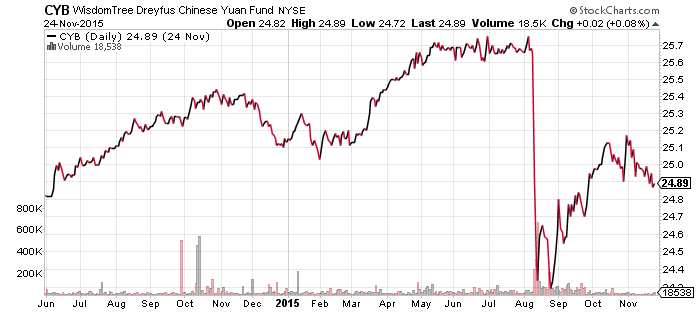

WisdomTree Chinese Yuan (CYB)

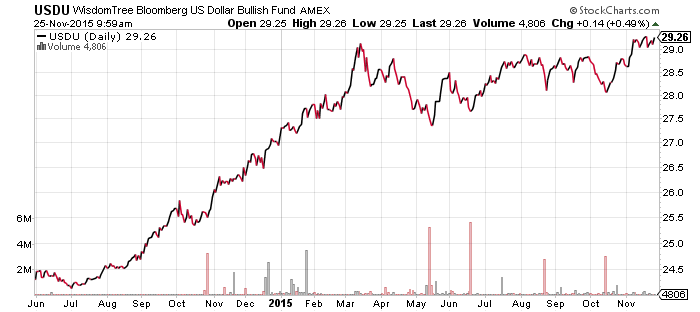

WisdomTree Bloomberg USD Bullish (USDU)

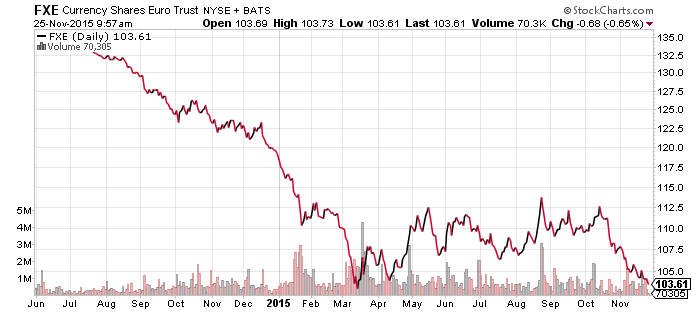

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

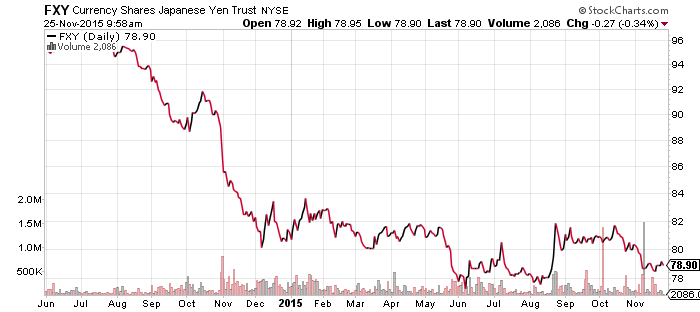

CurrencyShares Japanese Yen (FXY)

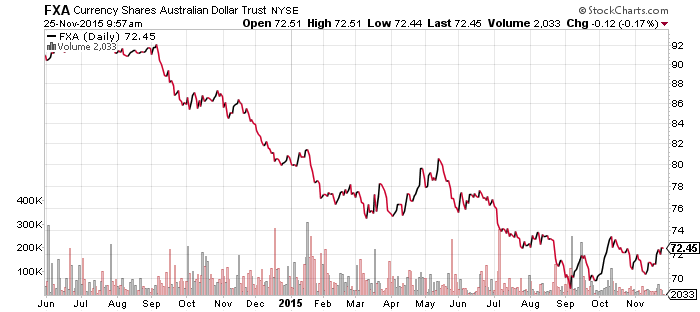

CurrencyShares Australian Dollar (FXA)

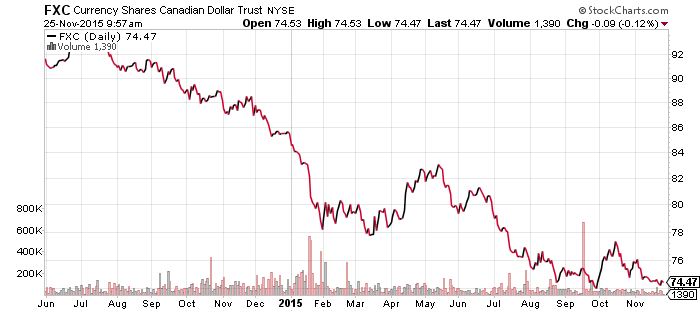

CurrencyShares Canadian Dollar (FXC)

