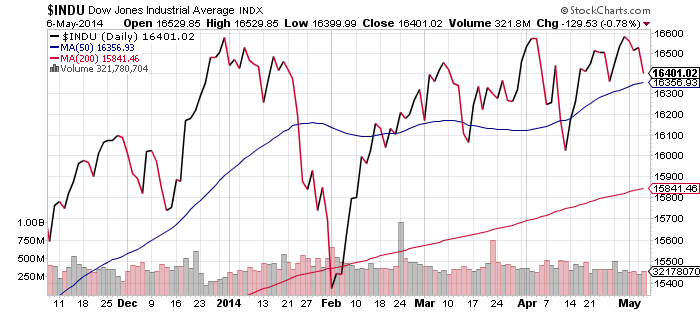

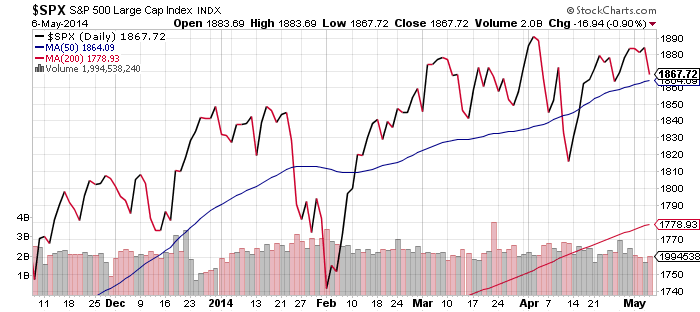

This week we will start with a look at the Dow and S&P 500 Index, as both of these broad indexes are bouncing off overhead resistance. This is the same trend we have seen for weeks – choppy sideways action as the market consolidates. What is very positive for investors is stocks have some room to fall without threatening the short-term bullish outlook for the market, let alone the intermediate or long-term picture. As it stands now, a breakout rally remains likely in the near future and it is important to remain patient through the current sideways action.

The reason why the indexes are moving sideways is because many sectors are not moving up or down in concert. Below, we will detail some sectors which are moving in opposite directions.

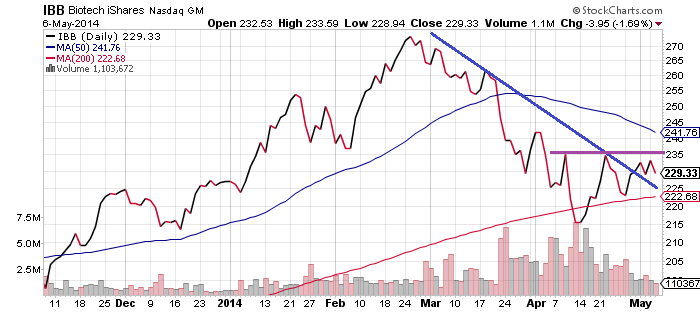

iShares Nasdaq Biotechnology (IBB)

Biotechnology finally broke out of its downtrend last week (moved above the blue line on the chart). This doesn’t signal a bullish break, but it does represent a solid sign that the pace of selling has declined.

The area to watch for a bullish move is $235, which IBB hit twice but failed to move beyond. If the Dow and S&P 500 are able to move higher, it would not be a surprise to see a bounce in biotechnology over the coming weeks.

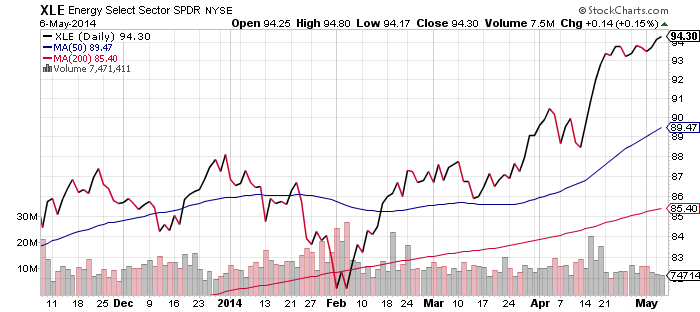

SPDR Energy (XLE)

A number of energy stocks broke out to new highs in the past week and this sector remains the catalyst attempting to move the indexes higher. Interestingly, not all energy ETFs have moved in a similar fashion. The iShares Exploration & Production ETF (IEO) hit a new high, but the SPDR version (XOP) did not, nor did iShares Oil Service (IEZ). Crude oil prices dipped last week, creating some headwind for the sector. However, based on the current trend, many of the stocks in the sector could advance over the next week.

