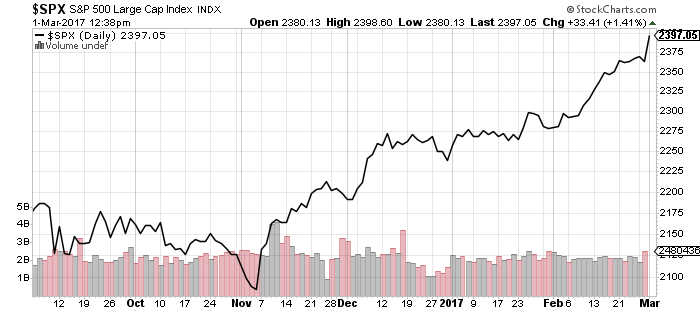

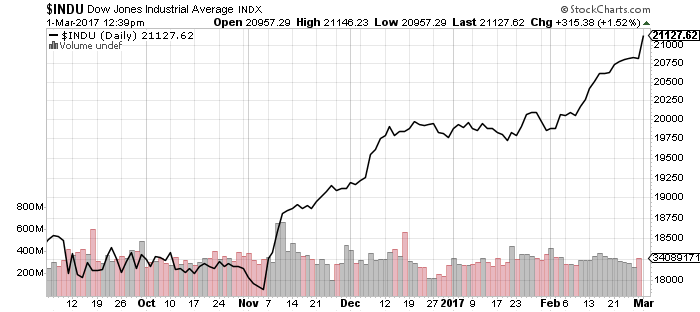

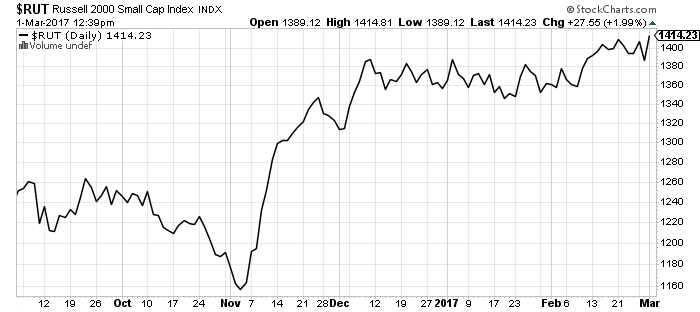

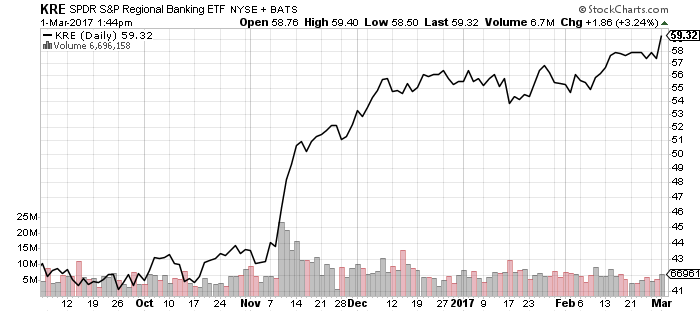

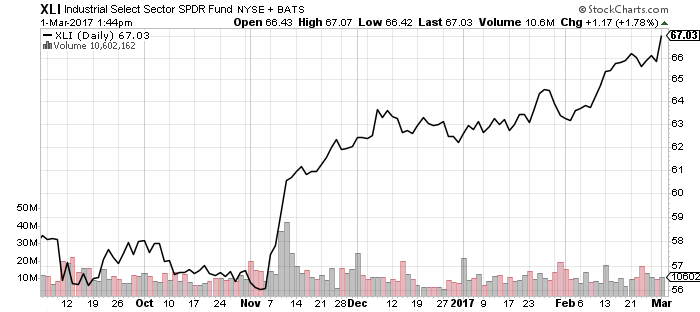

Markets enjoyed a substantial rally on Wednesday following President Trump’s address to Congress, further fueling financial and industrial sector advances. Hawkish statements by Fed officials also sent March rate expectations soaring from 35 percent to 70 percent.

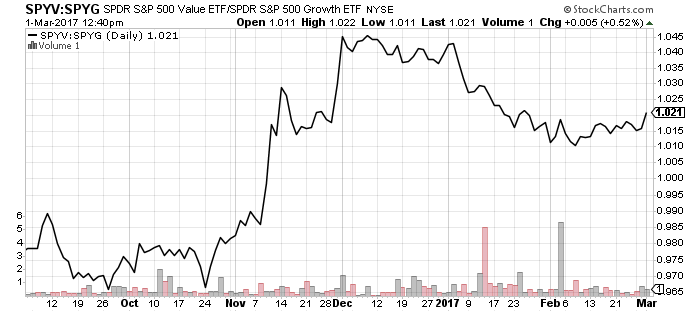

The jump on Wednesday and rising interest rates suggest the market will swing back in favor of value stocks. As the relative price chart shows, value has been consolidating gains. Value bottomed relative to growth in early February, when strong technology earnings boosted growth funds. Since then, the performance of value has improved relative to growth.

