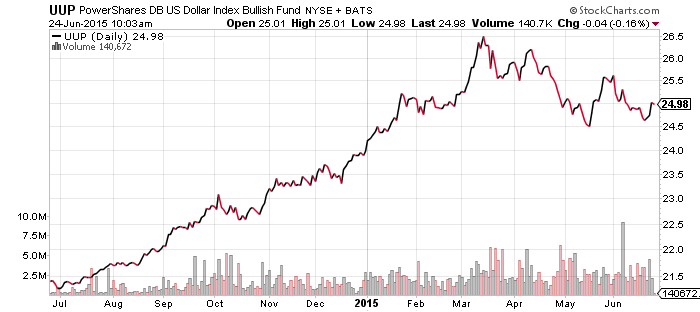

PowerShares U.S. Dollar Index Bullish Fund (UUP)

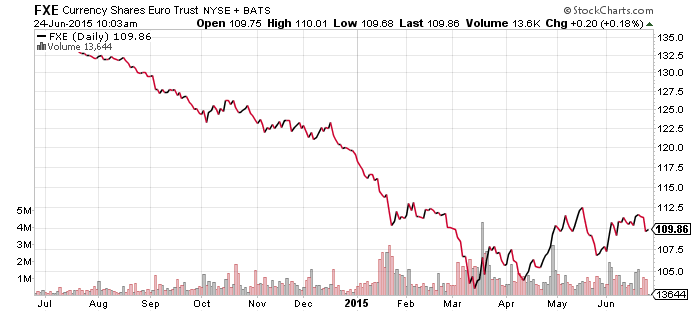

CurrencyShares Euro Trust (FXE)

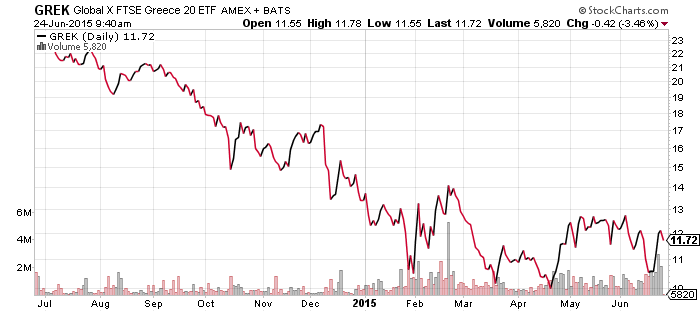

Global X FTSE Greece 20 (GREK)

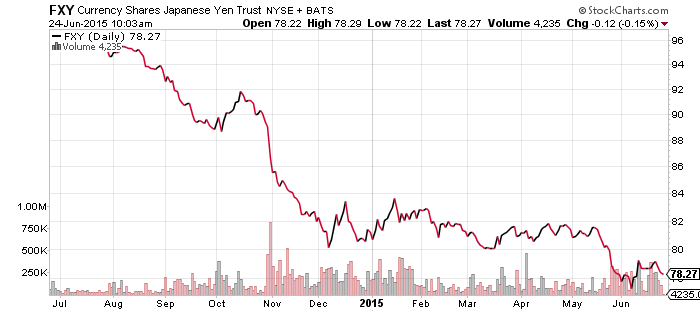

CurrencyShares Japanese Yen (FXY)

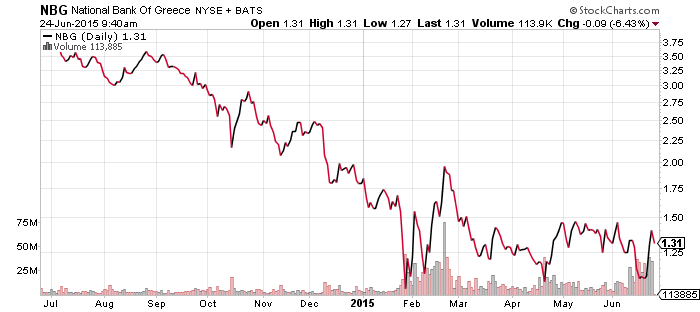

Greek shares rebounded strongly over the past week after a deal with creditors appeared likely. The National Bank of Greece (NBG) rebounded 27 percent to its high on Tuesday. On Wednesday, there was no deal, with both the EU and IMF rejecting Greece’s offer. Shares started to slip, but overall investors have shares trading much higher than a week ago.

