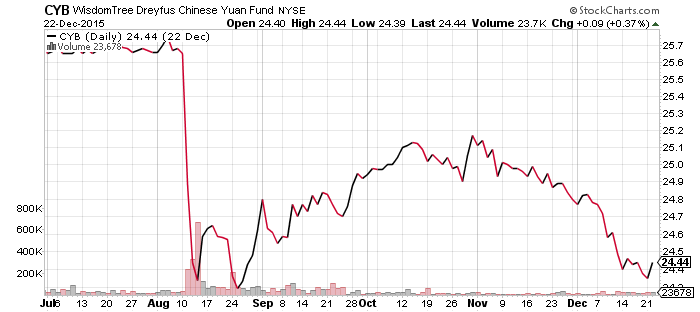

WisdomTree Chinese Yuan (CYB)

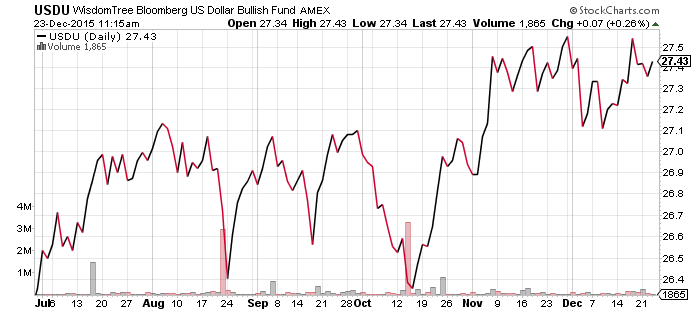

WisdomTree Bloomberg USD Bullish (USDU)

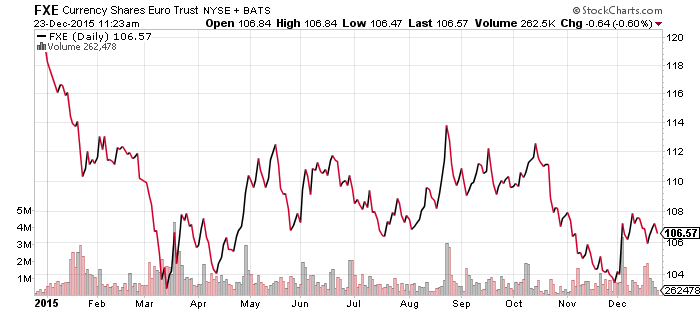

CurrencyShares Euro Trust (FXE)

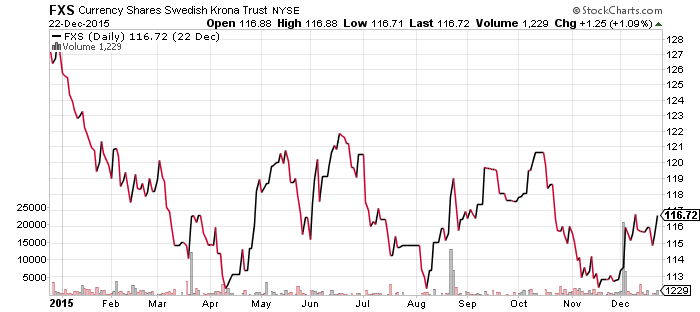

CurrencyShares Swedish Krona (FXS)

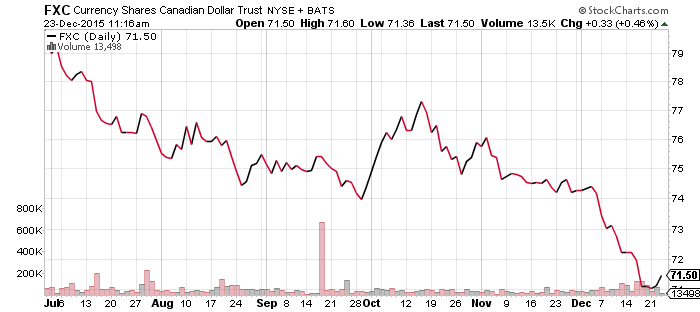

CurrencyShares Canadian Dollar (FXC)

