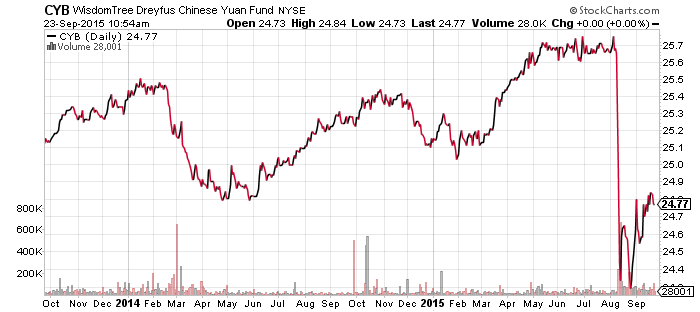

WisdomTree Chinese Yuan (CYB)

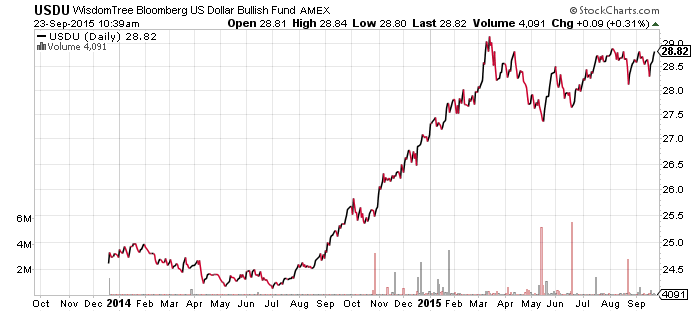

WisdomTree Bloomberg USD Bullish (USDU)

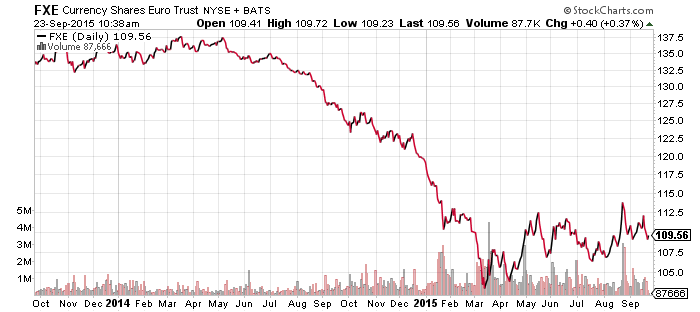

CurrencyShares Euro Trust (FXE)

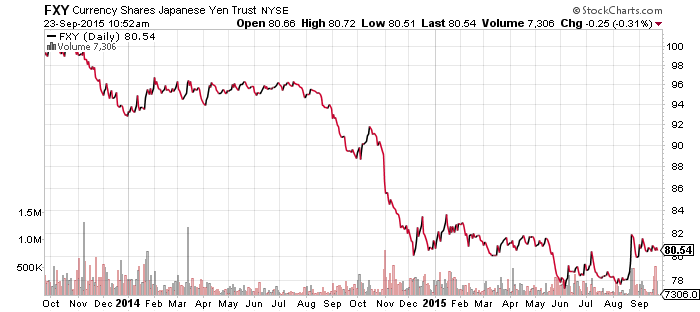

CurrencyShares Japanese Yen (FXY)

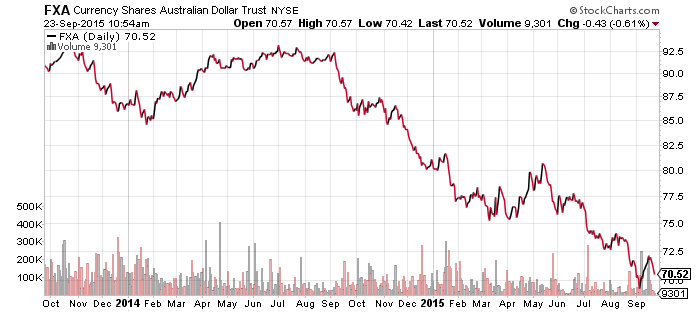

CurrencyShares Australian Dollar (FXA)

