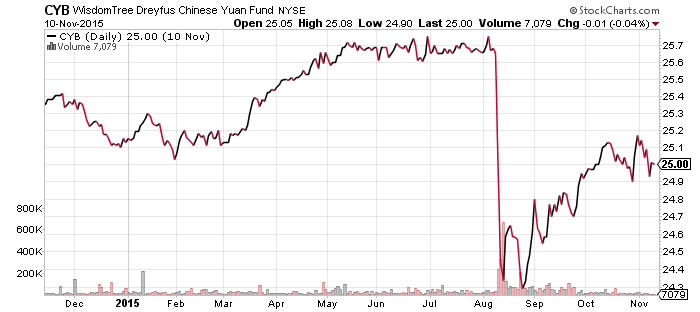

WisdomTree Chinese Yuan (CYB)

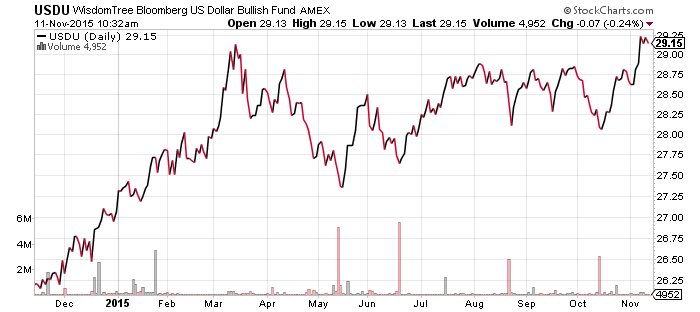

WisdomTree Bloomberg USD Bullish (USDU)

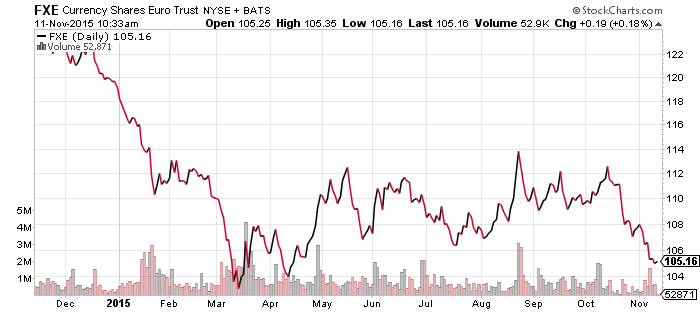

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

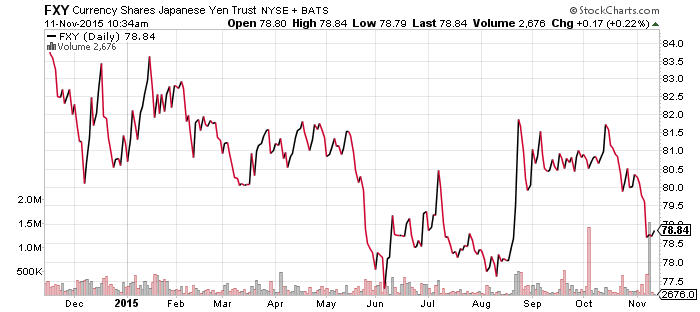

CurrencyShares Japanese Yen (FXY)

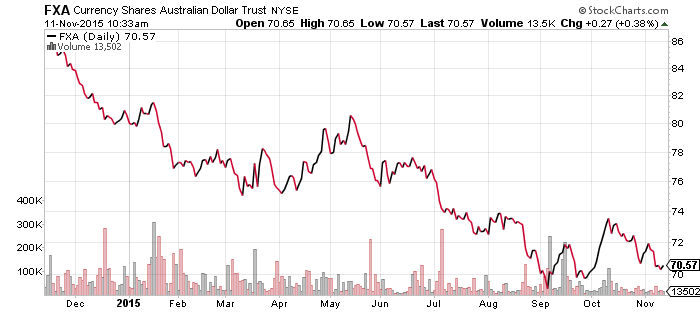

CurrencyShares Australian Dollar (FXA)

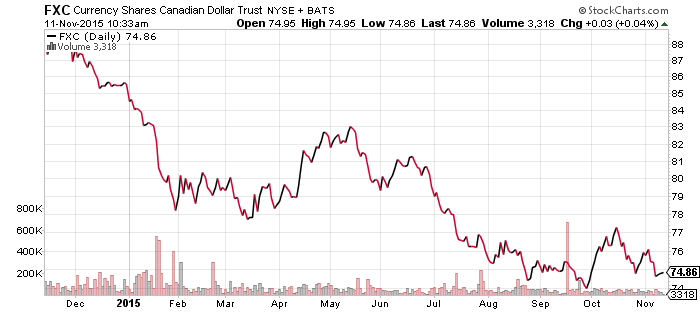

CurrencyShares Canadian Dollar (FXC)