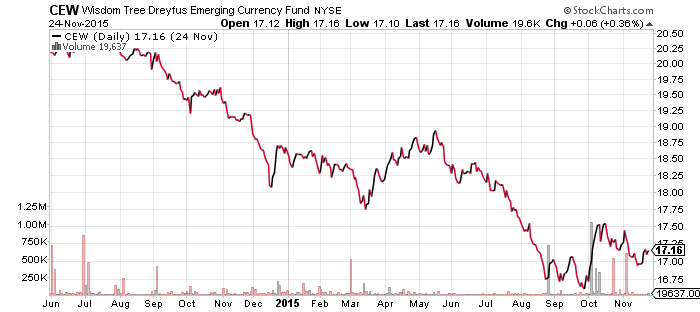

WisdomTree Emerging Market Currency (CEW)

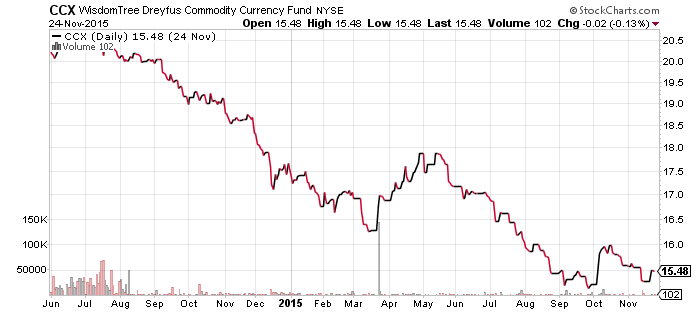

WisdomTree Commodity Currency (CCX)

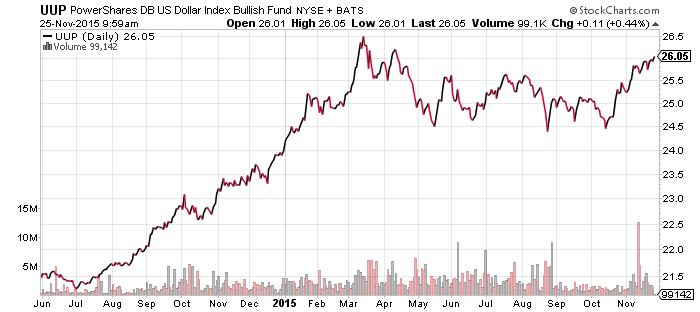

PowerShares DB U.S. Dollar Bullish Index (UUP)

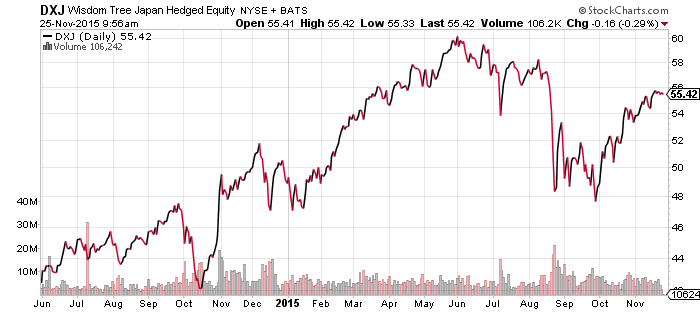

WisdomTree Japan Hedged Equity (DXJ)

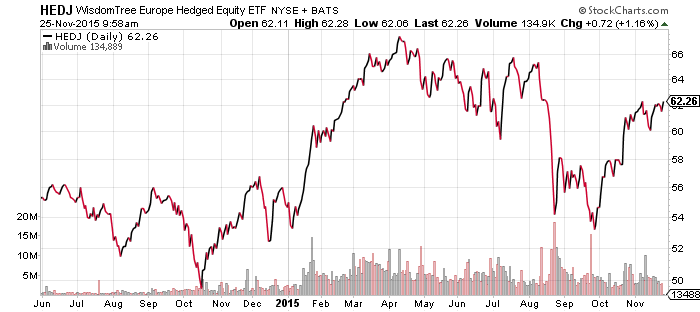

WisdomTree Europe Hedged Equity (HEDJ)

The U.S. economy grew at a 2.1 percent annualized pace in the third quarter, faster than the initial 1.5 percent estimate and in line with forecasts. The accelerated growth is promising for those looking forward to a long-awaited interest rate hike.

