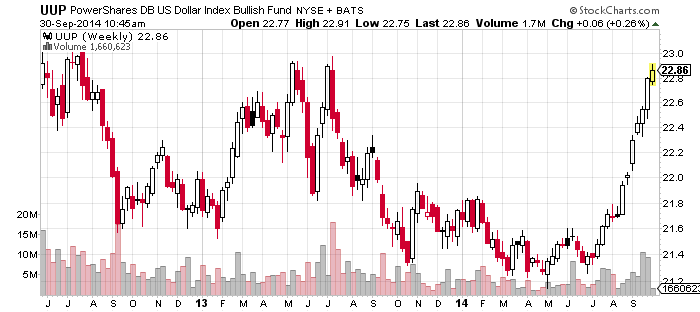

PowerShares DB U.S. Dollar Index Bullish Fund (UUP)

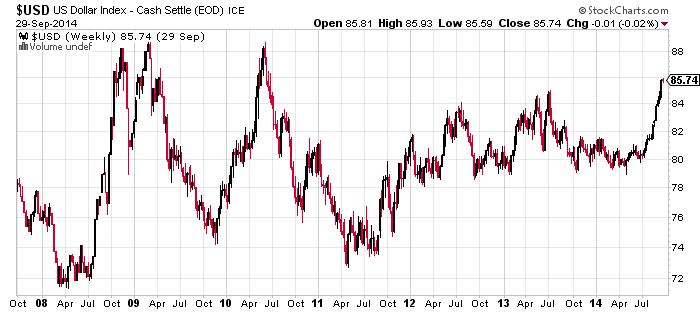

The U.S. Dollar Index has gone up for 11 consecutive weeks and is working on a 12th. In the chart below for UUP, there is one down week, which tracks futures contracts that do not perfectly follow the index. In the 41-year history of the index, the U.S. dollar has never rallied for this many consecutive weeks.

This might be the only chart that matters at the moment. Although many traders are expecting a reversal in the U.S. dollar, the greenback could push on and challenge the highs set in 2008 and again in 2010 as shorts are forced to cover.

Emerging markets and commodities have been hit very hard by the rally, as have the euro and the yen. A move to a new high would be very big because it would signal a big bullish breakout. It would also be a very bearish move for many foreign stocks.

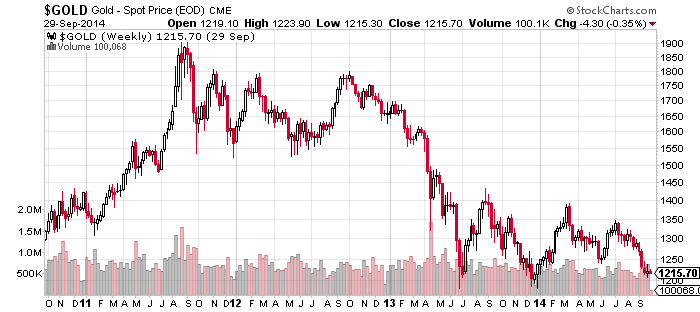

SPDR Gold Shares (GLD)

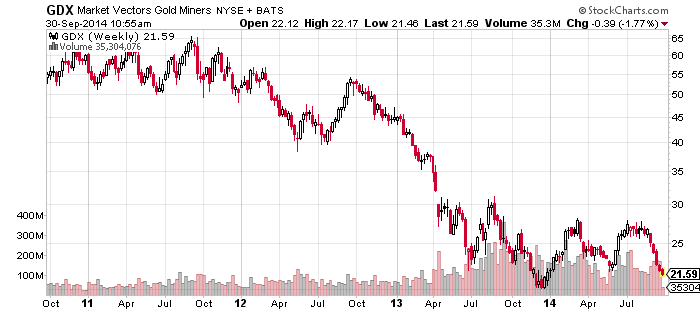

Market Vectors Gold Miners (GDX)

In addition to the U.S. dollar, gold is important to watch, as it may signal a correction in the dollar. Up until now, gold has traded with the rest of the commodities. However, gold and miners have failed to break lower and are now holding the lows set earlier this year. Gold miners tend to lead the gold price. Gold’s low last year was $1180 and $1200 also has support.