Given the history of negotiations, it is hard to know if time is really running out or not. Just this past weekend it was indicated a deal was needed by Monday night. Now a deal is supposedly needed by Wednesday night. Greece needs money to pay maturing IMF debt on June 30, so clearly that is the end of the line in terms of funding. Emergency funding could push the day of reckoning farther back, but the parties appear to be drifting apart rather than coming together. Rhetoric has been sharp on all sides and the parties aren’t publicly budging from their positions. The Greeks want tax increases and no spending cuts. The IMF wants spending cuts or debt relief, but no tax increases. The Germans do not want to give Greece debt relief. Leaked documents from the latest meeting show European negotiators have redlined at least 75 percent of the Greek proposal.

The euro slid on Tuesday when a deal appeared likely, and then it rebounded when the deal didn’t happen. The yen fell back and emerging market currencies also declined on Tuesday, erasing small gains from earlier in the week.

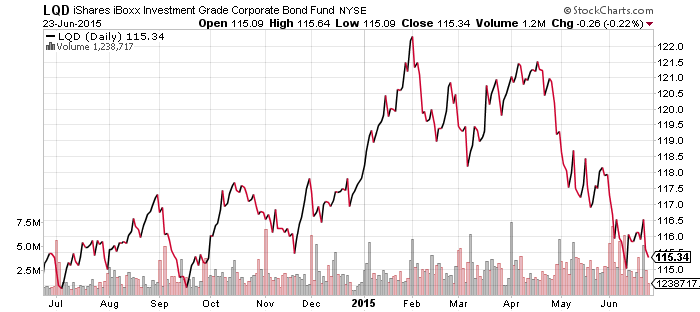

iShares iBoxx Investment Grade Corporate Bond (LQD)

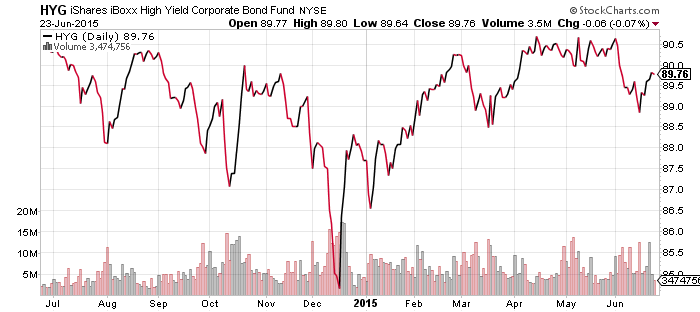

iShares iBoxx High Yield Corporate Bond (HYG)

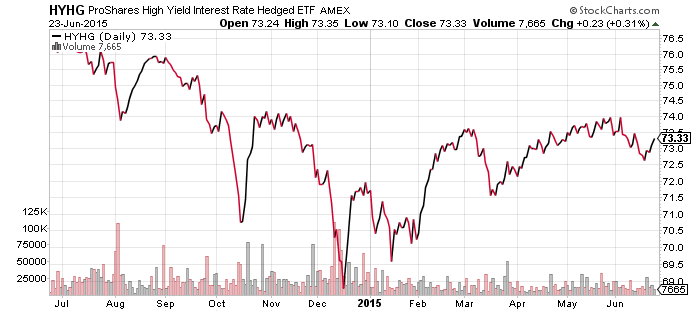

ProShares High Yield Rate Hedged (HYHG)

