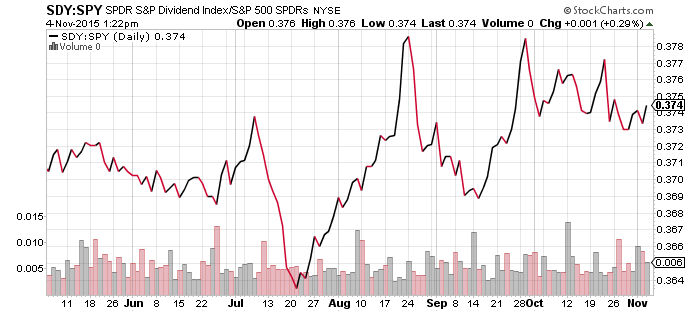

iShares MSCI Emerging Markets (EEM)

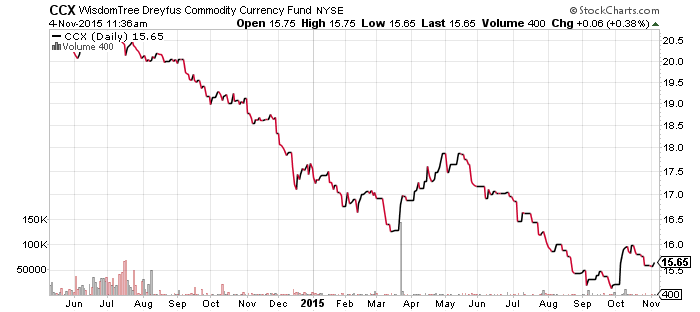

Emerging markets have stagnated over the past few days. Oil prices have boosted emerging markets that rely on oil exports, but a stronger U.S. dollar has muted broader gains. Oil is the vinculum between currencies, commodities and the China slowdown and merits continued close surveillance.

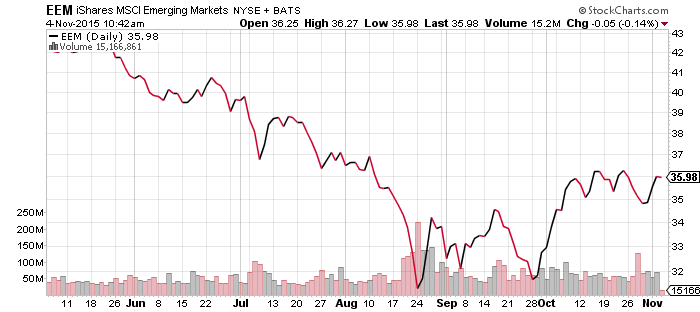

WisdomTree Chinese Yuan (CYB)

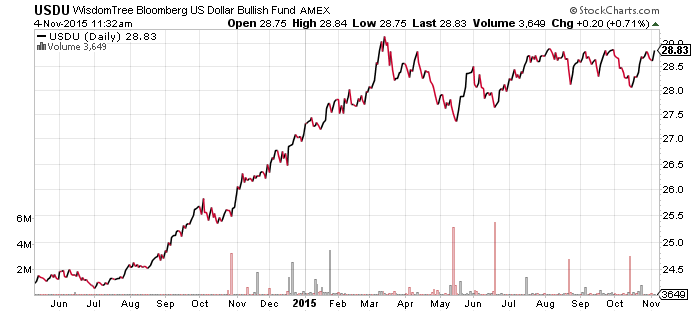

WisdomTree Bloomberg USD Bullish (USDU)

