The S&P 500 Index and the Dow Jones Industrial Average both climbed to new highs over the past week, as did the Nasdaq 100, which tracks the 100 largest stocks in the index. The Nasdaq Composite remains a bit weaker, but is showing signs of improving momentum. In contrast, the Russell 2000 remains the primary source of weakness in an otherwise strong market.

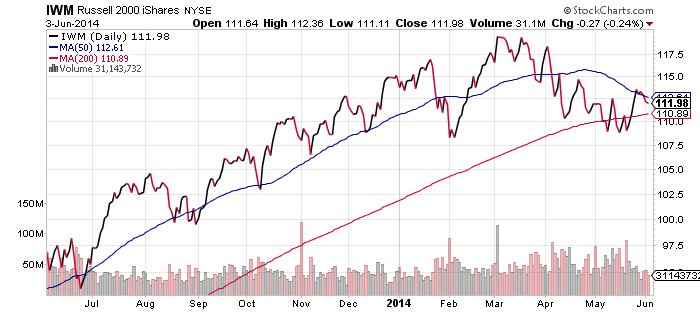

iShares Russell 2000 (IWM)

Last week, we noted the Russell 2000 was above its 200-day moving average and had crossed above its 50-day moving average. It looked as though a strong rally was ready to commence. Instead, as the chart below shows, the small cap index followed its 50-day moving average lower. The 50-day moving average is likely headed for a bounce off of the 200-day moving average. The last time the two moving averages were this close was April 2012. As long as IWM holds above this line, this should be a good buying opportunity. If it breaks lower, then IWM will likely experience a death cross, where the 50-day falls below the 200-day moving average. It wouldn’t be a majorly bearish signal for the overall market, but it would be a sign that small caps will take longer to join the current rally.

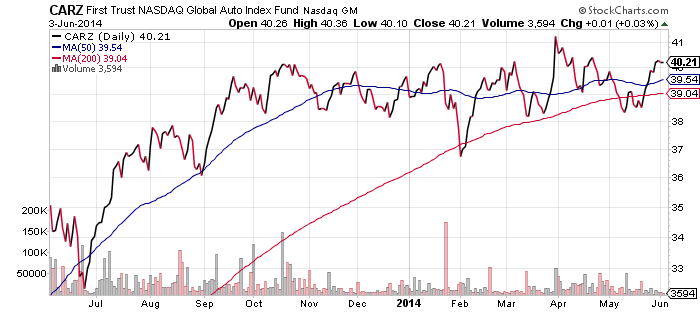

First Trust Nasdaq Global Auto (CARZ)

Investors who are bullish on the global economy should keep an eye on CARZ. In general, auto companies did well in 2013, even though their momentum slowed in September. It has been sideways movement since, save for a very small decline in late January when the rest of the market sold off. The Dow Jones Transports has been very strong though, suggesting the economy is picking up. Auto sales should follow and a gain of less than 3 percent would put CARZ at a 52-week high.

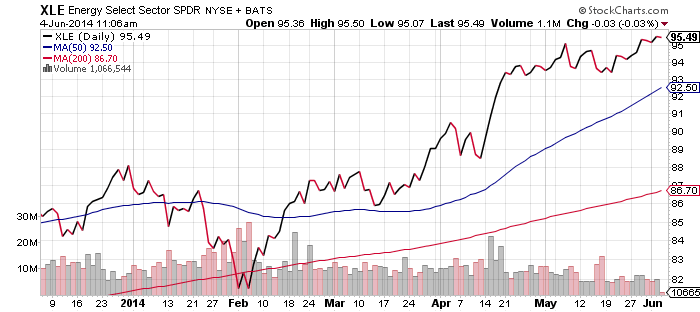

SPDR Energy (XLE)

Energy shares broke out to a new high over the past week, including the sub-indexes of oil exploration & production and oil services. For now, energy remains one of the market’s strongest sectors and the breakout confirms its leadership position.