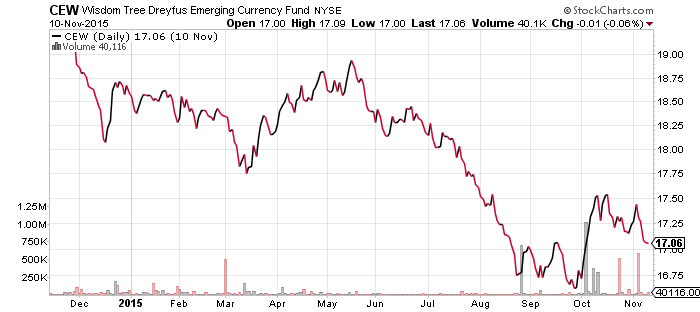

WisdomTree Emerging Market Currency (CEW)

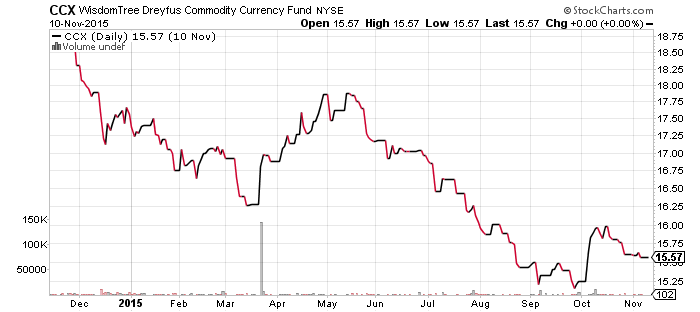

WisdomTree Commodity Currency (CCX)

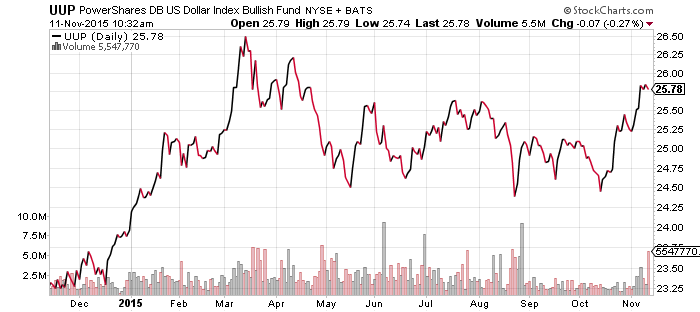

PowerShares DB U.S. Dollar Bullish Index (UUP)

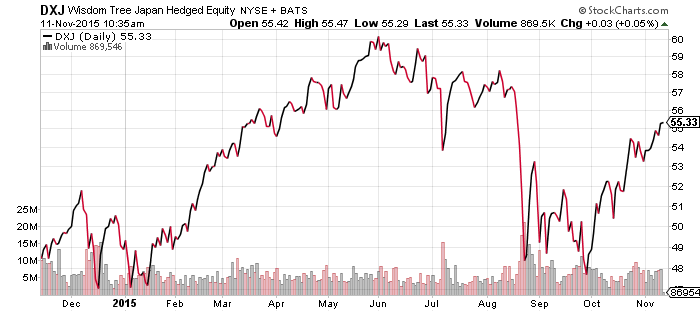

WisdomTree Japan Hedged Equity (DXJ)

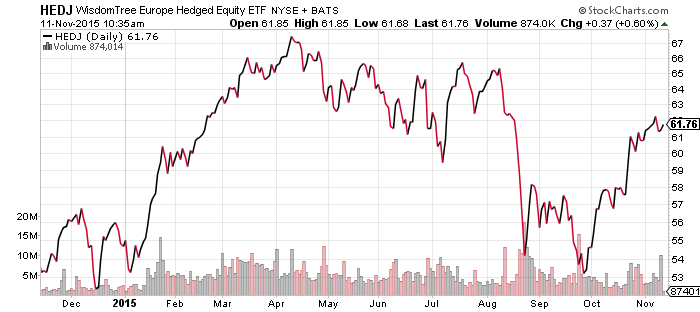

WisdomTree Europe Hedged Equity (HEDJ)

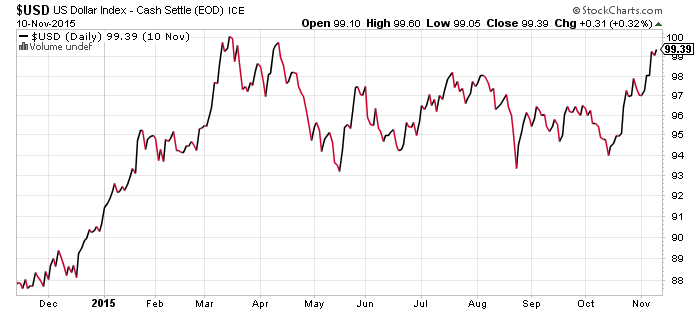

Speculators expect a rate hike in December following a strong jobs report for October and aggressive comments from the Fed, raising the odds to 68 percent by the end of the year. Currency traders responded to those developments by bidding the U.S. dollar higher, sending the Bloomberg U.S. Dollar Index, tracked by USDU, to a new 52-week record. In contrast, the Swiss franc and Swedish krona are on the verge of new 52-week lows.