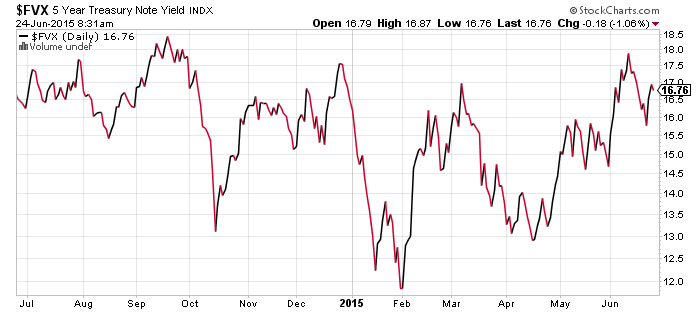

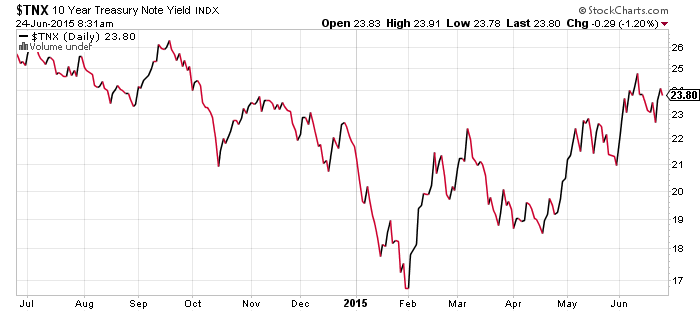

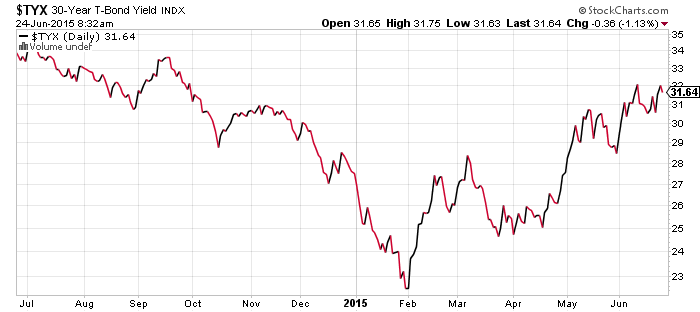

On Tuesday, Federal Reserve Governor Jerome Powell said the Fed would like to raise rates as soon as September and he put a second rate hike back on the table, albeit one that would be data driven. Although his comments are seemingly at odds with last week’s Federal Reserve policy statement, if the data were to improve as he expects, the Fed would face pressure to hike earlier.

Rates had been rising in the wake of the Fed’s announcement last week, but dipped on Tuesday. Events in Greece are having a greater impact on the market than comments from Fed officials and may continue to do so at least until there is a resolution.

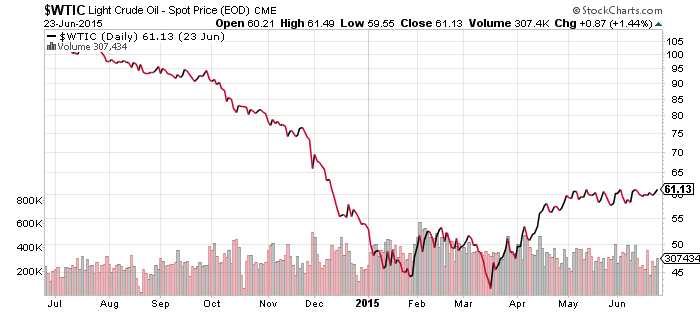

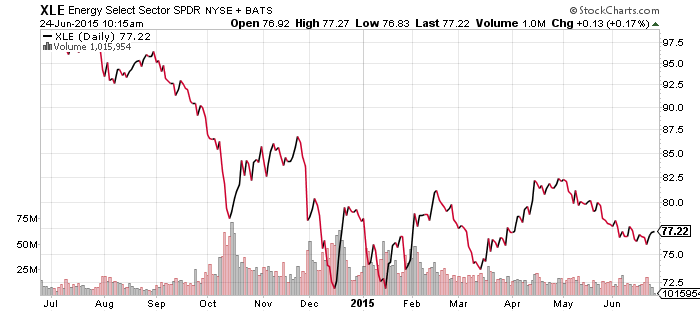

SPDR Energy (XLE)

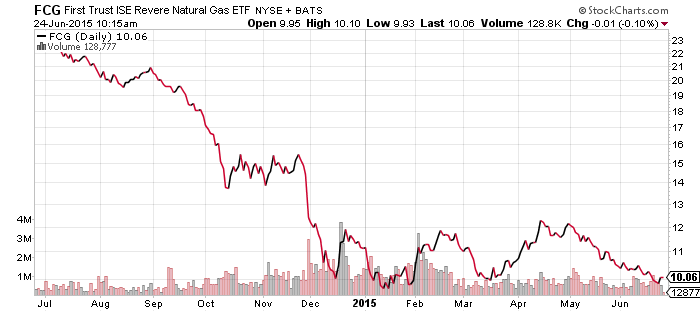

FirstTrust ISE Revere Natural Gas (FCG)

