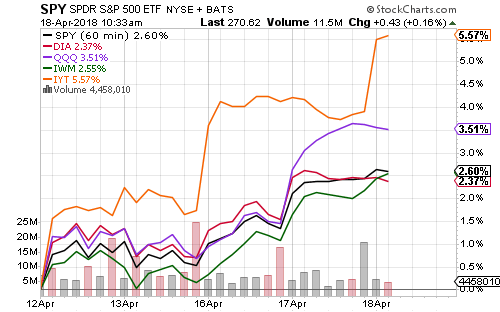

Equities rallied this week as geopolitical tensions eased. Earnings season has been positive with many companies beating estimates. The Dow Transports outperformed, while rebounding technology shares boosted the Nasdaq.

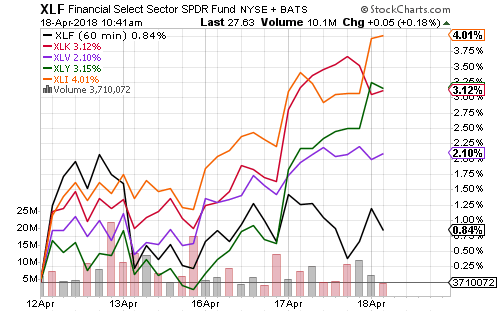

The industrial sector led this week’s performance.

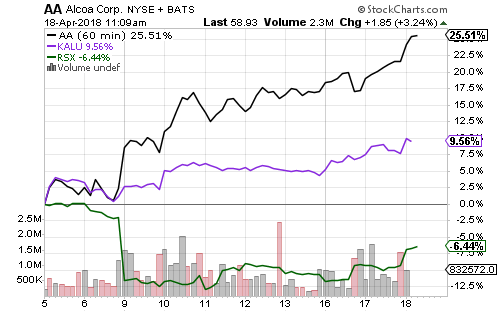

Oil, aluminum, and precious metals all rallied on the week. Sanctions on Russia boosted aluminum prices. Japan also cut off Russian imports to avoid secondary sanctions from the U.S.

Alcoa (AA) has gained 25 percent over the past 10 days, while Kaiser Aluminum (KALU) has risen nearly 10 percent. VanEck Russia (RSX) fell as much as12.5 percent following U.S. sanctions.

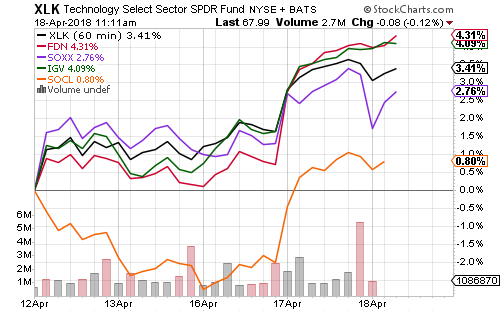

Software and Internet stocks led the technology sector. Social media continued to lag.

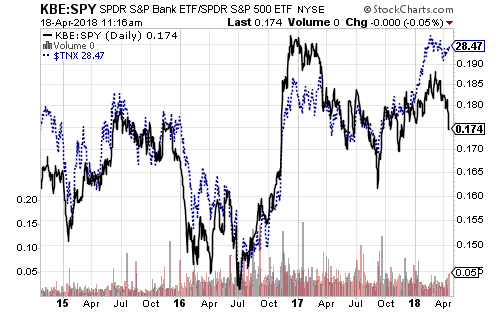

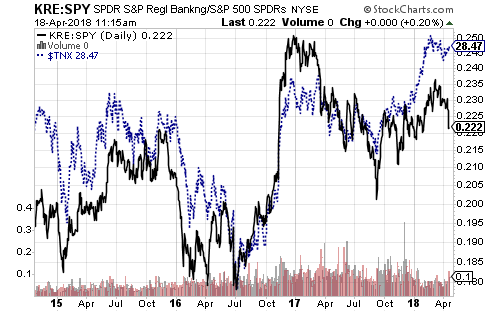

Bank stocks fell this week based on relative performance and the move in interest rates. The banking sector has been oversold. The charts below reflect the relative performance of SPDR S&P Bank (KBE) and Regional Banking (KRE) versus the S&P 500 Index, with the dashed blue line showing the 10-year Treasury yield.

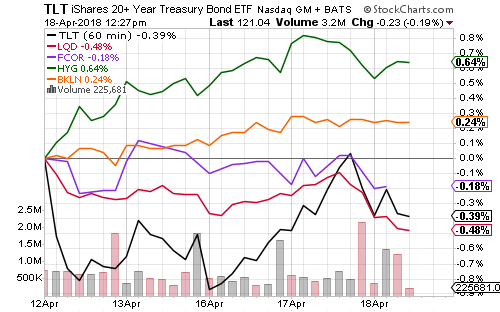

Interest rates edged higher this week, pulling long-term government, investment grade and corporate bond funds lower. High-yield and floating rate funds rallied as credit risk tumbled.