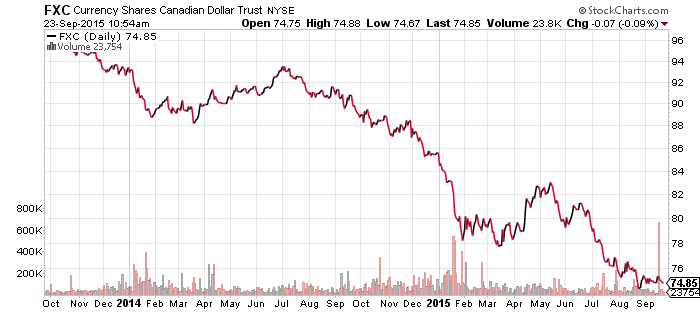

CurrencyShares Canadian Dollar (FXC)

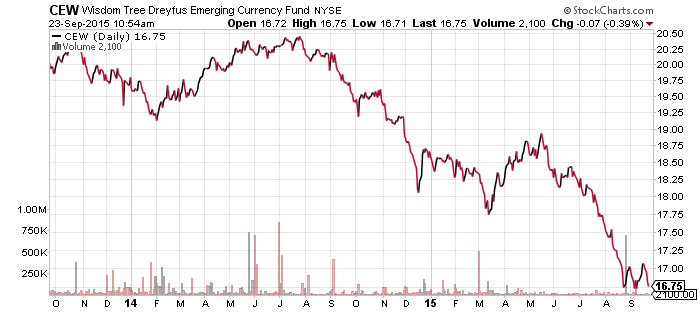

WisdomTree Emerging Market Currency (CEW)

WisdomTree Commodity Currency (CCX)

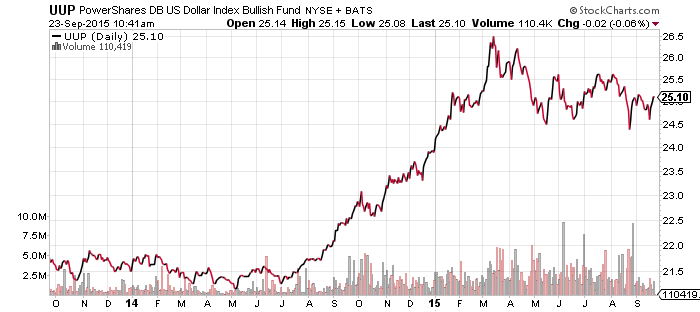

PowerShares DB U.S. Dollar Bullish Index (UUP)

The Federal Reserve’s decision to leave interest rates unchanged initially destabilized the U.S. dollar, which was followed by rumors that the European Central Bank would increase its quantitative easing program to push the euro lower. Today, there was additional speculation the ECB would enact additional easing. This has led to some volatility in the euro as well as the U.S. dollar.

The euro has been in an uptrend since March, but as the longer-term chart of FXE illustrates, its rebound has been remarkably weak. That said, there’s a chance of continued strength in the euro if the dollar fails to break out. USDU should be watched closely as it is closer to providing a decisive signal. USDU is less than 2 percent away from its old high, and while currency funds tend to be less volatile, the high could be surpassed in a few days of volatile trading. As we mentioned in our ETF Watchlist for July 15: The U.S. dollar appears to be tracing out a multi-month correction. If the pattern continues at the present rate, the U.S. dollar could be challenging its old highs sometime in September or October. A major factor is the euro, which makes up 58.6 percent of the U.S. Dollar Index.

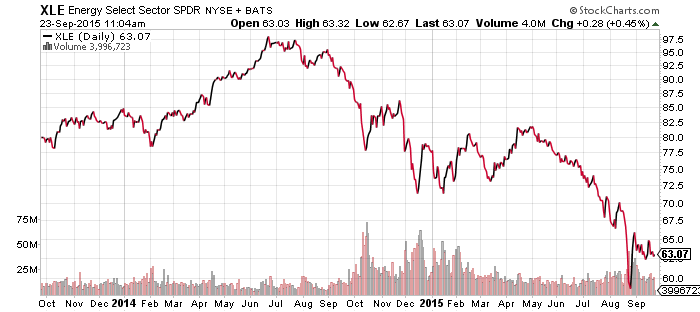

SPDR Energy (XLE)