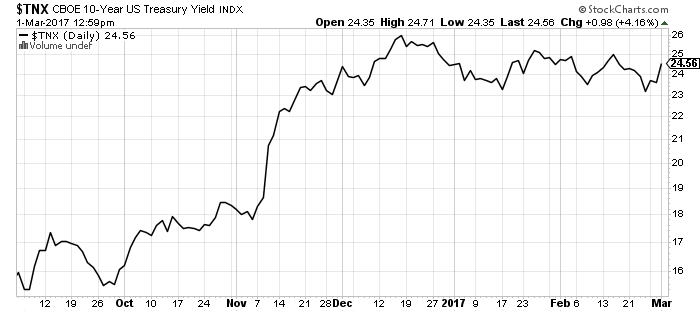

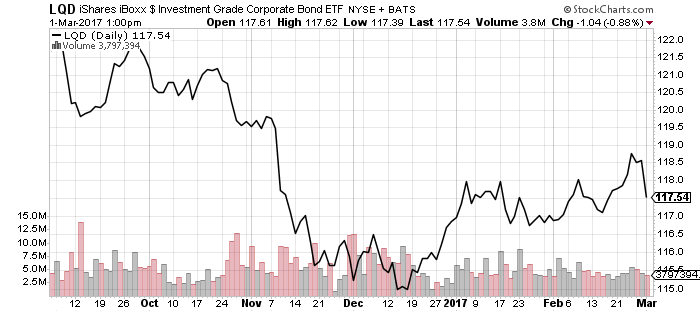

The 10-year Treasury yield quickly bounced off its 2.30 percent support level and climbed back above 2.4 percent. Investment-grade bonds sensitive to rate hikes, such as those in iShares iBoxx Investment Grade Corporate Bond (LQD), subsequently slid. SPDR Barclays Short-Term Corporate Bond (SCPB) saw a much smaller move due to its lower duration.

The 10-year Treasury yield quickly bounced off its 2.30 percent support level and climbed back above 2.4 percent. Investment-grade bonds sensitive to rate hikes, such as those in iShares iBoxx Investment Grade Corporate Bond (LQD), subsequently slid. SPDR Barclays Short-Term Corporate Bond (SCPB) saw a much smaller move due to its lower duration.

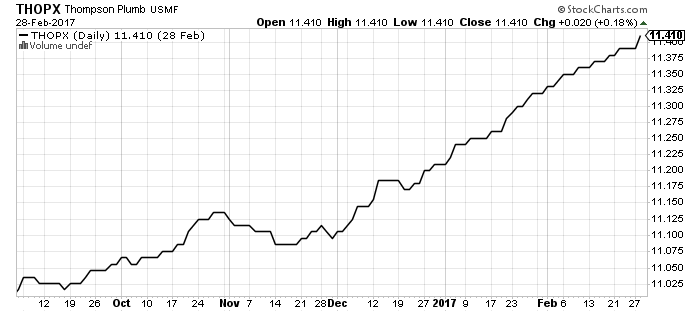

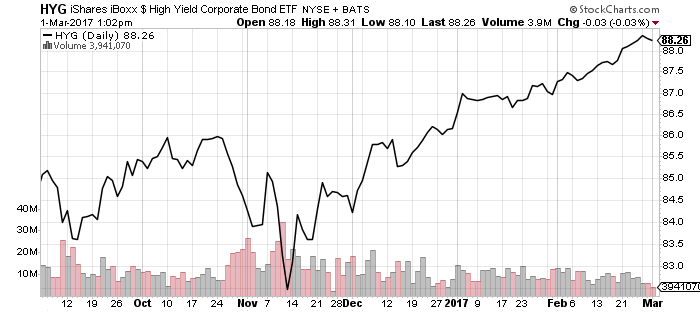

Thompson Bond (THOPX) should also remain relatively immune to the rise in rates. High-yield bond funds held up well as rising interest rates were offset by falling credit risk. High-yield funds also generally have lower durations due to larger coupon payments.

Thompson Bond (THOPX) should also remain relatively immune to the rise in rates. High-yield bond funds held up well as rising interest rates were offset by falling credit risk. High-yield funds also generally have lower durations due to larger coupon payments.