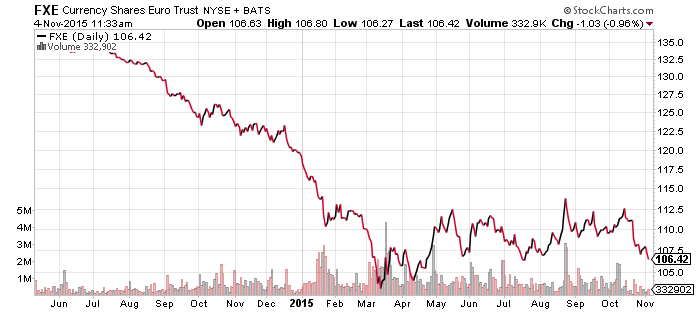

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

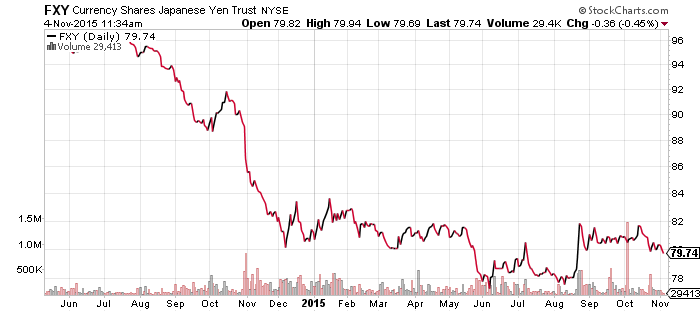

CurrencyShares Japanese Yen (FXY)

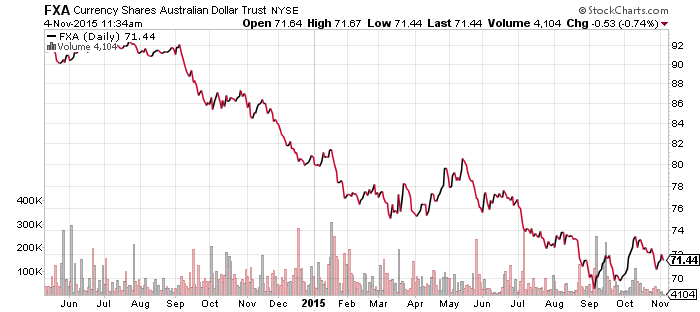

CurrencyShares Australian Dollar (FXA)

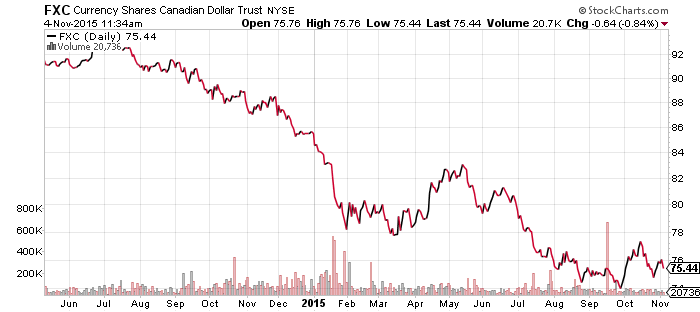

CurrencyShares Canadian Dollar (FXC)

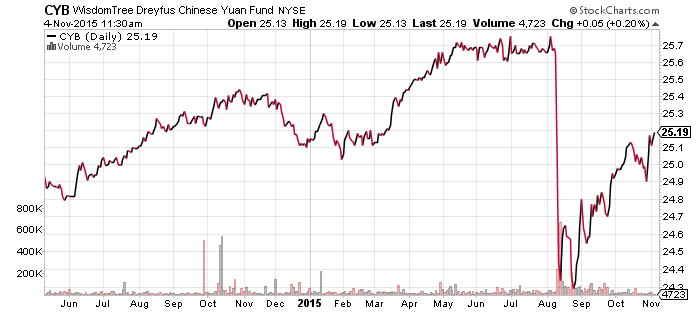

WisdomTree Emerging Market Currency (CEW)

WisdomTree Commodity Currency (CCX)

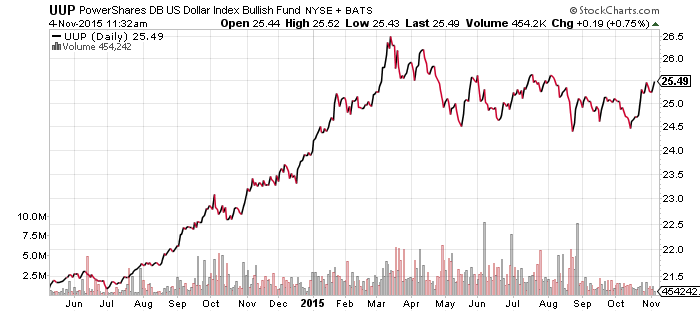

PowerShares DB U.S. Dollar Bullish Index (UUP)