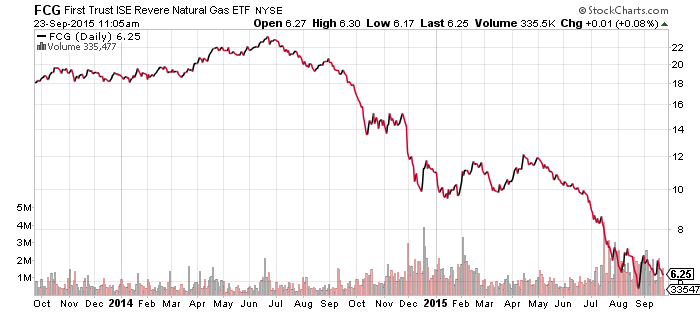

FirstTrust ISE Revere Natural Gas (FCG)

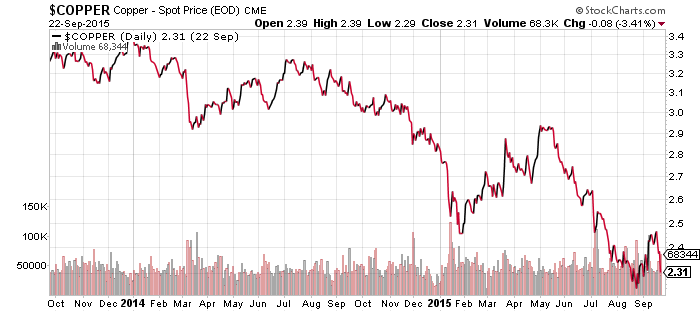

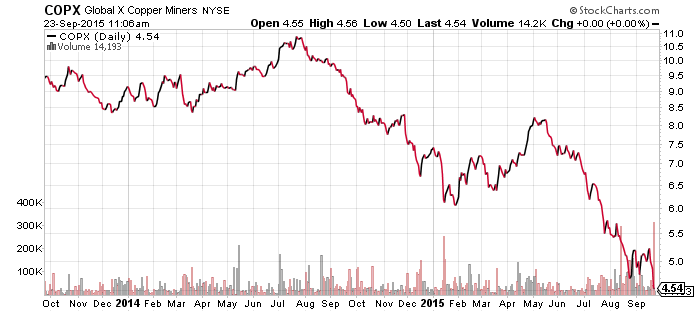

Global X Copper Miners (COPX)

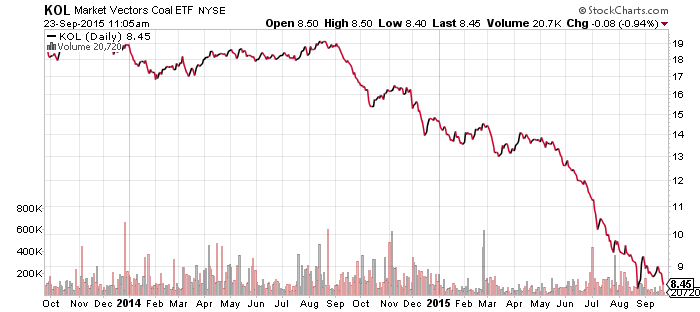

Market Vectors Coal (KOL)

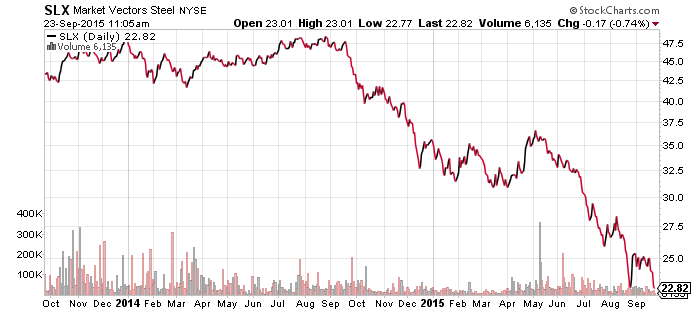

Market Vectors Steel (SLX)

