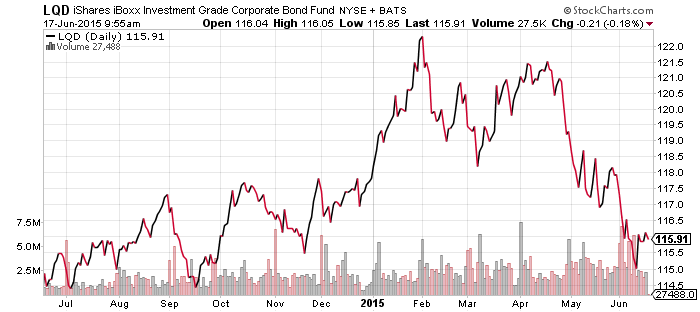

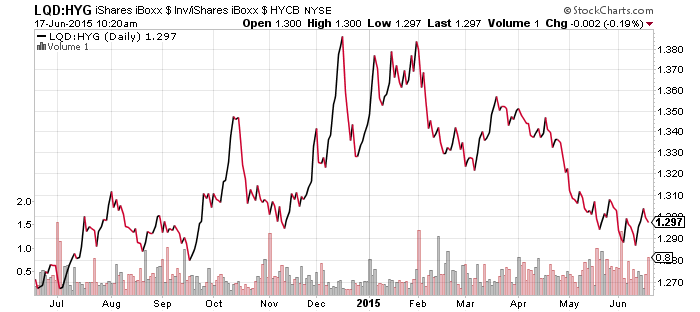

iShares iBoxx Investment Grade Corporate Bond (LQD)

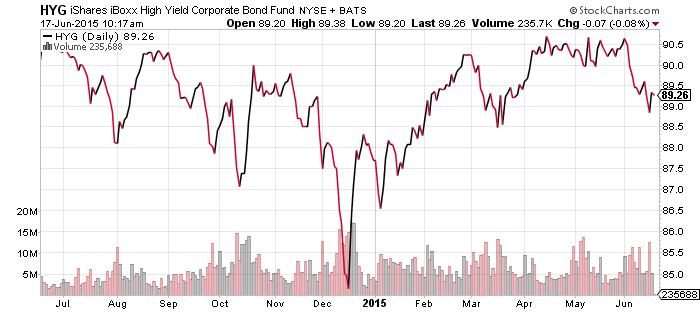

iShares iBoxx High Yield Corporate Bond (HYG)

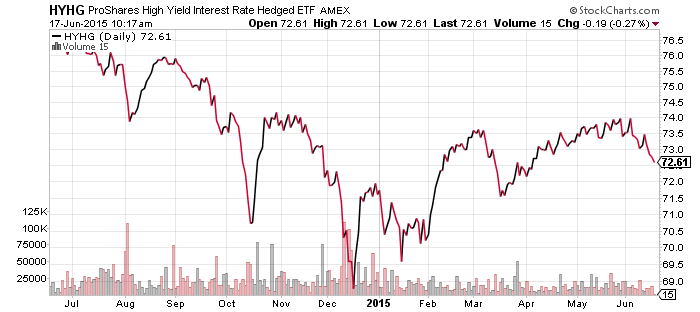

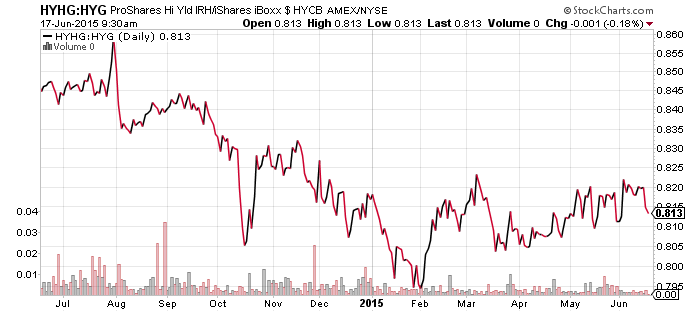

ProShares High Yield Rate Hedged (HYHG)