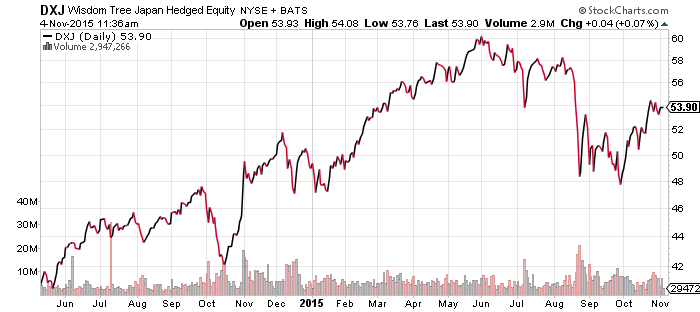

WisdomTree Japan Hedged Equity (DXJ)

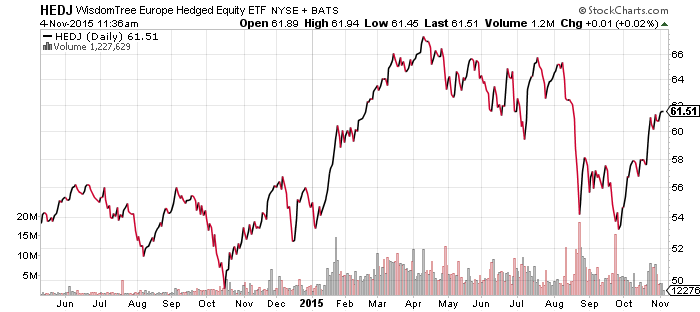

WisdomTree Europe Hedged Equity (HEDJ)

The People’s Bank of China drastically increased the value of the yuan last week as it vies for inclusion in the International Monetary Fund’s special drawing rights (SDR) basket of currencies. The IMF is expected to vote on the potential inclusion later this month, even though the United States has been critical of China’s currency policy, saying the yuan is undervalued.

The weakened euro is trading at its lowest levels since the summer. Investors are raising the odds of a December rate hike and the European Central Bank has alluded to additional quantitative easing. A further test of the lows may be plausible over the next few weeks. The euro remains in a bear market versus the U.S. dollar and both the krona and franc are trading in sympathy.

The U.S. dollar indexes tracked by USDU and UUP are nearing their 52-week highs. USDU is very close, needing only a 1.1 percent gain to set a new high. Based on recent volatility, USDU needs only two or three positive days to set a new high. UUP will require close to a 4 percent increase.

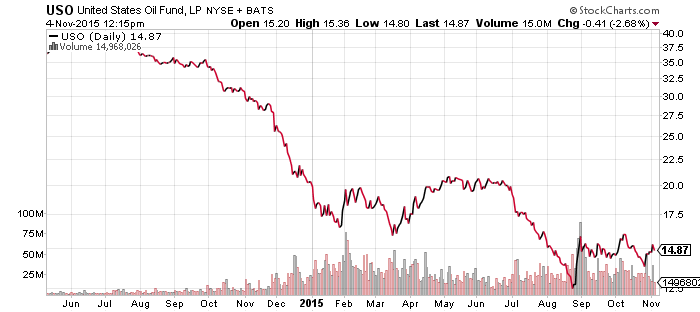

United States Oil (USO)

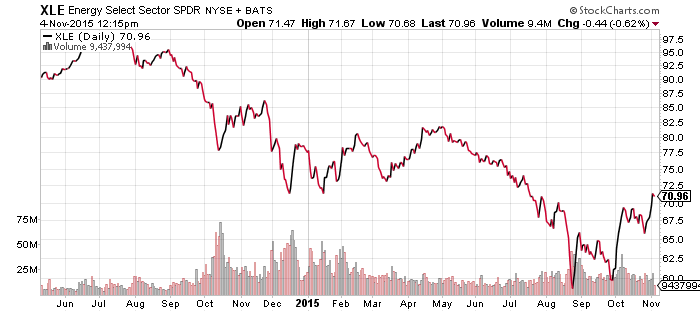

SPDR Energy (XLE)