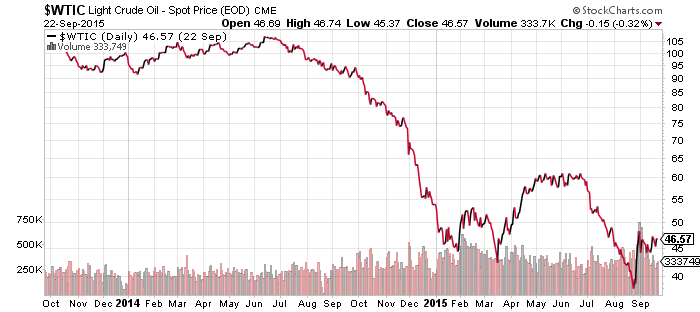

Domestic oil prices rallied on Tuesday thanks to a larger than expected decline in oil inventory, though the rest of the commodity space is flirting with multi-year lows. The latest impetus for weakness was the flash manufacturing PMI for China, which came in at 47, the lowest reading since March 2009. China is a major consumer of copper, coal, iron ore and other resources. China also overinvested in areas such as steel, to the point where in some cases, a single steel mill produces more steel than some major industrial nations. This steel is flooding world markets as producers can’t find buyers at home but need to generate cash to repay their debts.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

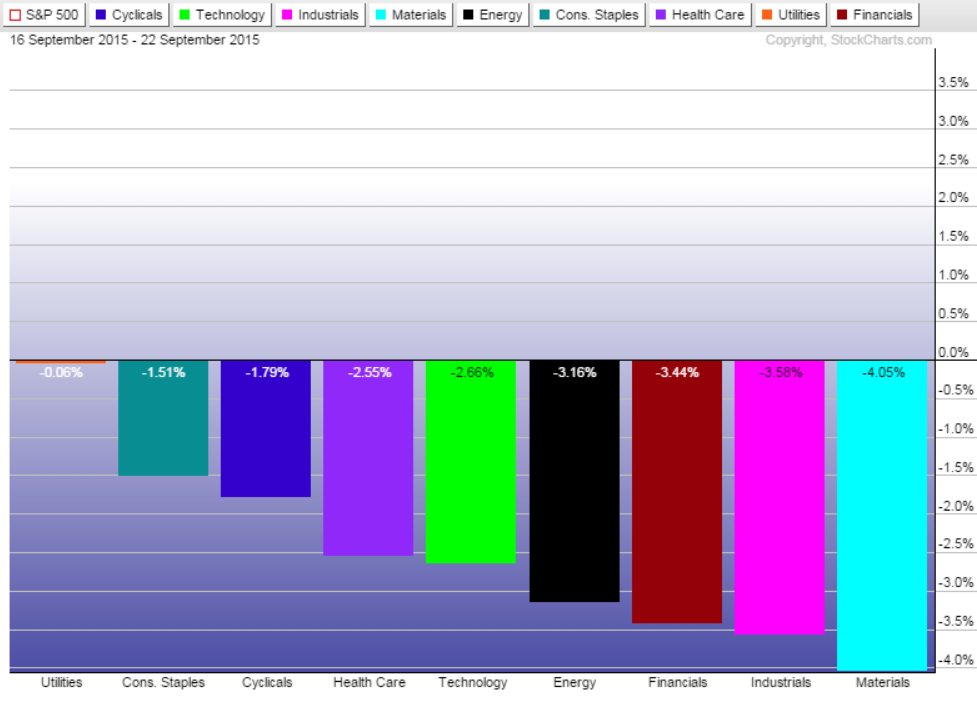

Weakness in the broader market weighed on most sectors over the past week. Materials, industrial and energy were among the weakest sectors, as they have been all year. Financials joined them due to the Federal Reserve’s decision to stand pat on interest rates.

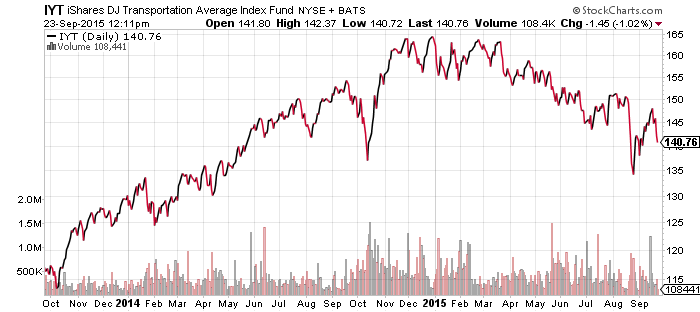

Transports initially did well despite FedEx (FDX) reporting lower than expected earnings last Wednesday, but it then headed lower with the rest of the market.