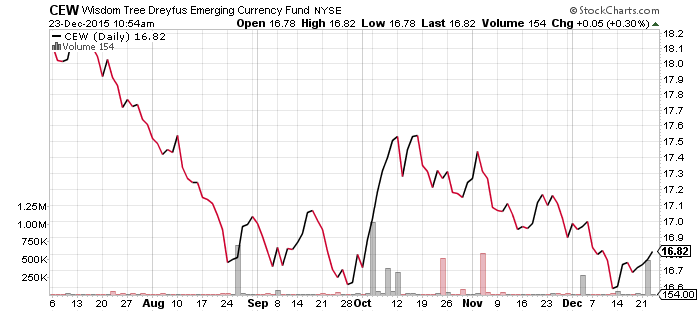

WisdomTree Emerging Market Currency (CEW)

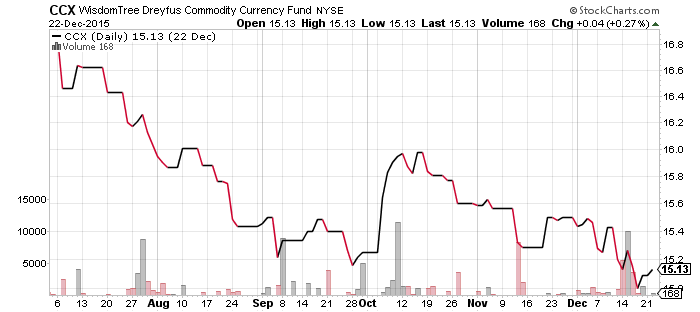

WisdomTree Commodity Currency (CCX)

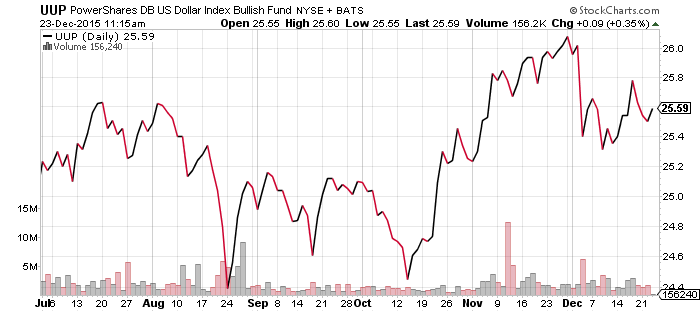

PowerShares DB U.S. Dollar Bullish Index (UUP)

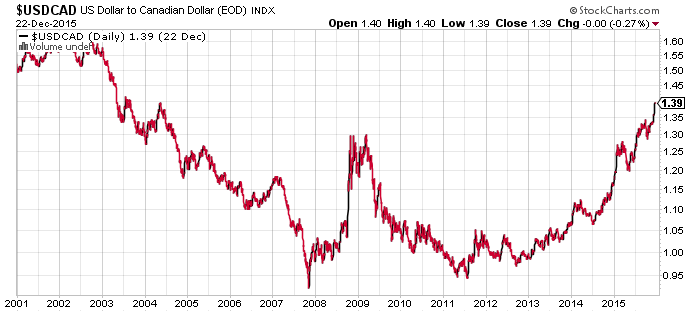

The Canadian dollar, emerging market and commodity-related currencies fell to 52-week lows versus the U.S. dollar over the past several days, while oil dropped to its 2004 lows. The Canadian economy enjoyed a housing boom tied to the rise in oil prices, which has now evaporated. Canada’s dollar is now at 2004 levels and a push to 2000 lows is possible. The U.S. dollar has gained more than 20 percent versus the loonie in 2015. Another rally of 15 percent would take it to those turn-of-the-millennium highs.

