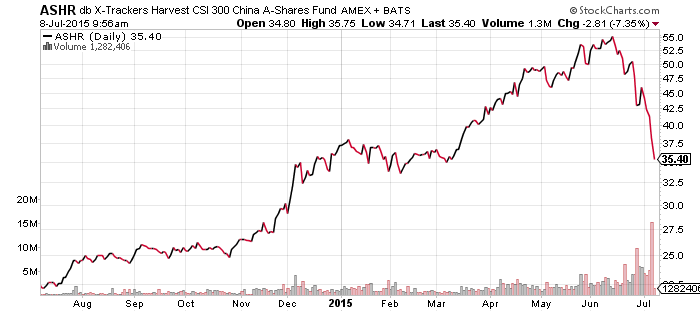

db X-Trackers Harvest CSI 300 China A-Shares (ASHR)

Guggenheim China Small Cap (HAO)

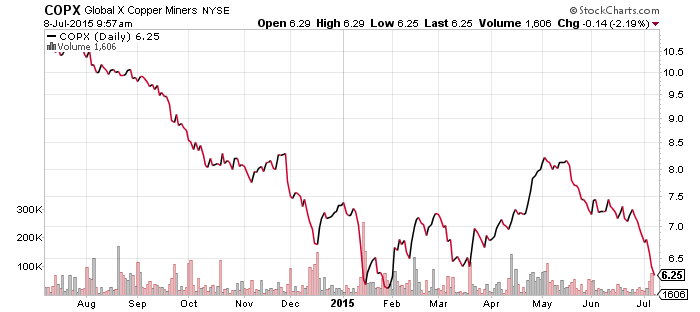

Global X Copper Miners (COPX)

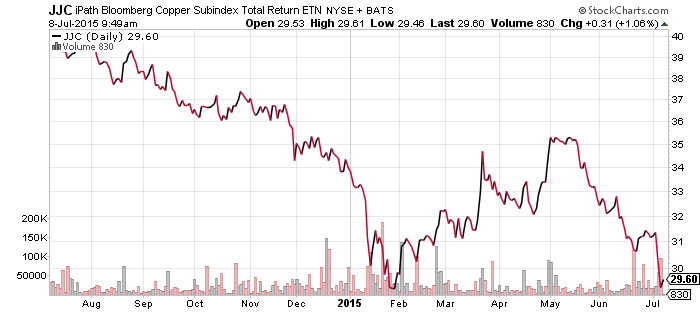

iPath Copper ETN (JJC)

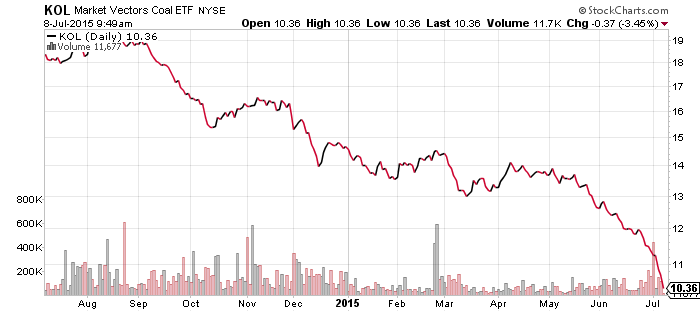

Market Vectors Coal (KOL)

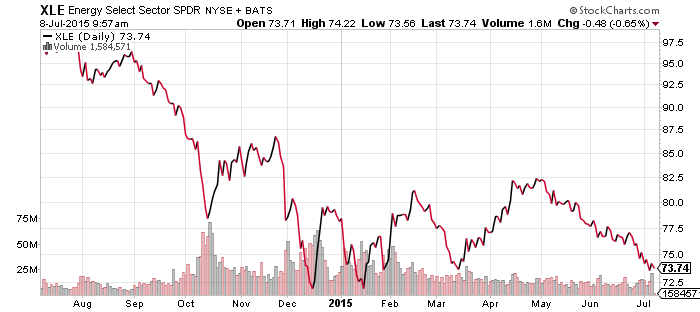

SPDR Energy (XLE)