European Central Bank officials have made public statements that may indicate increased quantitative easing in December, resulting in a slide for the euro. The Swiss franc ETF (FXF) sank to a new low, but the currency itself continues to cling to its former 52-week low. The Swedish krona is also struggling.

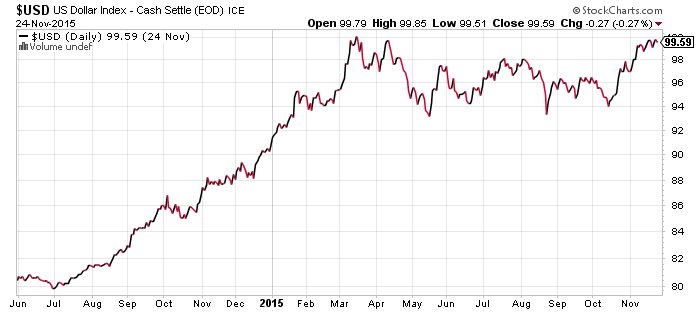

USDU, in contrast, held steady after climbing to a new 52-week high. This reflects the strength of support and we can look forward to another potential break out. Given the overall bullish trend in the U.S. dollar, odds support a resolution in the greenback’s favor.

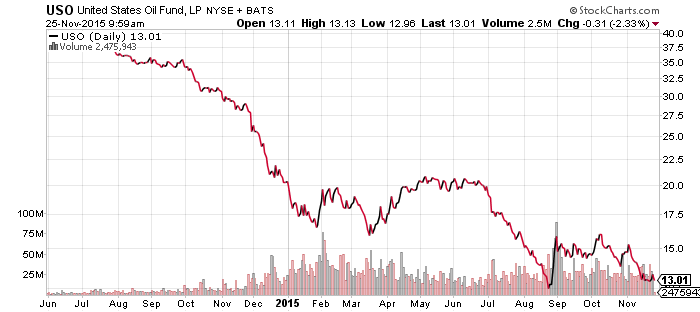

United States Oil (USO)

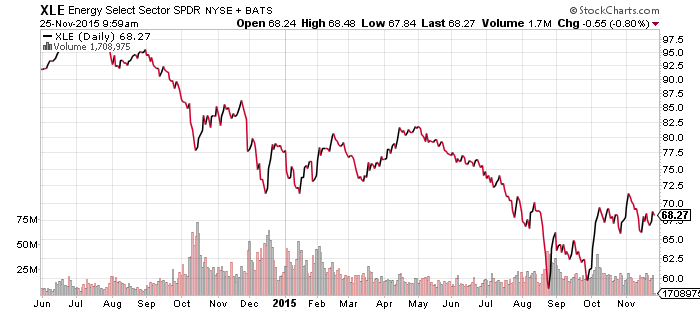

SPDR Energy (XLE)

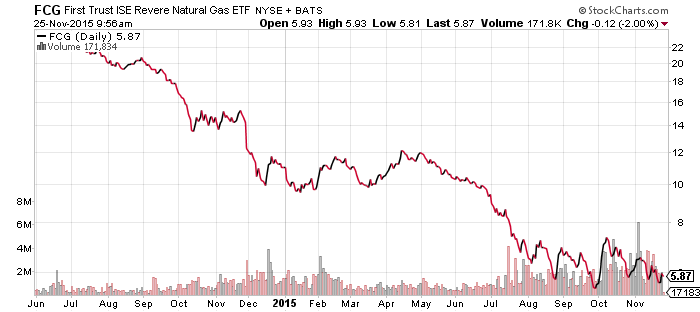

FirstTrust ISE Revere Natural Gas (FCG)