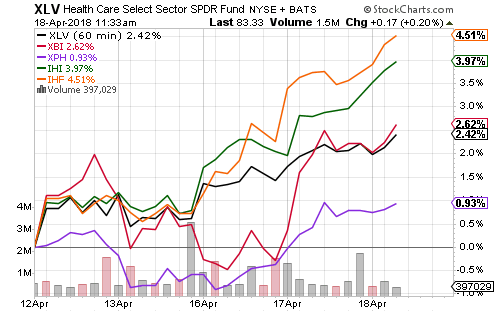

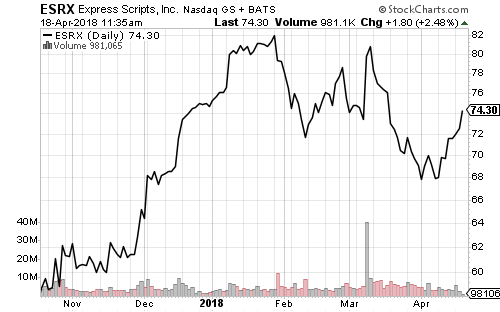

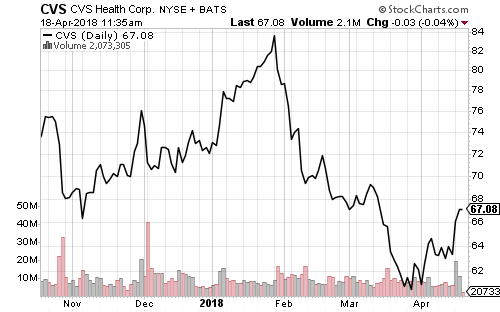

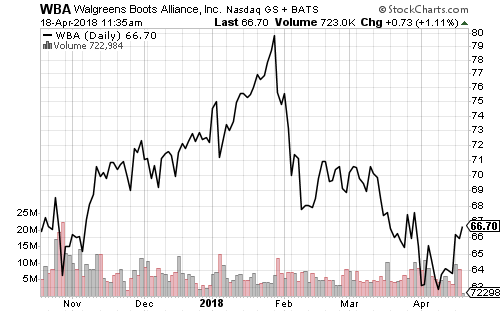

Medical providers and devices pulled the healthcare sector higher this week. Shares of Express Scripts (ESRX), CVS Health (CVS) and Walgreen’s (WBA) all rallied after Amazon (AMZN) retreated from the pharmacy business.

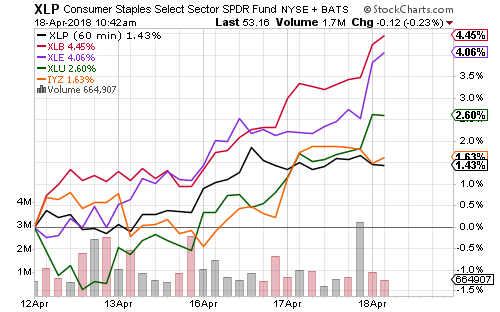

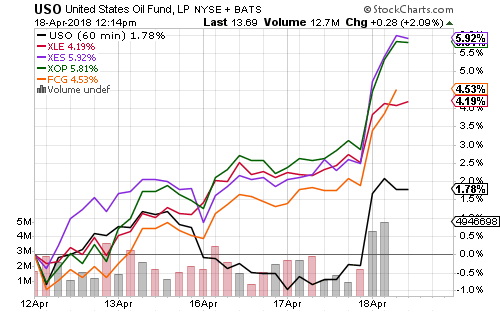

Energy rallied on Wednesday with crude oil crossing $68 a barrel on a larger-than-expected inventory draw. The more volatile subsectors climbed nearly 6 percent on the week, while the broad energy sector climbed more than 4 percent.

Natural gas stocks also joined in the rally.

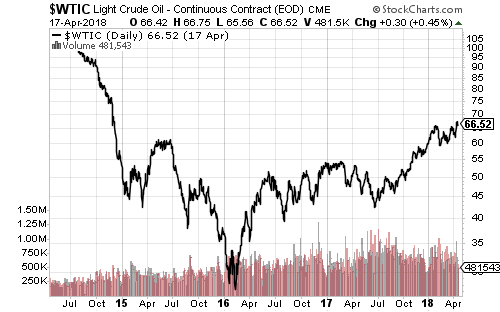

Crude oil doesn’t have much technical resistance between here and $100 a barrel. Fundamental factors will take on greater importance and will decide if this rally goes back to triple digits or hits resistance at a lower price point.

