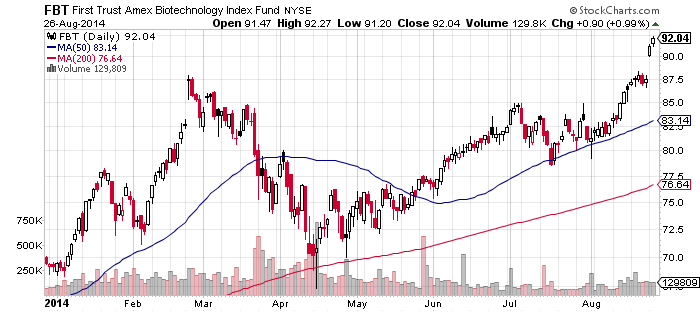

First Trust NYSE Arca Biotechnology (FBT)

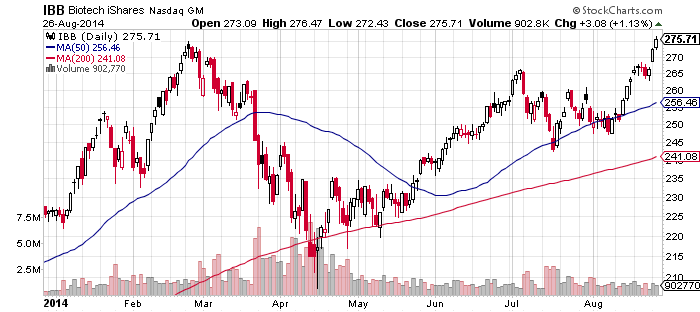

iShares Nasdaq Biotechnology (IBB)

It was questionable whether biotechnology stocks would recover from their major sell-off earlier this spring and return to market leadership. The odds of a rebound were good as long as the market stayed in a bullish trend, but many sectors give up their leadership following a major correction. Biotech has now fully recovered from its losses and is challenging again for market leadership. Leading the way is FBT, which is already one of the strongest ETFs in the market. The takeover of Intermune (ITMN) boosted FBT to a new 52-week high this week. IBB is close behind.

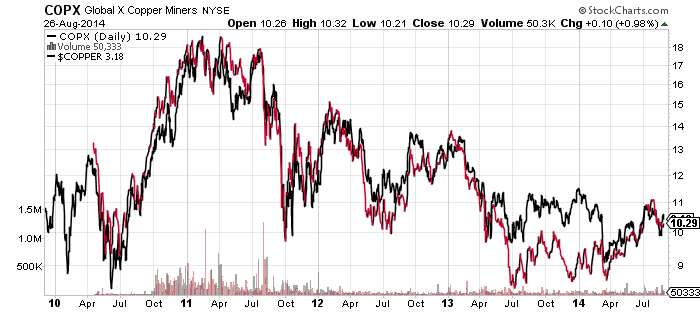

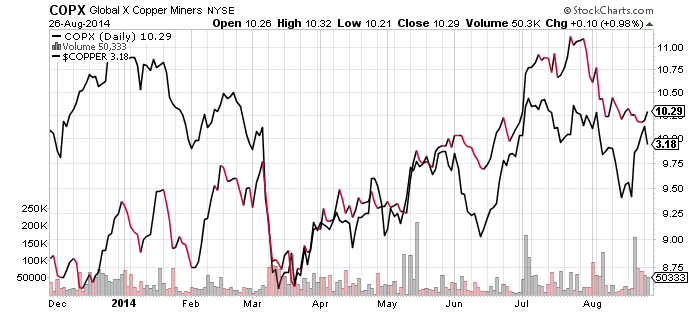

Global X Copper Miners (COPX)

COPX has tracked with copper prices since inception. Following the recent small corrective move, copper and COPX remain in an uptrend that goes back to April lows in the case of copper and to July 2013 lows in the case of COPX. Copper is starting to show some weakness though, failing to make a new high since July. Chinese lending for August is off to a slow start, so that could be weighing on the copper market.

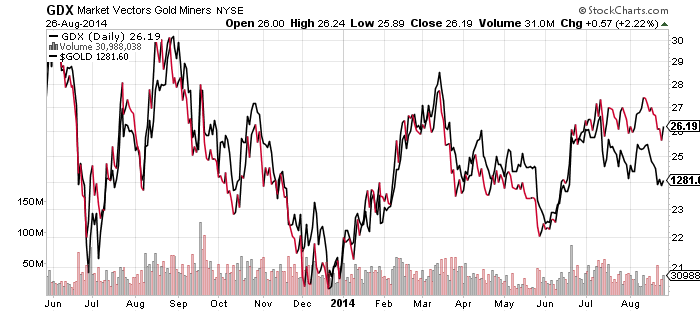

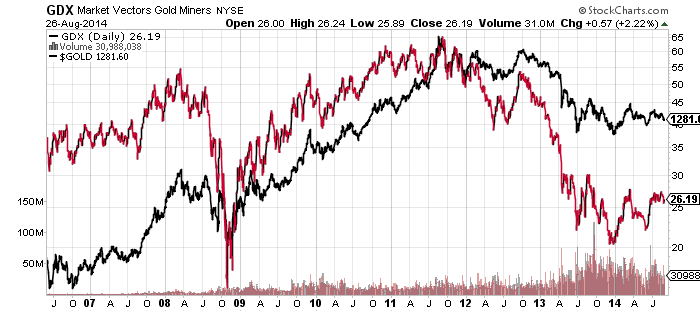

Market Vectors Gold Miners (GDX)

To contrast the chart above, which shows COPX moving in lockstep with copper, below is a look at gold miners and the price of gold. The two moved in lockstep over the past year, but a look farther back shows gold and mining shares, while being highly correlated, do not move as tightly as copper and copper mining shares. Gold and gold mining shares are in a similar position to copper though, with a series of higher lows in place.