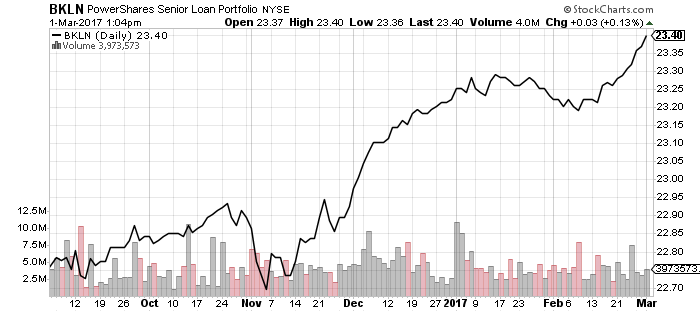

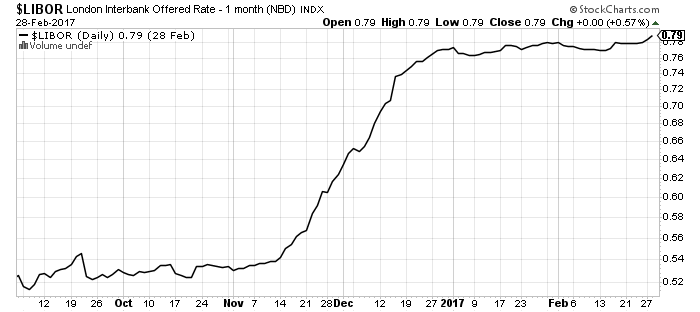

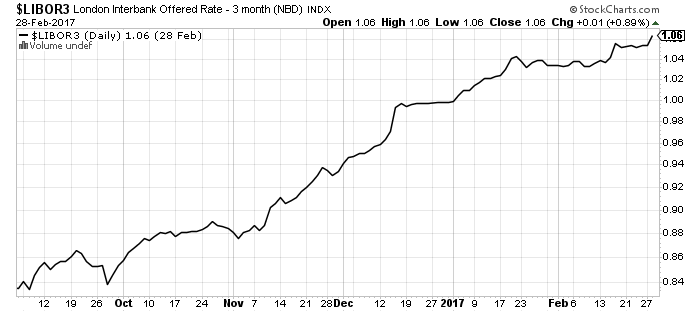

Floating-rate funds once again benefited from higher rates. PowerShares Senior Loan (BKLN) advanced in Wednesday trading. Both 1-Month and 3-Month Libor climbed to new 52-week highs on Tuesday.

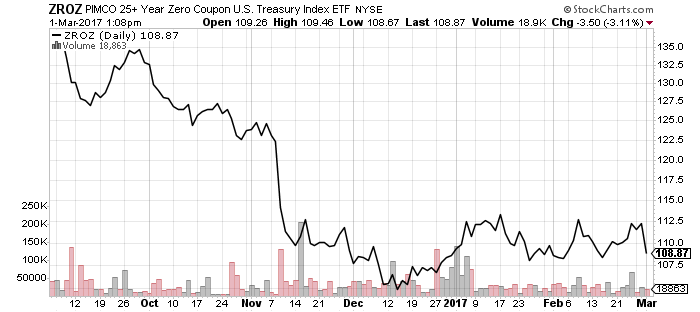

Long-term zero-coupon Treasury bonds slumped as much as 3 percent on Wednesday.

Long-term zero-coupon Treasury bonds slumped as much as 3 percent on Wednesday.