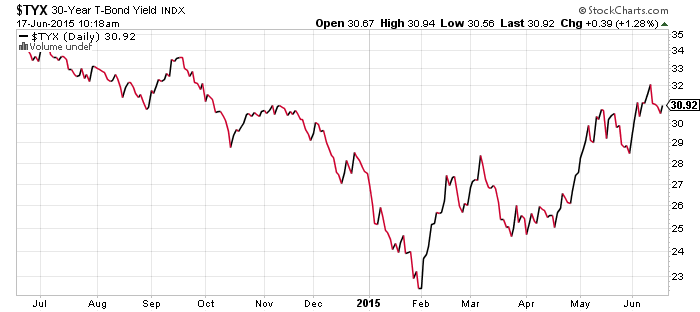

Third Avenue Focused Credit (TFCVX)

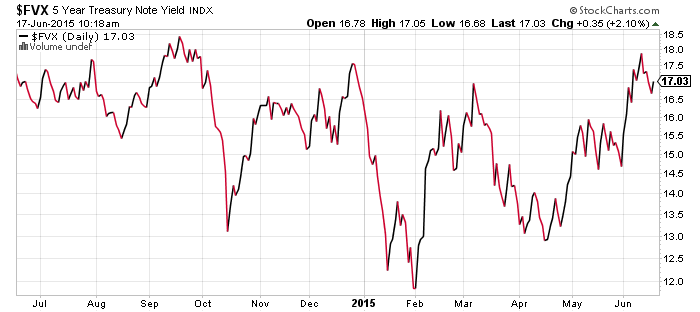

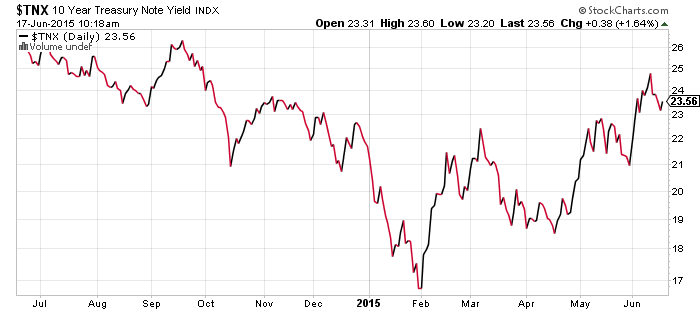

Interest rates finally paused in the past week. Later today, the Federal Reserve will deliver its policy statement from the current Federal Open Market Committee Meeting (FOMC). Investors do not expect a change in policy, but they do expect some guidance on the first rate hike and policy later this year. The Fed puts out long-term projections and in March, they were indicating interest rates would be above 0.50 percent by the end of 2015. In order to hit that target, the Fed would have to raise rates twice this year. If the Fed doesn’t lower that forecast, it would surprise the market as it would seem to contradict Yellen’s public statements about a gradual and slow rise in interest rates.

There was a slight increase in credit risk over the past week, with high yield bonds slightly underperforming investment grade debt. Nevertheless, for bonds of similar duration, interest rates are still the greater factor affecting prices. LQD remains in an intermediate-term downtrend relative to HYG.

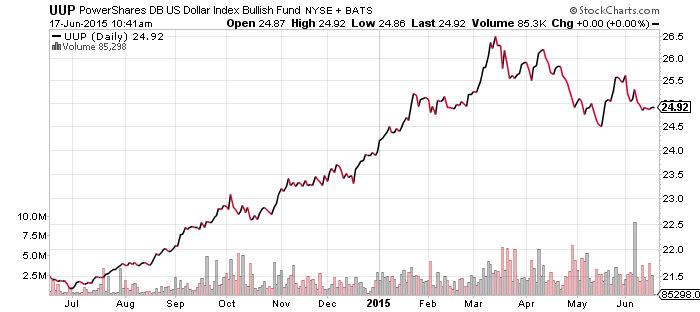

PowerShares U.S. Dollar Index Bullish Fund (UUP)

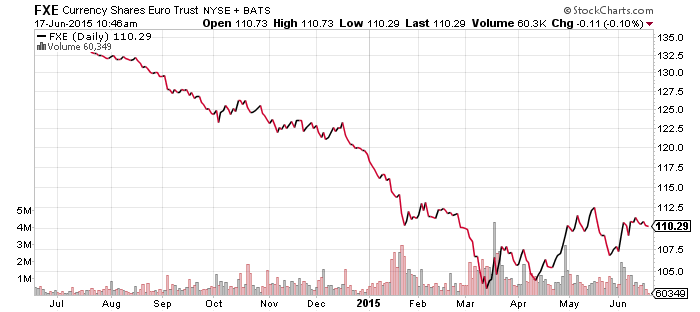

CurrencyShares Euro Trust (FXE)

