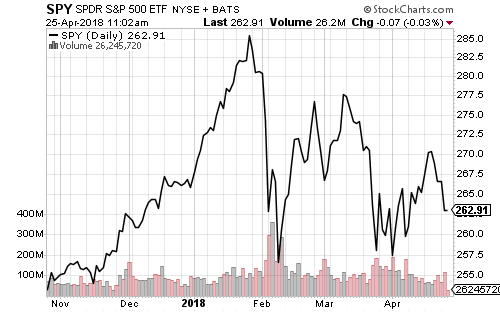

A rally of about 3 percent would take the S&P 500 Index (SPY) above the April high and break the recent series of lower highs.

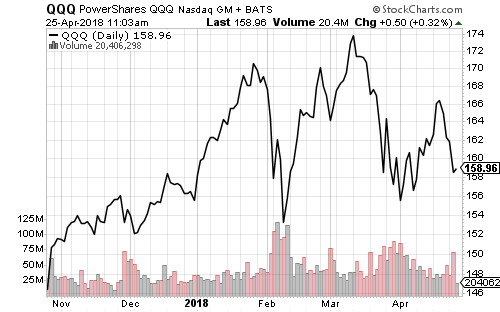

Despite large Internet companies’ selling over the past month, PowerShares QQQ (QQQ) has been gradually recovering.

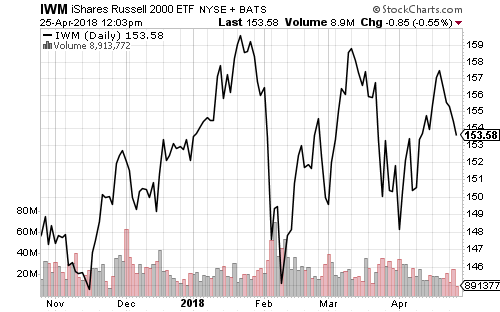

Small-caps tend to outperform in bull markets. iShares Russell 2000 (IWM) has the strongest looking chart right now. A rally of 4 percent would take IWM to a new all-time high.

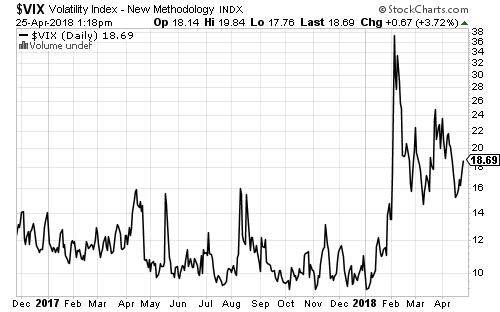

The post February market has seen several intraday moves of 2 percent or more. When the correction completes, volatility should fall back into the prior zone, although a return to levels below 10 is unlikely.

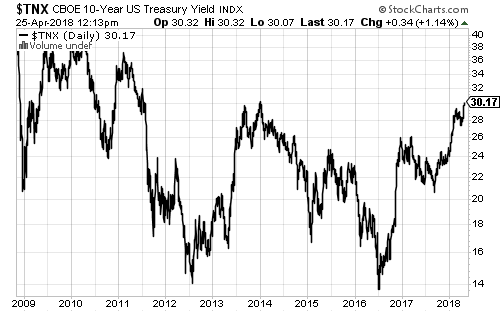

The key asset to watch in the next week will be the 10-year Treasury yield. It broke out to a new 52-week high this week and touched 3.03 percent on Wednesday. The yield peaked at 3.04 percent in 2013. Technical traders are looking for a move to 3.05 percent, a new 7-year high.

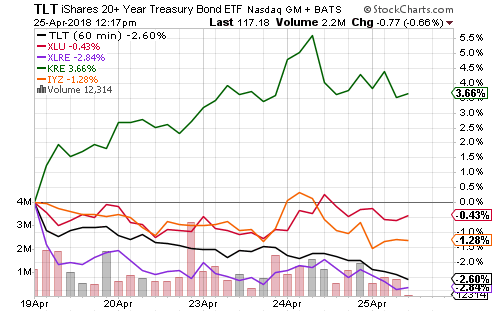

Rising interest rates weighed on bond funds and rate-sensitive sectors such as real estate this week. Utilities held up better, and banking stocks rallied strongly. SPDR S&P Regional Bank (KRE) gained 5.5 percent this week.

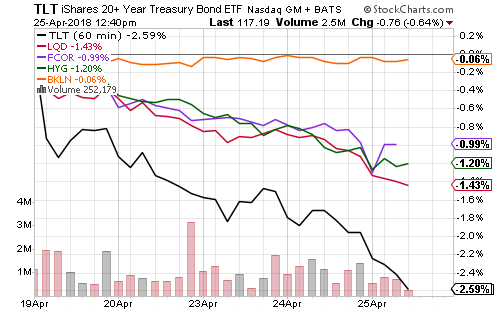

Floating-rate funds held steady amid rising interest rates, while corporate, high-yield and investment- grade bonds all declined along with government bonds.