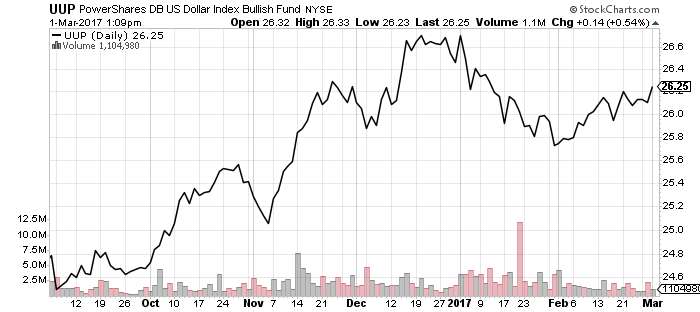

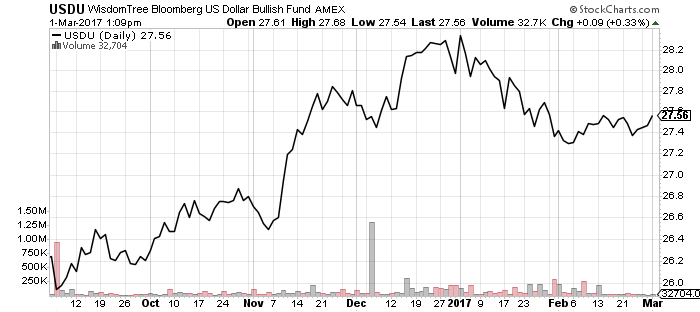

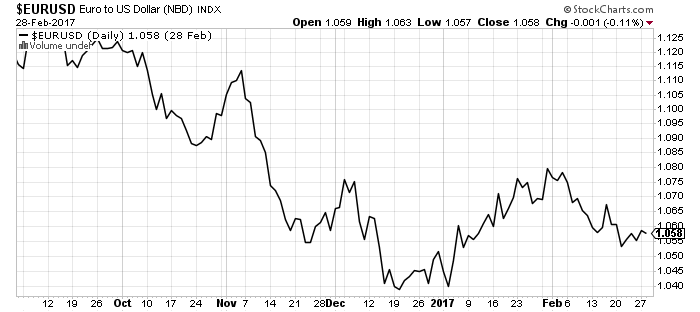

The jump in interest rates on Tuesday and Wednesday lifted the U.S. dollar. If the dollar behaves as it did in the past, there is still room for consolidation before it resumes the bull rally. The euro remains near its 52-week low.

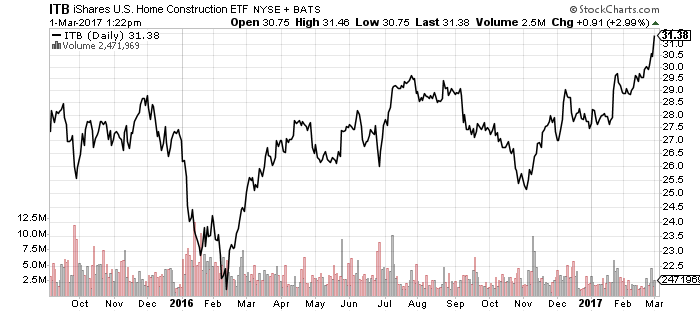

Homebuilders broke to the upside two weeks ago, hitting their highest level in nearly a decade. They added nearly 5 percent more over the past week. This is a very bullish sign for the stock market and the economy.

Homebuilders broke to the upside two weeks ago, hitting their highest level in nearly a decade. They added nearly 5 percent more over the past week. This is a very bullish sign for the stock market and the economy.

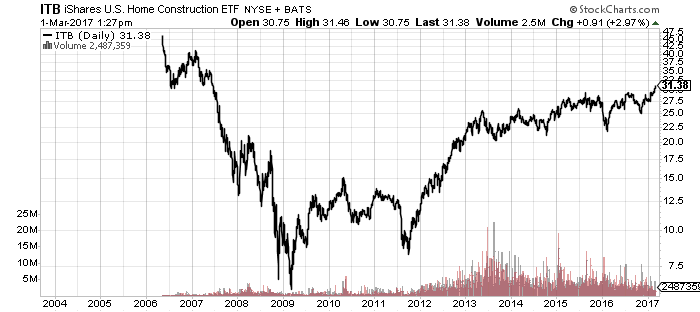

Shares of ITB launched almost right at the peak of the housing bubble. Shares remain well below the all-time high. ITB would need to rally 50 percent to overtake the old high.

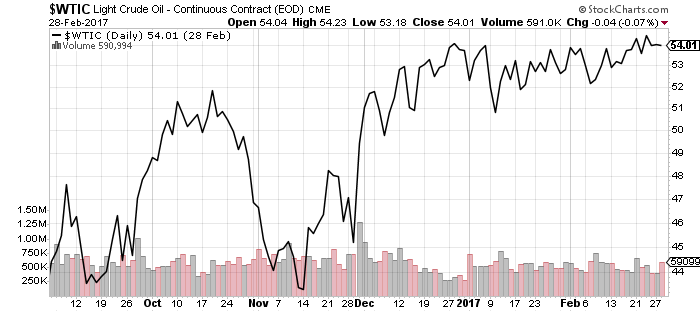

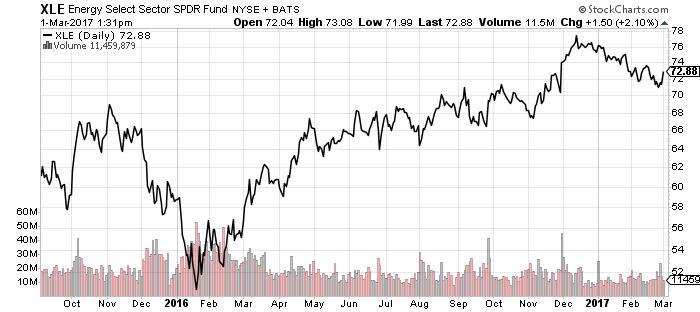

Oil prices failed to hold above $54 again last week. Rising inventories and a glut of gasoline inventory weighed on prices.