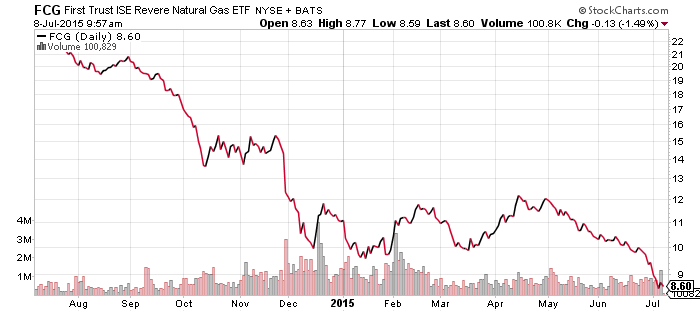

FirstTrust ISE Revere Natural Gas (FCG)

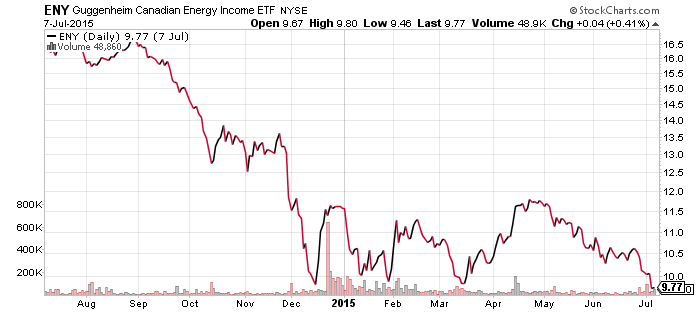

Guggenheim Canadian Energy Income (ENY)

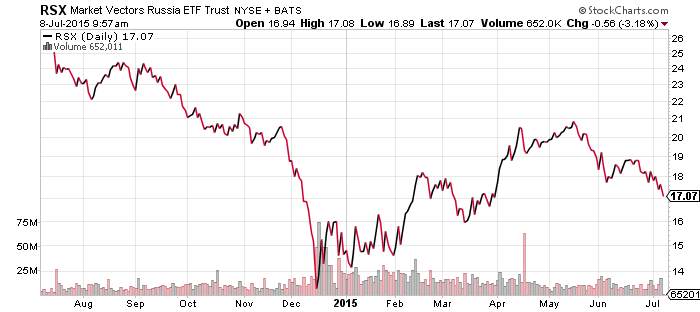

Market Vectors Russia (RSX)

China’s government launched a barrage of bailout measures over the past two weeks. It started by easing some margin lending rules that it had tightened only a month earlier, followed by a surprise interest rate cut by the People’s Bank of China. More measures were added in the following days. Last weekend, a “plunge protection team” was created. The national securities regulator will support the market with credit and 21 financial institutions will buy shares. Insider trading rules are suspended, state-owned companies aren’t allowed to sell, insiders can’t sell, insurance companies had their equity cap lifted, margin on futures contracts was raised and the number of contracts one can trade has been reduced. On Wednesday, a majority of shares were halted by company request, possibly because many firms have used shares as loan collateral and may be reaching the point where banks can sell that collateral.

This is only a partial list of bailout measures launched in recent days, yet nothing stemmed the selling in the mainland Chinese market. The rise in shares was fueled by margin and cheerleading by the official media. The crash is fueled by the unwinding of leverage and the government’s panic evidenced by a never ending stream of bailout measures. The Shanghai Composite is still up about 75 percent from July 2014, when the bull market started. However, the H-shares held in HAO are trading at a new 52-week low. Foreign investors are able to sell down shares faster because they aren’t limited to the mainland’s 10 percent daily limit. A possible sign that selling is close a bounce can be seen in ASHR, which is currently selling at an 8 percent discount to NAV.

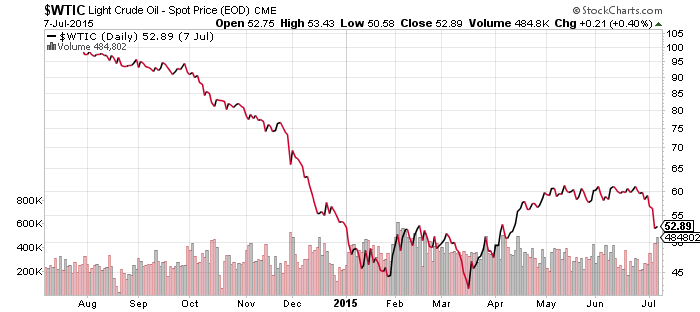

Although Greece captured most of the attention recently, China is far more important for global markets. In the past week, the collapse in Chinese shares subdued the hope of investors that the bull market in China signaled faster economic growth. Copper prices fell near its 52-week low, coal prices in China fell to a 9-year low, while iron ore prices fell to a new 52-week low in the country. Crude oil also broke out of its trading range to the downside.

