Janet Yellen let slip that interest rates might go up a year from now, assuming quantitative easing (QE) is ended later this year. The result was a sell-off in bonds and stocks, plus added pressure in emerging markets such as China, where monetary policy is tightening as well.

There are a few ways to look at the situation with QE, taper and higher rates. By ending QE, the Federal Reserve is tightening monetary policy. Some analysts and even the Fed itself have said that low rates constitute easy money, but QE was even more of a gift. One can still call Fed policy loose, but relative to just a few months ago, significant steps have been taken to reverse course. Unless we see bank lending pick up (more on that below), the ending of QE alone means tighter monetary policy.

Yellen calling for higher interest rates isn’t a surprise. In fact, if you look at Fed policy moves in prior decades before the advent of QE, the Fed is usually following the market when it sets interest rate policy. Whether the Fed raises short-term interest rates or not, the market may decide to push rates higher anyway. While many investors look at the Federal Reserve as in total control of the market, it actually has much less power than people realize. With a global rate hike cycle underway, the only way interest rates will set new lows is if there is another global financial crisis.

Some analysts do think another crisis is a possibility. China is tightening monetary policy and using deflation as a tool for reform. If they err in their strategy implementation, the global economy will suffer. In the U.S., there are plenty of folks who believe the Fed is getting it wrong again and will be forced to reverse course when the economy weakens. Put enough mistakes together in the world’s largest economies and it can make for a potentially dangerous situation.

However, there is another view that is worth considering. Critics of the Fed believe that QE is the biggest reason why the economy hasn’t fully recovered. With interest rates at super low levels, banks are not compensated for the risk they take by lending. They have been parking their reserves at the Fed and earning a low, but risk-free, return. As interest rates climb, however, banks have a greater incentive to lend, and if credit growth picks up, this can more than offset the Fed’s taper and rate hikes. In other words, QE is actually causing an extremely tight credit market; the ending of this policy could actually usher in higher GDP growth and higher inflation, the exact opposite of what the common wisdom expects. (Higher interest rates will also increase the return on savings, which can also fuel lending. Higher rates would also make retirees more confident to spend.)

We can already see some evidence of greater lending in commercial and industrial loans. According to data from the Federal Reserve, lending at banks has accelerated sharply since the taper began in December. You can also see in the chart below that lending was slowing in the run-up to the taper, which partly explains why economic growth was slow in the first quarter. It takes some time for credit to work its way into the economy, but we may see signs of a pickup early in the second quarter of this year if this trend holds.

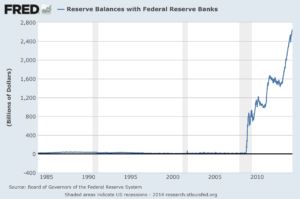

As rates move higher, banks may increase their lending and pull their reserves away from the Fed. Demand for credit would allow rates to climb and inflation could accelerate due to the Federal Reserve’s inflationary policies of the past 5 years.

Those reserves are part of what is known as “high powered money.” It is called that because $1 in high powered money can lead to several dollars of credit. It is not an exaggeration to say if all of those reserves flowed back into banks to be lent quickly, the economy could experience a jump in inflation. The Federal Reserve hasn’t ended its post 2008 policy of paying of interest on reserves as they do not want that money flowing back into the economy at an uncontrolled pace.

The big question mark for that scenario is credit demand. We know consumers are tapped out, but the driver of the economy is not consumption. Capital investment by businesses is what drives the economy in the long-run. If they start borrowing, the economy will pick up quickly.

Finally, there’s yet one more scenario worth considering. The Fed’s QE policy isn’t doing very much good anymore (even the Fed’s own research agrees) and when it exits, there will be neither a recession nor a boom in the economy. It will plod along at a similar pace of the past 5 years. Interest rates will be slightly higher due to the Fed exiting the market for bonds, but weak growth will keep a lid on inflation and interest rates.

For now, we maintain our bias towards higher interest rates in the long-term. Last year, we shifted our income holdings into funds such as ProShares High Yield Interest Rate Hedged (HYHG), while moving into low duration funds such as PIMCO Short Term (PSHDX) and PIMCO Short Maturity (MINT), plus the short-duration floating rate fund Fidelity Floating Rate High Income (FFRHX). While we may be a bit early, we believe that shorter duration funds make the most sense. Positions in these funds will protect investors from higher interest rates and will hold up should the market experience a correction triggered by weakness in foreign markets. While the yields are modest, having these positions minimizes downside risk for conservation bond positions.