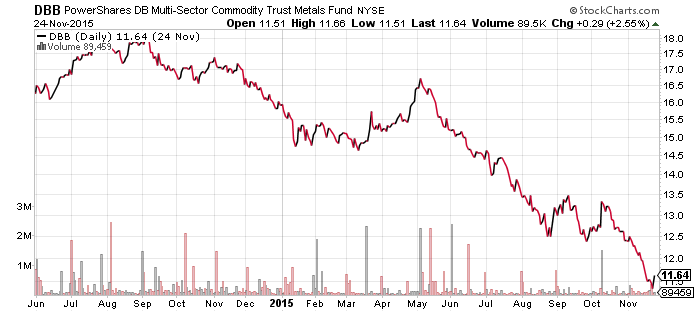

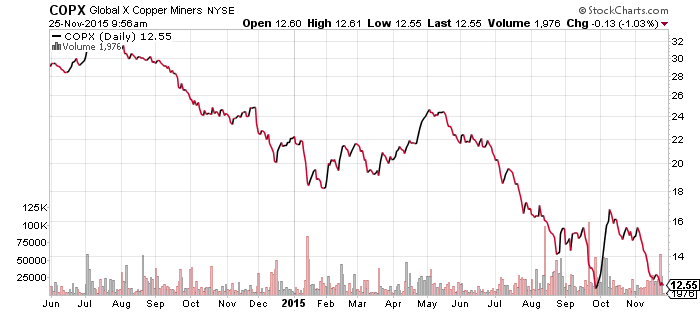

Global X Copper Miners (COPX)

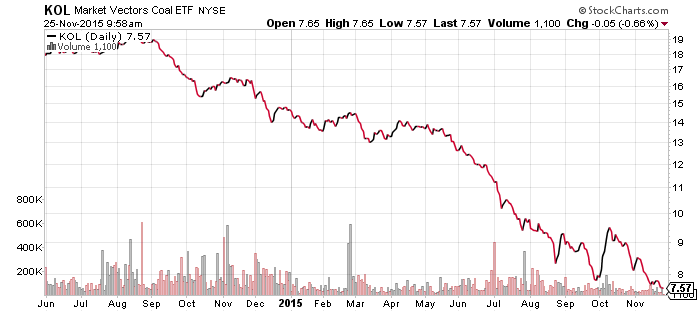

Market Vectors Coal (KOL)

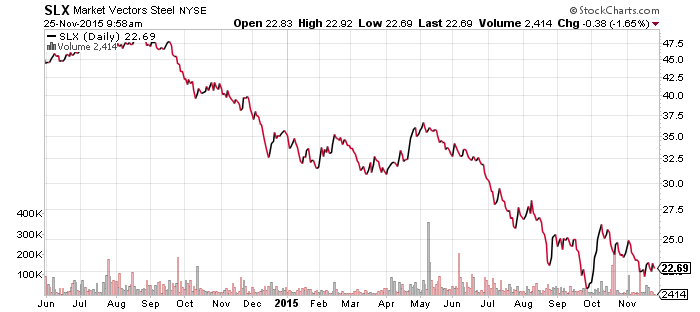

Market Vectors Steel (SLX)

Oil prices remain locked in the lower $40 range due to persistent selling pressure, despite a number of recent events. Saudi Arabia made assertive pledges last Monday, pushing oil prices up about $1 a barrel. The attack launched by Turkey that resulted in a downed Russian fighter plane was reflected in oil markets, which responded by bidding up prices. Geopolitical risk tends to be short-lived; the Russian incursion into Ukraine temporarily sent oil prices above $100 last year, but they quickly crumbled under the weight of fundamental economic forces.

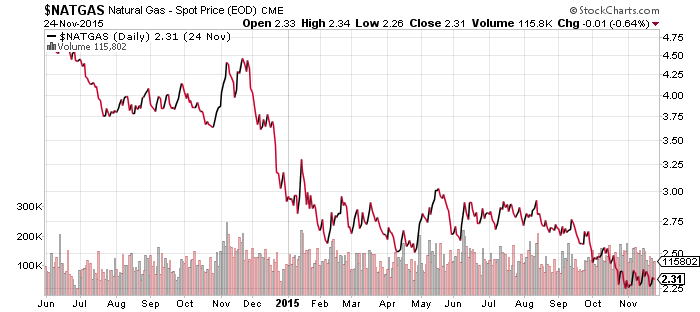

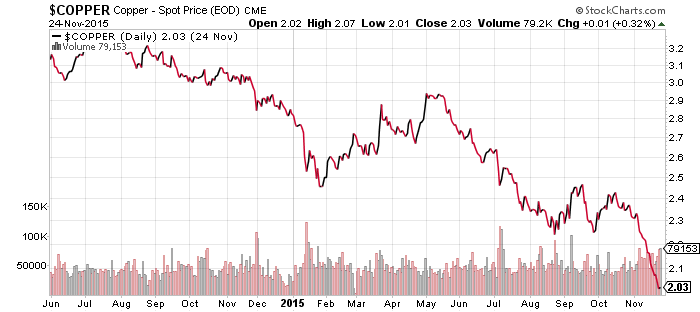

Copper sank to a new multi-year low in the past week, briefly falling below $2 a pound in the futures market.