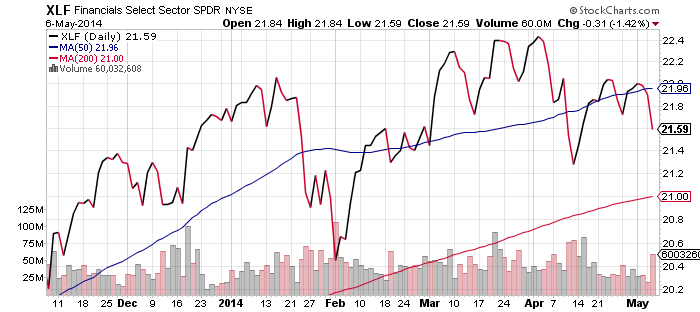

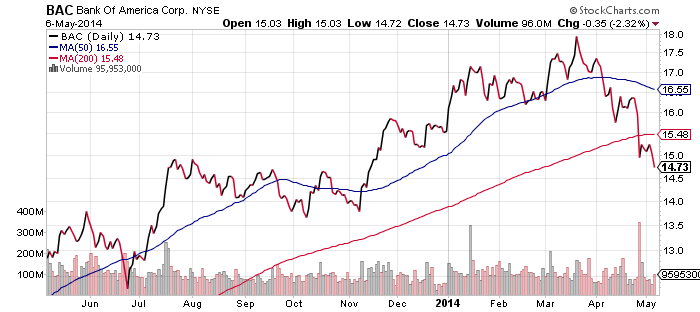

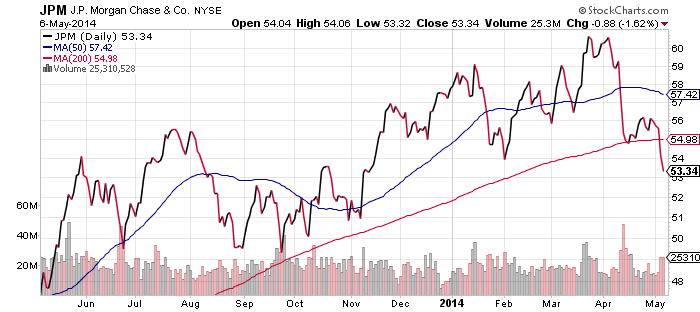

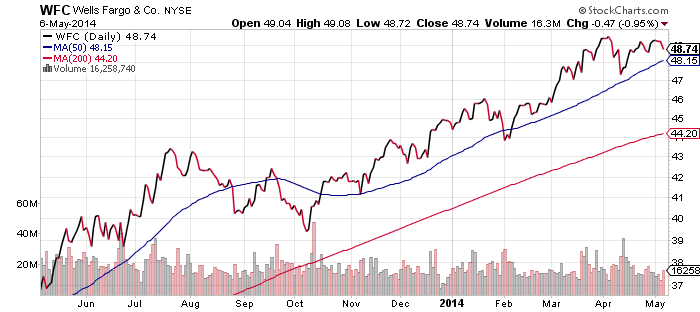

SPDR Financials (XLF)

Moving in the opposite direction of energy was financials. Bank of America (BAC) and J.P. Morgan (JPM) have delivered some bad news and because they are so large, they can meaningfully impact financial ETFs. The entire sector has been hit by weakness: even better performing Wells Fargo (WFC) has been dragged down by selling over the past week.