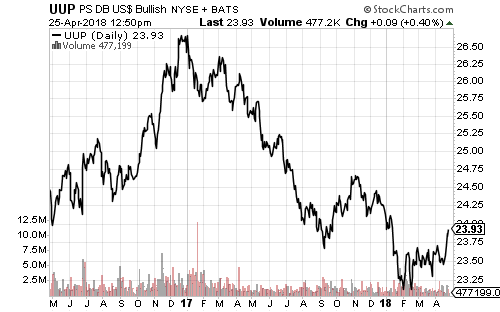

The U.S. Dollar Index rose with bond yields. The index peaked in December 2016 and this week’s rally broke the downtrend.

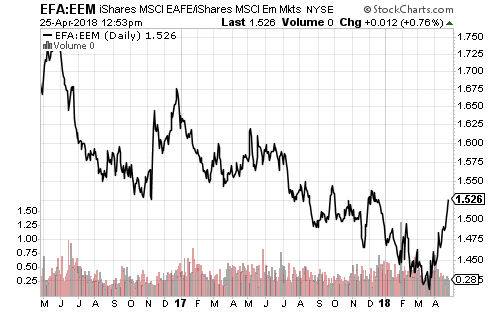

The relative underperformance of developed markets also decisively broke a trend this week. iShares MSCI EAFE (EFA) rallied sharply relative to iShares MSCI Emerging Markets (EEM). In the past month, EFA has gained 3.5 percent, EEM has fallen 1.5 percent.

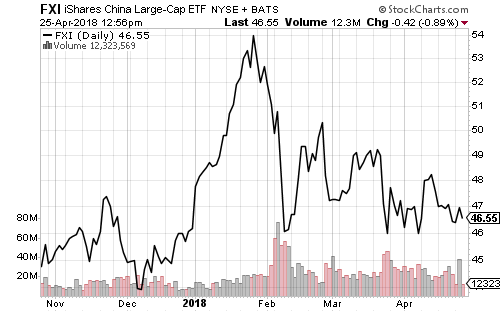

China was a drag on emerging markets this week. The Chinese government held a meeting on April 23 and signaled it may do more to prop up economic growth. Chinese shares rallied on the news, but then gave up gains as it suggests the government fears a larger slowdown is underway. The line in the sand for iShares China Large-Cap (FXI) is $46.

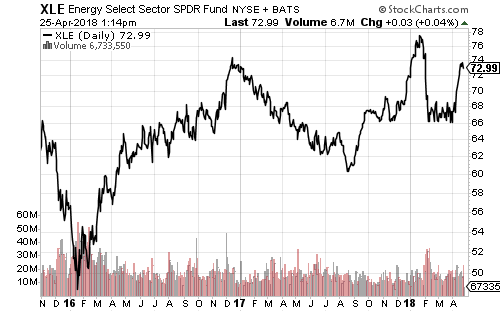

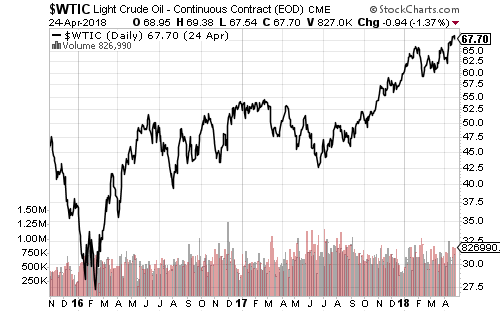

The energy sector has seen several sharp rallies over the past 18 months, followed by consolidation. Crude oil remains in an uptrend. It is currently one of the strongest assets in the financial markets. A push to $70 might be enough for a new 52-week high in XLE.

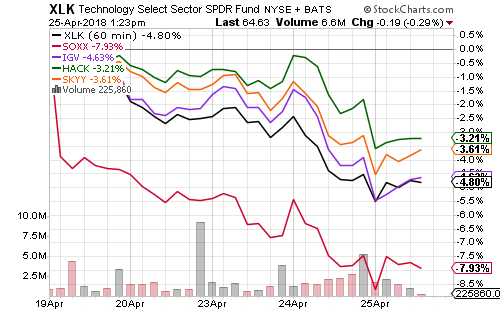

Semiconductors pulled technology lower this week. Two of the best performing subsectors remain cybersecurity and cloud services. Since the market correction began in February, both have outperformed the overall technology sector.

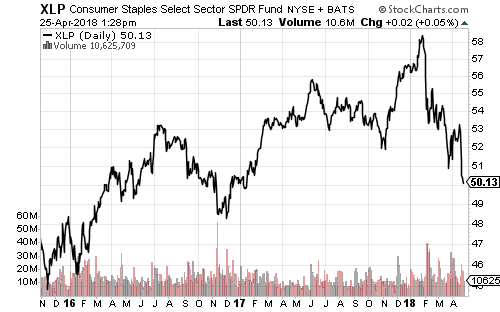

Consumer staples and tobacco companies declined over the past week following less than stellar earnings reports. SPDR Consumer Staples (XLP) now yields 2.9 percent, Vanguard Consumer Staples (VDC) yields 2.7 percent.