Although the dollar has gained approximately 5 percent since mid-October, investors should proceed with caution. A pullback is possible over the short-term, but it would likely be short lived and relatively limited in size.

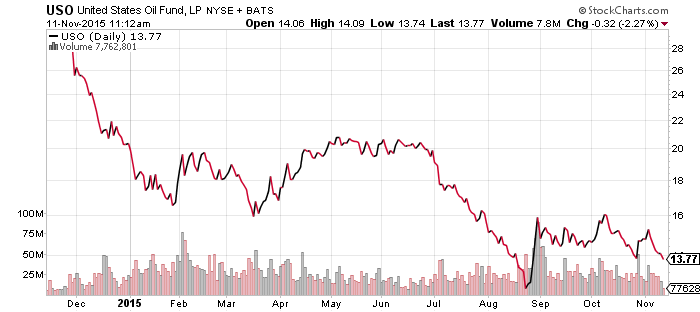

United States Oil (USO)

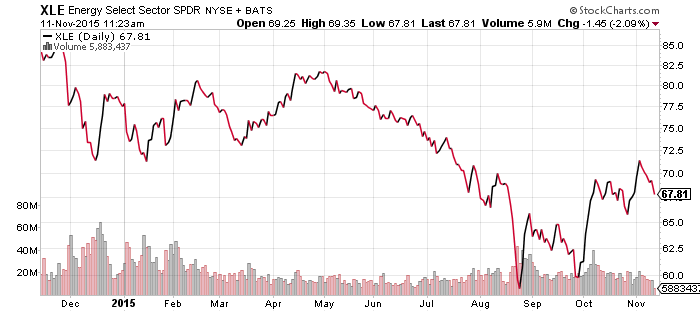

SPDR Energy (XLE)

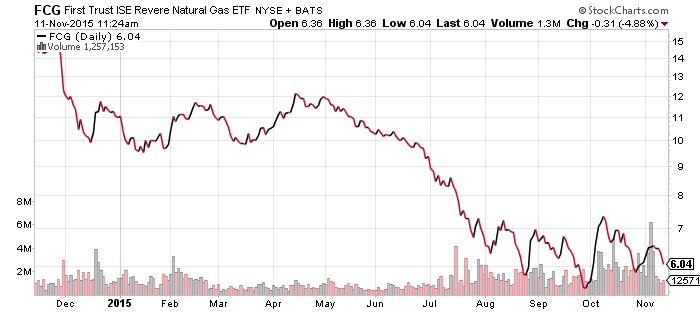

FirstTrust ISE Revere Natural Gas (FCG)

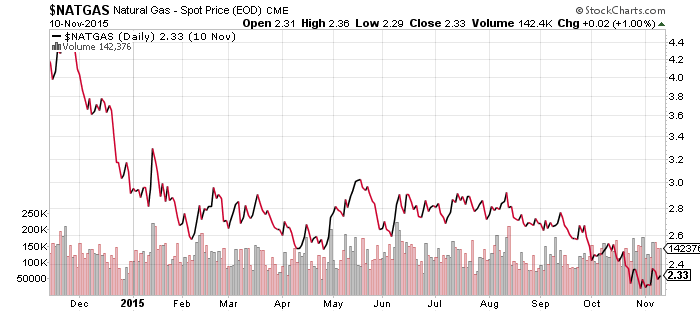

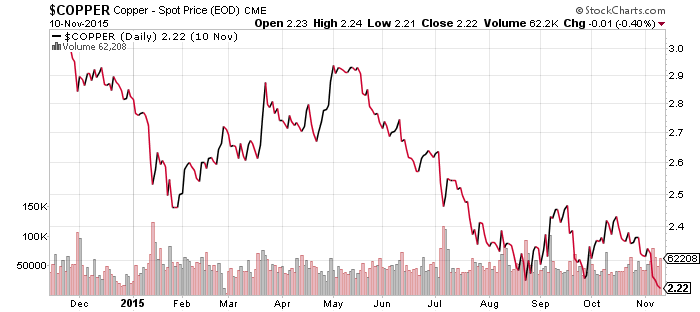

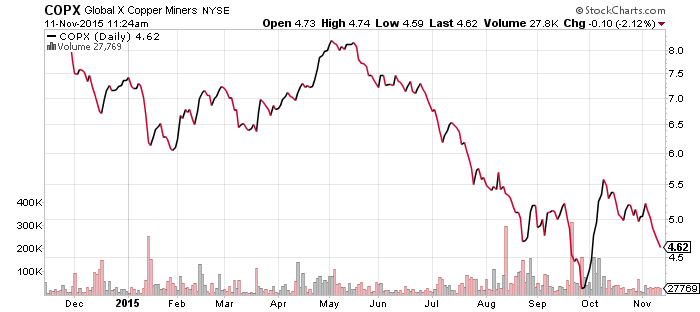

Global X Copper Miners (COPX)