Given the high degree of attention and panic surrounding China, evidenced by investors dumping ASHR at an 8 percent discount to NAV and the drop in assets such as copper, a bounce is likely. Longer-term, the break to new lows in commodities may signal a resumption of the downtrend in these assets.

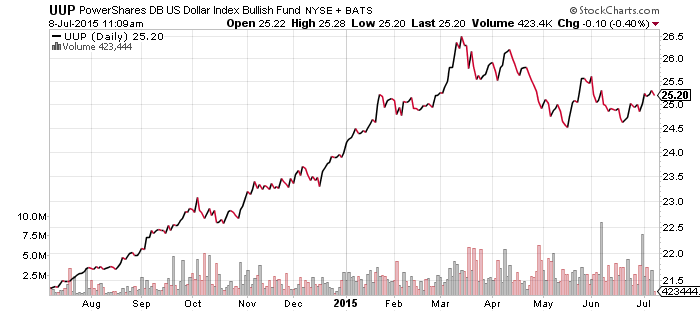

PowerShares U.S. Dollar Index Bullish Fund (UUP)

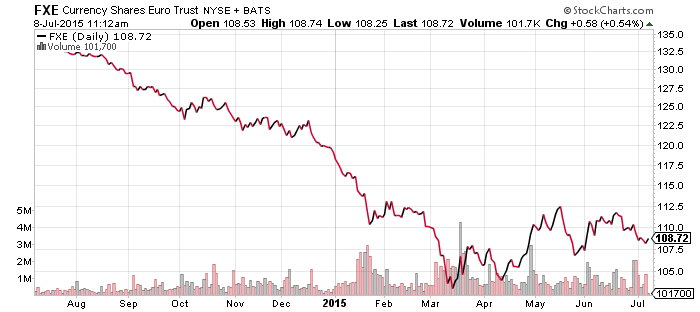

CurrencyShares Euro Trust (FXE)

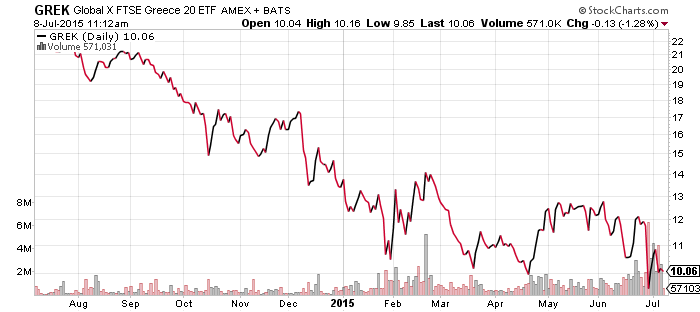

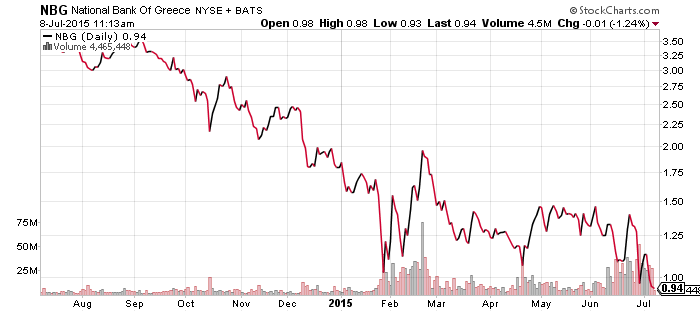

Global X FTSE Greece 20 (GREK)

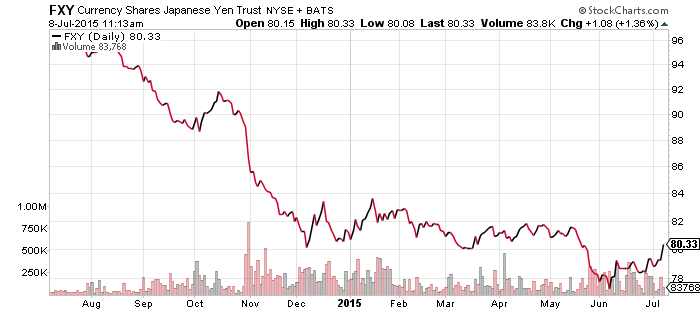

CurrencyShares Japanese Yen (FXY)

Shares of National Bank of Greece (NBG) has broken lower but GREK and the euro have done slightly better, all despite the turmoil in the country. The U.S. dollar is holding steady, being pushed lower by the stronger yen, but moving up against the Canadian and Australian dollars. The yen is a carry trade currency; investors borrow yen to finance bullish bets elsewhere, such as the higher yielding Australian dollar. When markets drop, the yen often rallies. The Australian and Canadian currencies are correlated with commodities.