SPDR

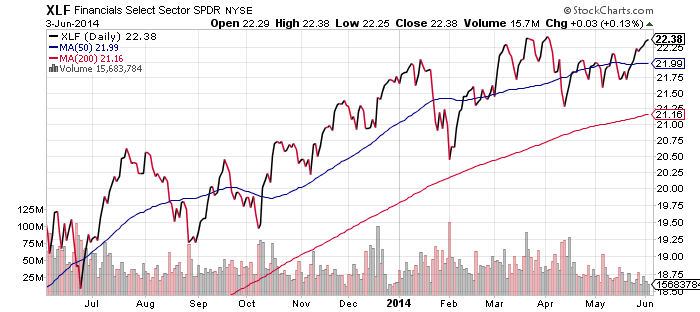

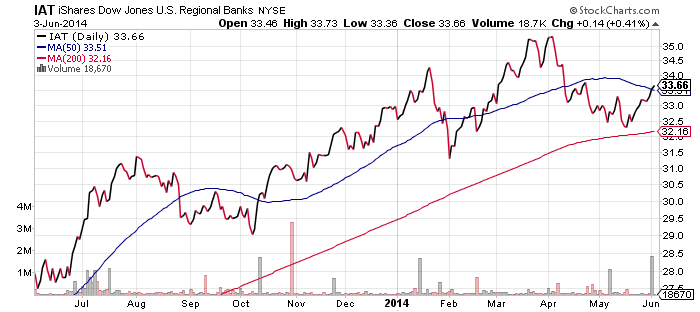

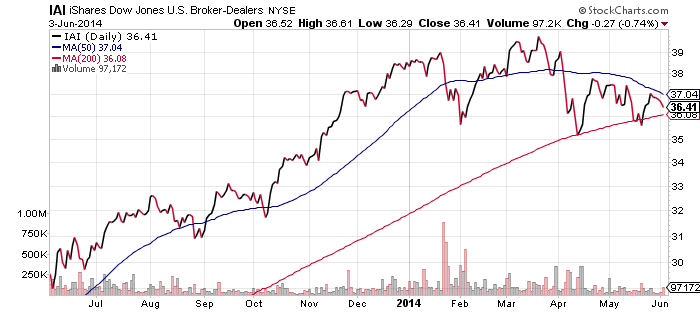

SPDR Financials (XLF)

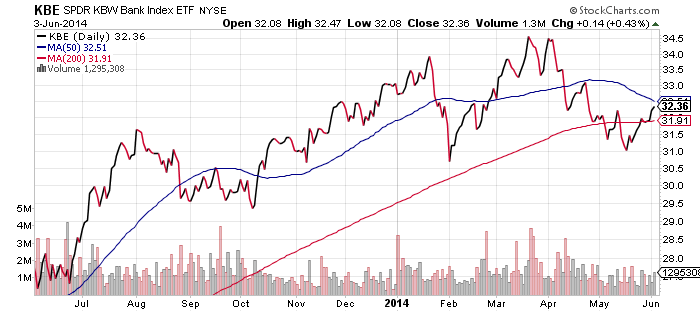

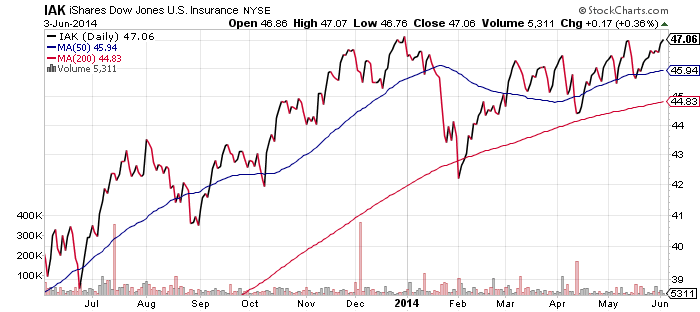

Financials have struggled in 2014, but the sector looks poised to hit new highs in the week ahead. The charts below show the performance of various sub-sectors. Investment related firms (including exchanges) are weighing on performance. This is due to very low volatility in the markets, which has kept trading volume subdued. May was one of the calmest and quietest months for the financial markets it decades. This cannot last, with the likely resolution being a move higher. The financial sector is the second largest in the S&P 500 Index and a breakout would add strength to the overall market.