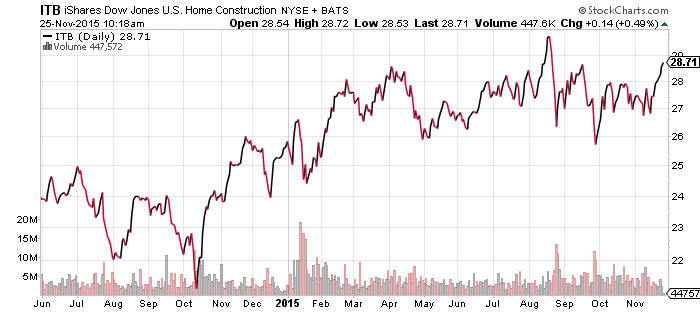

iShares US Home Construction (ITB)

ITB spiked this past week, reversing recent underperformance versus the S&P 500 Index. New homes sales for October were out today and showed a pickup in activity. As rate hike expectations have solidified, the fund has rallied, which is an encouraging sign. The strong housing number further raised rate hike expectations, bringing the odds of a December rate hike up to 78 percent.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

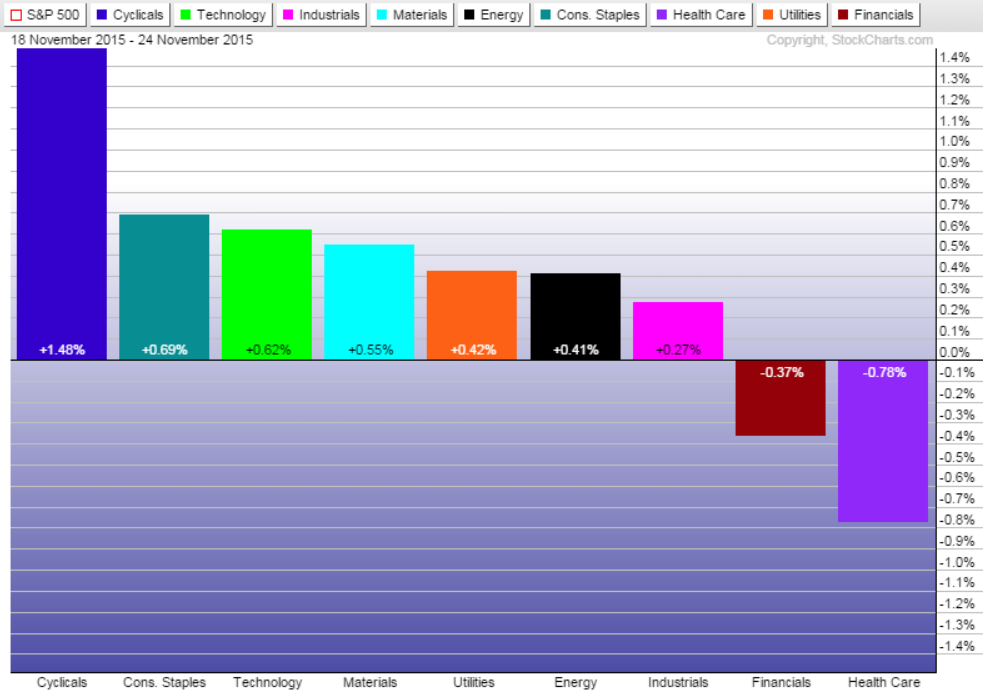

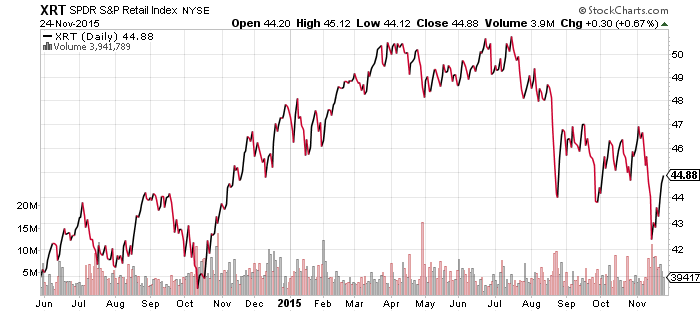

Healthcare was the worst performing sector over the past week, while consumer discretionary was the strongest. Within the consumer sector, retail firms powered the advance as they recovered from recent losses.

