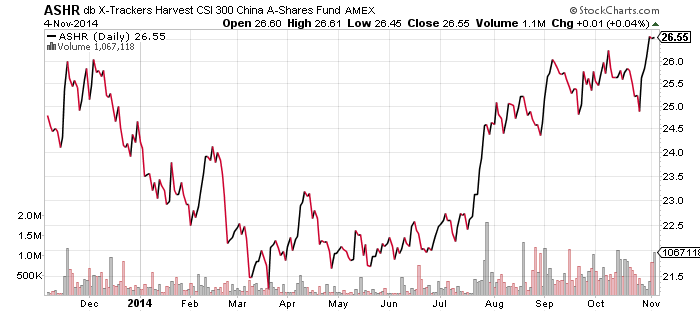

United States Oil (USO)

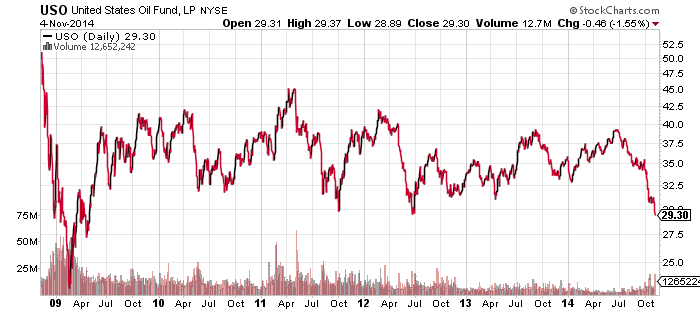

SPDR Energy (XLE)

Oil appeared ready to bounce last week, but then the Bank of Japan stepped in and dropped a monetary surprise on the financial markets. The short-term impact was selling in commodities, with already weak oil bearing the brunt. Saudi Arabia poured on by cutting prices for American buyers, but not those in Asia and Europe. This is seen as a direct assault on U.S. oil production, but it could also be a coordinated move to hammer Russia. The Russian government budget planned for oil above $100 a barrel in 2015. Below $90 a barrel, cuts need to be made and if prices continue sliding into the low $70 range, the Russian economy could be in serious trouble.

The long-term chart of USO below shows how oil could be breaking out of its range from the past six years. Lower prices could be a result of a glut in production as the oil market is particularly prone to marginal supply and demand and a small oversupply or shortage can lead to big price moves. A slowing global economy doesn’t help matters though, since falling oil prices could also be a result of weaker demand. Even if demand isn’t an issue, further losses are possible.

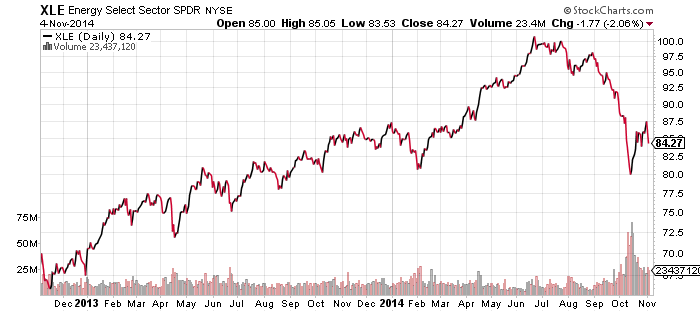

As for energy stocks, the $80 level on XLE is a line in the sand. First Trust ISE Revere Natural Gas (FCG) is also at a major support level.

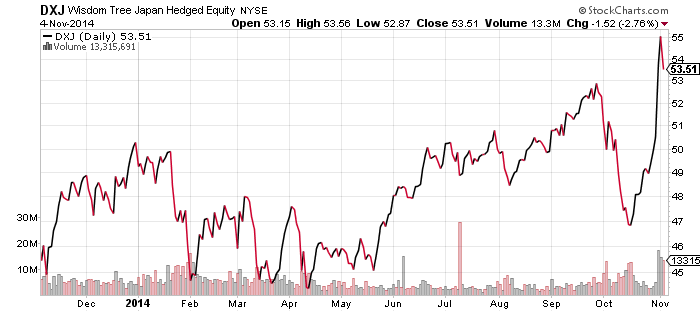

WisdomTree Japan Hedged Equity (DXJ)

The Bank of Japan increased quantitative easing on Halloween and it scared investors out of the Japanese yen. Since the announcement three trading days ago, the yen has tumbled about 5 percent (as of Wednesday morning), a massive move for a major currency. Investors fleeing the yen are moving into stocks. Additionally, the government is forcing large government pension funds out of bonds and into stocks. The result is that over the past three days, the Nikkei is up about 8 percent.

An unhedged ETF such as iShares MSCI Japan (EWJ) can benefit from the move in the Nikkei, but is exposed loses in the yen. Over the past five days, EWJ is up 3.14 percent, almost perfectly reflecting these two moves. DXJ, meanwhile, hedges away the currency effect and it is left with the gains from equities, which has the fund up 7.43 percent in the past week.