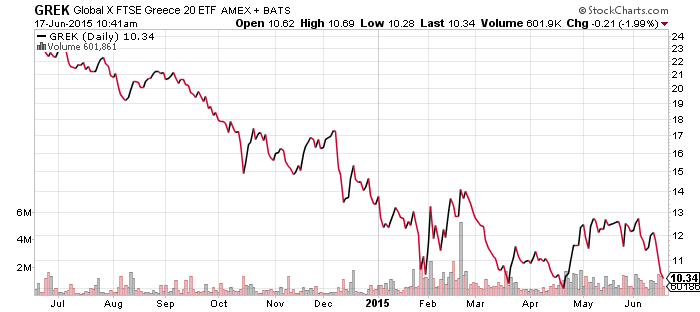

Global X FTSE Greece 20 (GREK)

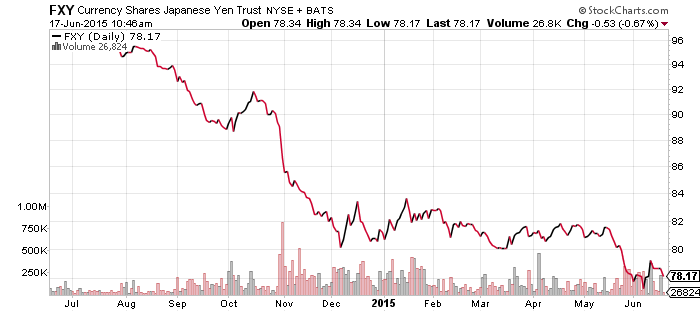

CurrencyShares Japanese Yen (FXY)

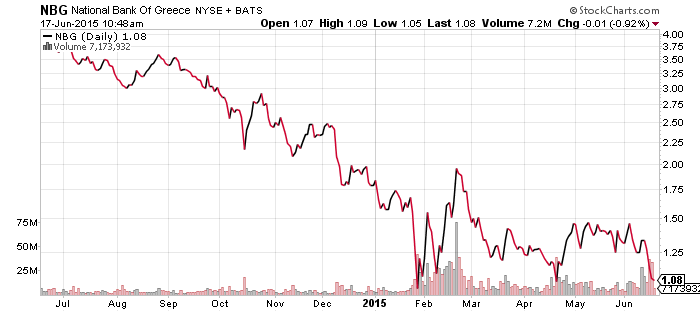

All eyes are on Greece as the country heads for what appears to finally be the endgame. A faction within the ruling Syriza party wants to exit the euro and create a new central bank. They also say they have support from opposition parties. One of the main problems for the Syriza government has been its inability to satisfy voters’ conflicting demands. Greeks want an end to austerity, but they also want to stay in the Eurozone. Creditors will let Greece stay in the Eurozone, if they accept more austerity. The other problem for Syriza is domestic politics: if it’s seen as rejecting a deal and leaving the euro, it would face a political price at home. If instead creditors make the next move, Syriza could put the blame on others. By exhausting its options with European creditors, it appears Germany is ready to play the role of bad guy if need be.

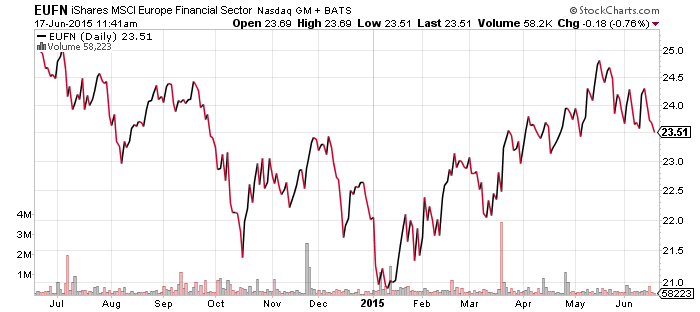

Of course, this could all be extremely high stakes negotiating tactics. The currency market reflects this attitude, with the euro rising this week. Greek stocks, reflected in GREK, shows equity investors are getting nervous. However, GREK hasn’t broken below its low set it in April. If that line holds, it would be a bullish signal for those expecting a deal. For a single stock, National Bank of Greece (NBG) is one to keep an eye on. If Greece defaults, NBG probably goes to zero. Greek government bonds have a similar chart to GREK, with prices approaching the April lows. Bonds are selling for about 56 cents on the dollar. Another ETF to keep an eye on is iShares MSCI Europe Financial Sector (EUFN). Shares are up strongly in 2015 and they pulled back with the rest of Europe since mid-May, but they’ve shown no sign of being impacted by Greece.