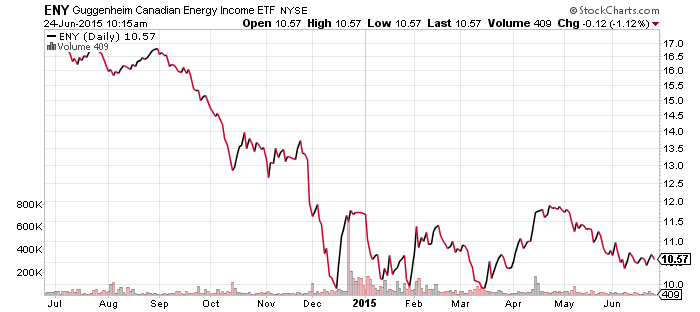

Guggenheim Canadian Energy Income (ENY)

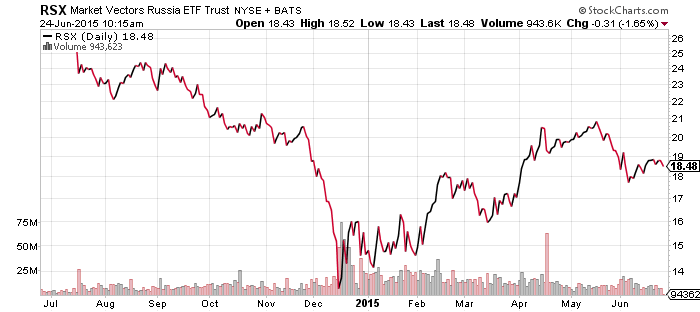

Market Vectors Russia (RSX)

Crude oil prices are now at their highest point in six weeks, setting up a potential breakout for black gold. Inventories have been coming down as U.S. crude oil demand rises during the summer driving season.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