Financials are important for the broad indexes. At 16 percent of assets in the S&P 500, the financial sector is much larger than the energy sector, which only makes up 10.8 percent of assets.

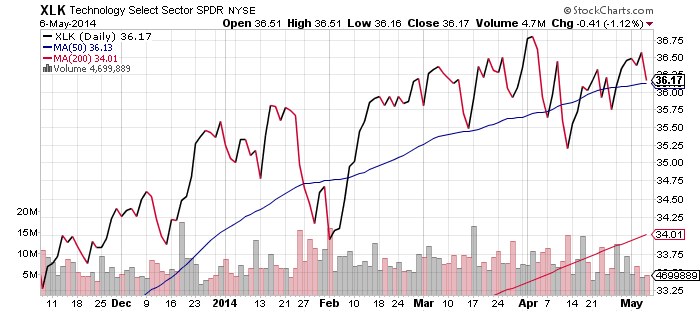

SPDR Technology (XLK)

Technology comprises 18.5 percent of the S&P 500, but its chart is moving in a similar manner to the broader indexes. At this point in time, the sector is not a leader pushing the market upwards or downwards. This is quite positive as the Nasdaq has been the source of weakness in March and April. The relative calm in XLK is evidence of the concentrated selling is limited to technology sub-sectors such as social media.

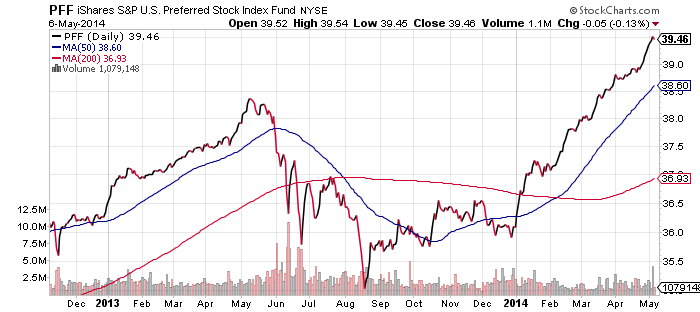

iShares S&P U.S. Preferred Stock (PFF)

One of the surprisingly strong ETFs of 2014 is preferred shares. The march higher is impressive for the asset class, as it has made nearly a 10 percent move in only four months. Why investors are pouring into the sector is a good question. One reason why they are in favor now is because preferred shares can offer a higher yield, but with less credit risk. PFF yields 5.9 percent (30-day SEC yield) versus 5.5 percent for iShares High Yield Corporate Bond (HYG). Additionally, this is a signal that investors are looking for a bit more safety given the choppy action in stocks this year.

We’ve also seen strength in bonds. If this is an indication of investor expectations surrounding interest rates and inflation, the yield on preferred shares would be highly attractive for those who think 30-year Treasury yields will fall below 3 percent.

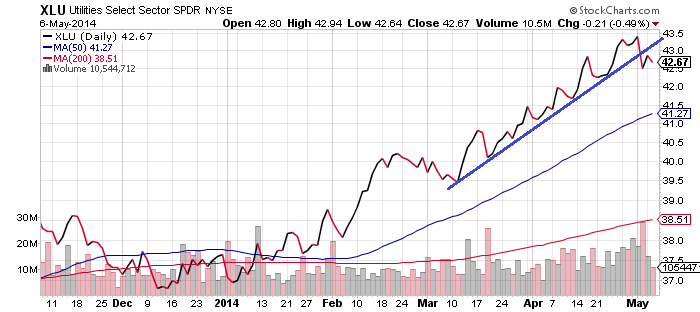

SPDR Utilities (XLU)

Utilities has been the strongest sector in the S&P 500 Index this year. As the chart below shows, XLU has broken the upward trendline after the March and April advance. While this not necessarily a bearish sign, it does indicate the fund may not advance as quickly. This could also be an early signal for the S&P 500 and Dow to move higher, since a breakout would push some defensively positioned investors out of utilities and into more aggressive sectors such as energy and technology.