The yen spiked up and then pulled back over the past several days. One week ago, Bank of Japan governor Kuroda said the yen was unlikely to fall further, triggering an immediate rally as currency traders assumed this meant no more policy easing. Kuroda then clarified his comments, essentially sounding like the Federal Reserve in saying BOJ policy will be data dependent. If inflation picks up, there’s no need for further easing. The market responded by selling the yen.

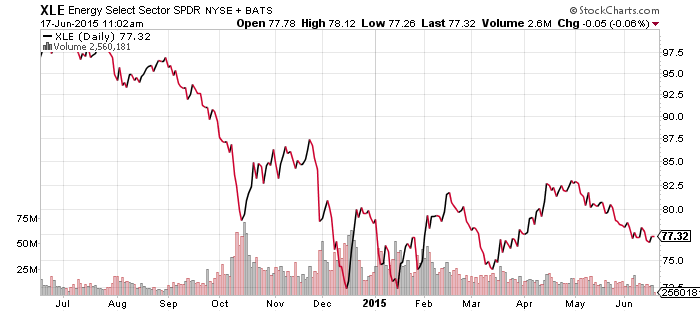

SPDR Energy (XLE)

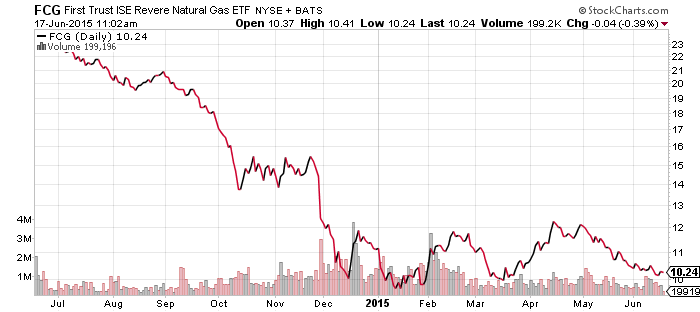

FirstTrust ISE Revere Natural Gas (FCG)

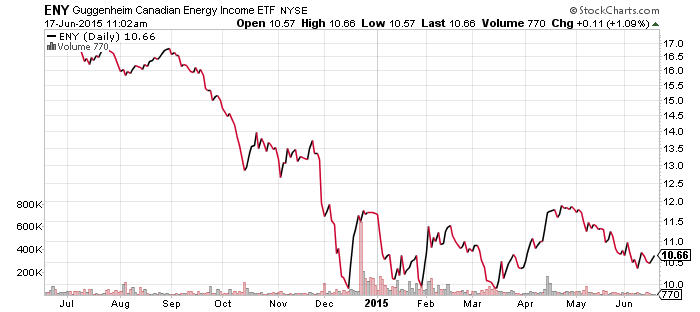

Guggenheim Canadian Energy Income (ENY)

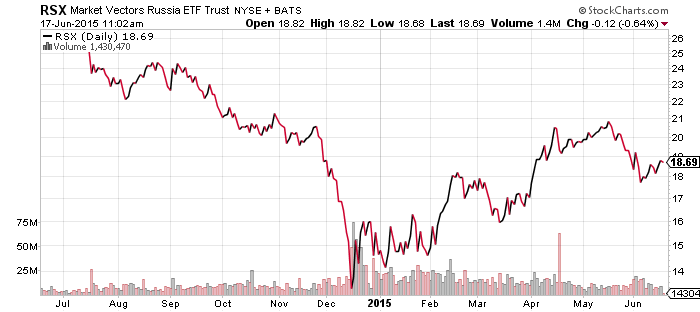

Market Vectors Russia (RSX)

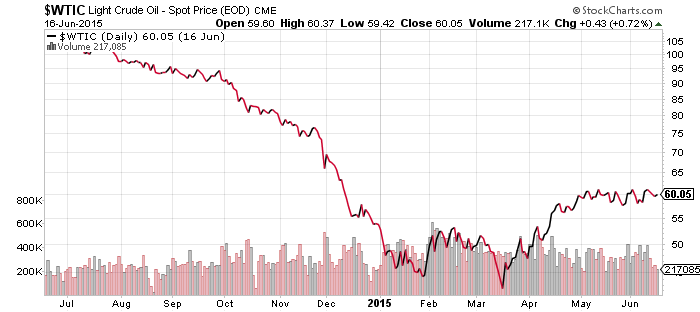

Crude oil remains locked in a tight trading range. Oil inventory dropped over the past week, but gasoline inventory, expected to drop, instead increased. The summer driving season increases gasoline demand and that should help deplete the large inventory.