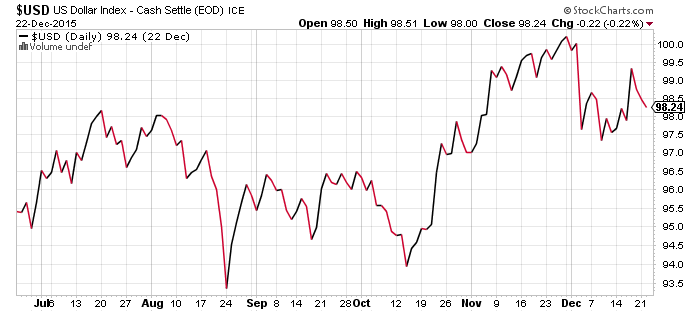

The Swedish krona rebounded nicely from a potential triple-bottom. The euro has not fallen below its March lows and could challenge the U.S. Dollar Index if it maintains short-term strength. USDU continues to outperform UUP due to its emerging market exposure. The Chinese yuan has further weakened the emerging market with its continued decline.

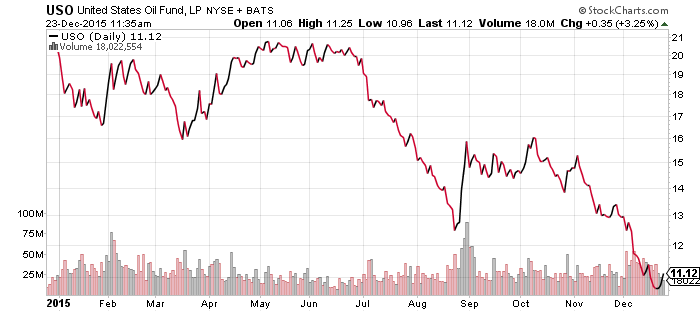

United States Oil (USO)

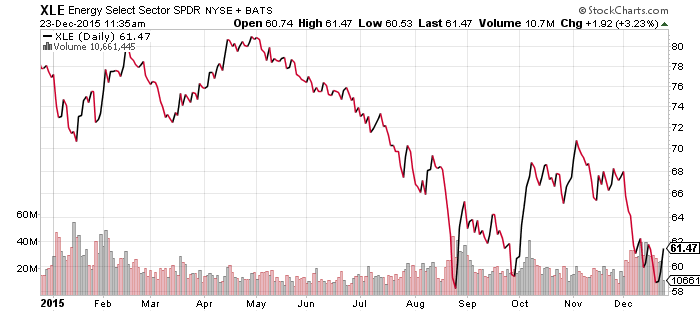

SPDR Energy (XLE)

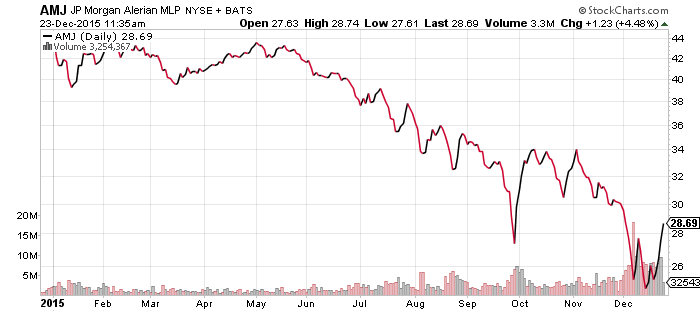

JP Morgan Alerian MLP Index (AMJ)

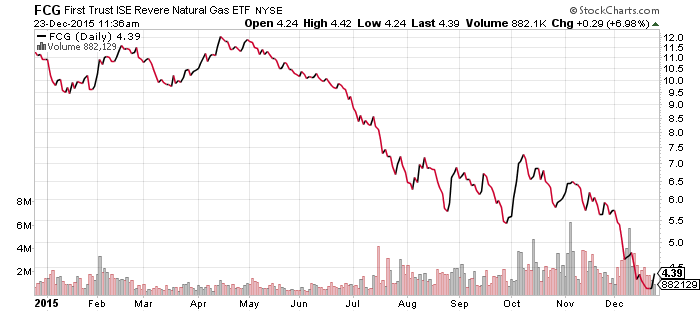

FirstTrust ISE Revere Natural Gas (FCG)