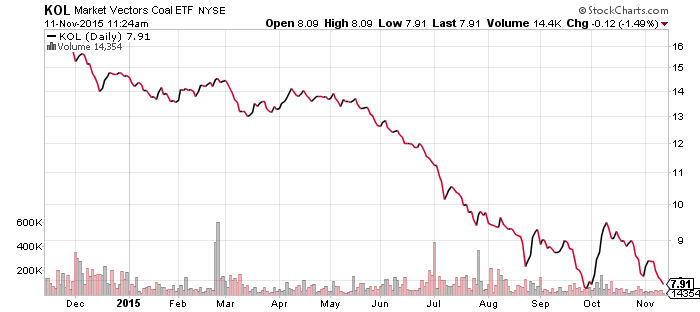

Market Vectors Coal (KOL)

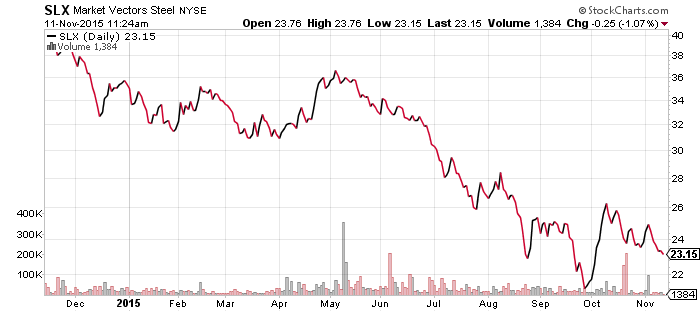

Market Vectors Steel (SLX)

Oil is now testing the low end of its support range, which is $43 for West Texas Intermediate Crude and the $13.60 for USO. The uptrend in XLE since late September is also under pressure and may not survive if oil continues to slide.

Copper is at a new 5-year low and KOL is still losing ground. COPX and SLX are also vulnerable to declines in oil and should be monitored closely.

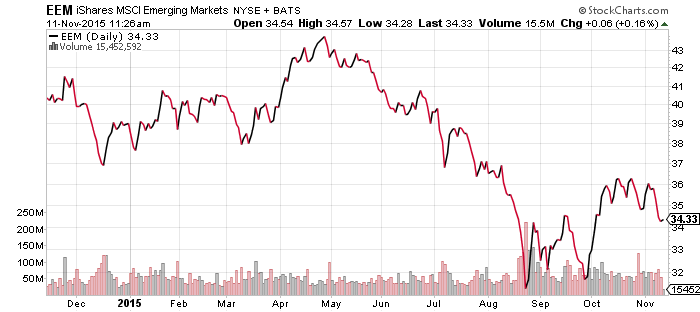

iShares MSCI Emerging Markets (EEM)

Emerging markets fell over the past week due to the outperformance of the U.S. dollar. If EEM can stay at or above $34 it will signal that the robust move in August remains intact.

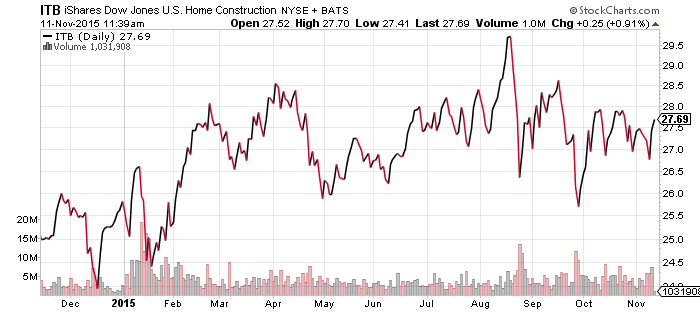

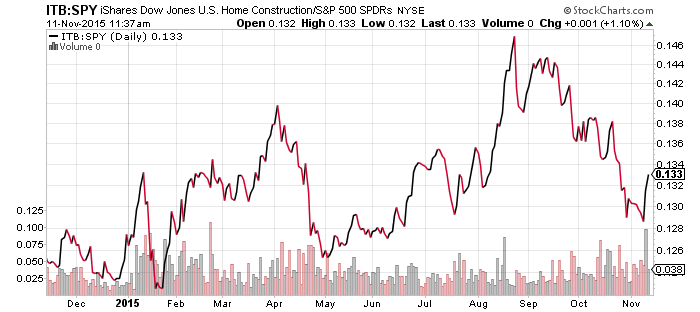

iShares US Home Construction (ITB)