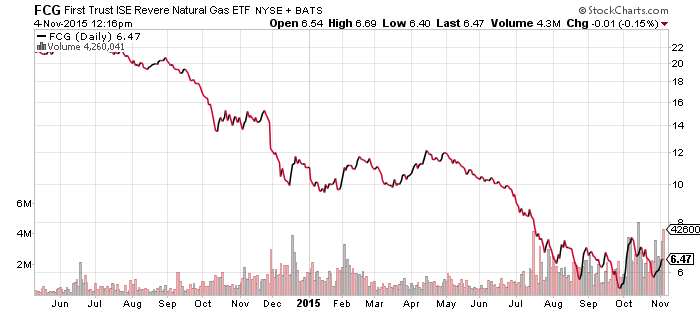

FirstTrust ISE Revere Natural Gas (FCG)

Global X Copper Miners (COPX)

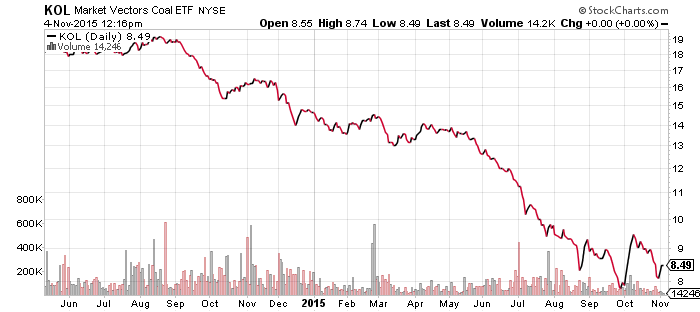

Market Vectors Coal (KOL)

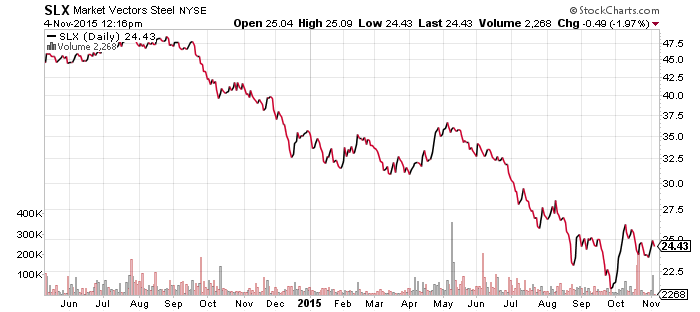

Market Vectors Steel (SLX)

Equity investors are betting the recovery in oil will continue, though it hit resistance today after Janet Yellen made comments that raised the odds of a December rate hike from about 50 percent to 60 percent. Other commodities are off their lows, but a widespread rally in the commodity complex is not underway. Weakness in China remains a concern, with the latest manufacturing PMI still shows that sector is in contraction.

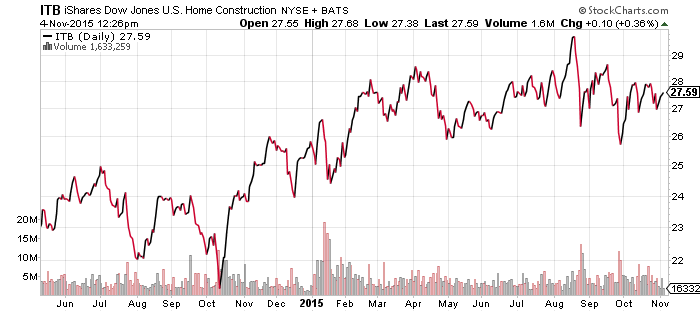

iShares US Home Construction (ITB)

Federal Reserve Chair, Janet Yellen, announced to Congress on Wednesday that a rate hike next month is a ‘live possibility.’ Housing continues to outperform the broader market. Economic growth remains the overriding concern, thus Fed rate hikes are positive news for the housing sector. The Fed has said it would raise rates slowly, giving homebuyers plenty of time to move off the sidelines and lock in low rates.