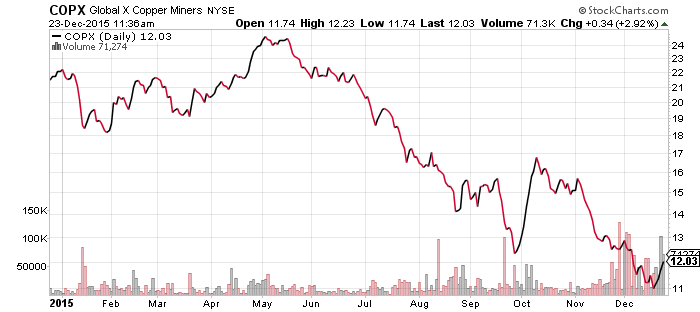

Global X Copper Miners (COPX)

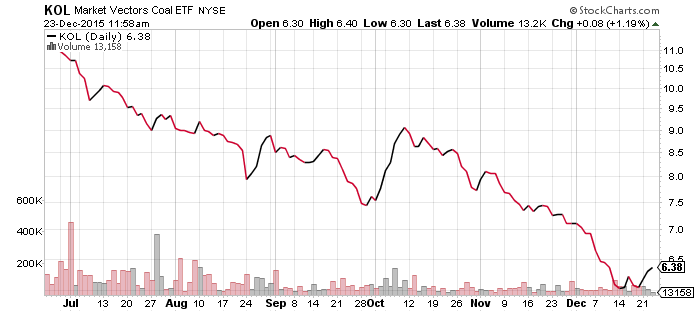

Market Vectors Coal (KOL)

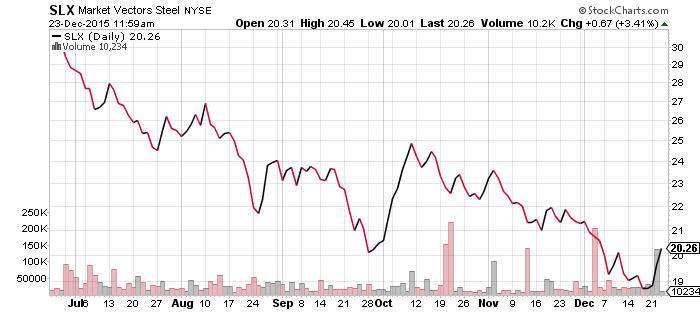

Market Vectors Steel (SLX)

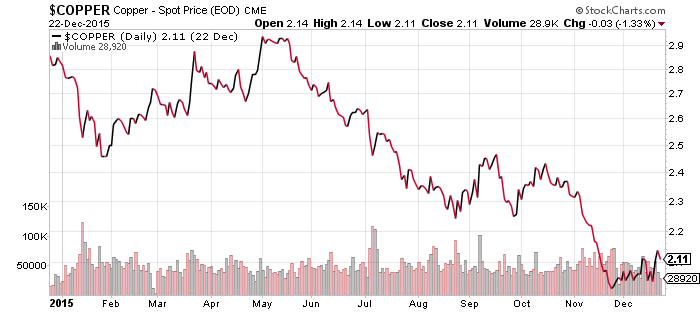

Investors moved back into MLPs, which sent steel stocks higher. The U.S. government will place a 256 percent tariff on some Chinese steel exports in retaliation for dumping. China has been selling nearly all of its excess steel onto the world market at deep discounts. Similar steel tariffs are likely to be imposed in 2016 in response to China’s selloff.