XLE and other energy funds ceased their rallies when oil prices stopped rising. Short-term traders playing a rebound in energy likely sold when they saw the current rally was exhausted. Energy shares may be in a period of limbo until oil prices decide to pick a direction, but with shares down over the past six weeks, there’s more upside potential in energy equities if oil moves up, than downside potential.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

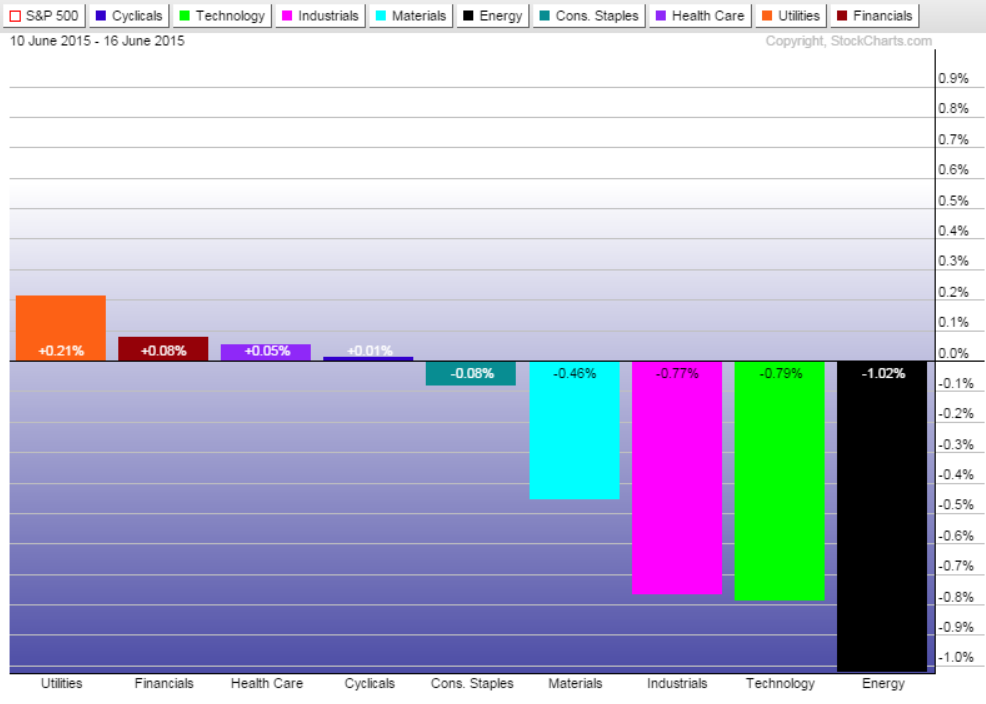

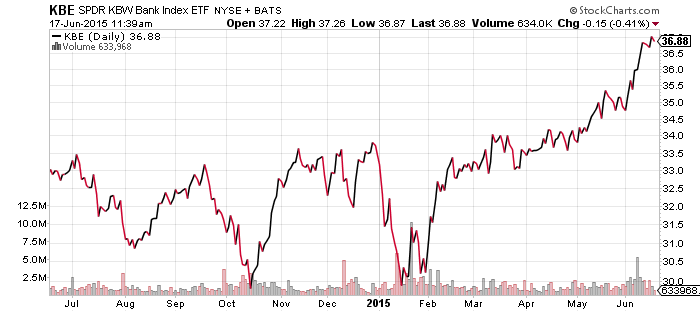

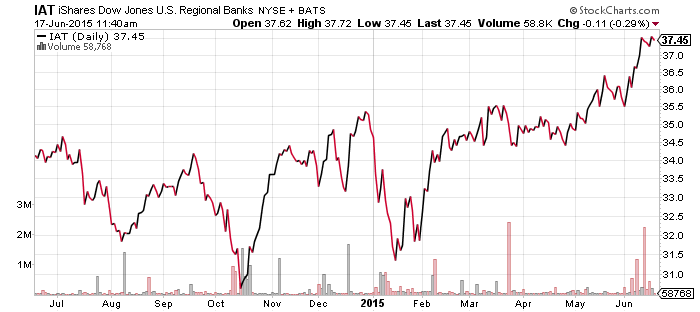

Utilities performed poorly a week ago, but this week they rebounded as interest rates came down. Surprisingly, financials were still the second best sector, with XLF up 0.08 percent. This is a strong showing and reflects the current momentum behind financials. Energy was the biggest loser.

