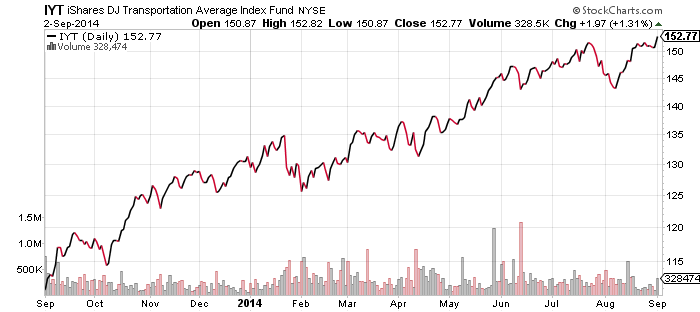

Guggenheim China Real Estate (TAO)

TAO has benefited from a strong rally in Hong Kong listed developers and deserves to be followed closely over the coming weeks. Chinese real estate developers haven’t joined in the rally due to concerns about the mainland’s real estate market. Home prices fell in August and the lifting of buying restriction has only had a limited impact in numerous cities. Weak credit growth and risks in the private economy, where bond defaults are an increasing threat, could scuttle a rebound in the housing market.

As for the shares themselves, many developers are cheap relative to their assets. They are showing rising debt levels though, because sales are slowing which is putting a strain on working capital.

The line to watch for TAO in the near term is the 2013 secondary high below $23. If TAO can push through that level, and then beyond the high from 2013, the bulls could be off to the races. If TAO breaks down, support is at $18.

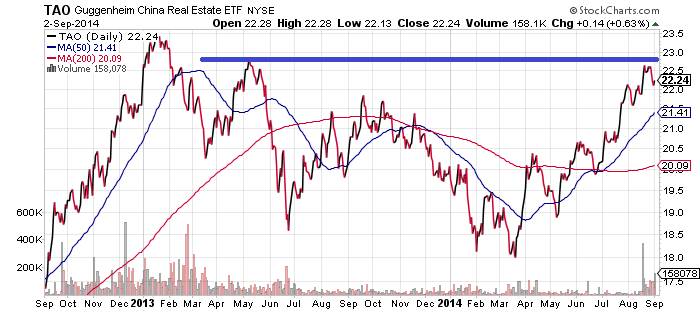

CurrencyShares Euro Trust (FXE)

The euro remains oversold in the short-term and a bounce could come soon. The European Central Bank (ECB) meets on Thursday and traders are pricing in some level of intervention. Even if the ECB announces something that should weaken the euro long-term, the short-term impact is likely to be a bounce as traders exit their positions. If the ECB does announce a new or expanded policy, European assets could enjoy very solid gains as stock markets rebound and the currency rises.

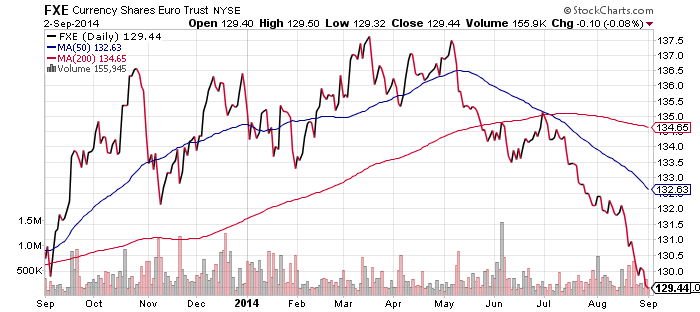

CurrencyShares Japanese Yen (FXY)

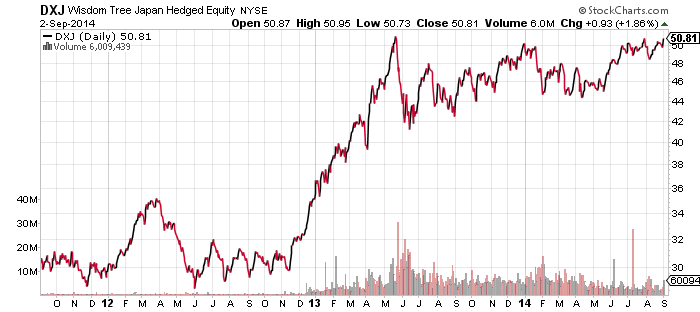

WisdomTree Japan Hedged Equity (DXJ)

The euro isn’t the only weak major currency, as the yen is now at 52-week lows. The question is, is this a double bottom or a possible breakdown in the yen? As the long-term chart shows, a break lower from here doesn’t leave much support. Japanese government policies are aimed at weakening the yen and if it breaks lower, a larger drop is likely.

A weak yen is good news for DXJ, which hedges yen exposure. The fund is near a two-year high and can move higher if the yen weakens, assuming the Nikkei doesn’t weaken.

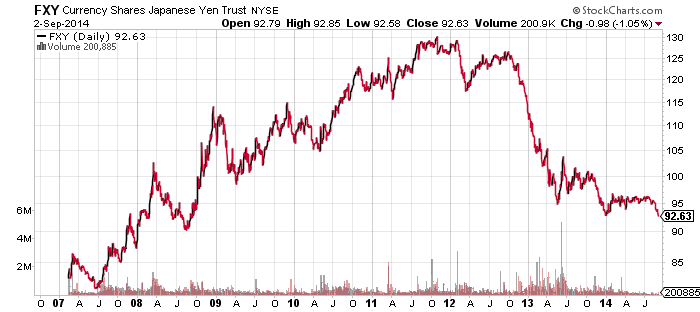

iShares DJ Transportation (IYT)

The transports pushed on to a new 52-week high on Tuesday thanks to strong manufacturing data. The U.S. manufacturing PMI climbed to 59 in August. The strong manufacturing data, which is a leading indicator of future growth, is a very good sign for the economy. The United States has only seen roughly 2 percent GDP growth since 2008, but it may finally be strengthening.