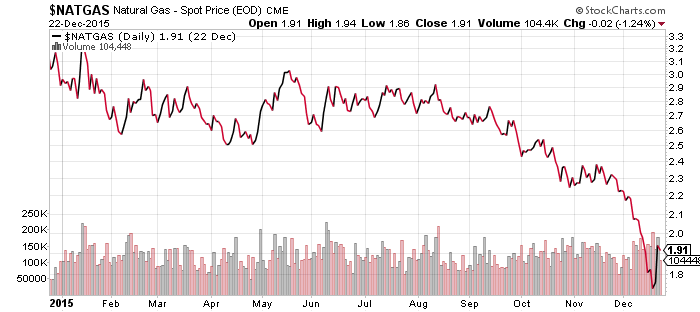

Russia is planning for $30 oil and demand for OPEC’s oil could fall for in response to increased production in non-OPEC countries, such as the USA and Russia. According to the International Monetary Fund (IMF), Iranian production could lower oil prices by $5 to as much as $15 a barrel.

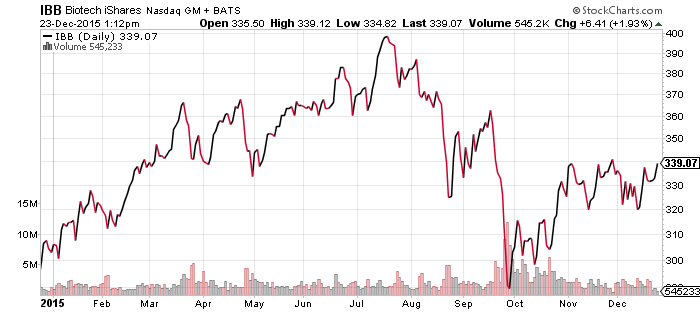

iShares Biotechnology (IBB)

Biotechnology is reaching the short-term resistance level of $340. A break above would be bullish and shares could run as high as $360 or $370 before facing resistance.

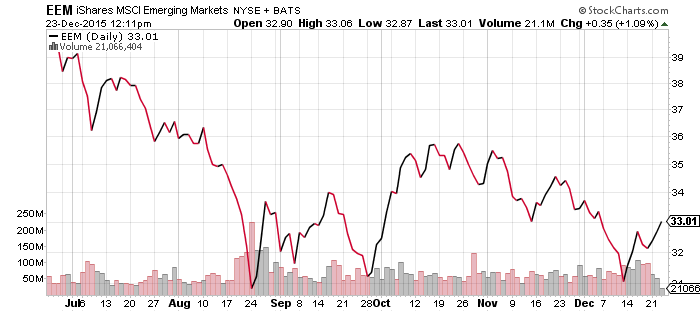

iShares MSCI Emerging Markets (EEM)

EEM bounced off the $31 key support level on December 11. For now, a push towards $36 is possible.

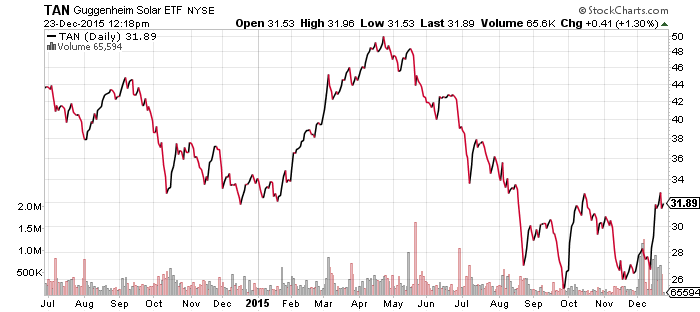

Guggenheim Solar (TAN)

Solar rebounded sharply on the extension of alternative energy tax credits, but has since stalled at the $34 level of resistance.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