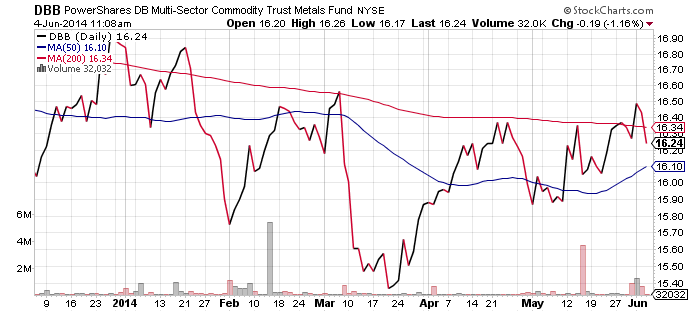

PowerShares DB Base Metals (DBB)

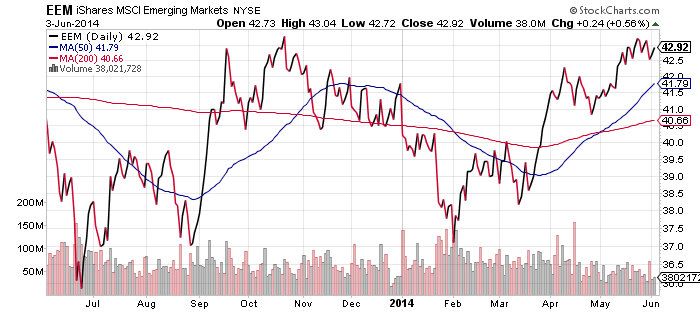

iShares MSCI Emerging Markets (EEM)

Last week, it appeared that EEM was going to break out to a new multi-year high. Instead, the fund turned lower (though still not far from a new 52-week high). DBB was looking to climb above its 200-day moving average, and it accomplished the feat, but has given up this gain in early trading on Wednesday.

Both of these funds are heavily influenced by the Chinese economy and they are unlikely to trade in opposite directions due to China’s global influence. The move in DBB highlights this correlation. Today, news of missing copper and aluminum from a single port warehouse in Qingdao caused copper prices to sink. DBB, as well as copper, could soon test their series of higher lows since March.

The missing metals were discovered when investigators tried to match trade receipts. Many Chinese companies issue fake trade reports in order to obtain bank financing, even though no metal exists. Due to the increasing number of bad loans, the risk is banks will seize whatever metal they can find and sell it into the market, whereby depressing global prices.

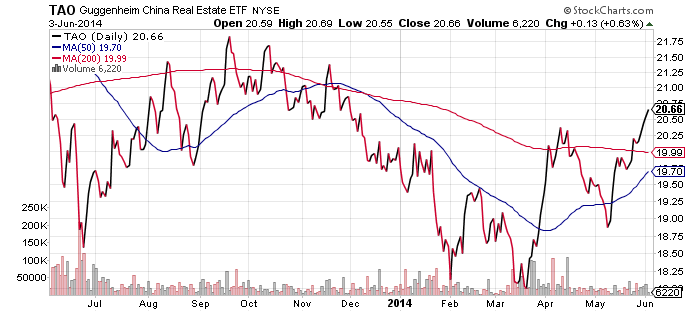

Guggenheim China Real Estate (TAO)

Shares of Chinese real estate developers have rallied and broken a downtrend that had been in place for the better part of 9 months. The next step would be for the fund to break the downtrend that began in 2013, which would require the rally to continue above $21 per share. That level isn’t far away, as the fund closed at $20.66 yesterday. This is a crucial fund to watch because China’s economic situation is closely tied to the real estate market.

While many China ETFs have rebounded over the past couple of months, TAO would be one of the first to break out of its intermediate term downtrend. This is also the point at which a rally is most likely to fail, as it is facing a major resistance line. Therefore, what happens could be a meaningful signal for the direction China related assets will take over the coming weeks and months.