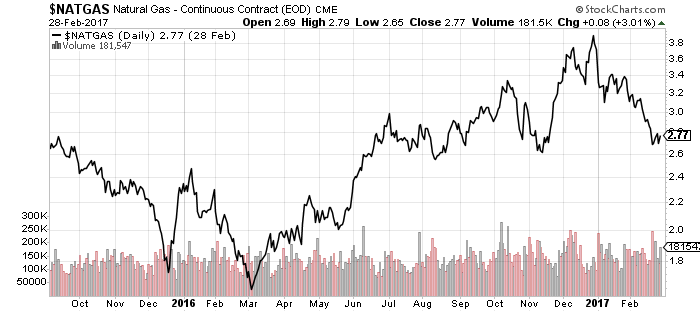

Natural gas prices held above $2.70 last week, keeping the short-term bullish uptrend from summer 2016 intact.

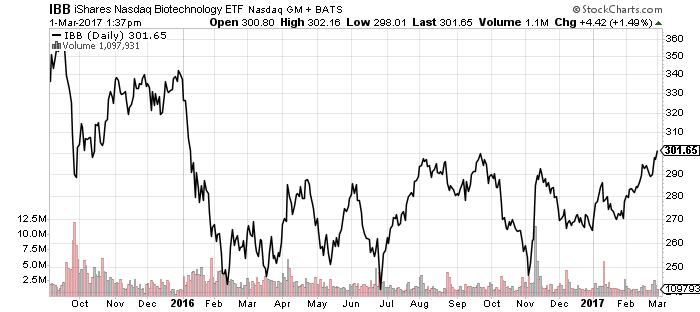

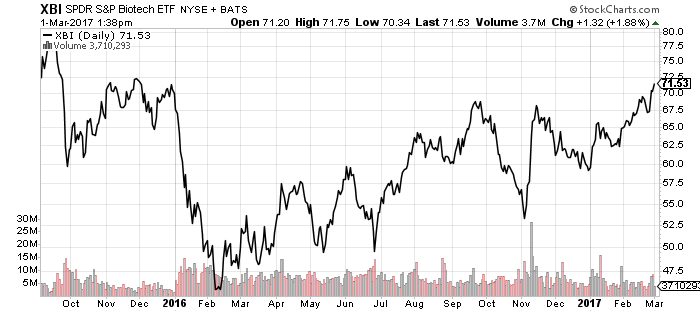

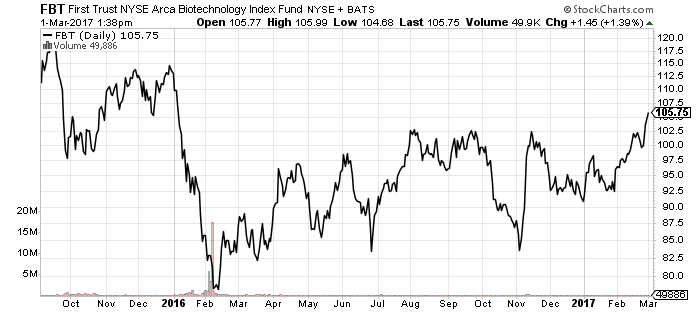

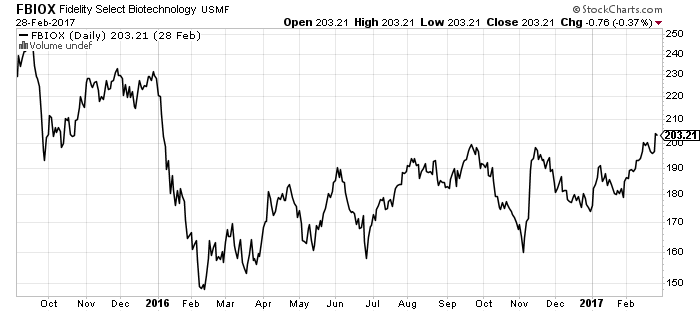

Biotech stocks climbed to a new 52-week high to lift SPDR Healthcare (XLV).

Biotech stocks climbed to a new 52-week high to lift SPDR Healthcare (XLV).