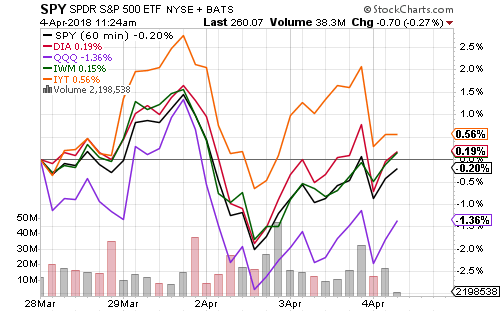

Equities moved into the black on Wednesday, solidly rebounding from Monday’s losses. The Dow Transports, Dow Industrials, and the Russell 2000 led index performance, while the Nasdaq lagged.

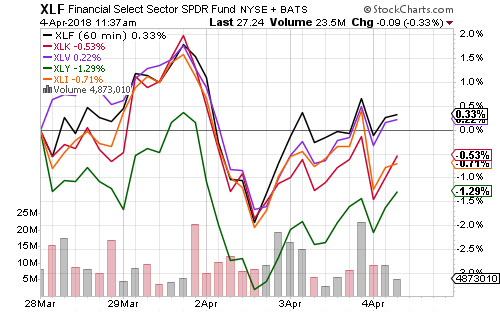

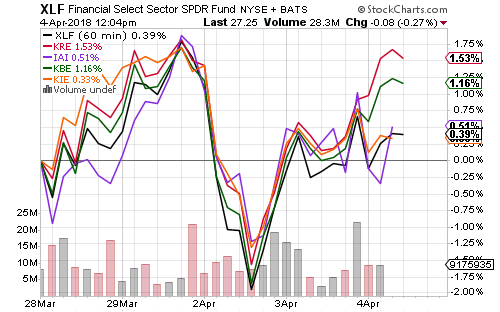

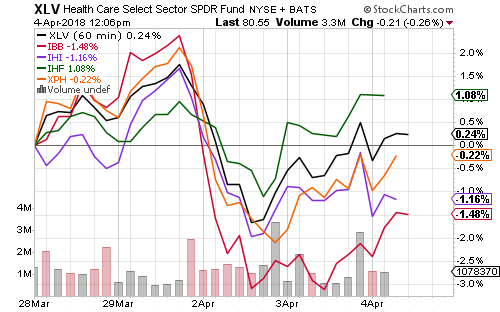

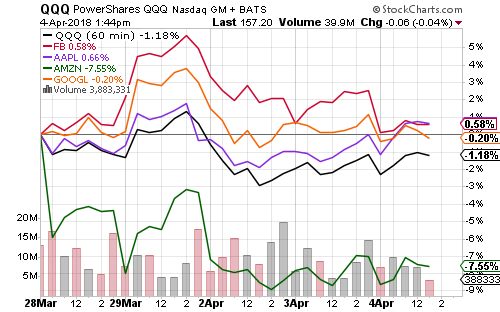

The financial and healthcare sectors led the market this week. Consumer discretionary’s 20 percent weighting in Amazon (AMZN) weighed on performance.

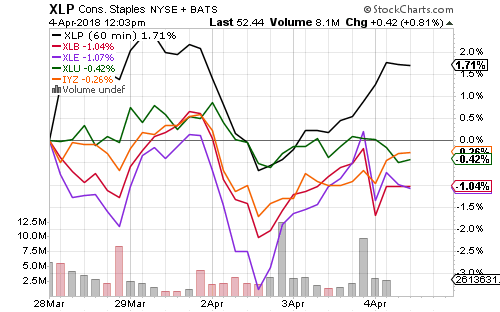

Consumer staples staged an impressive rally this week, outperforming other sectors by more than 1 percent.

Small and regional banks pulled the financial sector higher this week as Congress moved closer to passing bank deregulation.

Providers led healthcare over the past week, while biotechnology was pulled lower by the general trend in the Nasdaq.

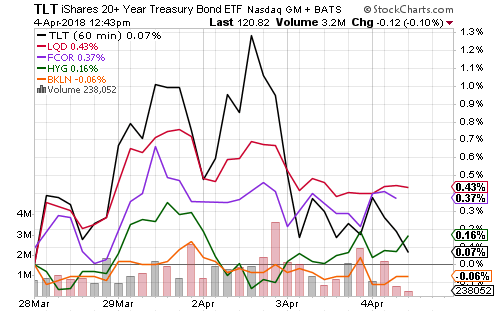

Long-term interest rates dipped this week, lifting bond prices. Credit risk also eased slightly, helping the corporate and high-yield sector. Investment-grade and corporate bonds enjoyed the best performance, while floating-rate funds saw a small decline.

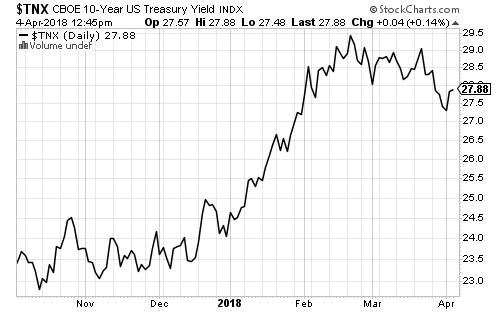

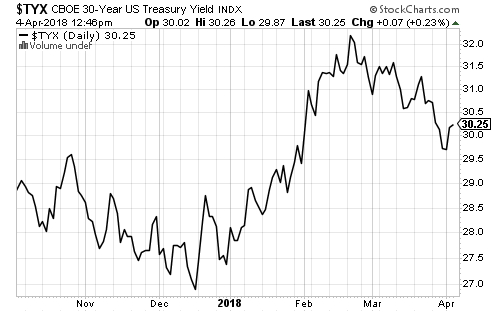

The 30-year Treasury bond yield slid below 3 percent on the week before bouncing. The 10-year held above 2.7 percent. Both have remained in short-term downtrends since peaking in February.