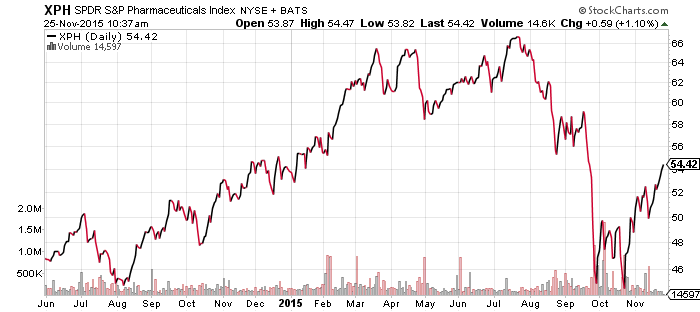

Healthcare is still struggling to recover its former glory. One subsector helping last week was pharmaceuticals, aided by the Pfizer (PFE) offer for Allergan (AGN), which pushed pharma funds to their highest levels since August. Health providers remain under pressure, having steadily lost ground since July. The nation’s largest insurer, UnitedHealth Group (UNH) said it may quit the Affordable Care Act in 2017, due to high costs. UNH is a relatively small insurer within the ACA, but investors are taking its potential exit as a sign others may follow suit.

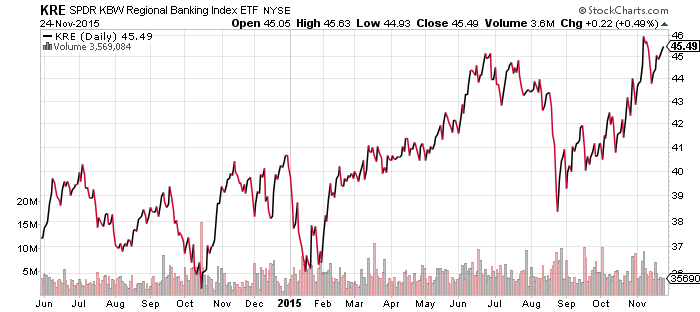

Regional banks rebounded last week, nearer to their highs. Insurers are another emerging financial subsector that is piquing our interest. Insurance companies will benefit from rising interest rates which will increase the profits on the capital held in asset pools used to pay claims.

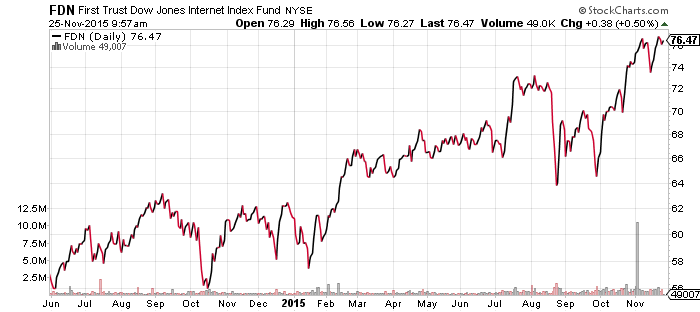

The FANG stocks, Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOG) continued to pull the Internet sector and technology higher last week.

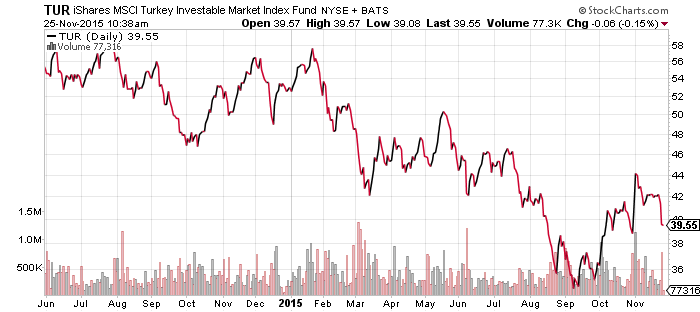

iShares MSCI Turkey (TUR)

The Turkey/Russia tensions rattled global markets on Tuesday. TUR slipped more than 4 percent on the day. Turkey has been immersed in a growing economic crisis and this incident may distract the public from the economy, but won’t change the overall trend.