Since the Nikkei is moving up along with the yen, DXJ should continue to rally. It is important to note that DXJ is currently overvalued by about 0.8 percent versus its net value. Since the Japanese market is closed when DXJ trades, some of the price is based on investors’ expectations for the yen and Nikkei on the following day. Investors closed out Tuesday slightly bullish.

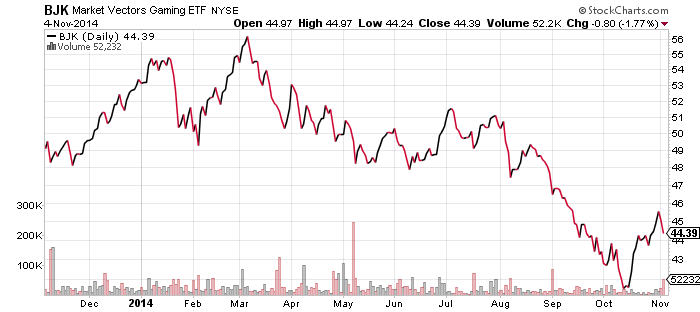

Market Vectors Gaming (BJK)

Gaming stocks could be headed for trouble if the news out of Macau is a sign of Chinese growth rates. Macau gambling revenue fell sharply in October, with industry insiders calling it the worst month they’ve ever seen. Some reasons for the drop include Ebola, Hong Kong protest and a crackdown on corrupt officials. The best explanation, besides a slowing economy, is the smoking ban that recently took effect. Gamblers can still smoke in Las Vegas and it could be that many VIPs, for whom the extra cost of a flight is insignificant, went elsewhere.

If the smoking ban was a major reason for the 23 percent drop in revenues, signs of stabilization should come in the next month or two and BJK, or Macau gambling stocks, will represent a good buy. If instead it is a sign of China’s slowing economy, lower prices could be on the way.

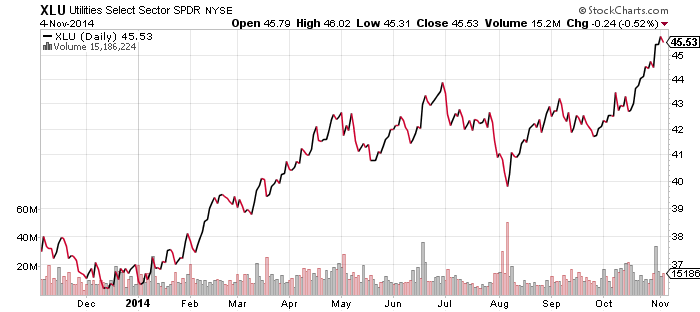

SPDR Utilities (XLU)

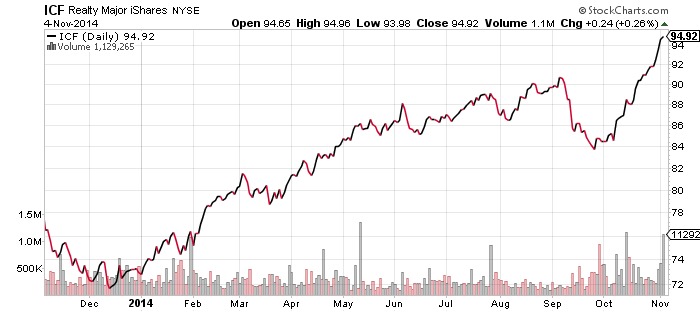

iShares Cohen & Steers Realty Majors (ICF)

One of the side effects of Japan’s latest expansion of quantitative easing and pension reforms is that it will lead to more purchases of foreign assets by Japanese investors. Japanese buying of U.S. bonds will help suppress interest rates, and that is good for interest rate sensitive sectors such as utilities, which continued marching higher over the past week. REITs have seen an even bigger push to new highs, with ICF now up nearly 13 percent from its lows in October.

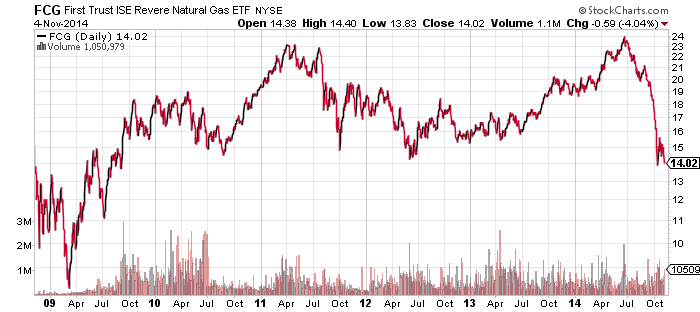

db X-Trackers Harvest CSI 300 A-Shares (ASHR)

Most Chinese ETFs are trading below their highs, with one notable exception being ASHR. China was supposed to begin allowing foreign investors to access the Mainland market through Hong Kong last week, but the opening has been delayed due to technical difficulties. No new date has been set. Investors remain optimistic about the opening though. Chinese shares are cheap following a 6-year bear market that has yet to officially end and reforms are helping to fuel interest even though the economic data has been weak.