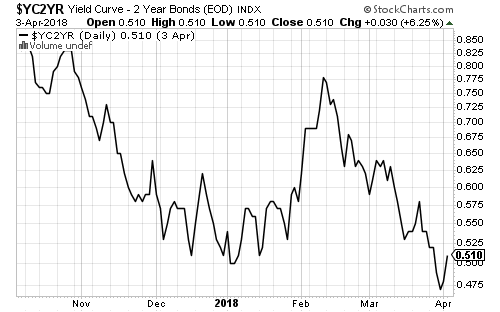

Long-term bonds declined this week, but short-term rate expectations held steady. This week’s job report could be very important for the bond market. The ADP employment report showed 241,000 new jobs in March. Economists expect the Bureau of Labor Statistics will report 175,000 new jobs on Friday. They also see the unemployment rate falling from 4.1 to 4.0 percent.

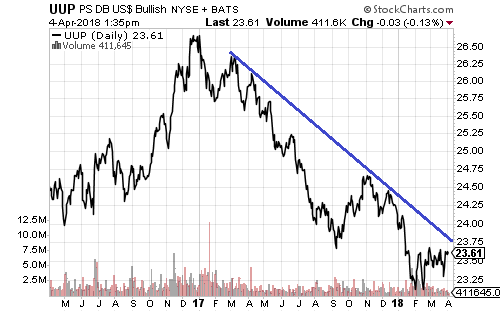

The U.S. Dollar Index has been in consolidation for two-and-a-half months. Despite fears of a trade war, the dollar has moved towards the upper end of its trading range. The level to watch on PowerShares DB U.S. Dollar Index Bullish (UUP) is $23.75.

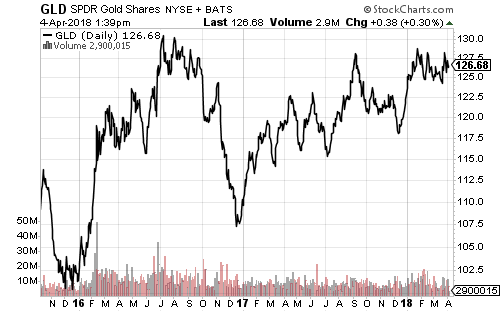

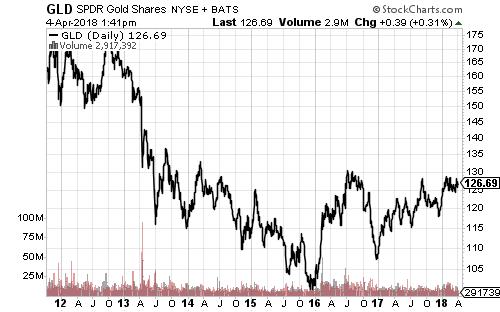

Gold has been falling over the past 20 months and needs around 3.5 percent to break above its summer 2016 highs.

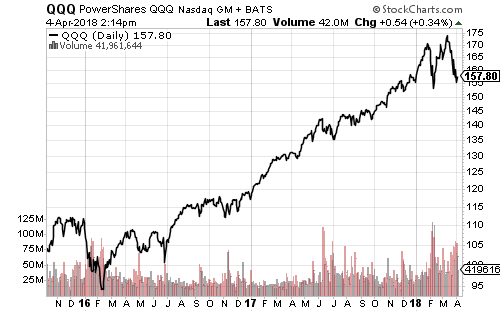

Although technology stocks have led the stock market decline since February, shares are still up from December 2017 levels.

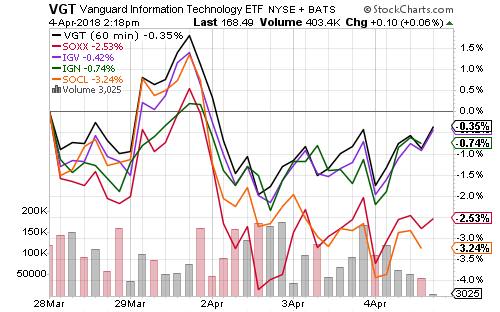

Within the technology sector, software and networking stocks saw small losses. Social media and semiconductors saw larger declines. Apple (AAPL) announced it was working on its own microprocessors, sending shares on Intel (INTC) down 8 percent on Monday before they rebounded.

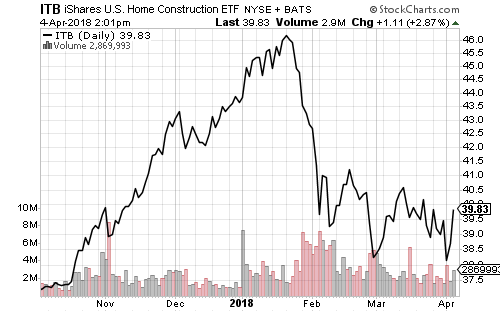

iShares U.S. Home Construction (ITB) rallied on Wednesday after Lennar (LEN) beat earnings estimates. Analysts forecast $0.77 per share, but the company delivered $1.11 in earnings. Orders rose 30 percent. Revenue increased 28 percent, and beat analyst estimates by 12 percent.