SPDR Utilities (XLU)

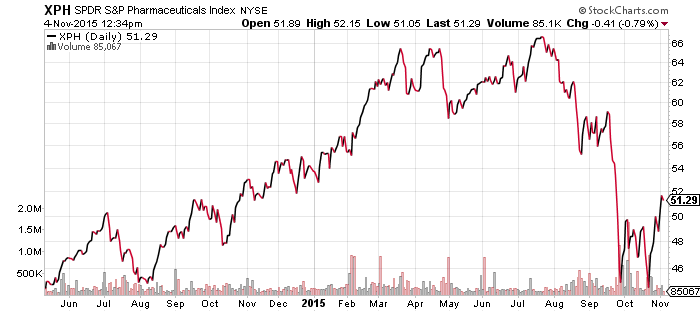

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

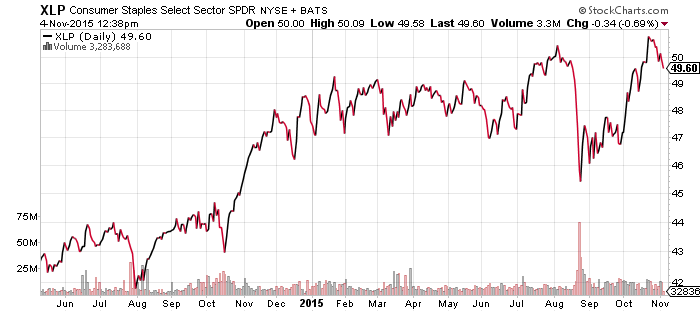

SPDR Consumer Staples (XLP)

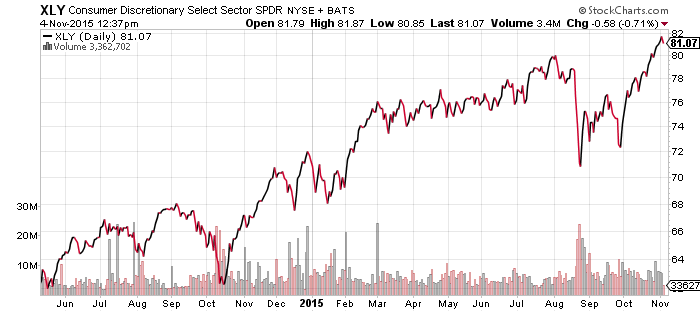

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

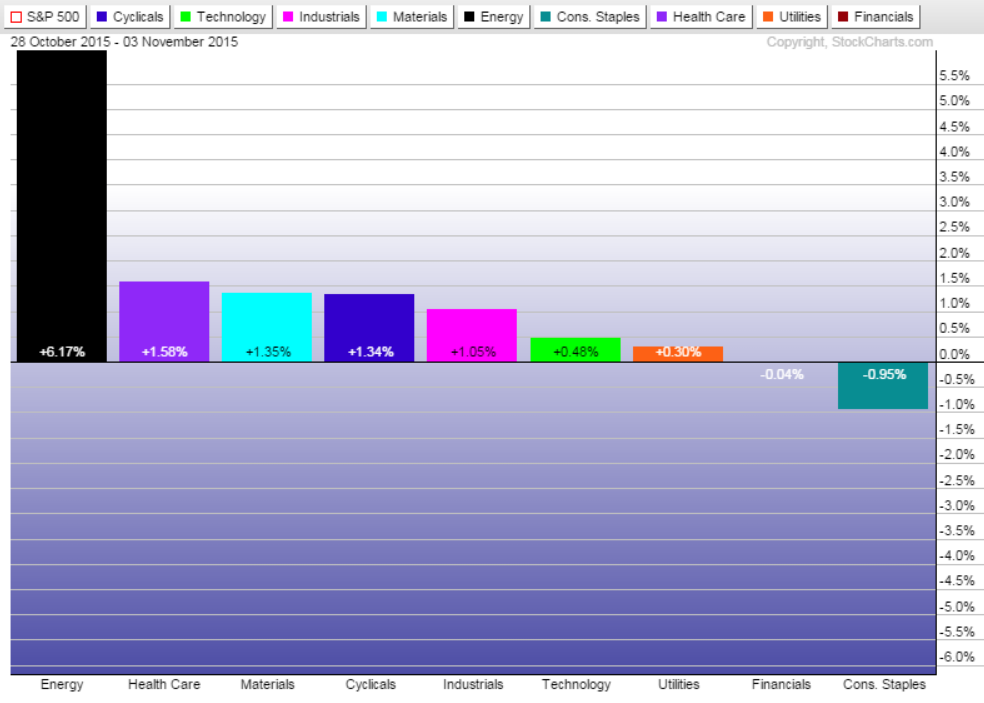

As can be seen in the charts above, energy had a strong week with oil prices rallying. Healthcare also rebounded, aided by gains in the pharmaceutical subsector.