Housing rallied this week despite the rising odds of a rate hike, but remains in a downtrend since August relative to the broader market. It has also stagnated, hovering between $27 and $28. There will be no housing data until next week’s release of the home builders index for November.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

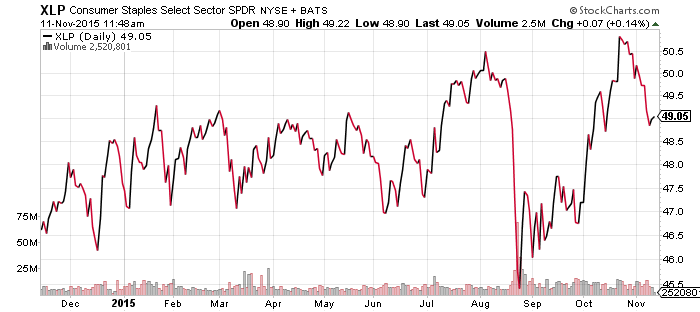

SPDR Consumer Staples (XLP)

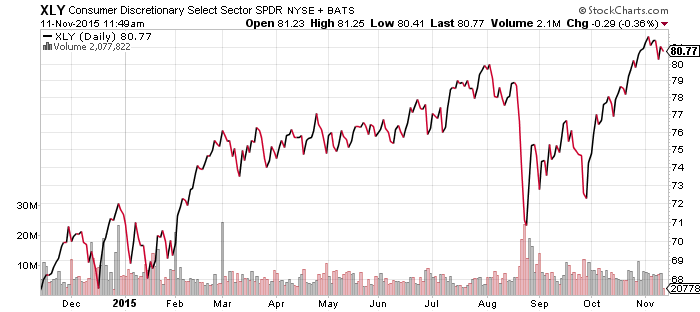

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

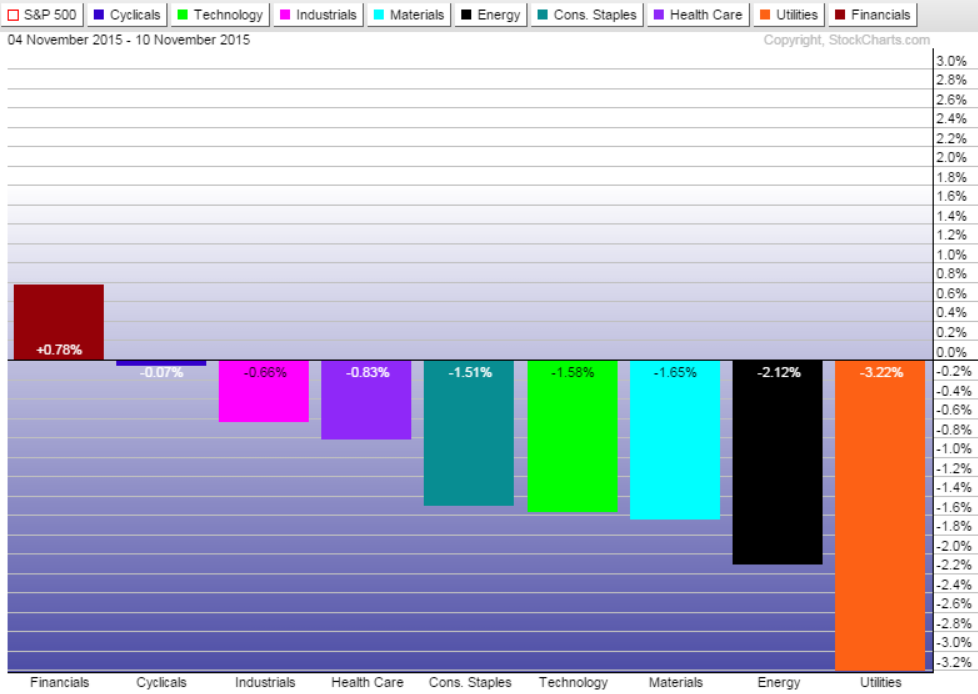

SPDR Financials (XLF)

The financial sector performed well from November 4 through November 10 in response to rate hike rumors. Utilities proved to be last week’s weakest-performing sector and is also the most rate-sensitive among the S&P 500 sectors.

Biotechnology has a chance to break from its recent downtrend over the coming days, which is positive for the broader healthcare sector.