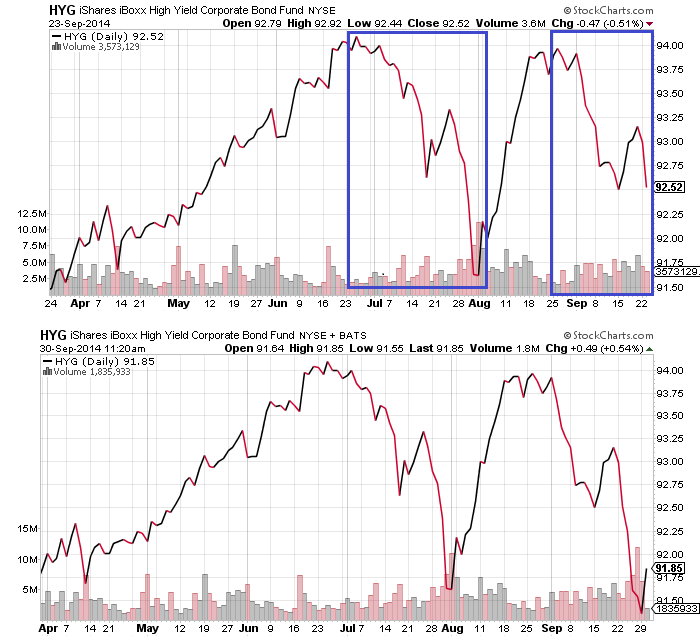

iShares iBoxx $ High Yield Corporate Bond (HYG)

Last week we discussed how HYG was acting in a similar manner to its July performance. Sure enough, the fund continued the trend and slid on the week. For now, the move looks to be finished, as shares bounced on Tuesday.

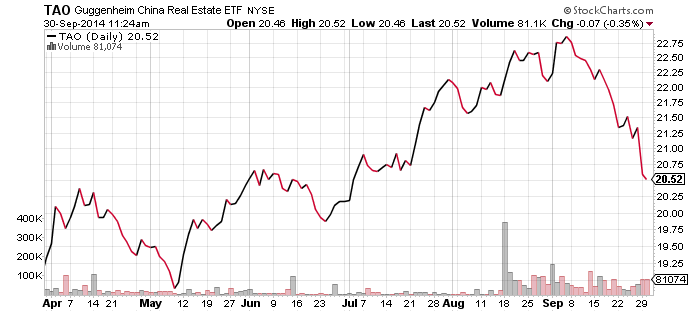

Guggenheim China Real Estate (TAO)

The latest data out of China shows home prices fell 0.9 percent in September, the worst one-month decline in 4 years. Investors have been steady selling TAO, but the move may halt or reverse at least in the short-term, assuming the U.S. dollar cooperates. Yesterday, the central bank eased lending rules, allowing buyers who pay off their mortgage to qualify as a first time purchasers. First time home buyers pay a 30 percent down payment and can receive as much as a 30 percent discount off the prime rate. Second home buyers must pay 60 percent down and cannot receive discounted mortgage rates.

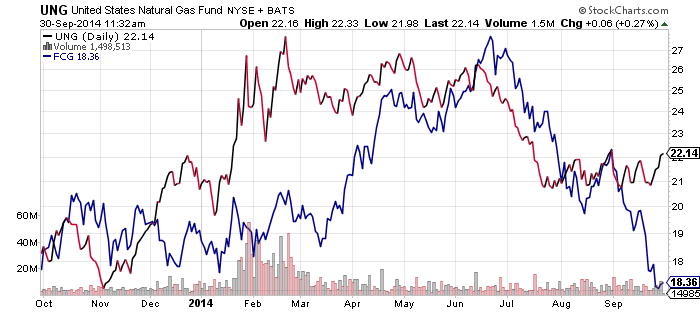

First Trust ISE Revere Natural Gas (FCG)

U.S. Natural Gas (UNG)

Last week we looked for a bounce in natural gas. It came for UNG, but not for FCG. FCG is impacted by the broader stock market, so it could be pulled lower if stocks drop, even if UNG pushes higher. If that happened, it would make FCG a good choice for traders looking to play an inevitable rebound.

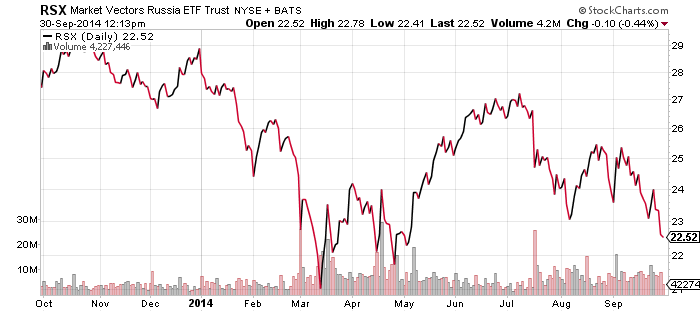

Market Vectors Russua (RSX)

The Russian ruble has been under pressure and the Russian central bank said temporary capital controls may be needed if the capital outflows accelerate. Even though sanctions have escalated and the ruble has fallen, RSX is still above its lows in May. This series of higher lows going back to March is a positive sign because investors aren’t selling. We could see a rally over the short-term.