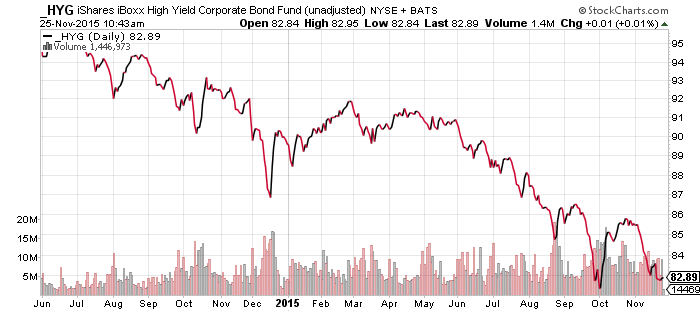

iShares iBoxx High Yield Corporate Bond (HYG)

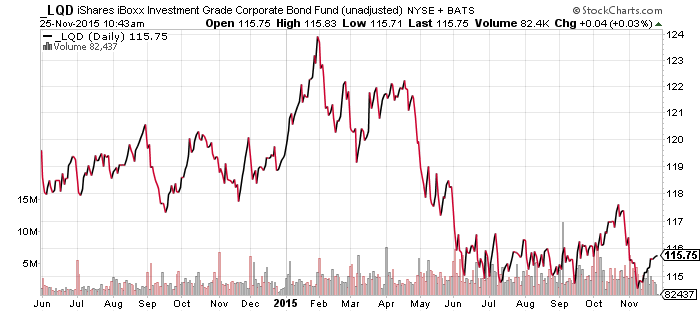

iShares iBoxx Investment Grade Corporate Bond (LQD)

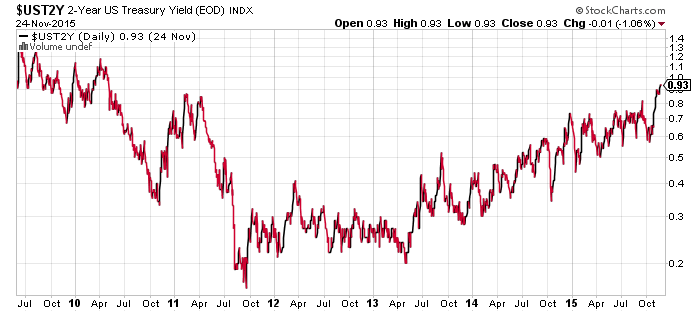

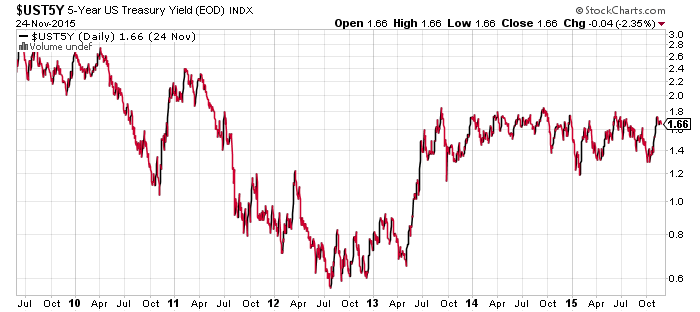

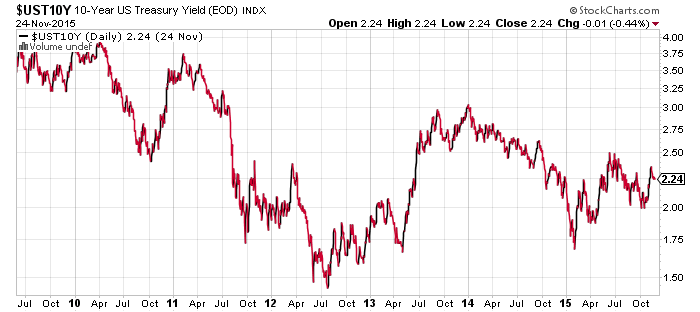

The charts of HYG and LQD show the price without dividends, which approximates the value of the underlying bond portfolio. HYG is approaching its 2015 low and LQD recently bounced off its lows. With rate hike expectations hardening, interest rates are rising across the board. The 2-year treasury yield climbed above its 2011 highs this week. Both the 5- and 10-year treasury yields have been growing as well.