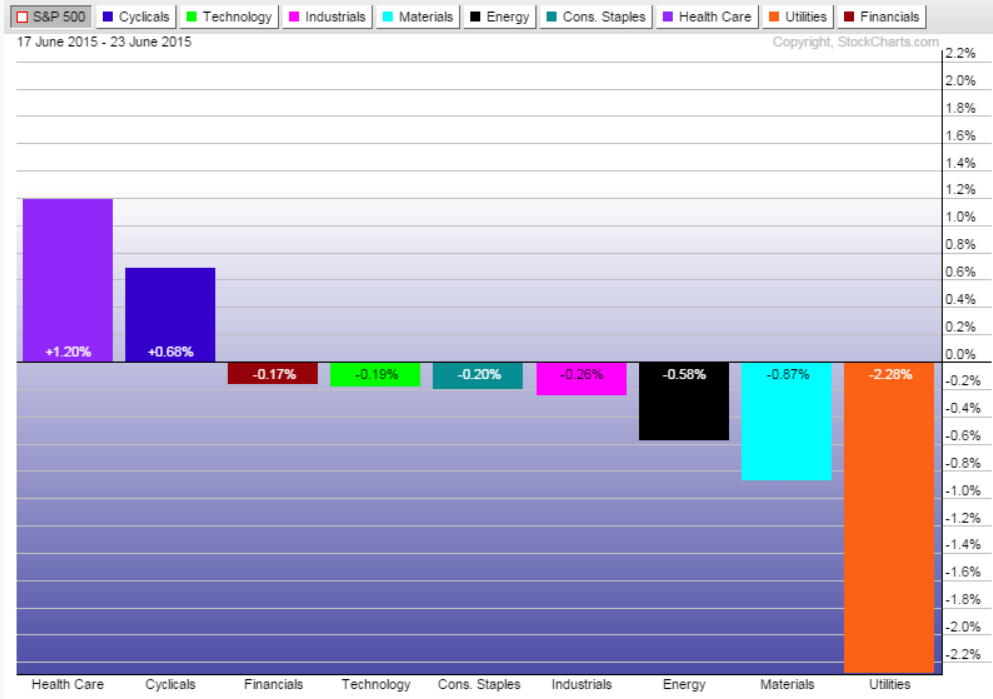

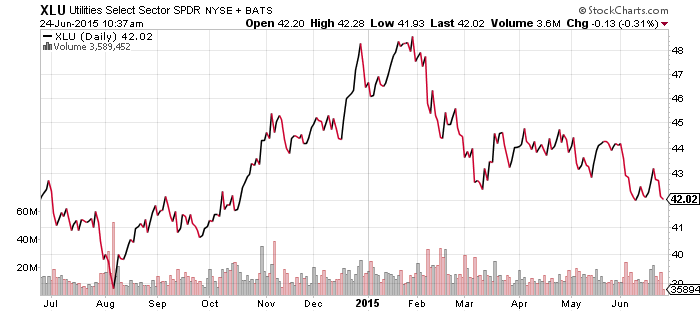

The rebound in interest rates last week sent the utilities sector lower again. The chart below shows the performance of each sector relative to the S&P 500 Index; overall XLU slipped 1.15 percent and was the only sector to lose ground on the week. XLU is now approaching its lows for the year.

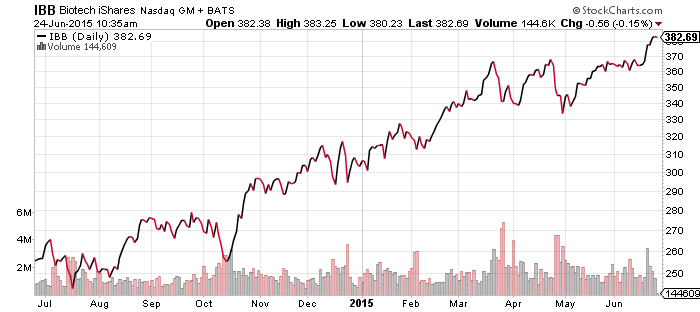

At the other end, healthcare remains the stalwart leader of this bull market. For at least a couple of weeks, we’ve been watching the large cap biotechnology space for signs of a breakout. Last week it moved up, breaking out from a nearly 4 month sideways trading range.

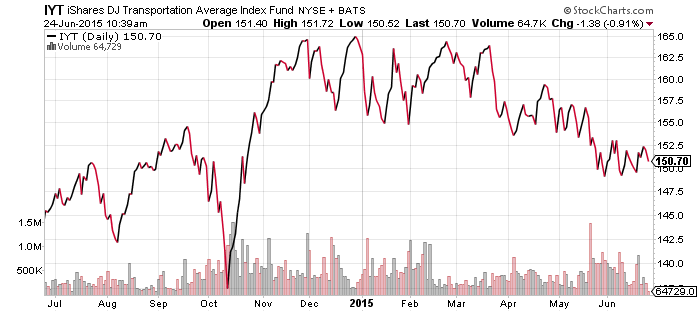

iShares Dow Transports (IYT) held steady in the past week, but a move lower remains the more likely path over the short-term.

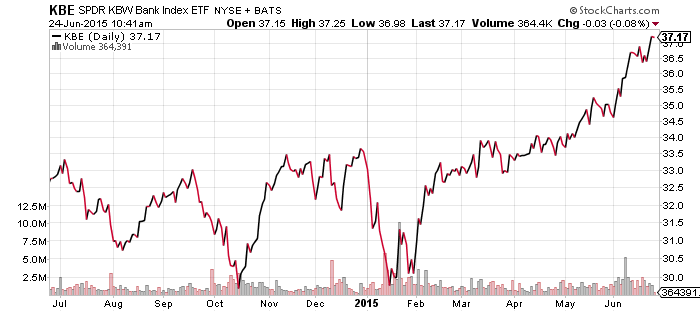

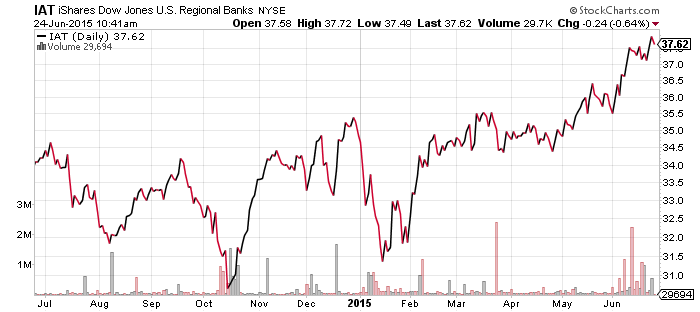

Bank stocks rebounded along with interest rates last week and remain one of the strongest sectors in the market at the moment.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

S&P Midcap 400 (MDY)