The drop in oil, copper and other commodities is bullish for the U.S. dollar. Nevertheless, the U.S. Dollar Index, which UUP tracks, may hinge on the outcome in Europe.

Greece asked for a new 3-year bailout on Tuesday and supposedly there is a new deadline of Sunday. The new proposal includes tax reform and pension cuts, were ostensibly rejected in the referendum vote on Sunday. Greek media reports the government is preparing an alternative currency.

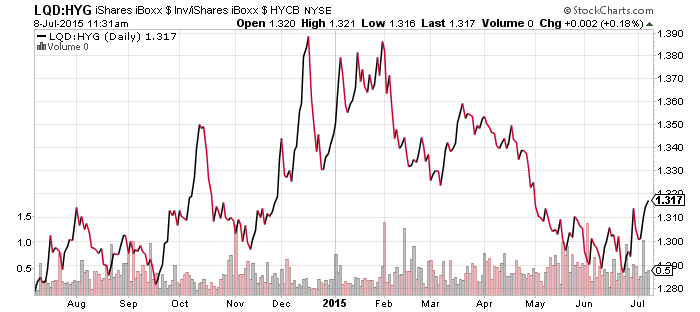

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

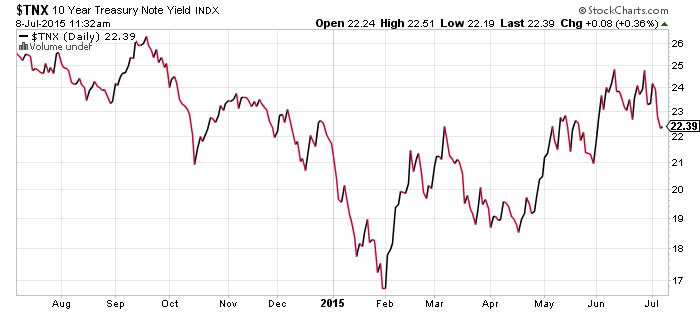

Investment grade bonds outperformed high yield bonds over the past week as investors opted for less risky assets. Bond yields retreated, but have only given up a small bit of their gains. Economic data was good over the past few days, with the Atlanta Fed’s GDP Now forecast ticking up to 2.3 percent in the second quarter. The initial estimate at the start of the quarter was 0.8 percent growth.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