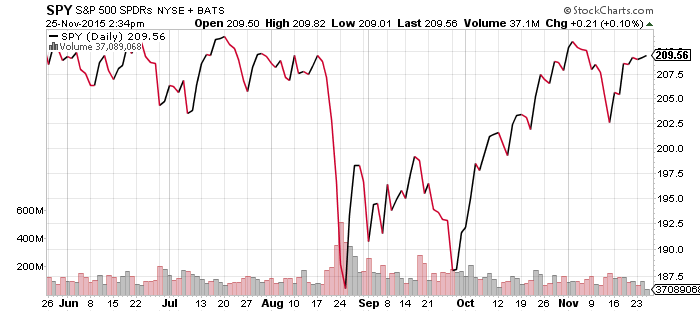

SPDR S&P 500 (SPY)

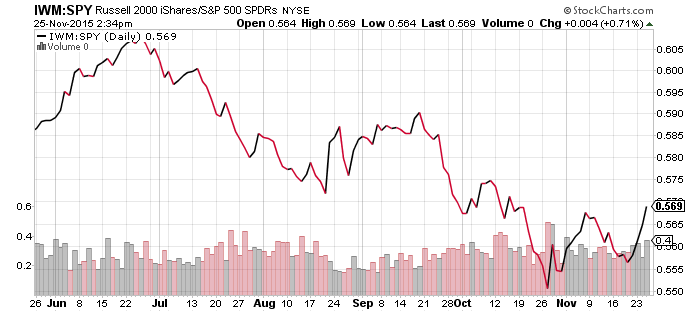

iShares Russell 2000 (IWM)

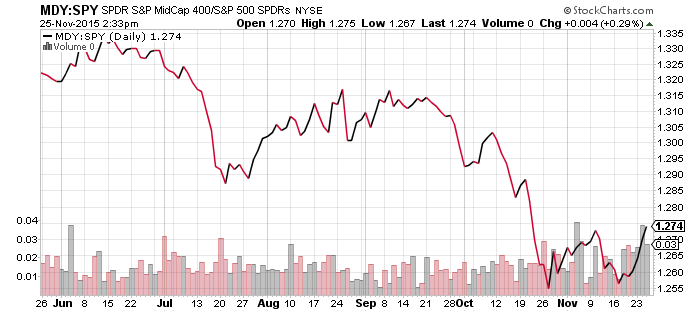

S&P Midcap 400 (MDY)

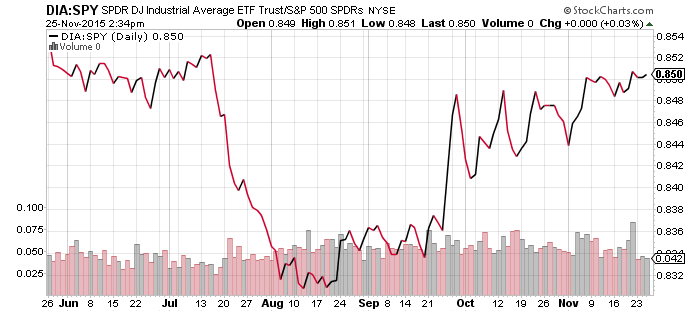

SPDR DJIA (DIA)

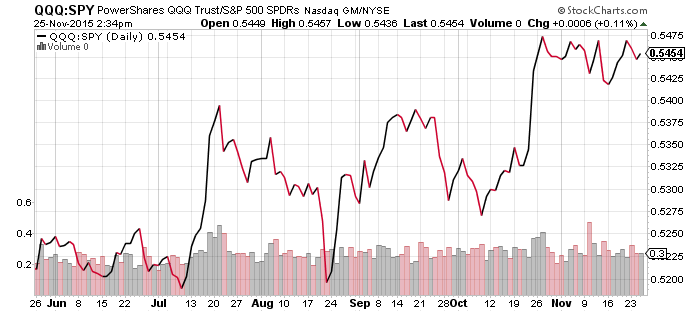

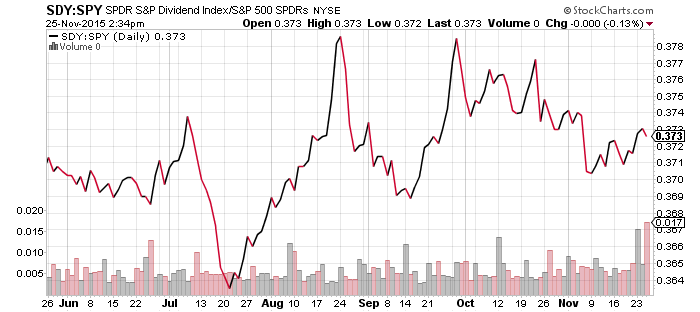

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

Mid- and small-cap shares ETFs have displayed improvements since late October, followed by strong economic data. These funds generally include higher financial exposure; in both MDY and IWM, financials are the largest sector. Additionally, a strong U.S. dollar is considered negative for large-cap multinational earnings, as smaller firms are generally domestically focused, particularly in the financial sector.