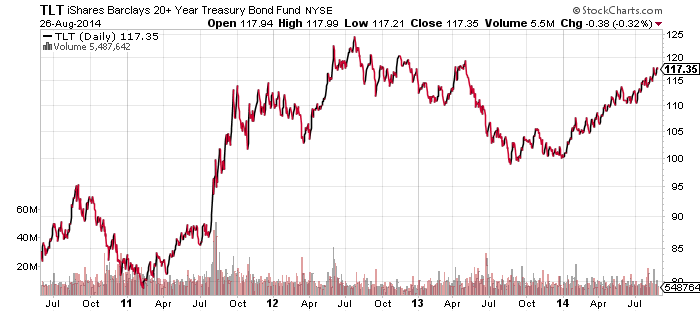

iShares Barclays 20+ Year Treasury (TLT)

Bonds have quietly staged a strong rally in 2014. TLT is up 17 percent since the start of the year (including dividends) and is looking like it might test its all-time high from the summer of 2012. What’s interesting is the stair step gain in TLT, it appears to be following a straight line ever since the Fed began its taper. With about eight more weeks to go, TLT will be a fund to keep an eye on.

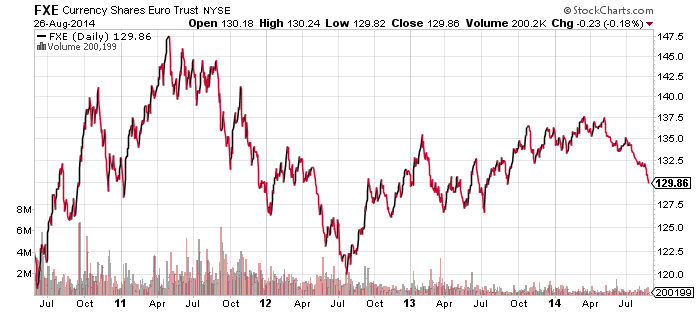

CurrencyShares Euro Trust (FXE)

One reason why TLT is rallying is that U.S. bond yields are being pulled lower by their European counterparts. German bonds have a negative yield out to three years now as more economists are beginning to believe that Europe is in a depression, not a recession. This has talk of quantitative easing heating up, something European Central Bank President Draghi has mentioned as a possibility, but with no firm commitment. The net result is a slide in the euro as traders anticipate a surprise move by the ECB.

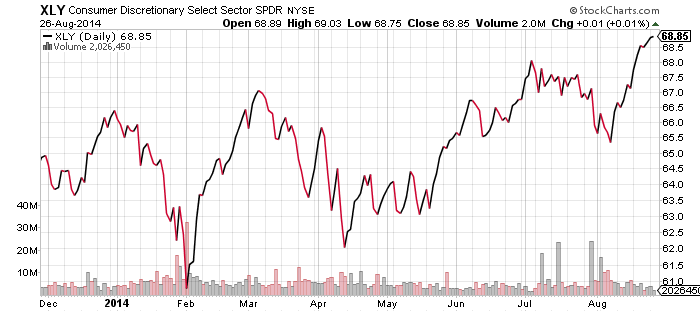

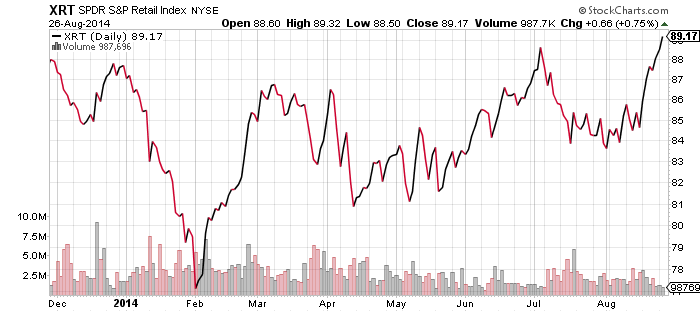

SPDR Consumer Discretionary (XLY)

XLY and XRT held their gains over the past week and pushed to new 52-week highs. This week still has a few retailers reporting earnings, including Best Buy (BBY), which missed analyst estimates when it reported yesterday and warned of a weak holiday season. This sent the stock down about 6 percent. Even though that firm missed, the general trend for retailers has been positive. Retail, along with the larger consumer discretionary sector, has underperformed in 2014. That this lagging sector is trading at 52-week highs tells us about the overall strength of the market this year.