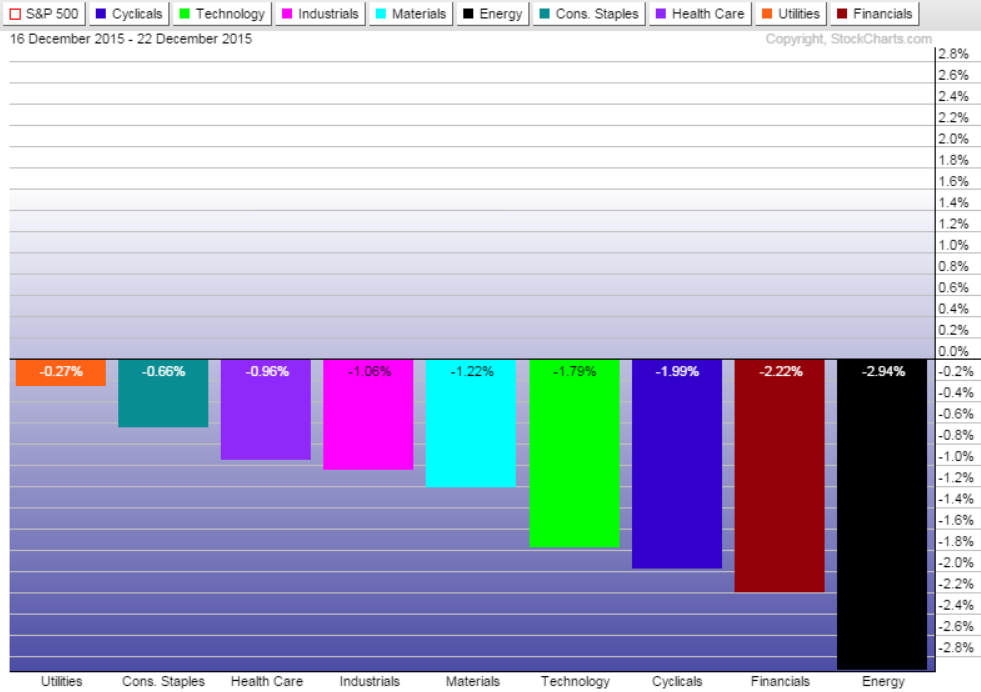

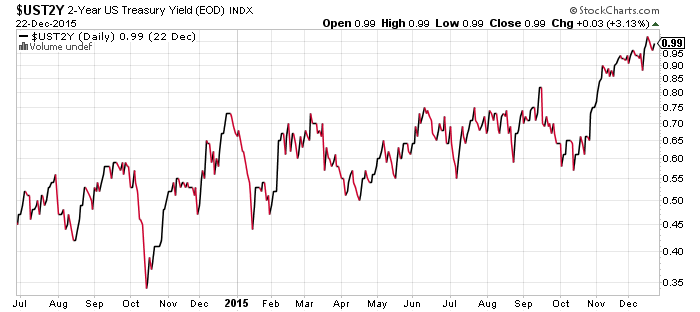

All sectors lost ground in the past week, with utilities weathering the storm as financials suffered. While financials typically benefit from rising interest rates, many traders closed their financial long positions and utilities shorts following the Fed’s decision. Energy drifted lower due to the dip in oil prices, but the sector did push higher on Wednesday.

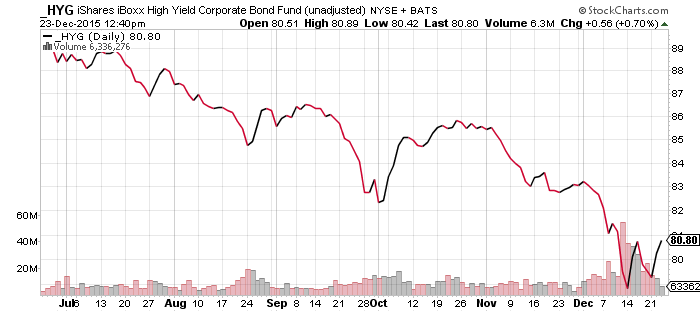

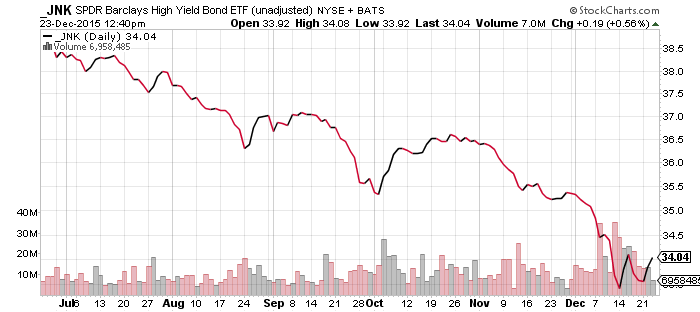

iShares iBoxx High Yield Corporate Bond (HYG)