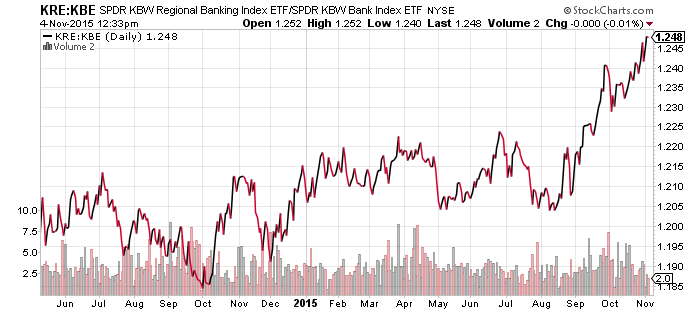

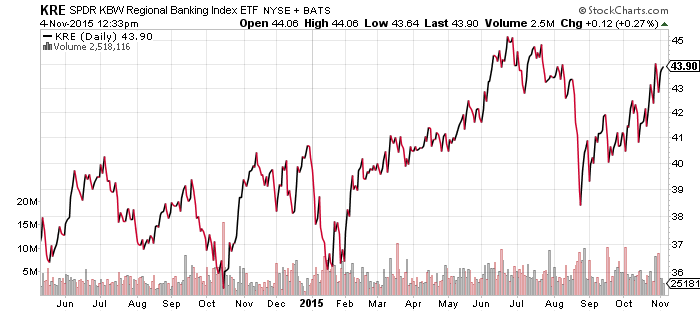

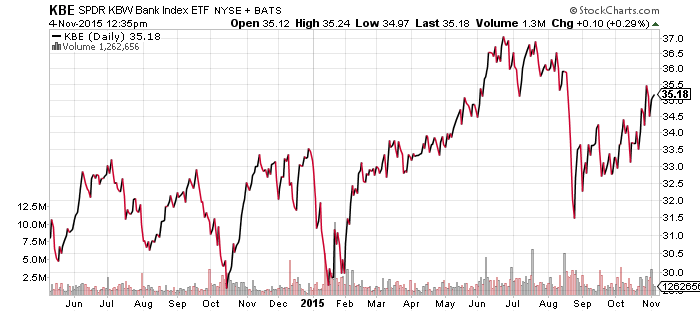

Regional banks added to their lead on larger banks. SPDR KBW Regional Banking (KRE) remains the stronger fund, but SPDR KBW Bank (KBE) has been following it higher. Yellen addressed both regional and larger banks in her comments on Wednesday, delivering good news for the sector, which had small gains at midday versus a small loss for the S&P 500 Index.

Consumer staples pulled back last week after a multi-week rally, though consumer discretionary funds pushed higher. Consumer credit and hourly earnings for September and October, respectively, will be announced on Friday.

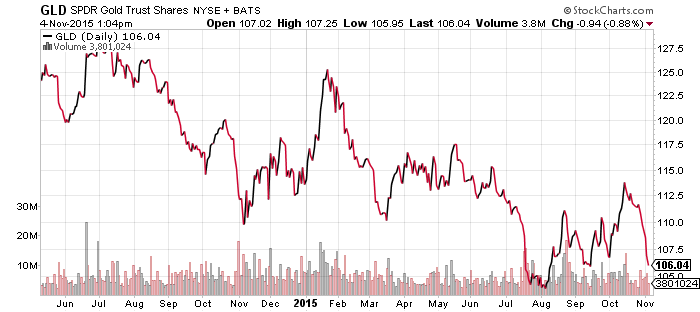

SPDR Gold Shares (GLD)

Gold was dinged by Yellen’s comments and the trend is pointing to strength in the U.S. dollar. Gold could see a decline if the greenback breaks to a new 52-week high, but the next bull wave may lead to more serious repercussions in the emerging market debt and currency markets. Gold is likely to fall if the U.S. dollar rises amid a stable global economy, but if foreign investors are concerned their currencies are at risk, they may opt for gold again, as they did in early 2015.