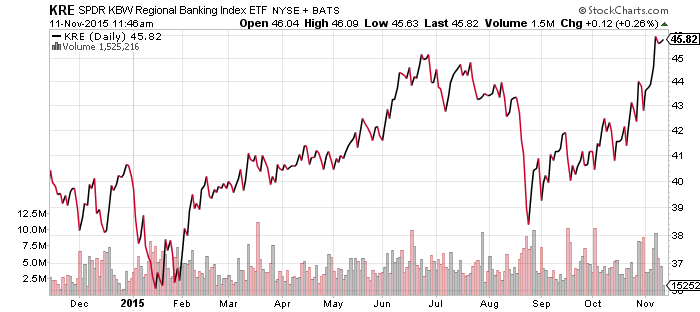

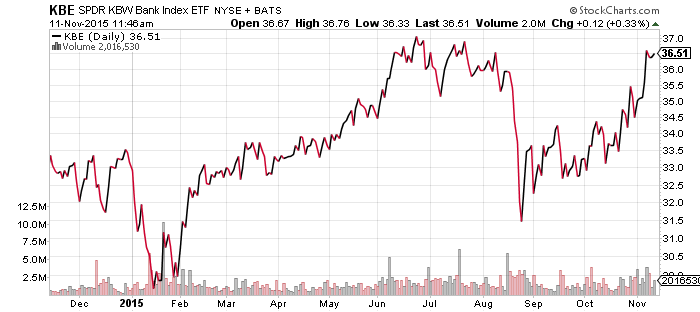

Regional banks recently broke out to a new 52-week high, while larger banks continue to lag their smaller competitors.

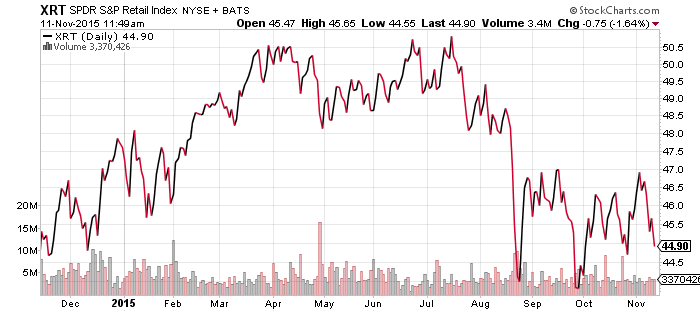

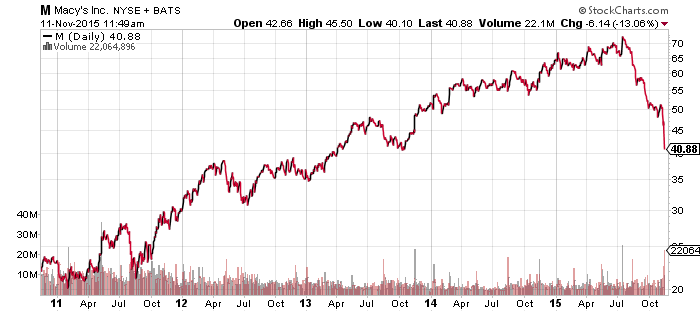

Consumer staples recently hit a new 52-week high, as well, but have since sharply retreated, while consumer discretionary remains near its highs. Retail, meanwhile, has taken a hit and may test its 2015 lows. The latest brick-and-mortar giant to face trouble is Macy’s (M).

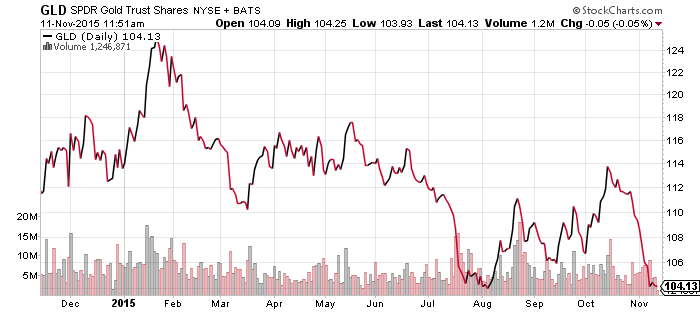

SPDR Gold Shares (GLD)

Gold was once again hit hard by Fed comments and the strong dollar last week. The metal is back near its 52-week low, which is also its 5-year low. This is a deflationary signal for the market; investors typically buy gold when they expect central banks will inflate their currencies. Gold rallied at the start of 2015 when the European Central Bank launched quantitative easing. If gold cannot rally, new lows in commodities such as oil, copper, steel and coal are much more likely.