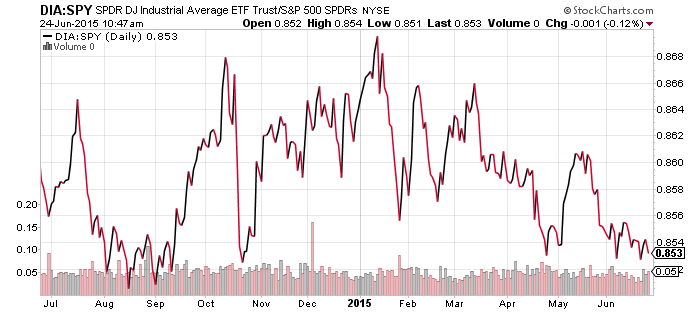

SPDR DJIA (DIA)

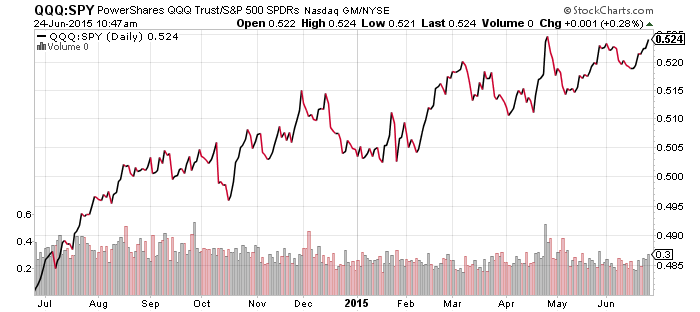

PowerShares QQQ (QQQ)

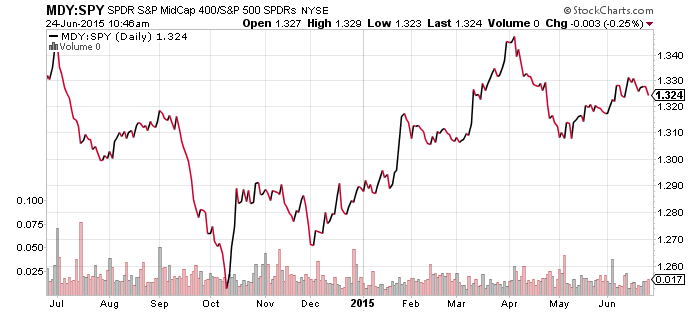

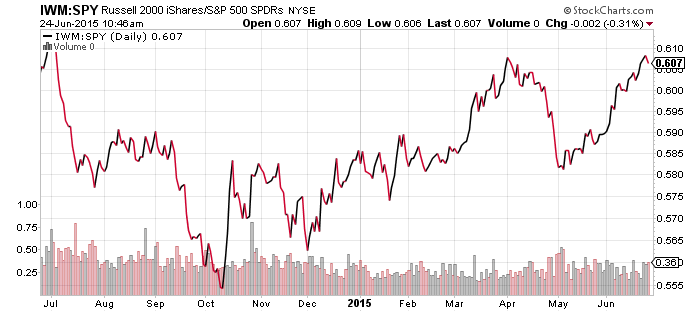

Small-caps have broken away from mid- and large-caps, while the Nasdaq continues to do well versus the S&P 500 Index. The Dow Jones Industrial Average continues to underperform. IWM and QQQ have been taking turns leading the market since October, but small-caps are in a slight uptrend versus the tech-heavy index. Mid-caps are still leading the broader market this year, but they haven’t followed small-caps higher over the past month.

db X-Trackers Harvest CSI 300 China A-Shares (ASHR)

The main Shanghai board fell 13 percent last week as the Chinese rally suffered a correction, but shares recovered midday on Tuesday. On a 1-year chart, the drop doesn’t look like much because shares are still up more than 125 percent after the drop. Regulators are partially blamed for the decline because they cracked down on margin, but they cannot directly control outside lenders. China’s margin rules are similar to those in developed markets, but some investors are leveraged 4 to 1 or more thanks to loans from credit companies. The government hopes to restrain leverage and slow the advance of the bull market.

iShares MSCI Ireland (EIRL)

Although Europe is in turmoil over the situation in Greece, EIRL broke out to a new 52-week high last week. The country is also deeply in debt, but it made the tough choices back in 2008 and 2009. Since 2012, shares have been in an uptrend.