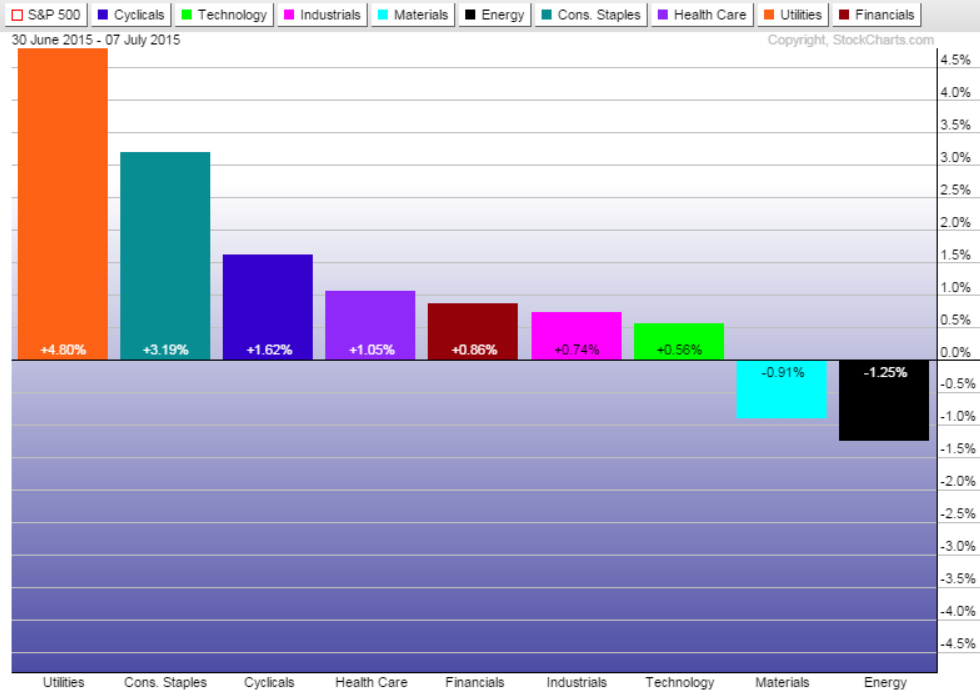

Utilities were the winner over the past week, gaining 4 percent since the end of June as interest rates dipped and investors opted for defensive shares. Consumer staples benefited as well. Healthcare, financials and cyclicals, which have been leading the market in 2015, were the next best performers. Energy and materials were the worst performers, hurt by falling commodity prices.

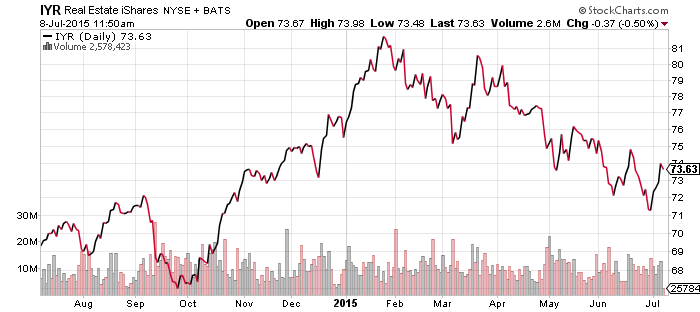

The rate sensitive real estate sector bounced as well last week, but did not break out of the 2015 downtrend.

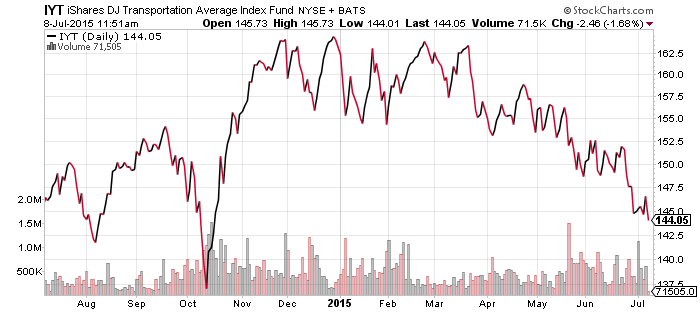

Transports continue to break to new lows and the government’s inquiry into airline fare pricing hasn’t helped matters. The short-term the drop in oil prices is a positive factor for the sector. Energy tends to rise and fall with the transportation sector because both are affected by the overall level of business activity, but in the short-term, transportation stocks react to moves in energy as it is a major cost for the industry.

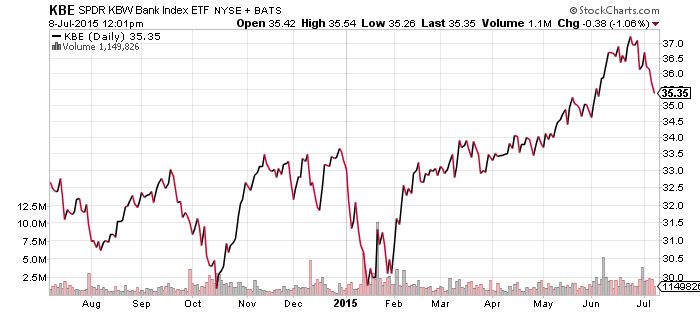

Bank stocks retreated from their highs for the year and gave up some of the sharp gains made in June.

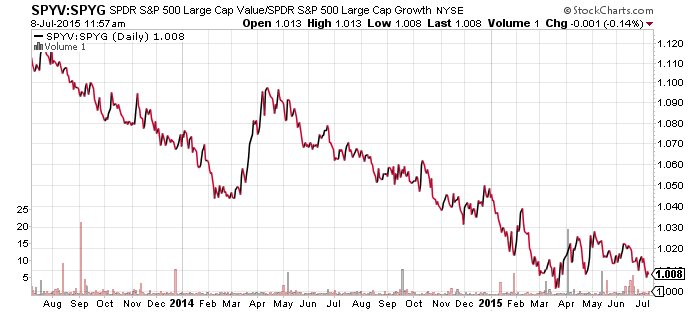

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

The drop in oil prices and interest rates sent the energy sector lower and slowed the financial sector, resulting in a decline in value relative to growth.