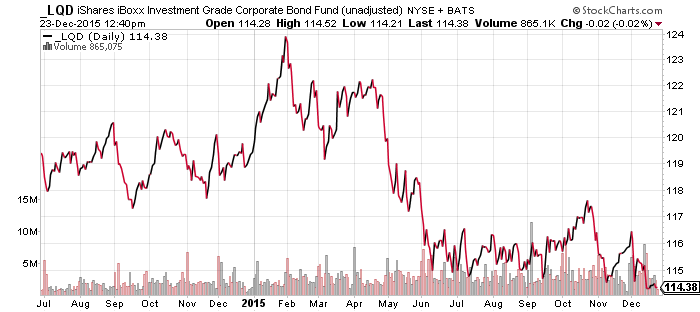

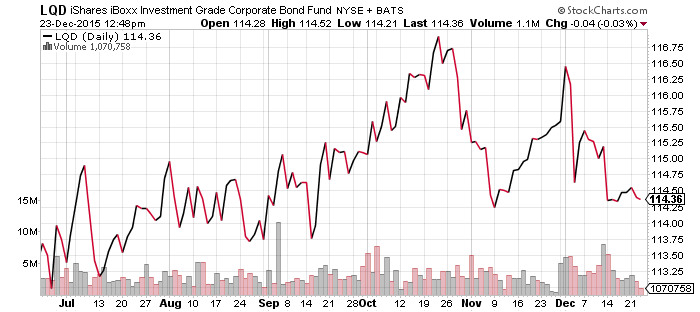

iShares iBoxx Investment Grade Corporate Bond (LQD)

The charts below depict bond funds without dividends. HYG and JNK bounced over the past several trading days. The lows hit on December 14 are now key support levels and a test is likely before high-yield can fully recover. Rebounding oil prices would go a long way to shoring up these funds. Rising bond yields are starting to chip away at portfolio value for investment-grade LQD, but interest payments offset the small dip.