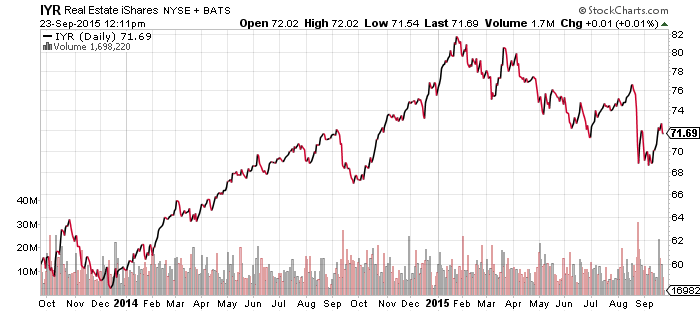

Real estate rallied thanks to the Fed’s decision. Rate sensitive utilities were the best performing sector in the past week for the same reason.

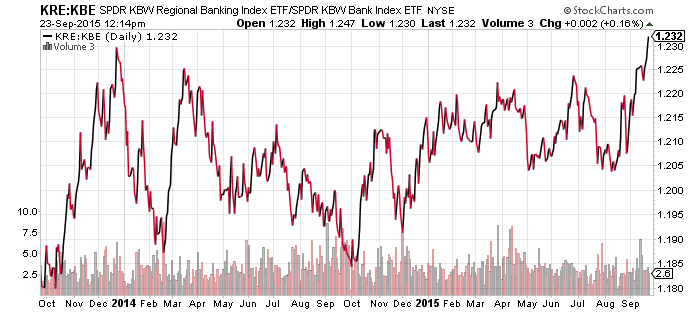

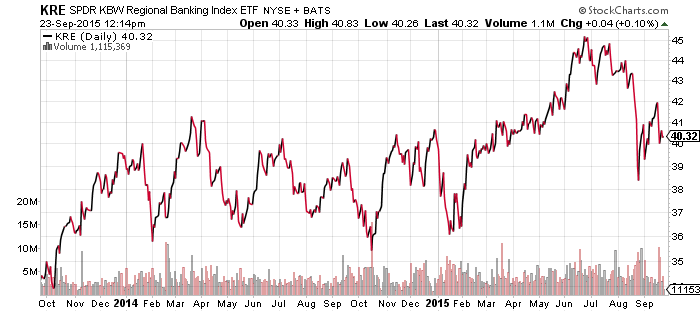

Bank stocks fell on the Fed decision, but regional banks continue to power ahead as investors look towards an eventual rate hike later this year.

The homebuilder sector has performed surprisingly well recently. One theory for why this has occurred was due to the looming rate hike. Prospective home buyers may begin purchasing if they see prices remain stable but interest rates begin moving higher. In the wake of the Fed’s decision to hold off on a rate increase, ITB tumbled, which may substantiate this theory.

SPDR Gold Shares (GLD)

The Fed’s decision to hold raise rates steady was good news for gold. Over the near term, the price to watch is $106. Gold has been in an uptrend since China devalued the yuan in August and, if gold is to break away from the rest of the commodities complex, it will be currency risk that moves it.

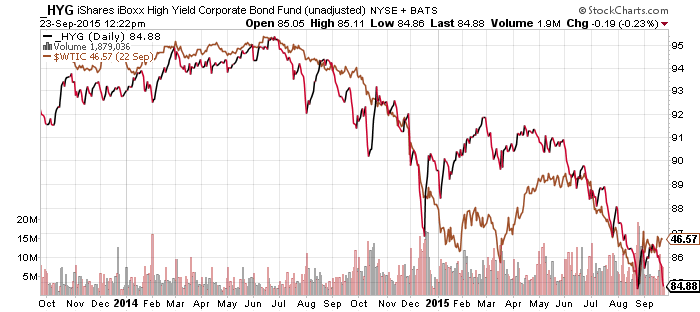

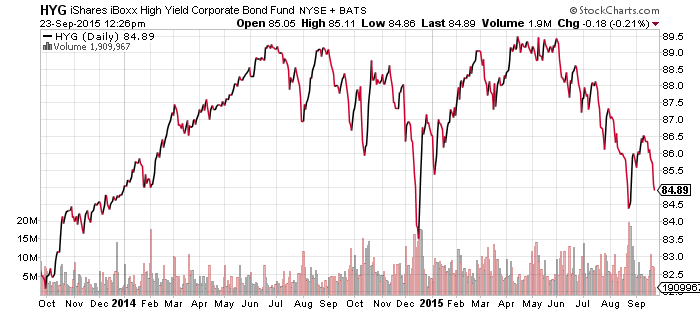

iShares iBoxx High Yield Corporate Bond (HYG)