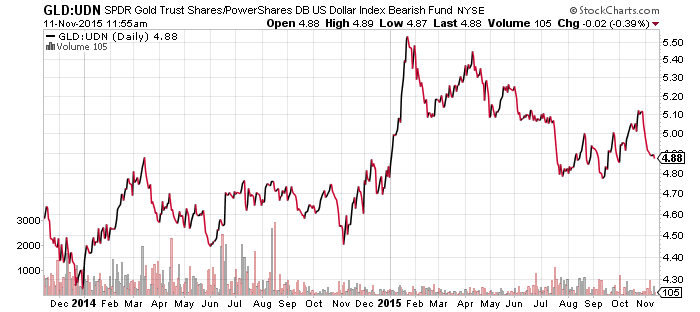

The second chart shows the price ratio of gold to PowerShares U.S. Dollar Index Bearish Fund (UDN), which displays the price of gold versus the foreign currency basket of the index. Gold made a global bottom in 2014 and has been rising or holding steady versus most foreign currencies. Foreign central banks are trying to increase inflation and their efforts are showing up in the gold market.

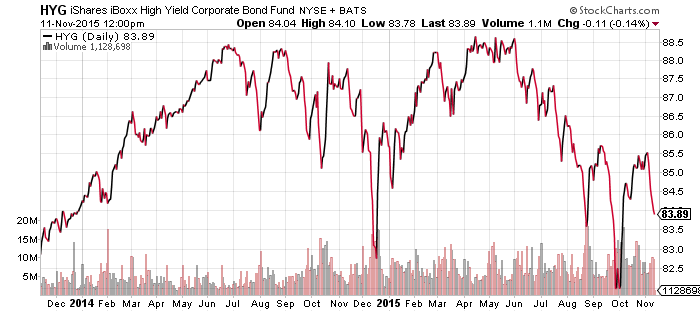

iShares iBoxx High Yield Corporate Bond (HYG)

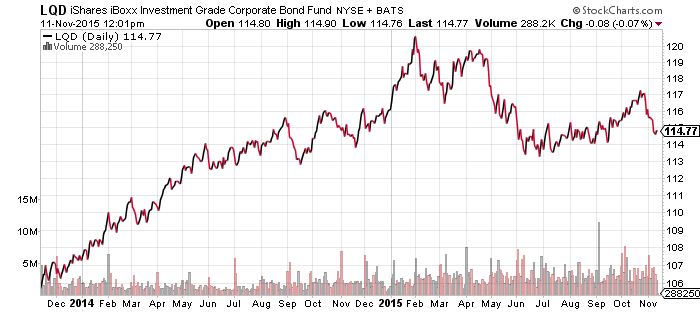

iShares iBoxx Investment Grade Corporate Bond (LQD)

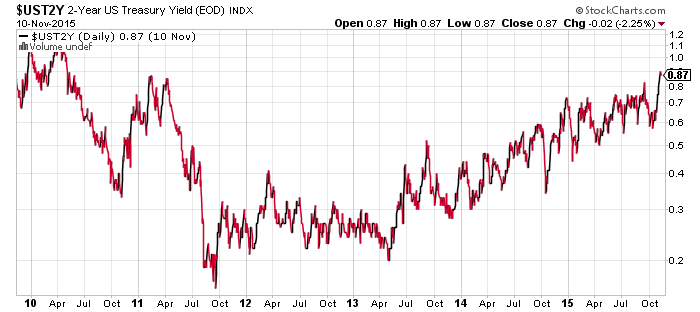

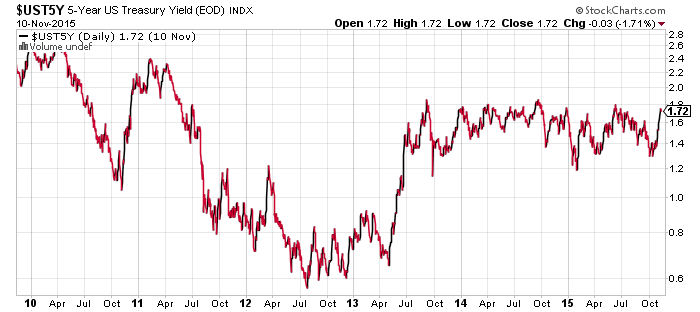

Interest rates continued to weigh on bond funds, with even the less sensitive high yield funds coming under pressure due to rising rates. The 2-year treasury yield is at its highest level since 2010, while the 5-year is on the verge of hitting a high.