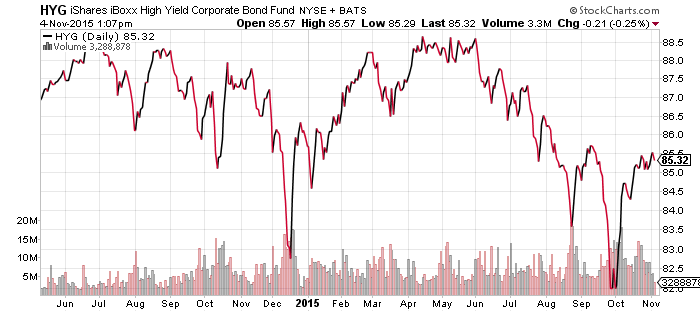

iShares iBoxx High Yield Corporate Bond (HYG)

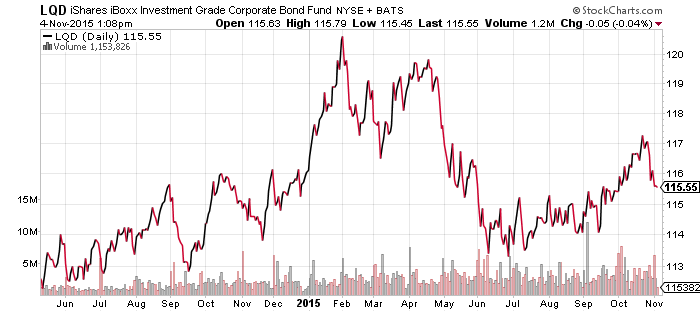

iShares iBoxx Investment Grade Corporate Bond (LQD)

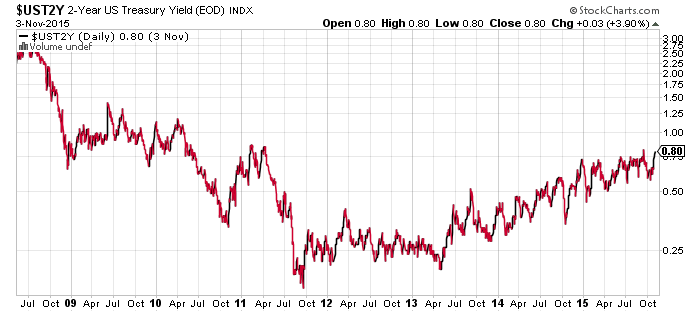

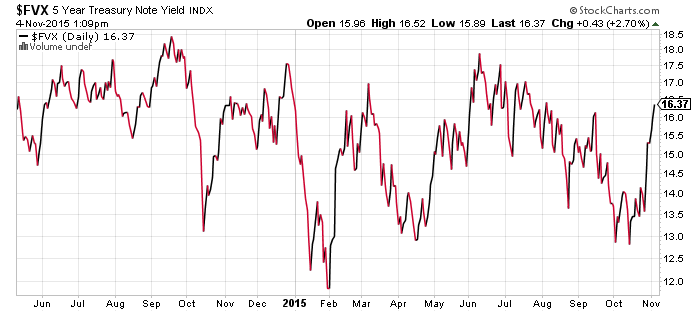

Interest rates have spiked in recent days. The 2-year treasury is at a multi-year high and the 5-year treasury has experienced a sharp rally over the past week, erasing about three months of losses.

The spike in rates weighed on LQD, but the high yield HYG was buttressed by the recovery in oil prices. HYG is also less rate sensitive due to having a higher yield. As long as credit concerns hold steady, HYG can continue outperforming LQD in a rising rate environment.