SPDR S&P 500 (SPY)

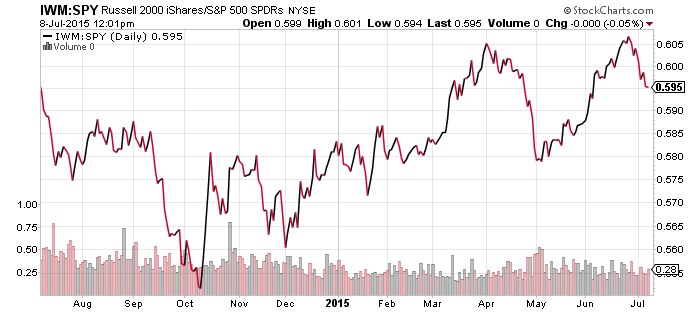

iShares Russell 2000 (IWM)

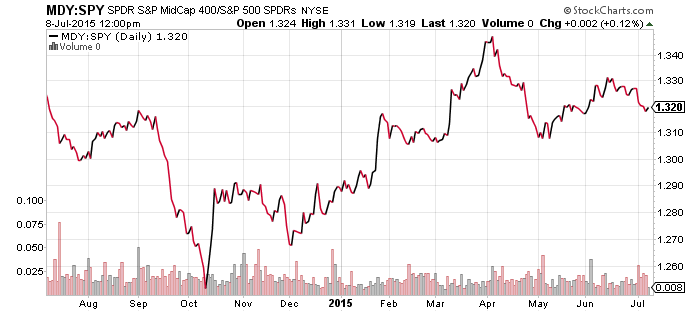

S&P Midcap 400 (MDY)

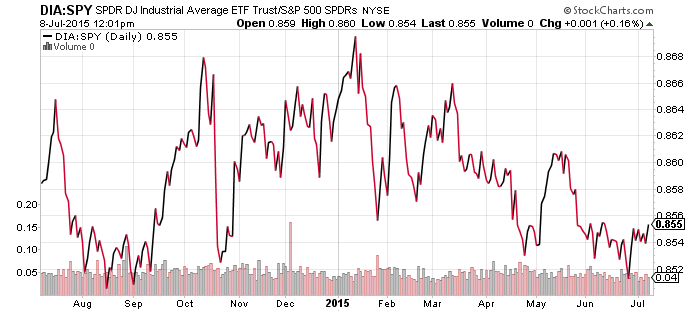

SPDR DJIA (DIA)

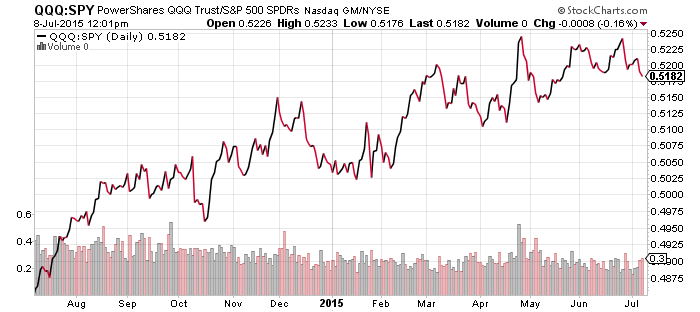

PowerShares QQQ (QQQ)

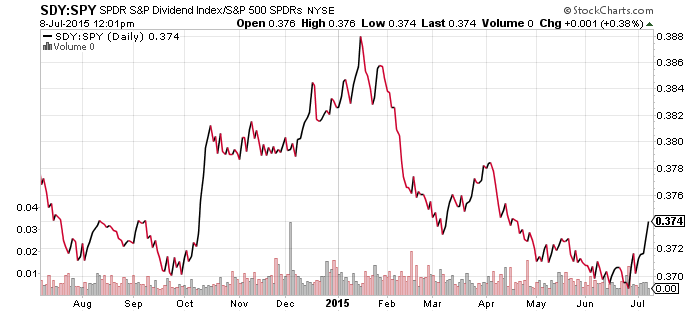

SPDR S&P Dividend (SDY)

Small- and mid-cap shares underperformed the broader market as investors sold shares over the past week, while the blue chip Dow Jones Industrial Average outperformed. Investors held on to dividend paying shares as well, with SDY clearly besting SPY. Shares of SDY are down over the past couple of weeks, but they’ve held up much better as investors hold those shares and dump riskier, non-dividend paying shares first.