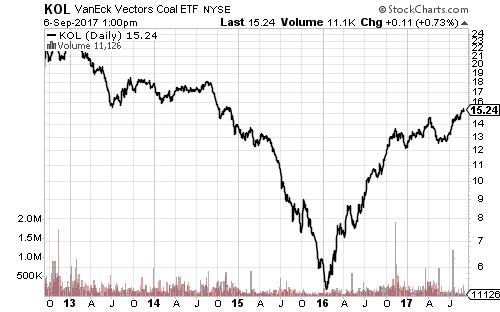

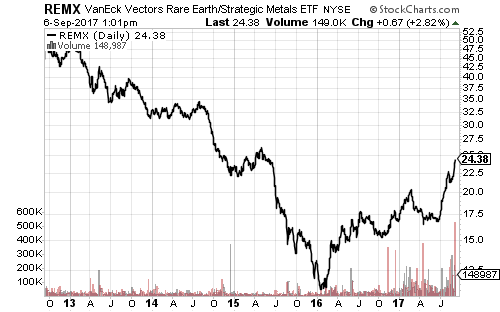

Industrial commodities and producers kept rising last week. Steel producers, copper and coal miners are back to 2014 levels. Rare earth miners also maintained their sharp rally amid speculations of a potential trade conflict between China and Japan.

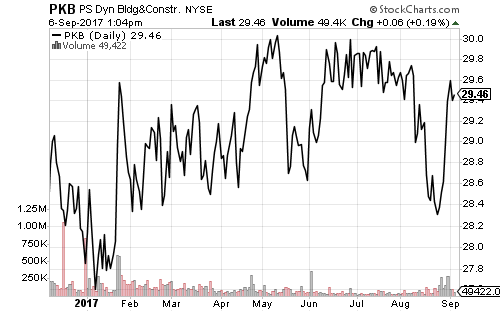

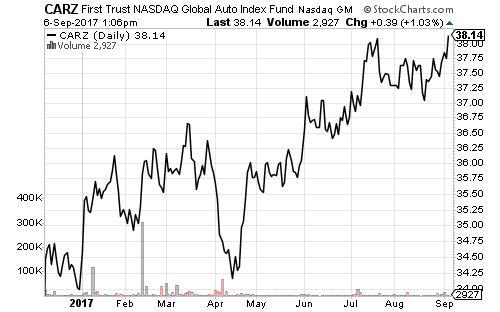

Construction companies, auto shares and materials producers also rose last week as rebuilding costs continued to mount. Hurricane Harvey is estimated to have destroyed 1 million cars and Hurricane Irma will add to that total if it makes landfall. Auto sales were on pace for 16 million-plus in 2017, but Harvey alone will probably push sales over 17 million.

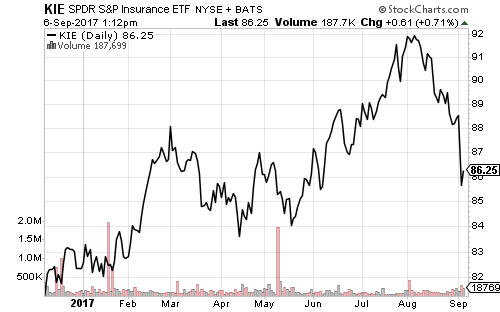

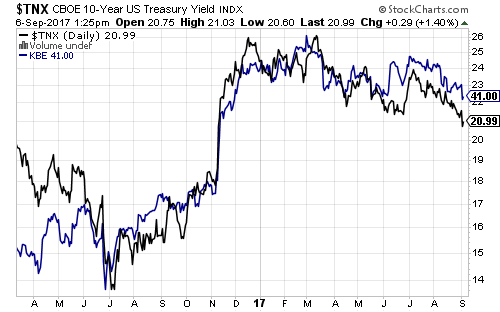

Weather-associated losses in insurance over the past week contributed to general weakness in financials.