SPDR S&P 500 (SPY)

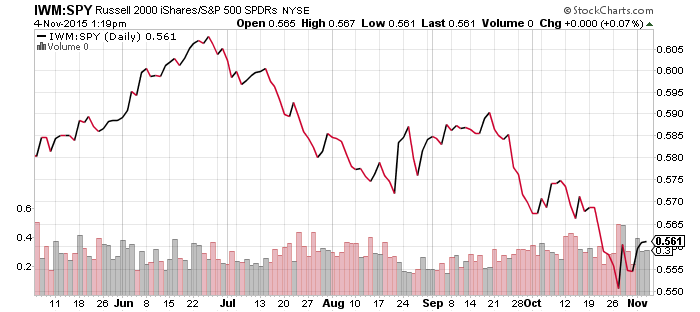

iShares Russell 2000 (IWM)

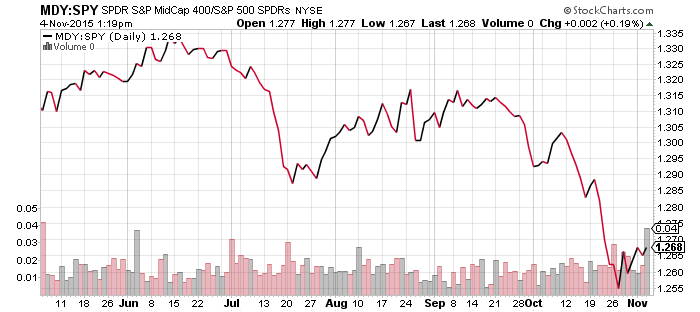

S&P Midcap 400 (MDY)

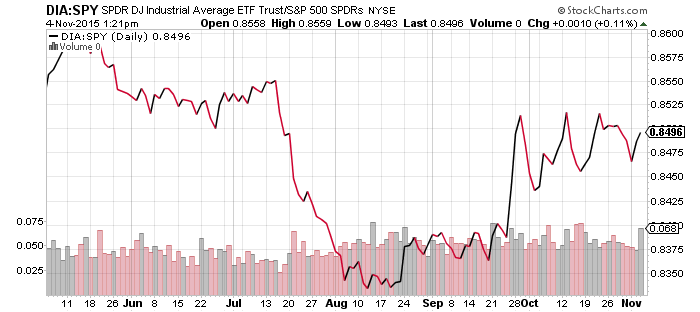

SPDR DJIA (DIA)

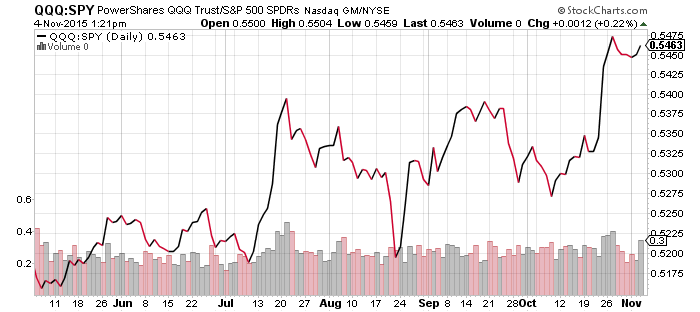

PowerShares QQQ (QQQ)

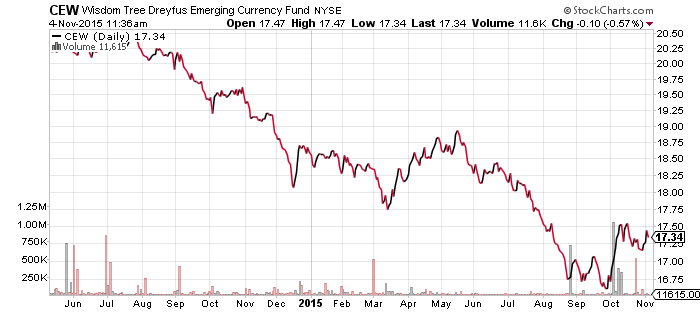

SPDR S&P Dividend (SDY)

The Fed policy statement, supported by hawkish commentary from Yellen on Wednesday have been predominate in this week’s headlines. Small- and mid-cap shares tend to perform better in a strong U.S. dollar environment. Dividend-paying shares are holding up relatively well, as higher rates have generally caused them to lag the broader market.