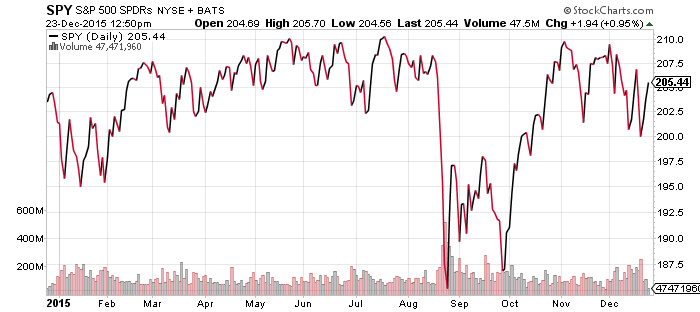

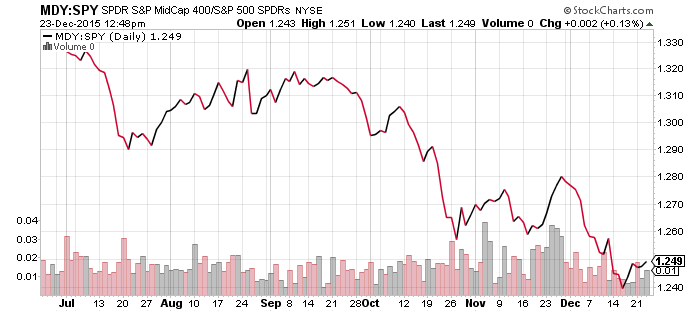

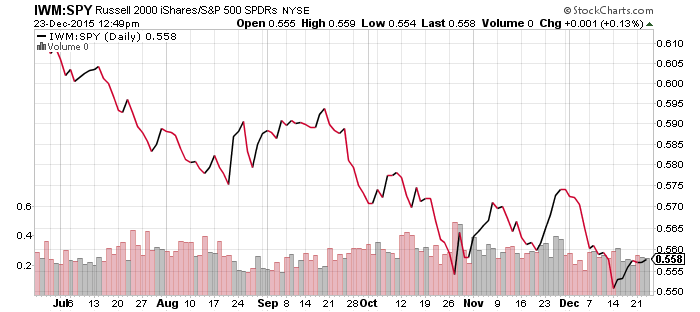

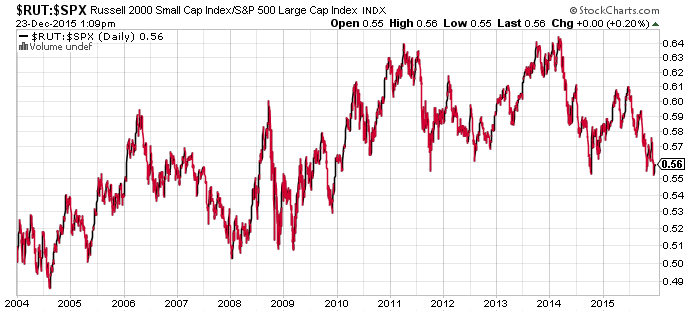

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

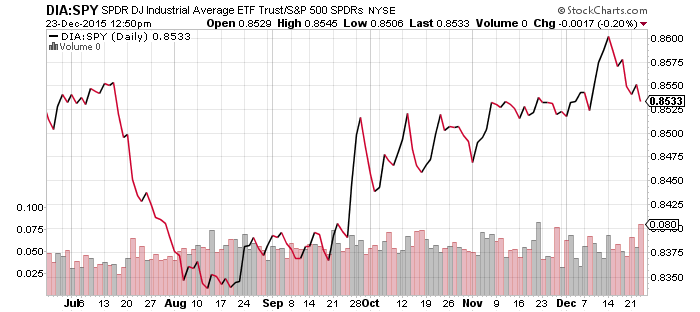

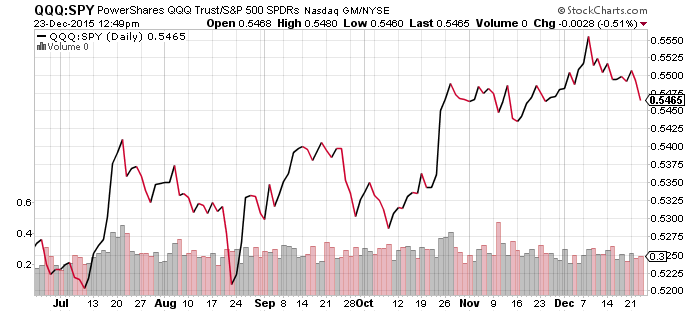

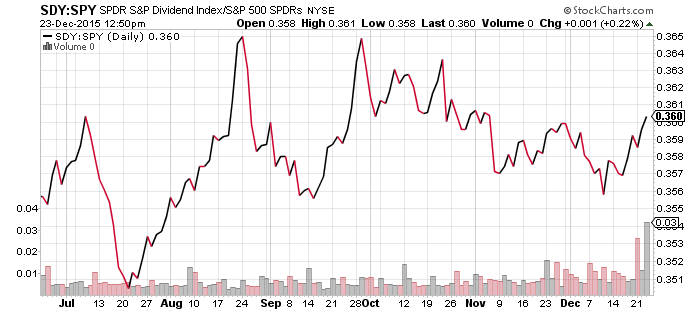

SPDR DJIA (DIA)

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

Barring an extremely volatile final week of trading, the Nasdaq will be 2015’s best-performing major index. Small- and mid-cap stocks will complete a second consecutive year of underperformance versus large-caps. With dividends, both the S&P 500 and Dow Jones Industrial Average are likely to close with a gain for the year.