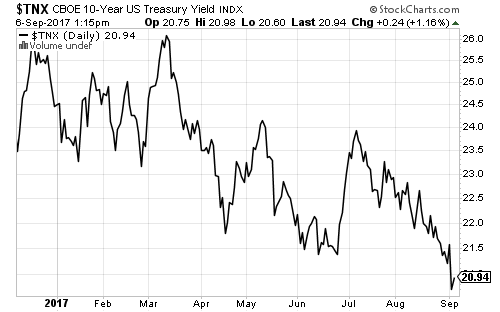

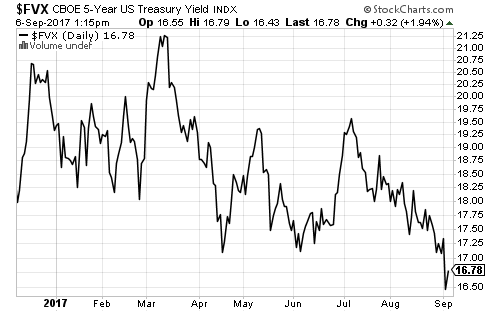

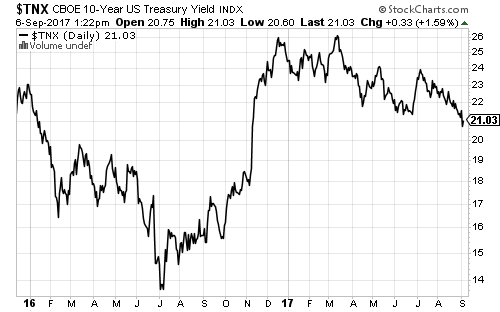

The 5- and 10-year Treasury yields fell to new 2017 lows over the past week. Rates are still up substantially from 2016 lows, but banks stocks are reacting sensitively as geopolitical concerns weigh on rates.

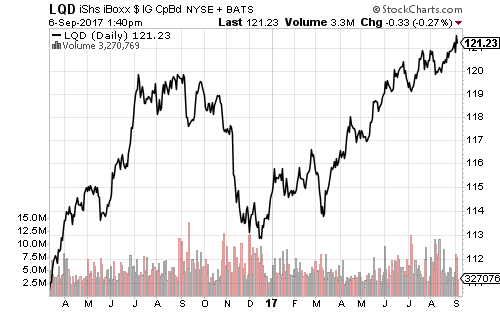

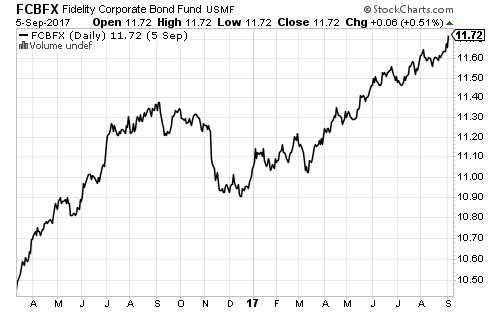

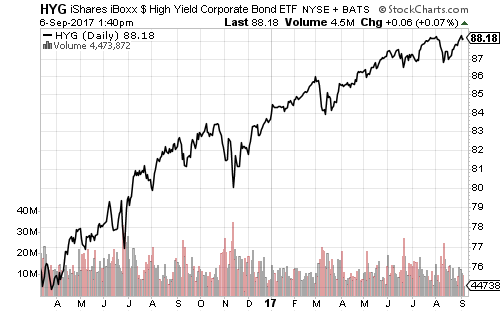

Investment-grade, corporate and high-yield bond funds all made 52-week highs in the past week.

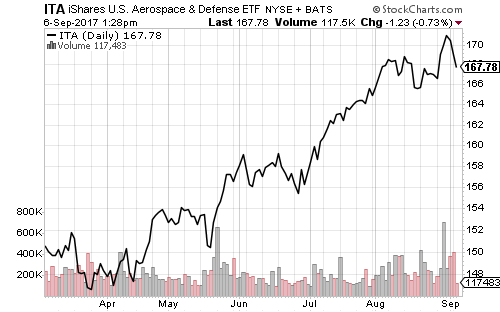

United Technologies (UTX) weighed on the defense sector after it announced a buyout of Rockwell Collins (COL). Both companies are top-10 holdings in iShares U.S. Aerospace & Defense (ITA).