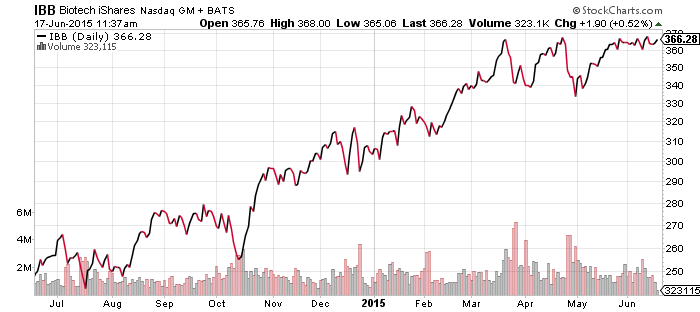

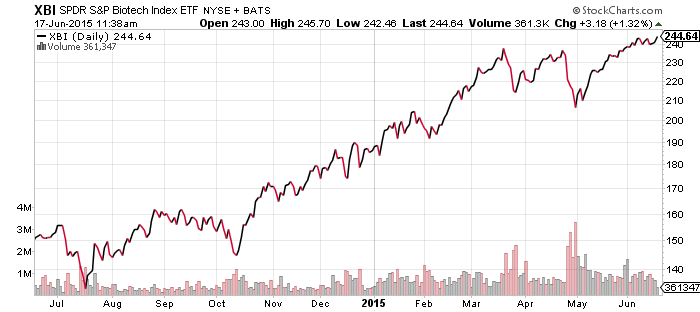

Large cap biotechnology failed to make a new high last week, instead trending sideways. This is in contrast to XBI, which has climbed to yet another new record. The difference in performance is best explained by the current gap between small and large cap stocks. Small caps have been moving higher in June, while large caps have moved lower.

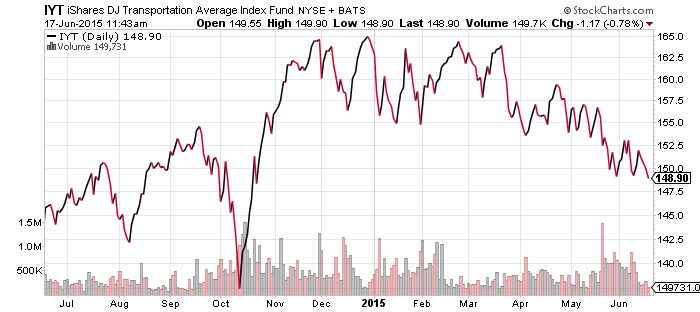

iShares Dow Transports (IYT) has been highlighted a few times in recent weeks. It is starting to turn lower again and at risk of breaking recent lows after FedEx (FDX) missed earnings estimates today.

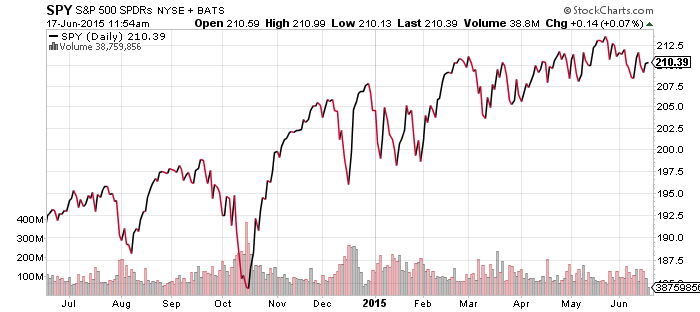

SPDR S&P 500 (SPY)