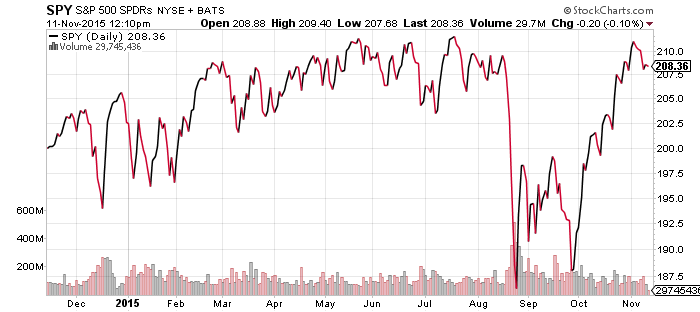

SPDR S&P 500 (SPY)

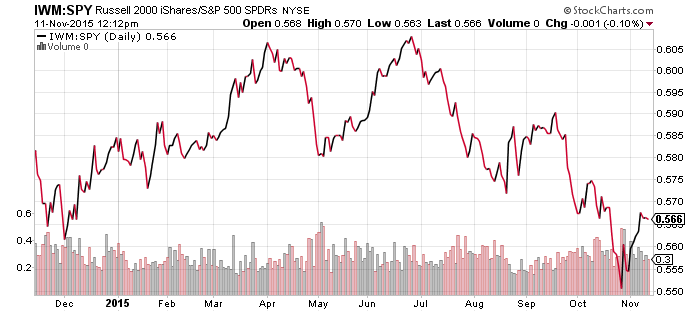

iShares Russell 2000 (IWM)

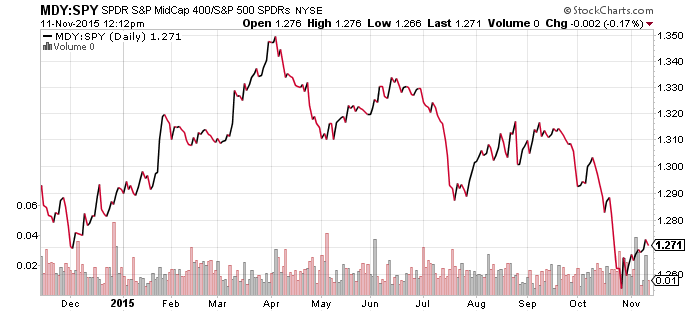

S&P Midcap 400 (MDY)

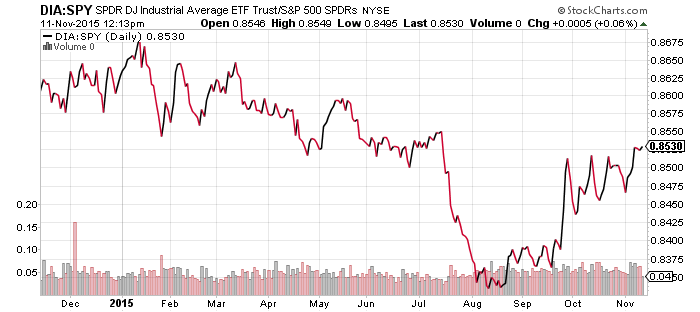

SPDR DJIA (DIA)

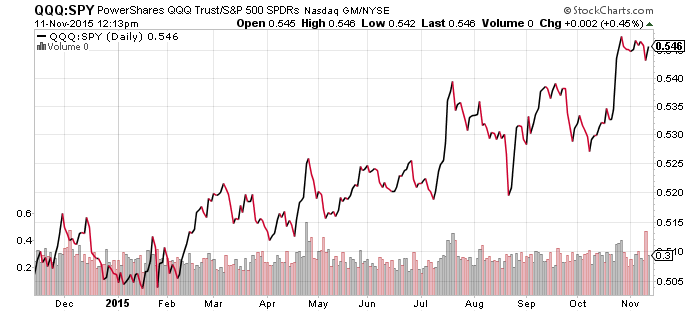

PowerShares QQQ (QQQ)

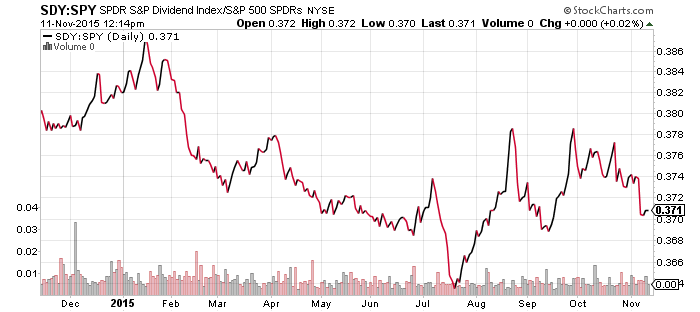

SPDR S&P Dividend (SDY)

Unsurprisingly, the S&P 500 Index rally stalling as it reached its 2015 highs. None of the major benchmarks have made new highs yet, with the exception of QQQ. Given the current bull market, one or more of the other indexes should follow suit in a few weeks.

Both small- and mid-caps have been outperforming since the end of October as rate hike expectations and the U.S. dollar both rise. The Dow also remains in its outperformance trend since August’s correction, alongside the Nasdaq, which has been in a league of its own in terms of consistent outperformance. Fears regarding higher interest rates have weighed on dividend-paying shares, which have dipped versus the broader market.