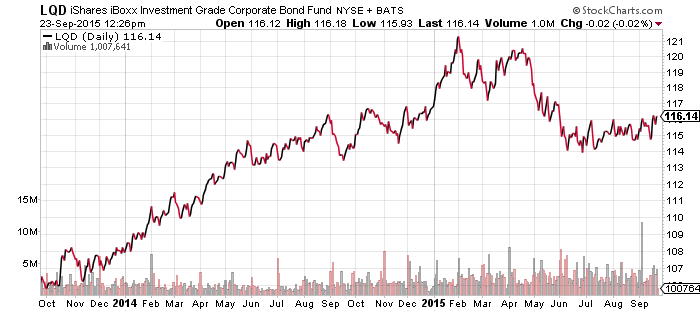

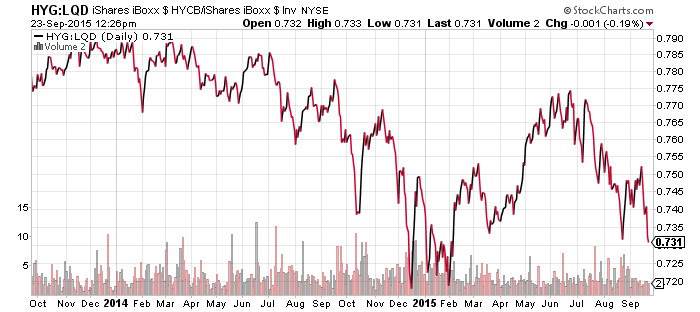

iShares iBoxx Investment Grade Corporate Bond (LQD)

The first chart below shows the price chart of HYG, unadjusted for dividends, versus the price of oil. The drop in oil and other commodities is driving the high yield market as investors grow concerned about the risk of bankruptcy in the energy sector. The drop in high-yield debt in the past week could reverse, as it did several times in the past couple of years, but given that oil is in a bear market, the more likely outcome is for oil to retest its lows.

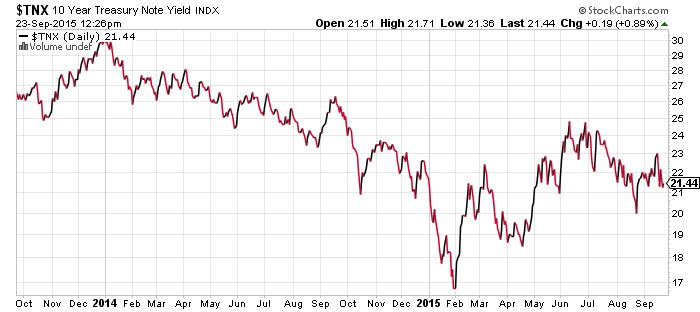

HYG dipped over the past week, while LQD rallied as interest rates dipped and investors sought out higher quality credit. Although rates fell, the 10-year Treasury was very stable relative to the equity and commodity markets.

SPDR S&P 500 (SPY)

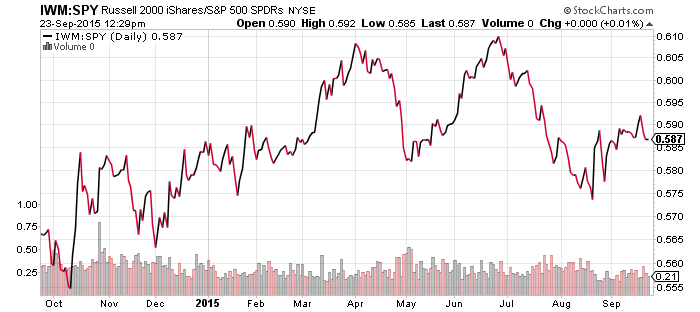

iShares Russell 2000 (IWM)