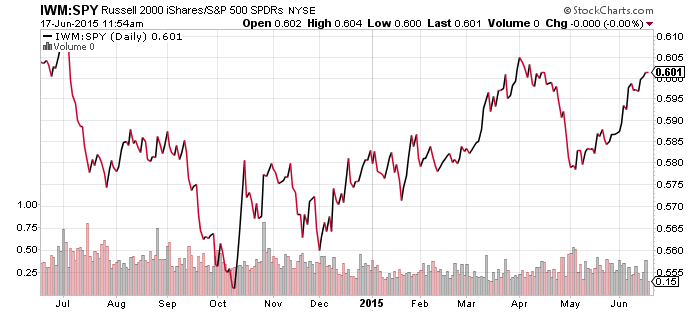

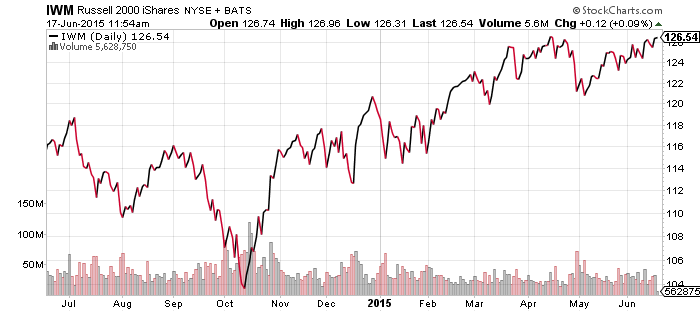

iShares Russell 2000 (IWM)

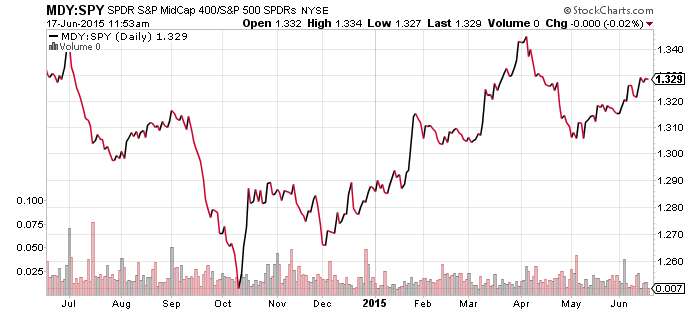

S&P Midcap 400 (MDY)

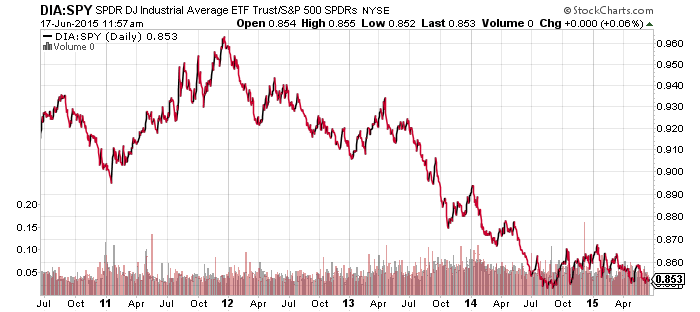

SPDR DJIA (DIA)

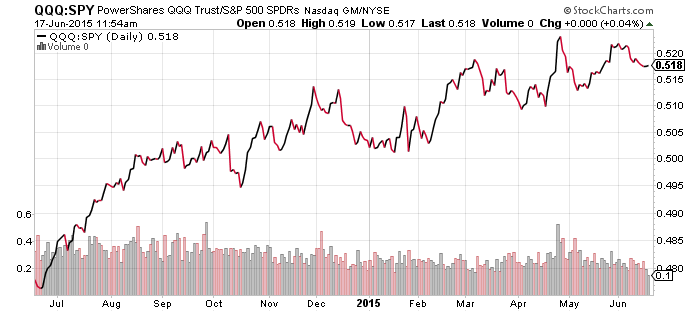

PowerShares QQQ (QQQ)

Mid- and small-cap stocks are still outperforming the broader market. The gap is quite clear in the IWM and SPY charts at the bottom. The Russell 2000 is back near its all-time high. The S&P 500 has been moving in the opposite direction since mid-May and needs to make up a little ground before it eclipses the prior high. The Dow Jones Industrial Average has been trending with the S&P 500 Index since last year, after having underperformed for two years. Technology continues to outperform, pulling the Nasdaq higher, but the pace of the outperformance has slowed. For now, small caps remain the strongest of these indexes.