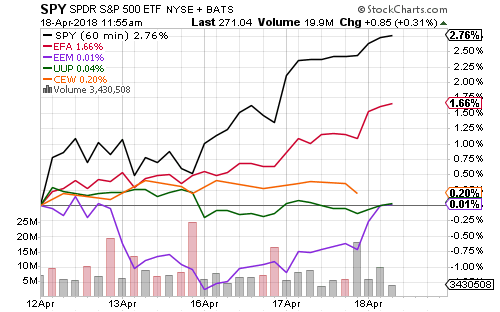

Domestic U.S. stocks outperformed thanks to strength in technology shares. Weakness in Russia caused emerging markets to underperform.

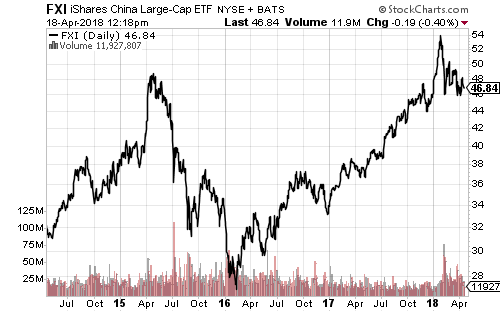

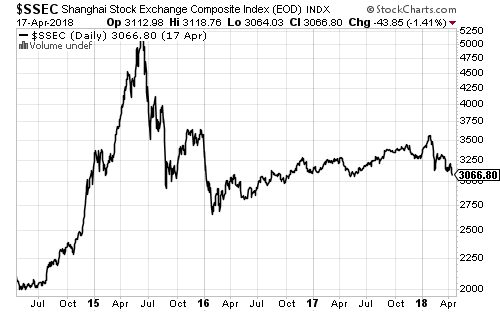

China’s is still slowing. The central bank slashed reserve requirements by 1 percent to help the economy. It’s also rumored the government bought stocks to keep the main Shanghai Composite from falling below 3000.

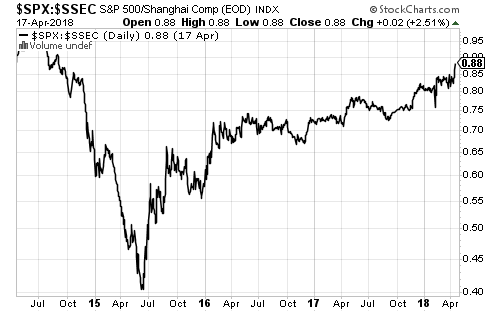

The relative price chart of the S&P 500 and Shanghai Composite illustrates Chinese shares’ underperformance since summer 2015, just before the Chinese central bank devalued the yuan.

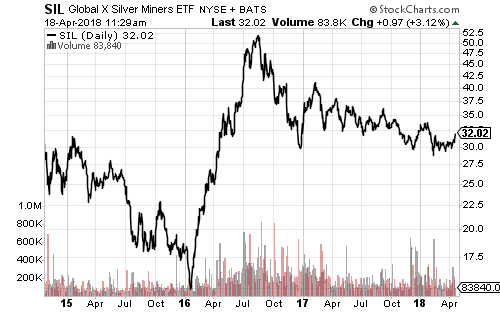

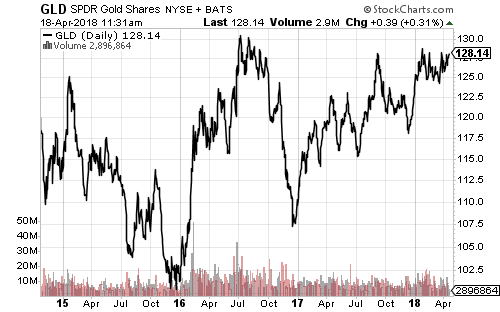

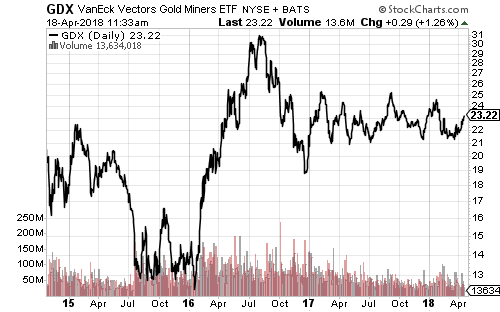

Global X Silver Miners (SIL) recently broke the downtrend in place since its 2017 peak. Support over the past 2-plus years is at $30. Gold and gold mining shares have not broken out.