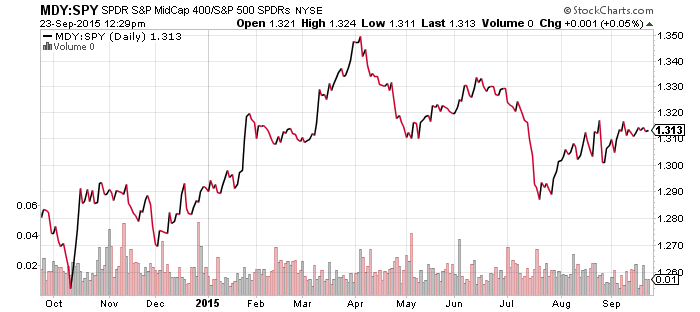

S&P Midcap 400 (MDY)

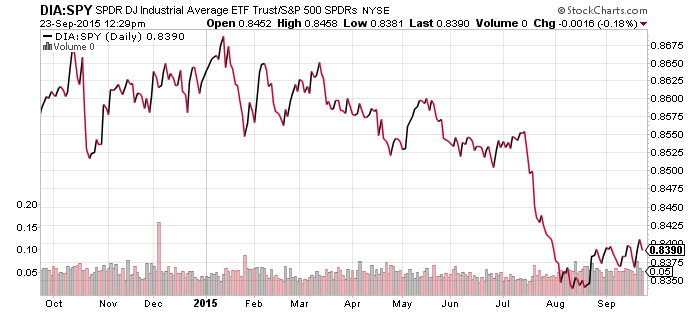

SPDR DJIA (DIA)

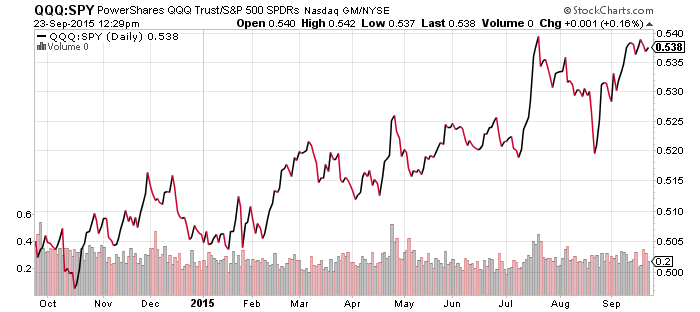

PowerShares QQQ (QQQ)

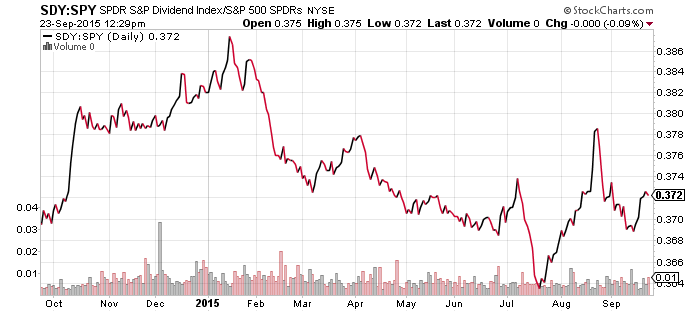

SPDR S&P Dividend (SDY)

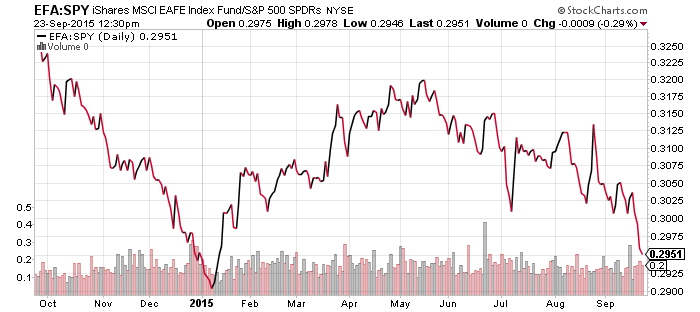

iShares MSCI EAFE (EFA)

The Nasdaq is close to hitting a new relative high versus the S&P 500 Index. Other indexes remain in the same relative pattern, although SDY did rally on the Fed’s decision to not hike rates.